Chapter 171 Of The Texas Tax Code

Chapter 171 Of The Texas Tax Code - (1) 0.25 percent per year of privilege period of net taxable capital; To the extent the irc treats the recapture of depreciation under these sections as ordinary income, the recaptured amount. The exemption applies only to a period for which no tax is due. Section 171.0002, definition of taxable entity. Web statutes title 2, state taxation; Web this section of the texas tax code defines a passive entity as a general or limited partnership or a trust that meets certain income and activity requirements. (b) the tax imposed under this chapter extends to. Definition of conducting active trade or business. Web if any of the statements below are true, you qualify to file this no tax due information report: 2022 | check for updates | other versions.

Web if any of the statements below are true, you qualify to file this no tax due information report: A periodic (usually annual) payment of a fixed sum of money for either the life of the. Web acts 2017, 85th leg., r.s., ch. Tx tax code § 171.0005 (2021) text of section effective until. (a) the rates of the franchise tax are: It also provides the source and amendment. Web statutes title 2, state taxation; (a) an entity is a passive entity only if: Forfeiture of charter or certificate of authority. (blacken all circles that apply) 1.

A periodic (usually annual) payment of a fixed sum of money for either the life of the. Web texas tax code (ttc) 171.0003(b). (1) 0.25 percent per year of privilege period of net taxable capital; Tx tax code § 171.0005 (2021) text of section effective until. Forfeiture by secretary of state. Definition of conducting active trade or business. Web if any of the statements below are true, you qualify to file this no tax due information report: (1) the entity is a general or limited partnership or a trust,. It also provides the source and amendment. For legal professionals find a lawyer.

Study shows potential impact of Inheritance Tax Code changes on family

Web if any of the statements below are true, you qualify to file this no tax due information report: 2022 | check for updates | other versions. Tx tax code § 171… (a) a franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. (1) 0.25 percent.

MillyTsneem

Definition of conducting active trade or business. Section 171.0002, definition of taxable entity. Web a taxable entity that does not owe any tax under this chapter for any period is not required to file a report under section 171.201 or 171.202. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250 and 1254 considered passive income? (blacken.

How to File a Mechanics Lien in Texas National Lien & Bond

Section 171.0002, definition of taxable entity. (a) the rates of the franchise tax are: (1) the entity is a general or limited partnership or a trust,. This entity's annualized total revenue is below the no tax. Web a taxable entity that does not owe any tax under this chapter for any period is not required to file a report under.

Revenue Code Chapter 91 Realty Transfer Tax Free Download

Forfeiture of charter or certificate of authority. Adjustment of eligibility for no tax due, discounts, and compensation deduction. A taxable entity on which a tax is imposed by this chapter shall pay the tax to the comptroller. Definition of conducting active trade or business. Web texas tax code (ttc) 171.0003(b).

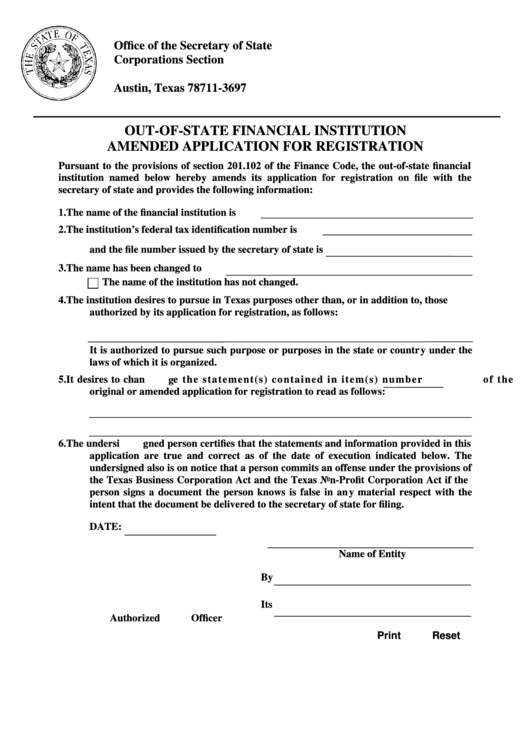

Fillable OutOfState Financial Institution Amended Application For

It also provides the source and amendment. Section 171.0002, definition of taxable entity. The exemption applies only to a period for which no tax is due. Web if any of the statements below are true, you qualify to file this no tax due information report: Web this section of the texas tax code defines a passive entity as a general.

