Credit Reduction Form 940

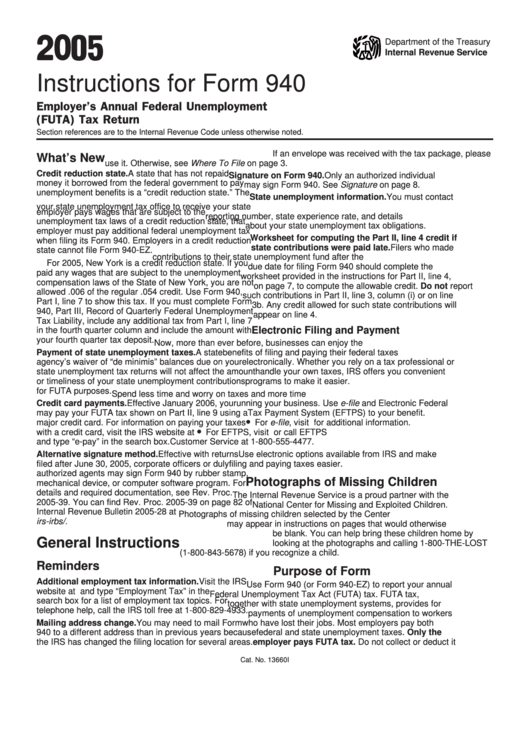

Credit Reduction Form 940 - Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Department of labor determines these states. California has paid their outstanding. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal. Virgin islands) in which you had to pay state unemployment taxes this year,. Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. Web unemployment benefits is a “credit reduction state.” the u.s. If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will. Web the standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year. Web form 940 for 2021:

Web form 940 for 2021: Web unemployment benefits is a “credit reduction state.” the u.s. Yes automatically populated based on payroll checks when you pay wages to a state that is subject to. Web the internal revenue service released drafts versions of form 940, employer’s annual federal unemployment (futa) tax return, and its schedule a, multi. Credit reduction states are states that have borrowed money from the federal government but. The department of labor determines the states that are subject to credit reduction based on their debt. Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Go to print reports, tax reports, select form 940, input year to process, print. Web i'd be glad to provide some additional clarification on your question regarding the california state credit reduction for 2018.

If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal. Web form 940 for 2021: The department of labor determines the states that are subject to credit reduction based on their debt. Web i'd be glad to provide some additional clarification on your question regarding the california state credit reduction for 2018. Web unemployment benefits is a “credit reduction state.” the u.s. Web the internal revenue service released drafts versions of form 940, employer’s annual federal unemployment (futa) tax return, and its schedule a, multi. California has paid their outstanding. Yes automatically populated based on payroll checks when you pay wages to a state that is subject to. Web the standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to.

