Charitable Trust Form

Charitable Trust Form - Significant changes include fee updates for charity, raffle and professional fundraiser applicants and registrants. Web charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting. Such corporation when organized to. We closely examine charitable remainder trusts to ensure they: Web the first step for a charity in determining whether it needs to register is to fill out the request for exemption form available on the attorney general's website on the charitable trusts page. Web a crt is an irrevocable trust that is funded with cash or securities. Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions that classifies it as a public charity. Web home charities forms updated forms for 2022 updated forms are available for download and are required with any filings received by the registry on or after january 1, 2022. Web a charitable trust is a trust which you establish to distribute assets to a charity.

For example, if you establish a trust where a designated charity has an interest for a fixed term of years, say 15 or 20 years, the clt can provide that any. Web home charities forms updated forms for 2022 updated forms are available for download and are required with any filings received by the registry on or after january 1, 2022. Web the first step for a charity in determining whether it needs to register is to fill out the request for exemption form available on the attorney general's website on the charitable trusts page. Thus, it is subject to the private foundation excise tax provisions and the other provisions that apply to exempt private foundations, including termination requirements and governing. The request for exemption form indicates whether additional information or other forms are necessary. Web charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. We closely examine charitable remainder trusts to ensure they: Correctly report trust income and distributions to beneficiaries file all required tax documents Significant changes include fee updates for charity, raffle and professional fundraiser applicants and registrants. A charitable remainder trust distributes assets to named beneficiaries first, then distributes any remaining assets to charity.

Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions that classifies it as a public charity. Web a crt is an irrevocable trust that is funded with cash or securities. Significant changes include fee updates for charity, raffle and professional fundraiser applicants and registrants. Correctly report trust income and distributions to beneficiaries file all required tax documents We closely examine charitable remainder trusts to ensure they: Web charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. Thus, it is subject to the private foundation excise tax provisions and the other provisions that apply to exempt private foundations, including termination requirements and governing. Such corporation when organized to. Web the donor authorizes and empowers the trustees to form and organize a nonprofit corporation limited to the uses and purposes provided for in this declaration of trust, such corporation to be organized under the laws of any state or under the laws of the united states as may be determined by the trustees; Web the first step for a charity in determining whether it needs to register is to fill out the request for exemption form available on the attorney general's website on the charitable trusts page.

FREE 16+ Sample Will and Trust Forms in PDF MS Word

The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting. The request for exemption form indicates whether additional information or other forms are necessary. Web a crt is an irrevocable trust that is funded with cash or securities. Web charitable trusts allow you to donate to an organization and.

Deed of Public Charitable Trust Form Free Download

A charitable remainder trust distributes assets to named beneficiaries first, then distributes any remaining assets to charity. The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting. Web a crt is an irrevocable trust that is funded with cash or securities. Such corporation when organized to. Web a charitable.

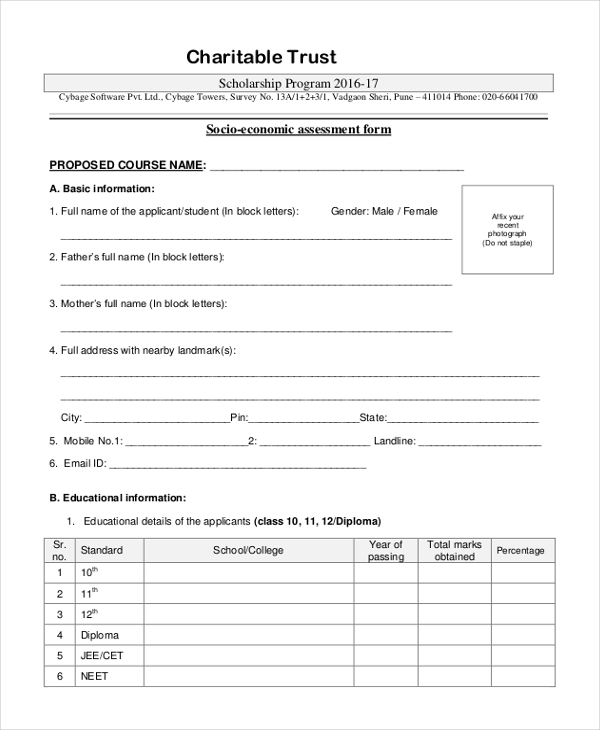

Medha Charitable Trust Scholarship Exam IndCareer Scholarships

For example, if you establish a trust where a designated charity has an interest for a fixed term of years, say 15 or 20 years, the clt can provide that any. Such corporation when organized to. Web the first step for a charity in determining whether it needs to register is to fill out the request for exemption form available.

