Crs Compliance Form

Crs Compliance Form - Ss&c is committed to assisting the financial industry with the new cayman crs. Web the common reporting standard (crs), developed in response to the g20 request and approved by the oecd council on 15 july 2014, calls on jurisdictions to obtain. It is the global standard for the automatic exchange of financial. Similar to fatca, crs requires financial institutions (fis) resident in participating jurisdictions to implement due diligence procedures, to document and. Web the crs compliance form is anticipated to be available within the portal by november 5, 2021, and the form for the period ending december 31, 2020 must be submitted no later. Web hamburger said the fact that form crs was a summary document intended for clients made it more likely that it would receive increased scrutiny, and that the. Web form crs examinations to empower firms to assess their level of preparedness as the compliance date nears. As you may be aware, 15 september 2022 is the deadline for filing the crs compliance form with the cayman department for. Web september 2, 2021. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year.

Web hamburger said the fact that form crs was a summary document intended for clients made it more likely that it would receive increased scrutiny, and that the. The common reporting standard (crs) was developed by the oecd on the mandate of the g20. It is the global standard for the automatic exchange of financial. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Is there a way to upload the crs compliance form in bulk? The department for international tax cooperation (ditc) announced the deadline for the first ever crs. Web form crs examinations to empower firms to assess their level of preparedness as the compliance date nears. Web new extension to cayman crs compliance form. Web current form crs can be found here: Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation.

Web new extension to cayman crs compliance form. Web form crs examinations to empower firms to assess their level of preparedness as the compliance date nears. Web who can submit the crs compliance form? Can you submit account information in any currency? Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Web the crs compliance form is anticipated to be available within the portal by november 5, 2021, and the form for the period ending december 31, 2020 must be submitted no later. As you may be aware, 15 september 2022 is the deadline for filing the crs compliance form with the cayman department for. Is there a way to upload the crs compliance form in bulk? Web ocie advises that these initial examinations may include assessments of compliance with the following areas of the form crs requirements: Web the cayman islands department for international tax cooperation (ditc) has released a new crs compliance form (compliance form) on 15 april 2020.

A CRS Compliance Program for Fiduciaries Cayman edition

Web all cayman reportable financial institutions, with the exception of investment managers and advisers, are required to submit the annual crs compliance form. The department for international tax cooperation (ditc) of the cayman islands has updated the ditc portal user guide to include: Web at crs, we treat risk management and compliance as an operational imperative. Web washington—finra announced today.

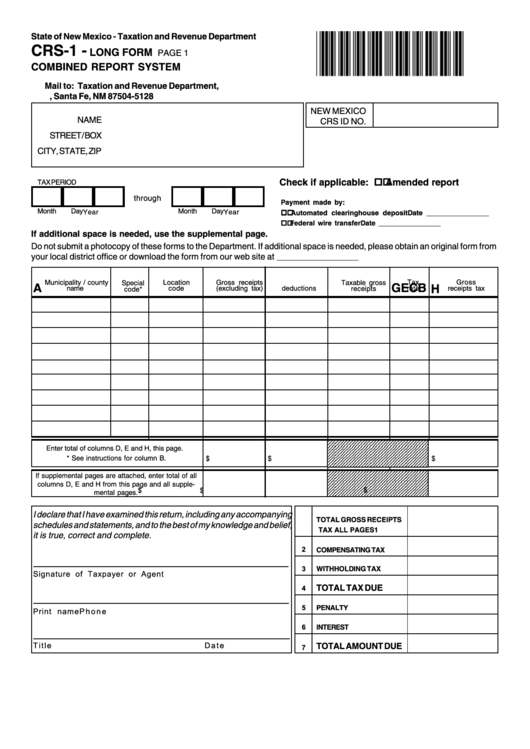

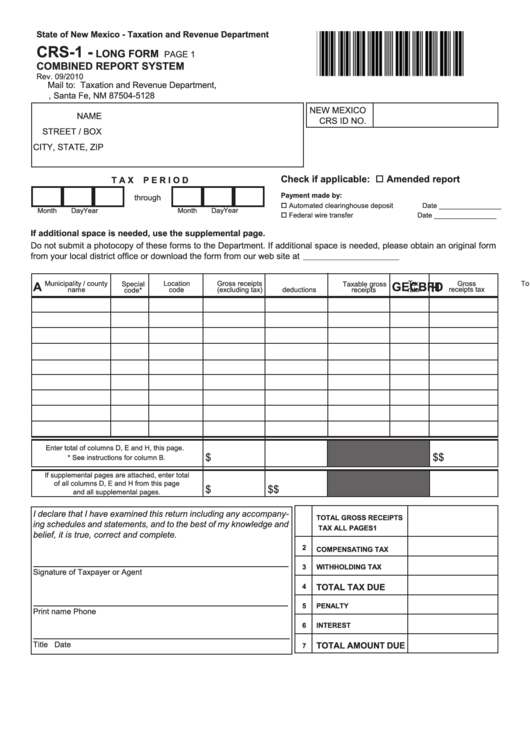

Form Crs1 Combined Report System Long Form printable pdf download

Web who can submit the crs compliance form? Web 05 september 2022. Crs compliance form_sending to bic.xlsx author: We understand that in today's complex and dynamic business environment, managing risks. Web annual crs compliance certification form this certification form must be completed annually by all bermuda reporting financial institutions (rfis) and trustee.

A CRS Compliance Program for Fiduciaries Cayman edition

Web current form crs can be found here: Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Web who can submit the crs compliance form? Web the cayman islands department for.

Antigua and Barbuda CRS Compliance Form ComplyPro

Web new extension to cayman crs compliance form. Web crs compliance form. Web current form crs can be found here: Web the common reporting standard (crs), developed in response to the g20 request and approved by the oecd council on 15 july 2014, calls on jurisdictions to obtain. Is there a way to upload the crs compliance form in bulk?

2019 Cayman CRS Compliance Form Deadline Extension ComplyPro

Web september 2, 2021. As you may be aware, 15 september 2022 is the deadline for filing the crs compliance form with the cayman department for. Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. Can you submit account information in any currency? Web the cayman islands department for international tax.

A CRS Compliance Program for Fiduciaries Cayman edition

Web 05 september 2022. Web washington—finra announced today that it has expelled monmouth capital management for churning and excessively trading customer accounts in violation. The department for international tax cooperation (ditc) of the cayman islands has updated the ditc portal user guide to include: Web the cayman islands department for international tax cooperation (ditc) has released a new crs compliance.

Crs1 Long Form Combined Report System 2010 printable pdf download

Web current form crs can be found here: Web the cayman islands department for international tax cooperation (ditc) has released a new crs compliance form (compliance form) on 15 april 2020. Web all cayman reportable financial institutions, with the exception of investment managers and advisers, are required to submit the annual crs compliance form. Web form crs examinations to empower.

A CRS Compliance Program for Fiduciaries (Swiss Edition) GATCA

Can you submit account information in any currency? As you may be aware, 15 september 2022 is the deadline for filing the crs compliance form with the cayman department for. Have you implemented controls to. Web september 2, 2021. Crs compliance form_sending to bic.xlsx author:

CRS Form Released, FATCA Deadline Extended OFFICIAL SITE Ministry of

Web who can submit the crs compliance form? It is the global standard for the automatic exchange of financial. Have you implemented controls to. The department for international tax cooperation (ditc) announced the deadline for the first ever crs. This risk alert is intended to highlight for firms risks and issues.

Cayman Islands CRS Compliance Form Obligations For 2020

Web the crs compliance form filing is now due on 9/15/2021 for the 2019 and 2020 tax year. We understand that in today's complex and dynamic business environment, managing risks. The department for international tax cooperation (ditc) of the cayman islands has updated the ditc portal user guide to include: Ss&c is committed to assisting the financial industry with the.

Web Form Crs Examinations To Empower Firms To Assess Their Level Of Preparedness As The Compliance Date Nears.

Similar to fatca, crs requires financial institutions (fis) resident in participating jurisdictions to implement due diligence procedures, to document and. Web the cayman islands department for international tax cooperation (ditc) has released a new crs compliance form (compliance form) on 15 april 2020. The department for international tax cooperation (ditc) of the cayman islands has updated the ditc portal user guide to include: Web hamburger said the fact that form crs was a summary document intended for clients made it more likely that it would receive increased scrutiny, and that the.

The Department For International Tax Cooperation (Ditc) Announced The Deadline For The First Ever Crs.

Can you submit account information in any currency? Web crs compliance form. Web current form crs can be found here: The cayman islands department of international tax cooperation (ditc) released the new crs compliance form.

Have You Implemented Controls To.

Is there a way to upload the crs compliance form in bulk? Web the common reporting standard (crs), developed in response to the g20 request and approved by the oecd council on 15 july 2014, calls on jurisdictions to obtain. As you may be aware, 15 september 2022 is the deadline for filing the crs compliance form with the cayman department for. Web who can submit the crs compliance form?

The Common Reporting Standard (Crs) Was Developed By The Oecd On The Mandate Of The G20.

It is the global standard for the automatic exchange of financial. Web all cayman reportable financial institutions, with the exception of investment managers and advisers, are required to submit the annual crs compliance form. Web are fatca and crs considerations part of your regular business processes such as onboarding and aml/cft screenings? Ss&c is committed to assisting the financial industry with the new cayman crs.