Chapter 3 Test A Accounting

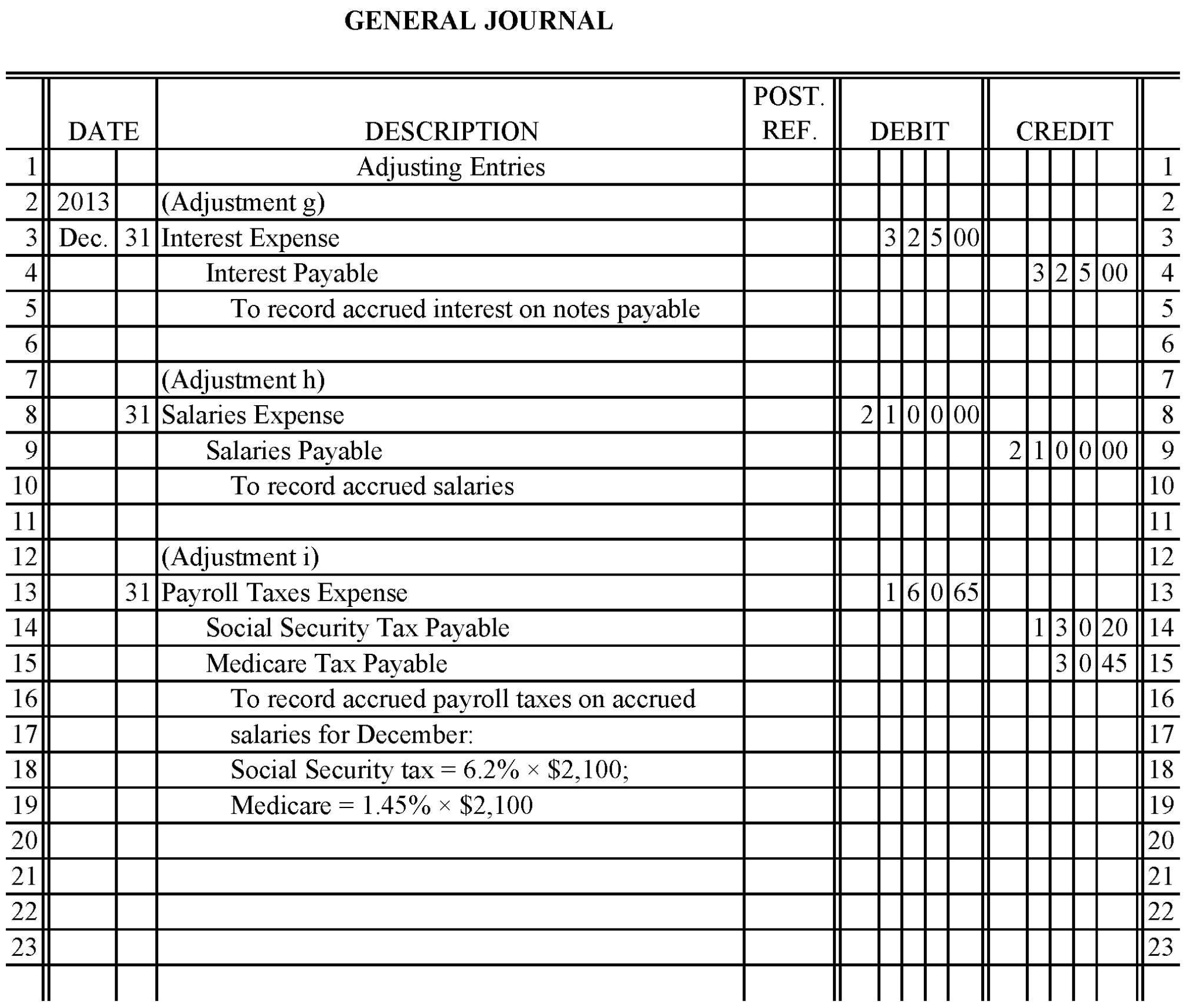

Chapter 3 Test A Accounting - The source document for all cash payments is a check. Kristina russo | cpa, mba, author. Explain the accrual basis of accounting. _____________ records revenues when services are provided, and records expenses when incurred. Click the card to flip 👆. Explain the reasons for preparing adjusting entries. Web accounting test chapter 3. Web 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; A receipt is the source document for cash received from transactions other than sales. The major types of adjusting entries are deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and accrued expenses).

