Chapter 93A Demand Letter

Chapter 93A Demand Letter - Web receipt of a g.l. Chapter 93a ) protects people from unfair and misleading business actions. 93a prohibits unfair and deceptive insurance settlement. Web any person receiving such a demand for relief who, within thirty days of the mailing or delivery of the demand for relief, makes a written tender of settlement which is rejected by the claimant may, in any subsequent. Taking the first step if you and a business are. 93a demand letter by any business is a serious legal issue. The application of chapter 93a to higher education in massachusetts, boston bar journal, january 2013. Web the consumer protection act (m.g.l. 2.describe the unfair or deceptive act in detail; Web when a business is the plaintiff and decides to sue another business for violations of the massachusetts consumer protection laws, section 11 of chapter 93a applies, and the rules are a little different.

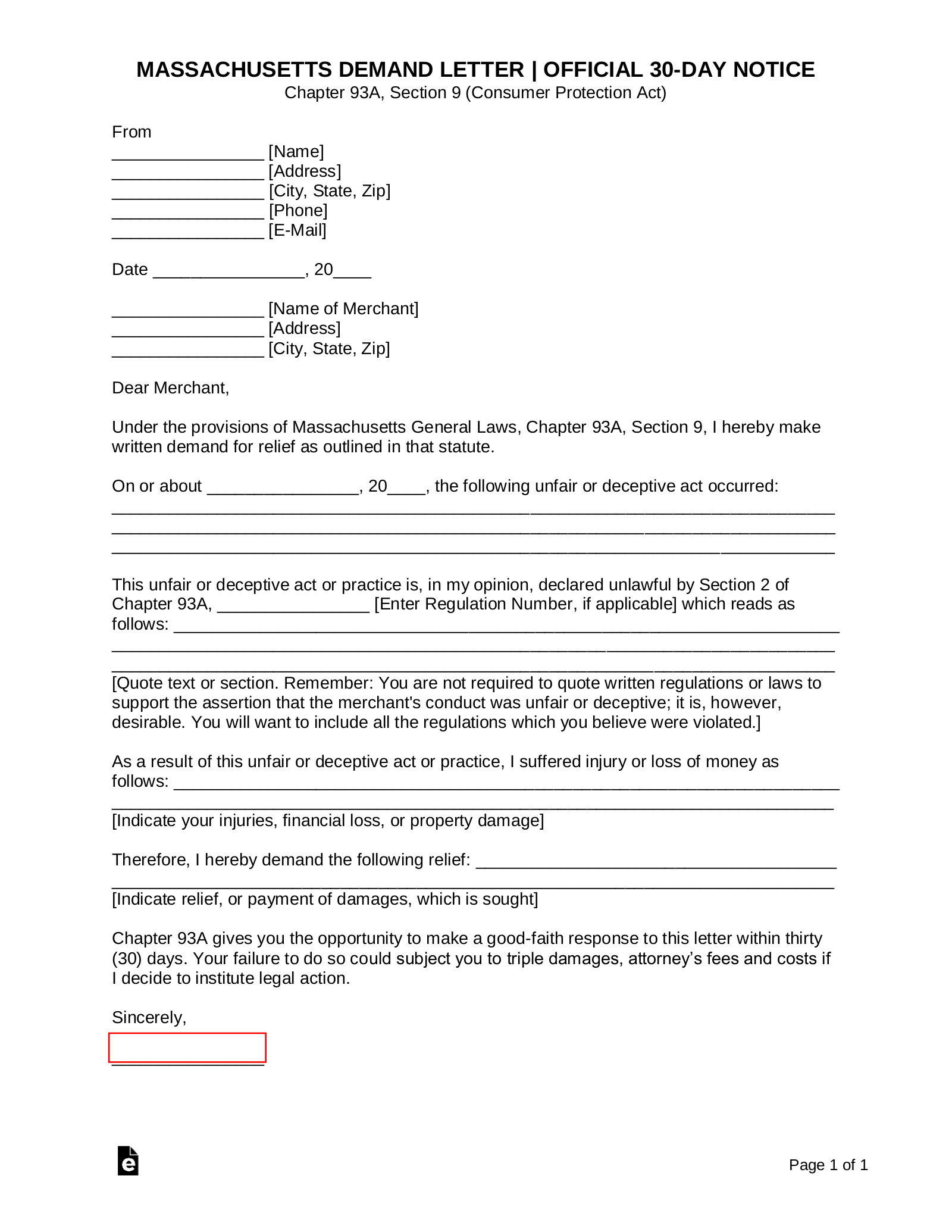

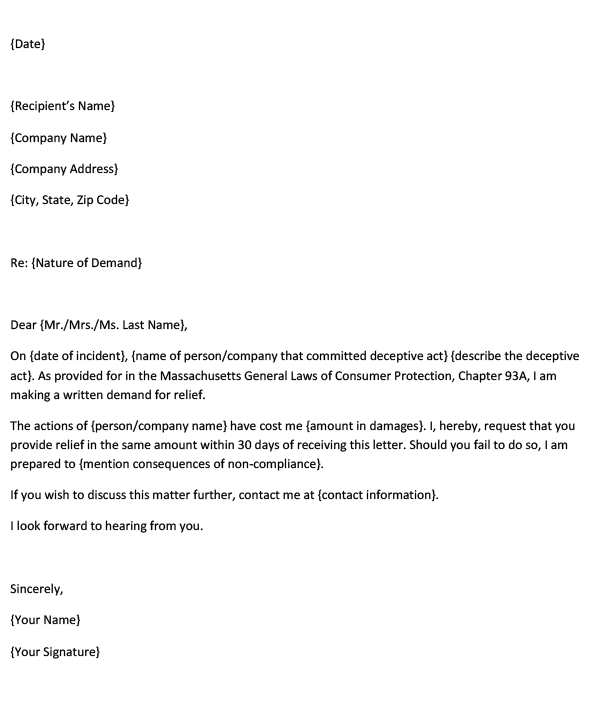

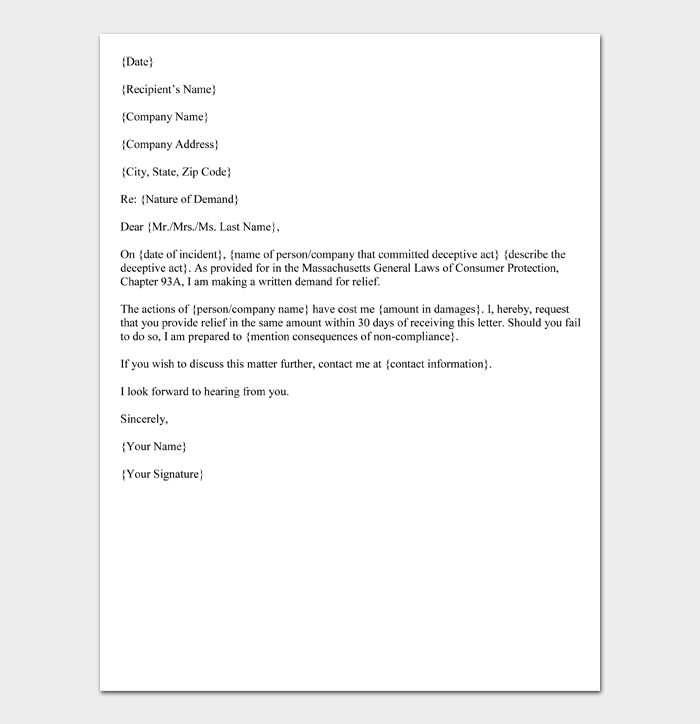

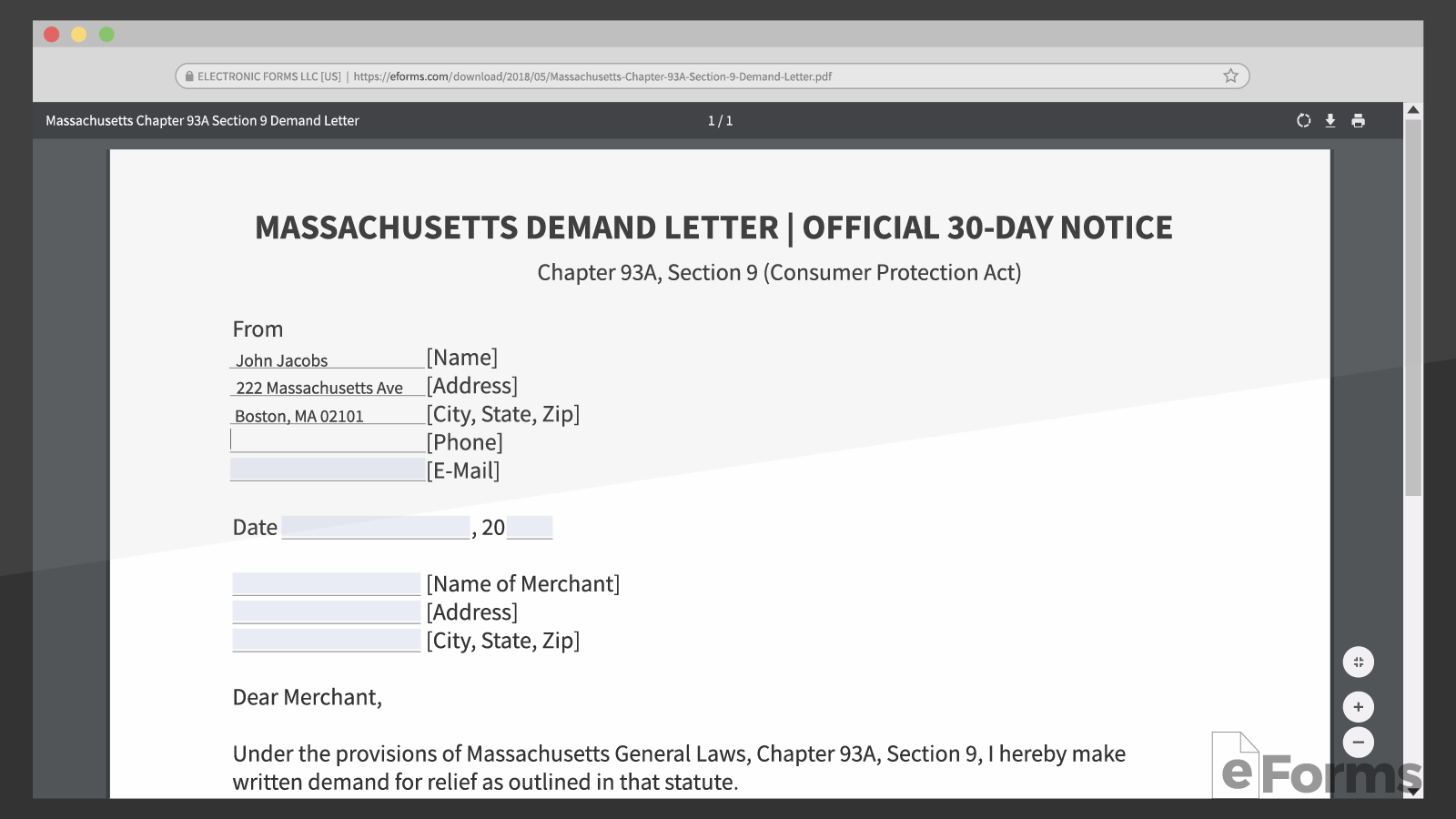

Web the demand letter must identify the claimant, describe the alleged unfair or deceptive acts and injury suffered, and give a company 30 days to provide a written response and tender a reasonable. Web this letter is a demand pursuant to massachusetts general laws chapter 93a, section 9 on behalf of [auto body shop] as assignee of your insured’s property damage claim. Web when a business is the plaintiff and decides to sue another business for violations of the massachusetts consumer protection laws, section 11 of chapter 93a applies, and the rules are a little different. Web this is called a 30 day demand letter.the business must make a good faith response within 30 days, or it could subject him/her to triple damages and attorney's fees. Web in order to bring a chapter 93a claim, however, an aggrieved party must begin the process by sending what is commonly referred to as a chapter 93a, section 9 consumer protection demand letter to which the business has 30 days to respond. On or about (date), the following. The application of chapter 93a to higher education in massachusetts, boston bar journal, january 2013. 3.identify the damages suffered by the claimant; Web outlines best practices for responding to a demand letter. Web if a chapter 93a letter has been filed against your business, the katz law group can help you respond appropriately to protect your business' rights.

Web any person receiving such a demand for relief who, within thirty days of the mailing or delivery of the demand for relief, makes a written tender of settlement which is rejected by the claimant may, in any subsequent. What is a consumer protection demand letter? Web the massachusetts consumer protection law. Web in order to know that this is an actual g.l.c.93a letter, the letter must: Chapter 93a ) protects people from unfair and misleading business actions. 93a demand letter by any business is a serious legal issue. Web this letter is a demand pursuant to massachusetts general laws chapter 93a, section 9 on behalf of [auto body shop] as assignee of your insured’s property damage claim. District court for the district of massachusetts has rejected attempts to throw out consumer protection lawsuits for failure to follow the strict mandates of the chapter 93a demand letter. Web this is called a 30 day demand letter.the business must make a good faith response within 30 days, or it could subject him/her to triple damages and attorney's fees. 2.describe the unfair or deceptive act in detail;

Letter Of Demand For Damages / Demand Letter Sample 14 Pdf Word

Web this letter is a demand pursuant to massachusetts general laws chapter 93a, section 9 on behalf of [auto body shop] as assignee of your insured’s property damage claim. Web in responding to a 93a demand letter, an attorney can help you determine whether to make a reasonable settlement offer. Massachusetts has a statute that specifically enables the attorney general.

Free Chapter 93A (Massachusetts) Demand Letter Sample PDF Word

Taking the first step if you and a business are. The law also allows businesses. Web when a business is the plaintiff and decides to sue another business for violations of the massachusetts consumer protection laws, section 11 of chapter 93a applies, and the rules are a little different. Web i am writing to you under the provisions of massachusetts.