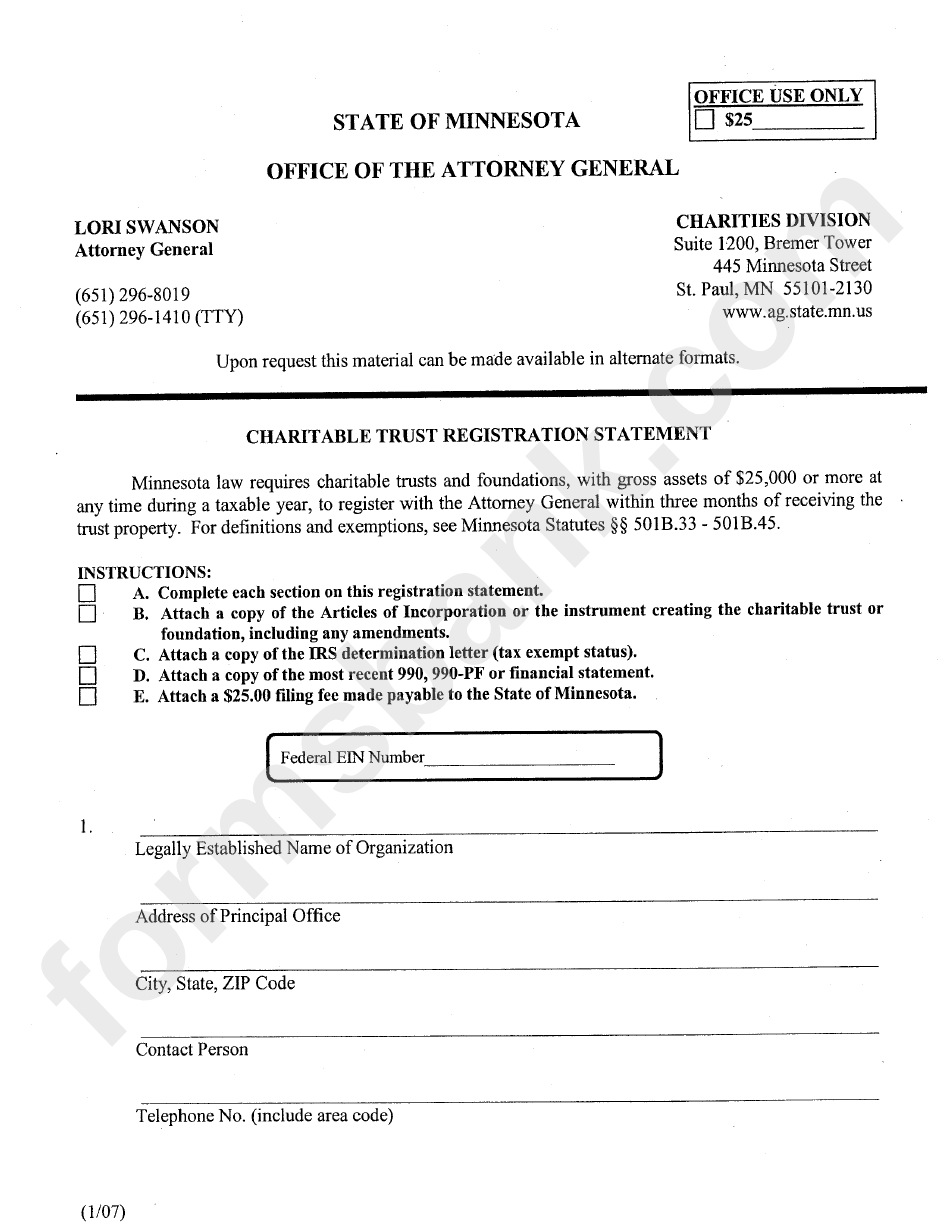

Charitable Trust Registration Statement Form printable pdf download

Such corporation when organized to. A charitable remainder trust distributes assets to named beneficiaries first, then distributes any remaining assets to charity. Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions that classifies it as a public charity. Web charitable remainder trusts are irrevocable trusts that let you donate.