Web accounting chapter 3 quiz. (b) there must always be entries made on both sides of the accounting. Explain the accrual basis of accounting. Web 35 basic accounting test questions. Web accounting chapter 3 test a. Prepare financial statements from the adjusted trial balance. _____________ records revenues when services are provided, and records expenses when incurred. The source document for all cash payments is a check. Web chapter 3 questions multiple choice the revenue recognition principle state that: A business paper from which information is.

Web accounting test chapter 3. The major types of adjusting entries are deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and accrued expenses). _____________ records revenues when services are provided, and records expenses when incurred. Multiperiod costs and revenues that must be split among two or more accounting. A receipt is the source document for cash received from transactions other than sales. When you reach the second objective. Our solutions are written by chegg experts so you can be assured of the highest quality! Web identify steps in the accounting cycle. Explain the time period assumption. Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance.

Advanced accounting 12th edition fischer solutions manual by Duchac Issuu

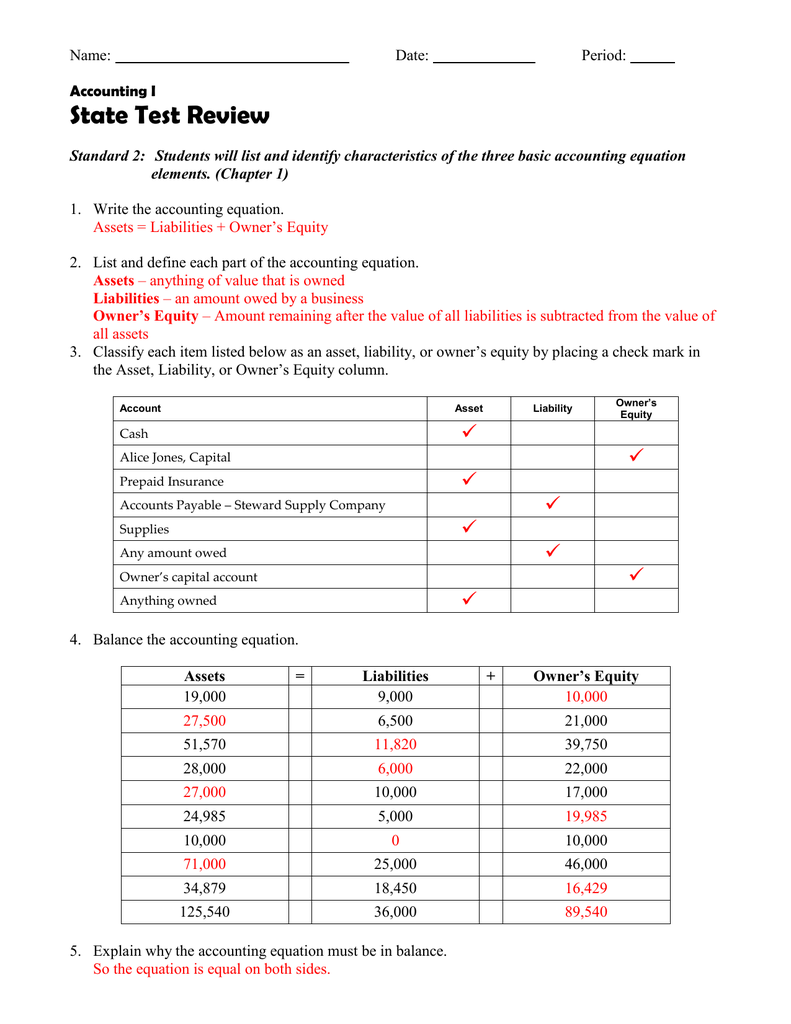

A receipt is the source document for cash received from transactions other than sales. Explain the accrual basis of accounting. Web terms in this set (14) true. If an individual asset is increased, then. There could be an equal decrease in a specific liability.

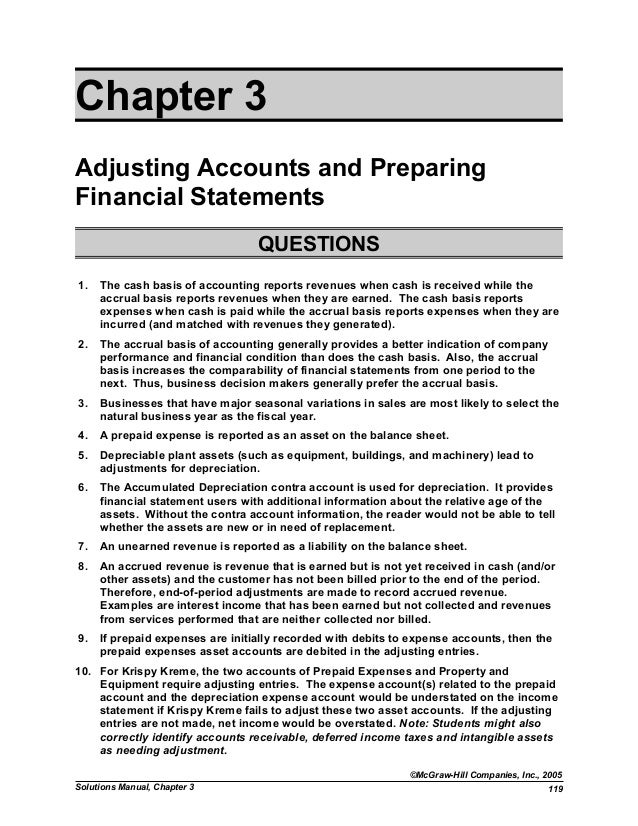

Ch03 Summary Financial Accounting IFRS, 3rd Edition CHAPTER 3

Other sets by this creator. There could be an equal decrease. Explain the reasons for preparing adjusting entries. Record transactions in journals, post to ledger accounts, and prepare a trial balance. A business paper from which information is.

Accounting Course Pdf Download Design Pro Makerr

Explain the accrual basis of accounting. (b) there must always be entries made on both sides of the accounting. Web identify steps in the accounting cycle. The 35 questions include many topics covered in a typical accounting 101 class. Survey the uninhabited floating city.