Q I want to bring a claim against someone for engaging in unfair and

The application of chapter 93a to higher education in massachusetts, boston bar journal, january 2013. Web this letter is a demand pursuant to massachusetts general laws chapter 93a, section 9 on behalf of [auto body shop] as assignee of your insured’s property damage claim. Web specifically, a consumer’s claims most often start with a chapter 93a demand letter, which the.

Chapter 93A (Massachusetts) Demand Letter Sample Word PDF

Web the consumer protection act (m.g.l. Massachusetts has a statute that specifically enables the attorney general and consumers to take legal action against unfair or deceptive conduct in the marketplace, called massachusetts consumer protection law, massachusetts general laws chapter 93a. Because chapter 93a generally requires a demand letter before. Web in order to bring a chapter 93a claim, however, an.

Chapter 93A (Massachusetts) Demand Letter Sample Word PDF

Be sent by certified or registered mail; Contact us today for a consultation. On or about (date), the following. It describes the actions for which the recipient is being sued, all of. Web i am writing to you under the provisions of massachusetts general laws, chapter 93a, section 9, the consumer protection act.

40+ Free Demand Letter Templates (All Types with Samples) Word PDF

3.identify the damages suffered by the claimant; Web the consumer protection act (m.g.l. 2.describe the unfair or deceptive act in detail; It describes the actions for which the recipient is being sued, all of. The demand letter must identify the claimant,.

Chapter 93a Demand Letter prosecution2012

3.identify the damages suffered by the claimant; It gives buyers the right to sue in court and get back money they lost. Web outlines best practices for responding to a demand letter. Chapter 93a, section 9 (consumer protection act) from [name of sender] [address] [city, state, zipcode] [phone] [email] [date] [name. The law also allows businesses.

Your Company Received a Massachusetts 93A Demand Letter...Now What?

District court for the district of massachusetts has rejected attempts to throw out consumer protection lawsuits for failure to follow the strict mandates of the chapter 93a demand letter. It describes the actions for which the recipient is being sued, all of. Web a 93a/176d demand letter is essentially a “93a demand letter” that is sent to an insurance company..

Free Chapter 93A (Massachusetts) Demand Letter Sample PDF Word

What is a consumer protection demand letter? Web in order to bring a chapter 93a claim, however, an aggrieved party must begin the process by sending what is commonly referred to as a chapter 93a, section 9 consumer protection demand letter to which the business has 30 days to respond. Because chapter 93a generally requires a demand letter before. It.

Responding to a 93A Demand Letter

Web in order to bring a chapter 93a claim, however, an aggrieved party must begin the process by sending what is commonly referred to as a chapter 93a, section 9 consumer protection demand letter to which the business has 30 days to respond. Web ma federal court confirms leniency of chapter 93a demand letter requirement in two recent cases, the.

What Is A Consumer Protection Demand Letter?

Web in order to know that this is an actual g.l.c.93a letter, the letter must: Web outlines best practices for responding to a demand letter. District court for the district of massachusetts has rejected attempts to throw out consumer protection lawsuits for failure to follow the strict mandates of the chapter 93a demand letter. Web when a business is the plaintiff and decides to sue another business for violations of the massachusetts consumer protection laws, section 11 of chapter 93a applies, and the rules are a little different.

I Am Writing To Request Relief As Outlined In That Statute.

Web a 93a/176d demand letter is essentially a “93a demand letter” that is sent to an insurance company. Be sent by certified or registered mail; Web ma federal court confirms leniency of chapter 93a demand letter requirement in two recent cases, the u.s. 2.describe the unfair or deceptive act in detail;

Web This Letter Is A Demand Pursuant To Massachusetts General Laws Chapter 93A, Section 9 On Behalf Of [Auto Body Shop] As Assignee Of Your Insured’s Property Damage Claim.

Web in order to bring a chapter 93a claim, however, an aggrieved party must begin the process by sending what is commonly referred to as a chapter 93a, section 9 consumer protection demand letter to which the business has 30 days to respond. The demand letter must identify the claimant,. Web if a chapter 93a letter has been filed against your business, the katz law group can help you respond appropriately to protect your business' rights. Web in responding to a 93a demand letter, an attorney can help you determine whether to make a reasonable settlement offer.

Taking The First Step If You And A Business Are.

Web any person receiving such a demand for relief who, within thirty days of the mailing or delivery of the demand for relief, makes a written tender of settlement which is rejected by the claimant may, in any subsequent. Web the consumer protection act (m.g.l. 93a, § 9, defendants are faced with the task of evaluating a case prior to litigation, and before discovery has been completed, based upon minimal information, in order to make a reasonable settlement offer within 30 days of receiving a demand letter. It gives buyers the right to sue in court and get back money they lost.