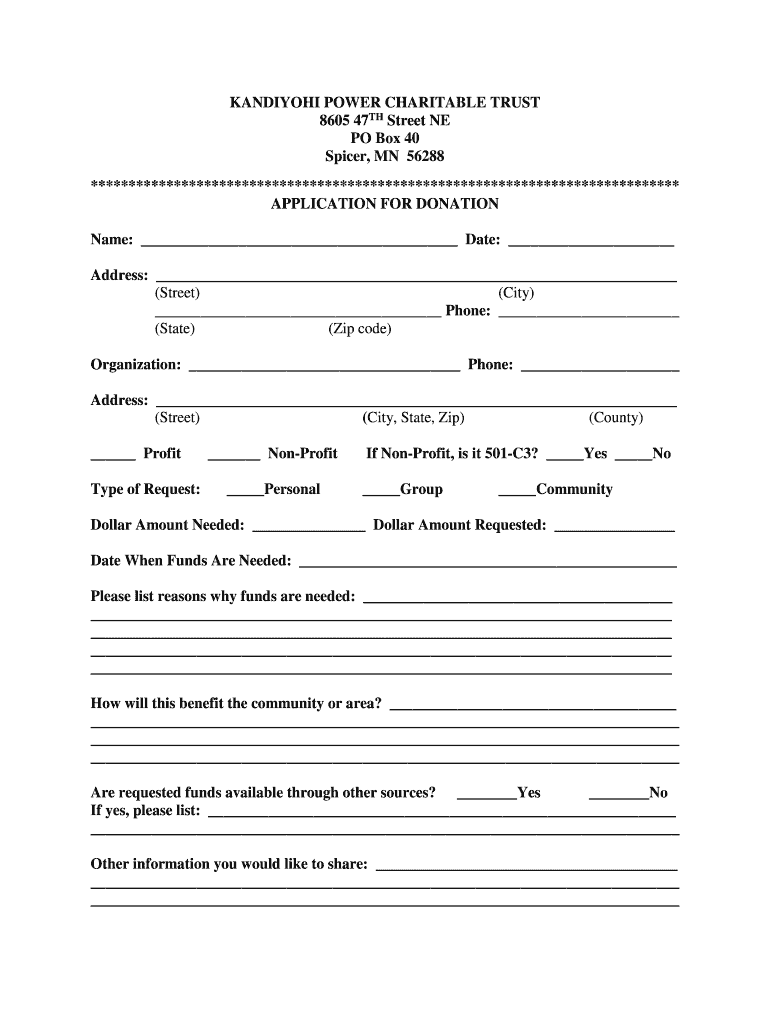

FREE 36+ Donation Forms in PDF MS Word Excel

The request for exemption form indicates whether additional information or other forms are necessary. We closely examine charitable remainder trusts to ensure they: For example, if you establish a trust where a designated charity has an interest for a fixed term of years, say 15 or 20 years, the clt can provide that any. Web charitable trusts allow you to.

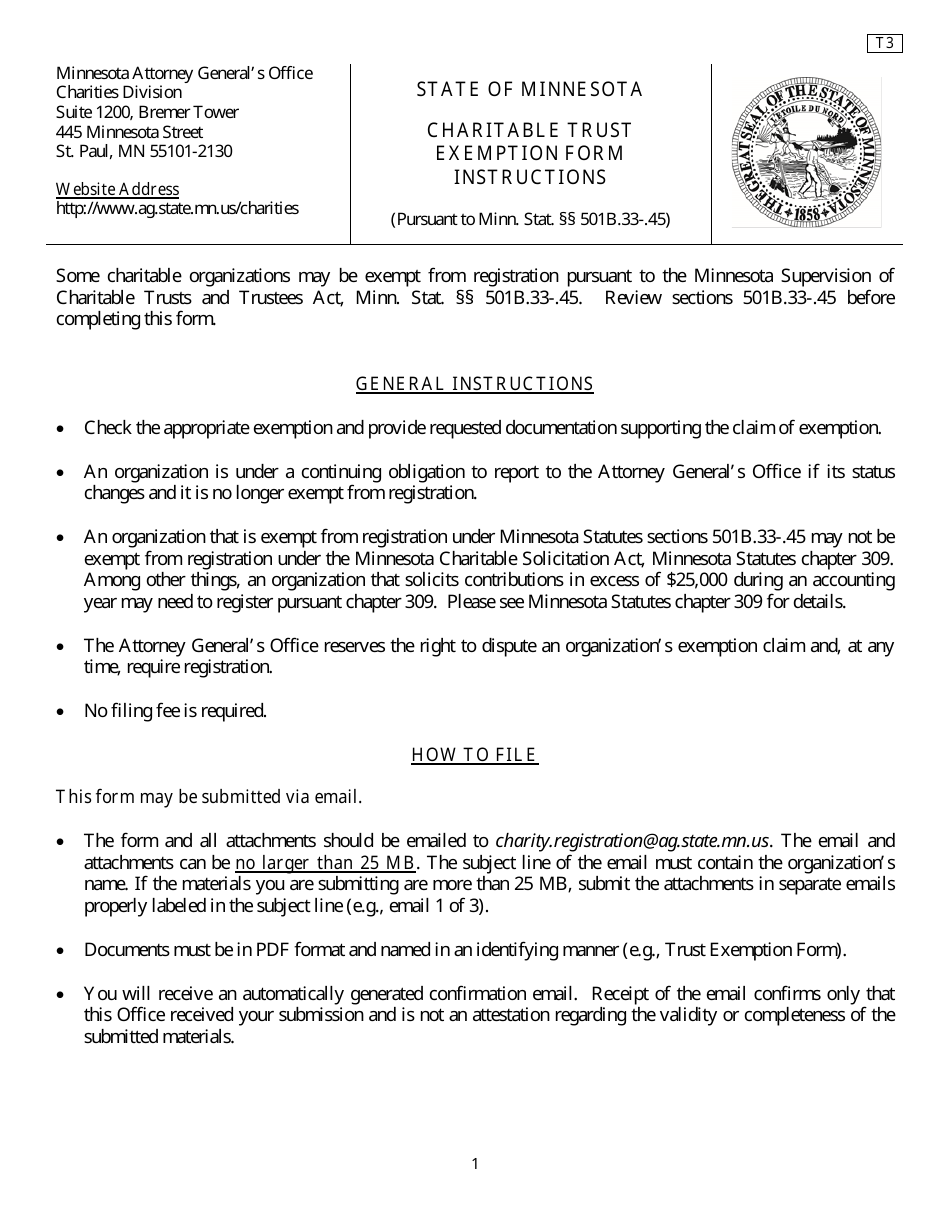

Form T3 Download Fillable PDF or Fill Online Charitable Trust Exemption

Web charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. Web a crt is an irrevocable trust that is funded with cash or securities. Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions.

Charitable Trust PDF Form Fill Out and Sign Printable PDF Template

We closely examine charitable remainder trusts to ensure they: The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting. Significant changes include fee updates for charity, raffle and professional fundraiser applicants and registrants. Correctly report trust income and distributions to beneficiaries file all required tax documents Such corporation when.

Free Printable Charitable Remainder Trust Form (GENERIC)

Web charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. A charitable remainder trust distributes assets to named beneficiaries first, then distributes any remaining assets to charity. Web a charitable trust is treated as a private foundation unless it meets the requirements for one.

Application Form for Padala Charitable Trust Scholarship 2020

Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions that classifies it as a public charity. Charitable lead trusts distribute money to charity, then distribute any remaining assets to named beneficiaries. The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in.

How to form a Charitable Trust in India

The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting. Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions that classifies it as a public charity. Significant changes include fee updates for charity, raffle and professional fundraiser applicants.

Web Home Charities Forms Updated Forms For 2022 Updated Forms Are Available For Download And Are Required With Any Filings Received By The Registry On Or After January 1, 2022.

For example, if you establish a trust where a designated charity has an interest for a fixed term of years, say 15 or 20 years, the clt can provide that any. Web charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. The crt provides the donor or other beneficiaries with a stream of income with the remaining assets in the trust reverting. We closely examine charitable remainder trusts to ensure they:

Significant Changes Include Fee Updates For Charity, Raffle And Professional Fundraiser Applicants And Registrants.

Web the donor authorizes and empowers the trustees to form and organize a nonprofit corporation limited to the uses and purposes provided for in this declaration of trust, such corporation to be organized under the laws of any state or under the laws of the united states as may be determined by the trustees; Web a charitable trust is a trust which you establish to distribute assets to a charity. Web a crt is an irrevocable trust that is funded with cash or securities. A charitable remainder trust distributes assets to named beneficiaries first, then distributes any remaining assets to charity.

Charitable Lead Trusts Distribute Money To Charity, Then Distribute Any Remaining Assets To Named Beneficiaries.

Web a charitable trust is treated as a private foundation unless it meets the requirements for one of the exclusions that classifies it as a public charity. Correctly report trust income and distributions to beneficiaries file all required tax documents Thus, it is subject to the private foundation excise tax provisions and the other provisions that apply to exempt private foundations, including termination requirements and governing. Web the first step for a charity in determining whether it needs to register is to fill out the request for exemption form available on the attorney general's website on the charitable trusts page.

Such Corporation When Organized To.

Web charitable trusts allow you to donate to an organization and receive tax benefits, while also creating regular income for you or your beneficiaries. The request for exemption form indicates whether additional information or other forms are necessary.