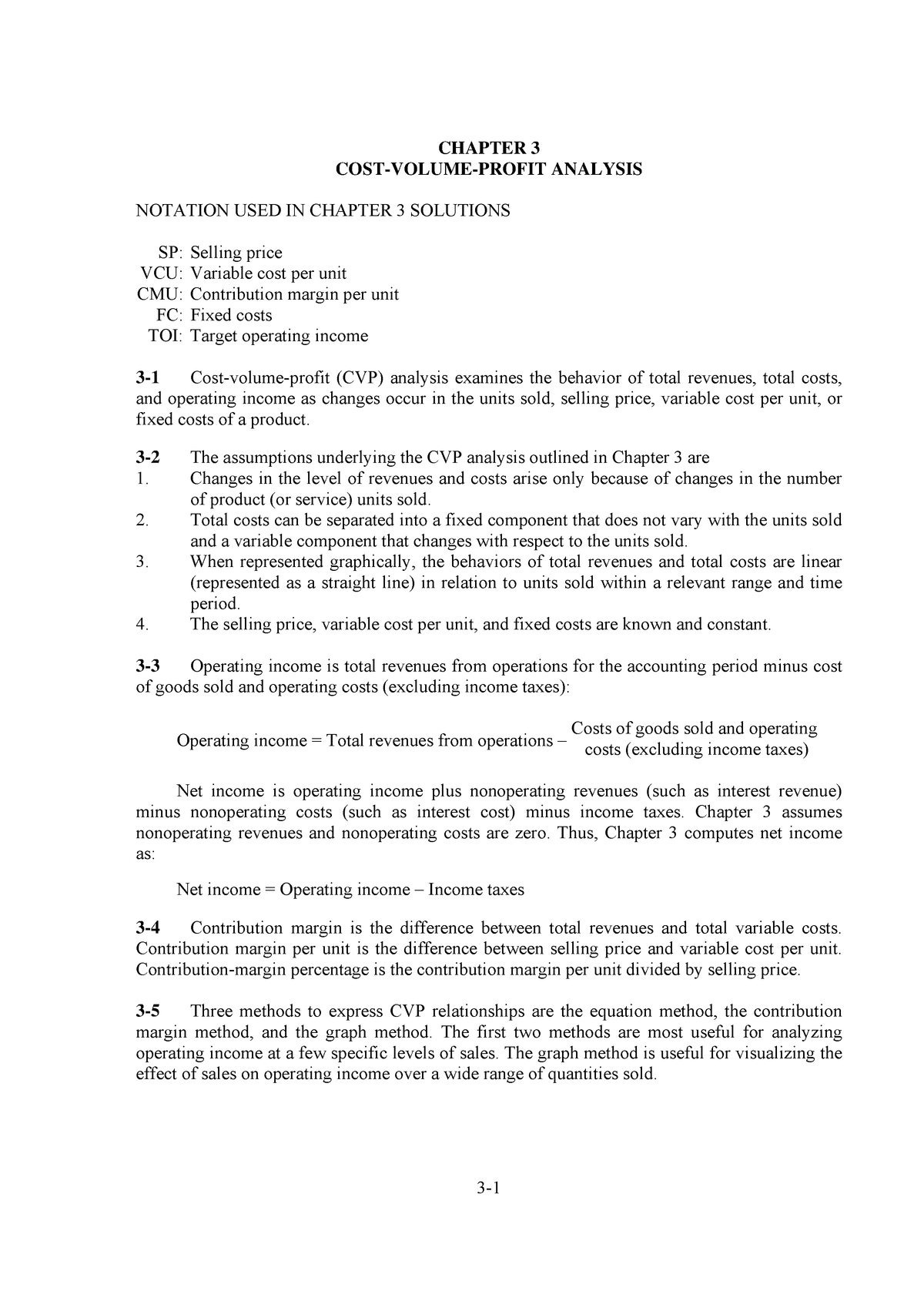

Solution manual chapter 3 fap

The 35 questions include many topics covered in a typical accounting 101 class. Explain the time period assumption. 1.2 identify users of accounting information and how they apply information; There could be an equal decrease in a specific liability. Prepare financial statements from the adjusted trial balance.

Chapter 3 Accounting Systems Test

Kristina russo | cpa, mba, author. Web chapter 3 the accounting information system ifrs questions are available at the end of this chapter. Web identify steps in the accounting cycle. Click the card to flip 👆. Differentiate the cash basis of accounting from the accrual basis of accounting…