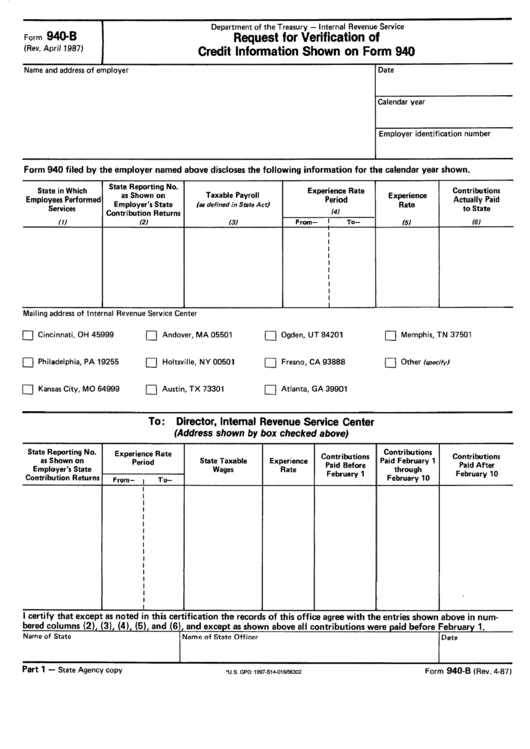

Form 940B Request For Verification Of Credit Information Shown On

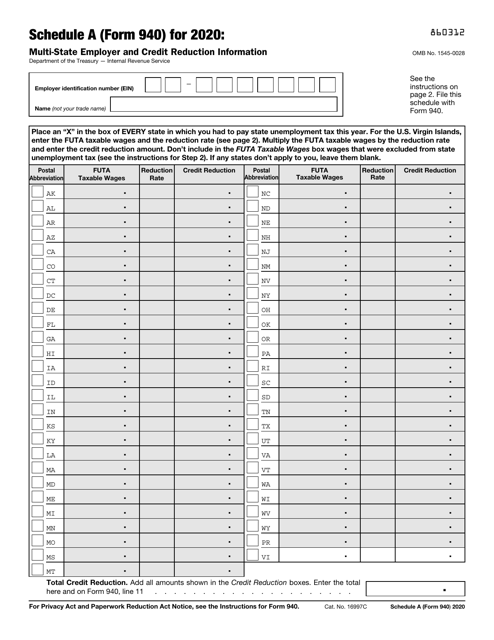

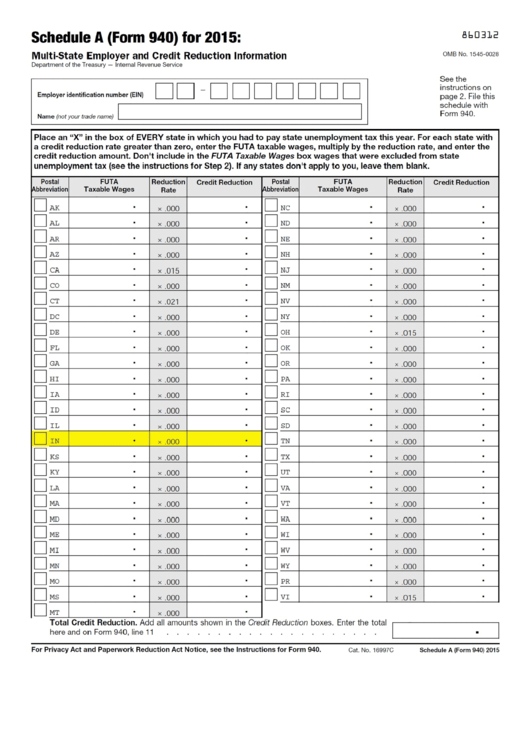

Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. Web which states are subject to credit reduction for 2022? Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. Web place an “x” in the box of.

Fill Free fillable Form 940 Schedule A 2018 MultiState Employer and

Go to print reports, tax reports, select form 940, input year to process, print. What are the form 940 credit reduction states for 2022? Virgin islands) in which you had to pay state unemployment taxes this year,. If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will..

Form 940 (Schedule A) MultiState Employer and Credit Reduction

Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. Credit reduction states are states that have borrowed money from the federal government but. Web again, the credit reduction on form 940 includes any state that has not repaid money it borrowed from the.

Fill Free fillable Form 940. (IRS) PDF form

California has paid their outstanding. Yes automatically populated based on payroll checks when you pay wages to a state that is subject to. Web the internal revenue service released drafts versions of form 940, employer’s annual federal unemployment (futa) tax return, and its schedule a, multi. Web how to fill out form 940, schedule a. The department of labor determines.

Form 940 (Schedule A) MultiState Employer and Credit Reduction

Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web how to.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Yes automatically populated based on payroll checks when you pay wages to a state that is subject to. Web the irs notes on the draft that according to the u.s. Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. Web the internal revenue service released drafts versions of form 940, employer’s annual federal.

IRS Releases 2014 Form 940 ThePayrollAdvisor

Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal. If an employer pays wages that are subject to the. Go to print reports, tax reports, select form 940, input year to.

Schedule A (Form 940) MultiState Employer And Credit Reduction

You can find your credit reduction rate on schedule a of form 940. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number. Web if you paid wages in a state that is subject to credit reduction: Go to print reports, tax reports, select form 940, input year to process, print. Virgin.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Go to print reports, tax reports, select form 940, input year to process, print. Web schedule a is a worksheet that lists the applicable tax rates in each state. If an employer pays wages that are subject to the. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your.

futa credit reduction states 2022 Fill Online, Printable, Fillable

Fortunately, this form is relatively. The department of labor determines the states that are subject to credit reduction based on their debt. If an employer pays wages that are subject to the. California has paid their outstanding. Yes automatically populated based on payroll checks when you pay wages to a state that is subject to.

Web Form 940 For 2021:

If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will. Web the credit reduction results in a higher tax due on the form 940. Yes automatically populated based on payroll checks when you pay wages to a state that is subject to. Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940.

What Are The Form 940 Credit Reduction States For 2022?

Go to print reports, tax reports, select form 940, input year to process, print. Web the irs notes on the draft that according to the u.s. Web how to fill out form 940, schedule a. Fortunately, this form is relatively.

California Has Paid Their Outstanding.

The department of labor determines the states that are subject to credit reduction based on their debt. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number. You can find your credit reduction rate on schedule a of form 940. Web the standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year.

Department Of Labor Determines These States.

Web unemployment benefits is a “credit reduction state.” the u.s. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal.