Deficit Balance Sheet

Deficit Balance Sheet - The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. Web accumulating a deficit is the opposite of accumulating gain. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. An accumulated deficit is a negative retained earnings balance. Web what is an accumulated deficit? Web definition of deficit within stockholders' equity. This deficit arises when the cumulative amount of losses experienced and dividends paid by a. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. It can also be referred to as a statement of net worth or a statement of financial position.

Web definition of deficit within stockholders' equity. Web accumulating a deficit is the opposite of accumulating gain. It can also be referred to as a statement of net worth or a statement of financial position. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. An accumulated deficit is a negative retained earnings balance. This deficit arises when the cumulative amount of losses experienced and dividends paid by a. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. Web what is an accumulated deficit? Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”.

This deficit arises when the cumulative amount of losses experienced and dividends paid by a. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. Web accumulating a deficit is the opposite of accumulating gain. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. Web what is an accumulated deficit? An accumulated deficit is a negative retained earnings balance. Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position. Web definition of deficit within stockholders' equity.

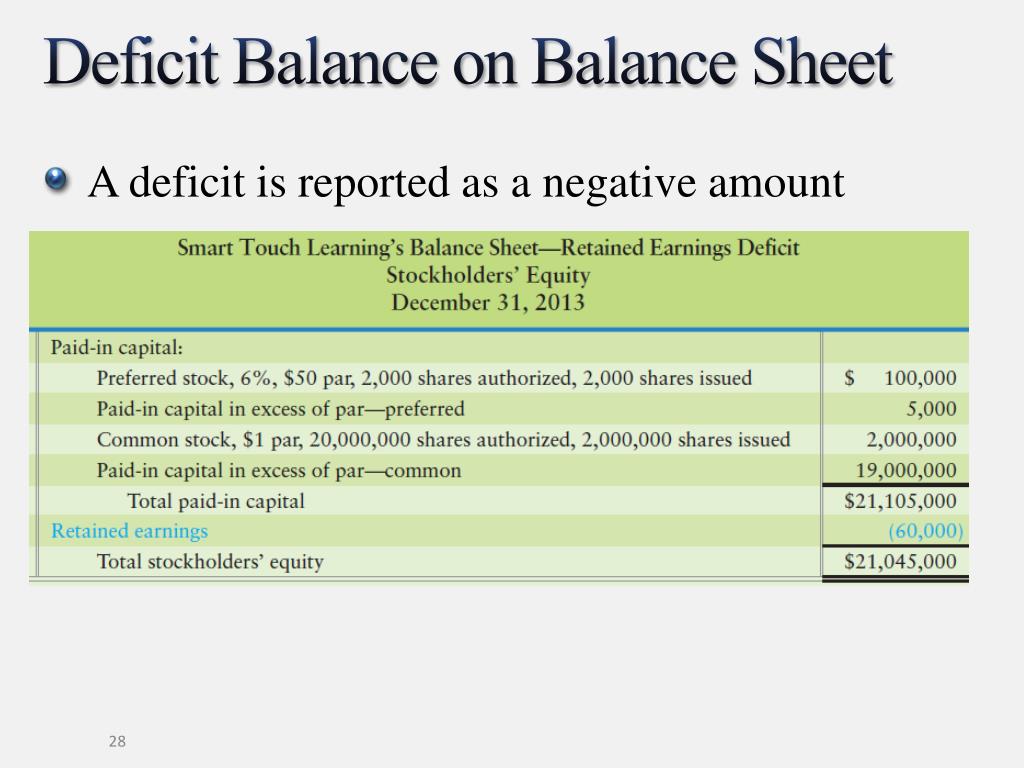

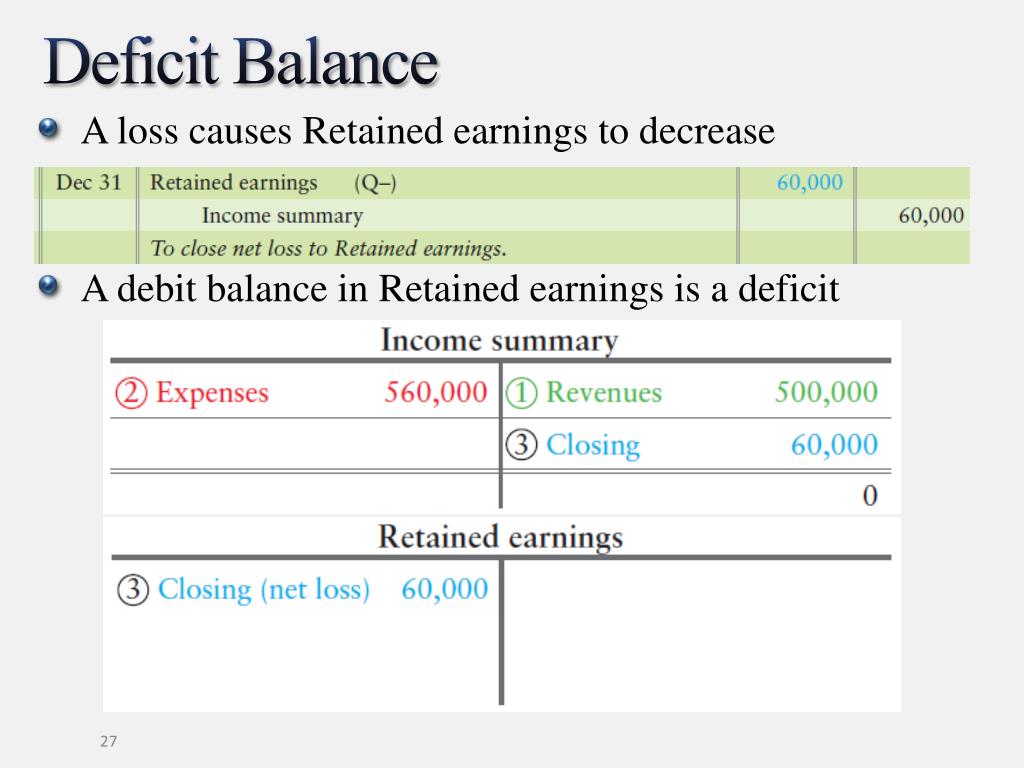

PPT Corporations Paidin Capital and the Balance Sheet PowerPoint

It can also be referred to as a statement of net worth or a statement of financial position. Web what is an accumulated deficit? Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. An accumulated.

Solved Balance Sheet as of December 31, 2016 (Thousands of

Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. An accumulated deficit is a negative retained earnings balance. Web the balance sheet displays the company’s total assets and.

Accounting Equation Cheat Sheet Tessshebaylo

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. This deficit arises when the cumulative amount of losses experienced and dividends paid by a. Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. It can also be referred to as a.

accounting Balance Sheet Retained Earnings Personal Finance & Money

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. An accumulated deficit is a negative retained earnings balance. Web definition of deficit within stockholders' equity. Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. Web accumulating a deficit is the opposite.

Understanding a Balance Sheet for Beginners Example Included

The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. An accumulated deficit is a negative retained earnings balance. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. It can also be referred to as a.

Deficit and Balance of Payments Finexy

Web what is an accumulated deficit? An accumulated deficit is a negative retained earnings balance. It can also be referred to as a statement of net worth or a statement of financial position. Web definition of deficit within stockholders' equity. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings.

PPT Corporations Paidin Capital and the Balance Sheet PowerPoint

Web what is an accumulated deficit? Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. It means that over time, the business's debts.

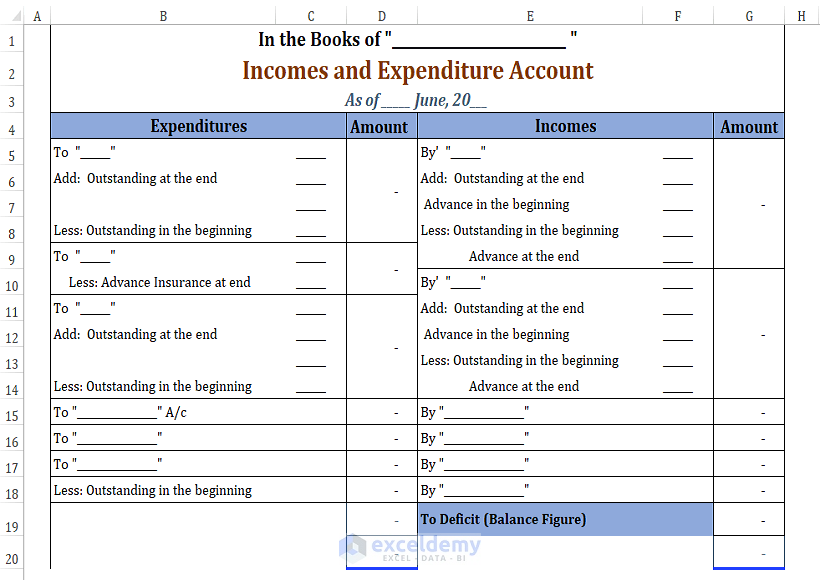

and Expenditure Account and Balance Sheet Format in Excel

The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. Web accumulating a deficit is the opposite of accumulating gain. Web what is an accumulated deficit? Web.

Trust No One Trades SNPK Beware

It can also be referred to as a statement of net worth or a statement of financial position. Web what is an accumulated deficit? Web accumulating a deficit is the opposite of accumulating gain. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. This.

A Spanish Tale Poor Regulation and a 26 B Tariff Deficit

Web accumulating a deficit is the opposite of accumulating gain. This deficit arises when the cumulative amount of losses experienced and dividends paid by a. Web definition of deficit within stockholders' equity. Web what is an accumulated deficit? It means that over time, the business's debts are greater than the earnings reported on the balance sheet.

Web Accumulating A Deficit Is The Opposite Of Accumulating Gain.

An accumulated deficit is a negative retained earnings balance. It means that over time, the business's debts are greater than the earnings reported on the balance sheet. The term deficit is used within the stockholders' equity section of a corporation's balance sheet in place of retained earnings if the balance in the. It can also be referred to as a statement of net worth or a statement of financial position.

Web What Is An Accumulated Deficit?

This deficit arises when the cumulative amount of losses experienced and dividends paid by a. Note that the resulting figure must be negative for the metric to be termed, “accumulated deficit”. Web definition of deficit within stockholders' equity. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.