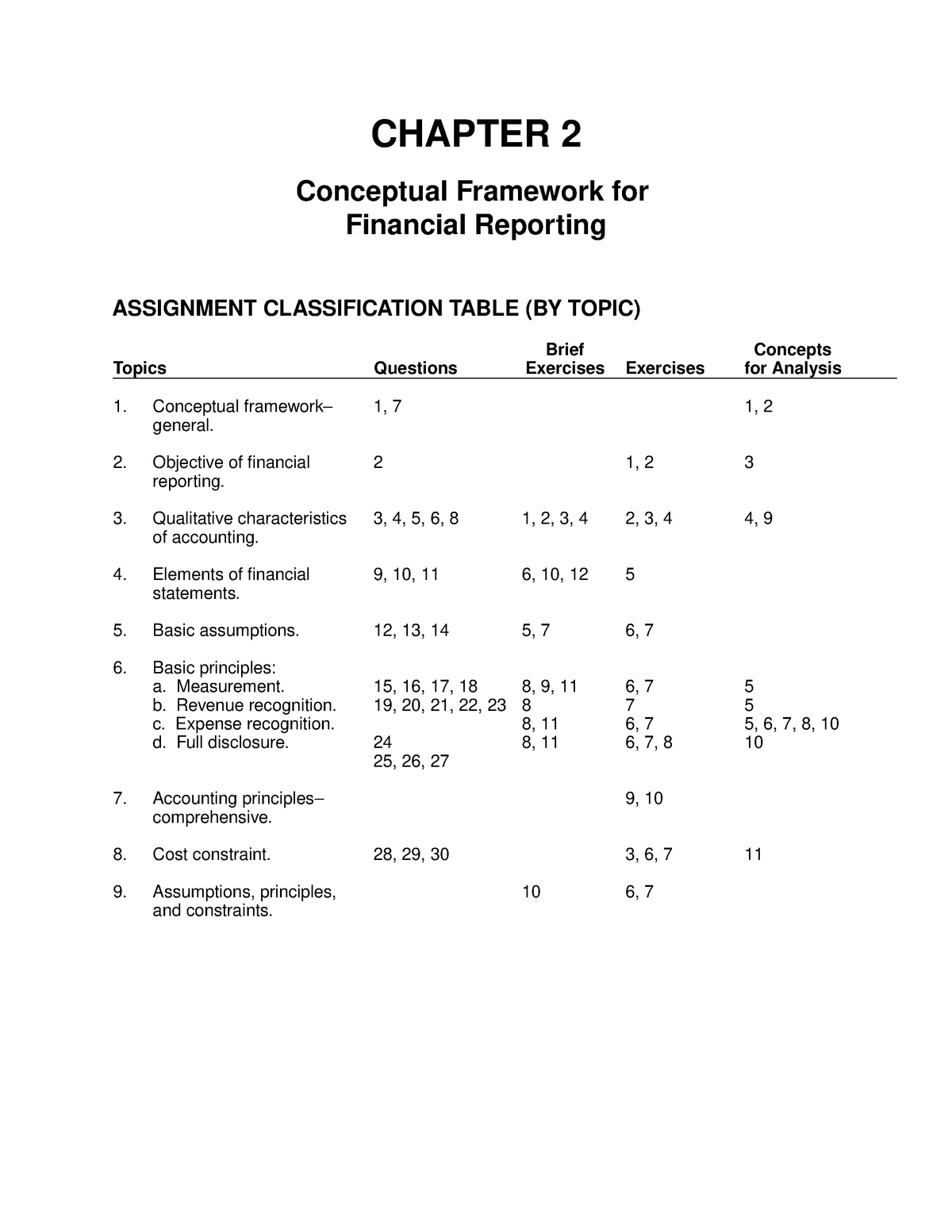

Intermediate Accounting Chapter 2 Solutions ACCT 310 StuDocu

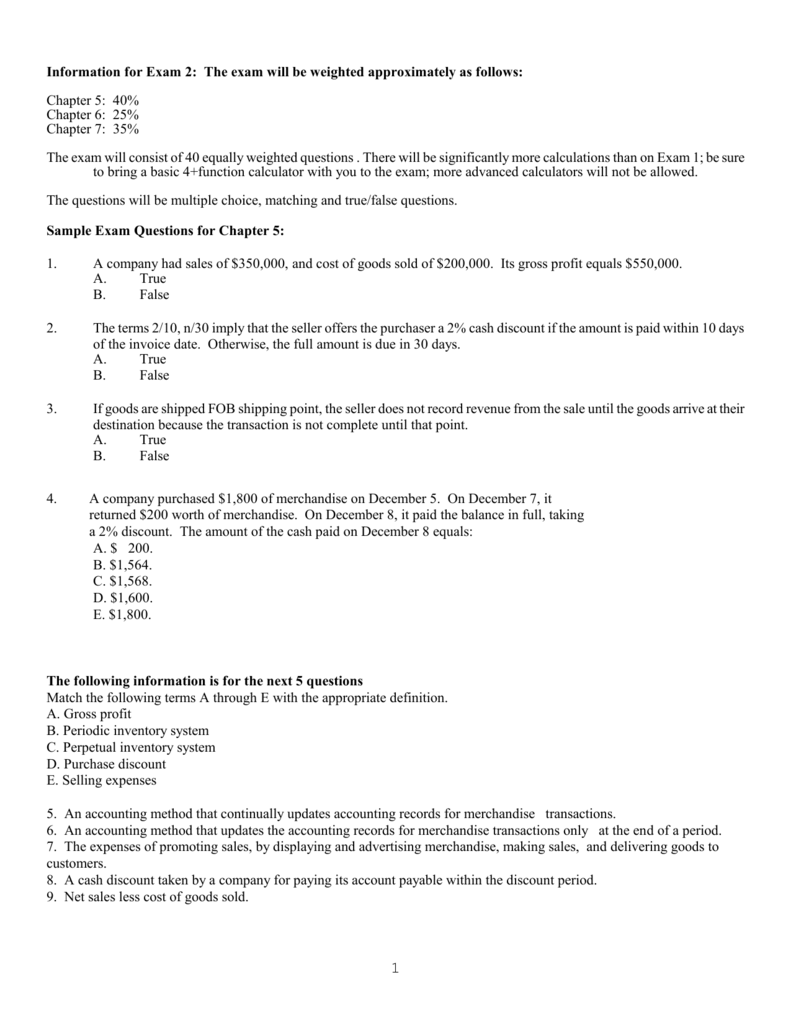

Web access principles of cost accounting 17th edition chapter 3 solutions now. Web terms in this set (14) true. Web identify steps in the accounting cycle. Survey the uninhabited floating city. Web accounting test chapter 3.

Chapter 6 Study Guide Accounting True And False Study Poster

_____________ records revenues when services are provided, and records expenses when incurred. Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance. Click the card to flip 👆. When you reach the second objective. A business form ordering a bank to pay cash from a bank account.

Chapter 13 Solutions College Accounting ( Chapters 130) 13th Edition

There could be an equal decrease in stockholders' equity. A business paper from which information is. Take this short quiz to assess your knowledge of basic accounting. When you reach the second objective. Explain the time period assumption.

College Accounting, Chapters 1 15, 23rd Edition 9781337794763 Cengage

The source document for all cash payments is a check. The 35 questions include many topics covered in a typical accounting 101 class. 1.2 identify users of accounting information and how they apply information; Prepare financial statements from the adjusted trial balance. When you reach the second objective.

Chapter 3 Review Business Transactions And The Accounting Equation

Survey the uninhabited floating city. Web identify steps in the accounting cycle. Web accounting test chapter 3. Answers with explanations are at the end of the test. Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance.

There Could Be An Equal Decrease In Stockholders' Equity.

Kristina russo | cpa, mba, author. There could be an equal decrease in a specific liability. 1.2 identify users of accounting information and how they apply information; The major types of adjusting entries are deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and accrued expenses).

Other Sets By This Creator.

Web 35 basic accounting test questions. Web answers goals achievement 1. Explain the accrual basis of accounting. Terms in this set (21) source document.

A Receipt Is The Source Document For Cash Received From Transactions Other Than Sales.

A business form ordering a bank to pay cash from a bank account. If an individual asset is increased, then. Click the card to flip 👆. The source document for all cash payments is a check.

A Business Paper From Which Information Is.

Web access principles of cost accounting 17th edition chapter 3 solutions now. Explain the reasons for preparing adjusting entries. Click the card to flip 👆. Take this short quiz to assess your knowledge of basic accounting.