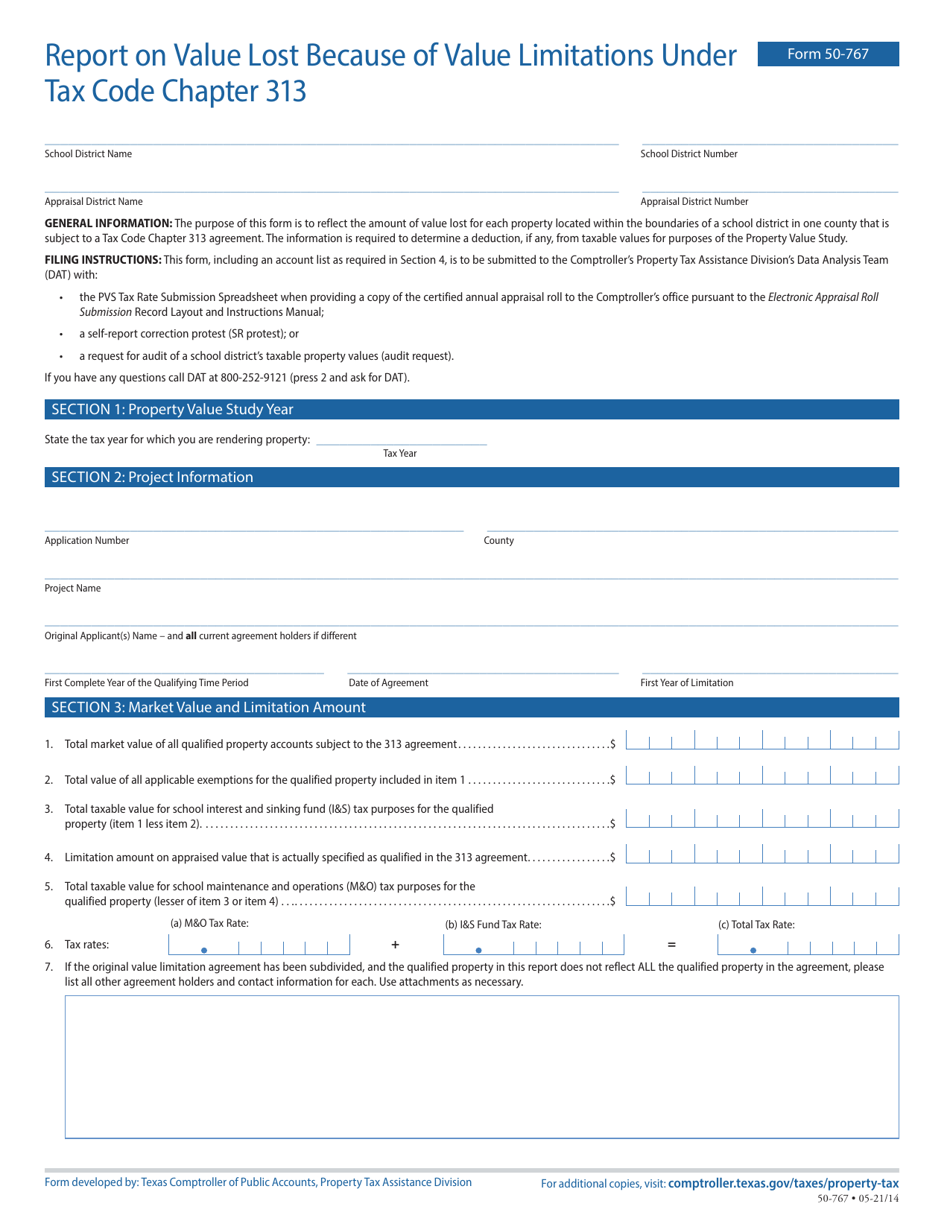

Form 50767 Download Fillable PDF or Fill Online Report on Value Lost

This entity's annualized total revenue is below the no tax. This entity is a passive entity as defined in chapter 171 of the texas tax code. (b) the tax imposed under this chapter extends to. For legal professionals find a lawyer. Penalty for failure to pay tax or file report 171.363.

Truth and Proof Judge Tano Tijerina

Paying off a loan by regular installments. This entity's annualized total revenue is below the no tax. Read the code on findlaw. For legal professionals find a lawyer. (blacken all circles that apply) 1.

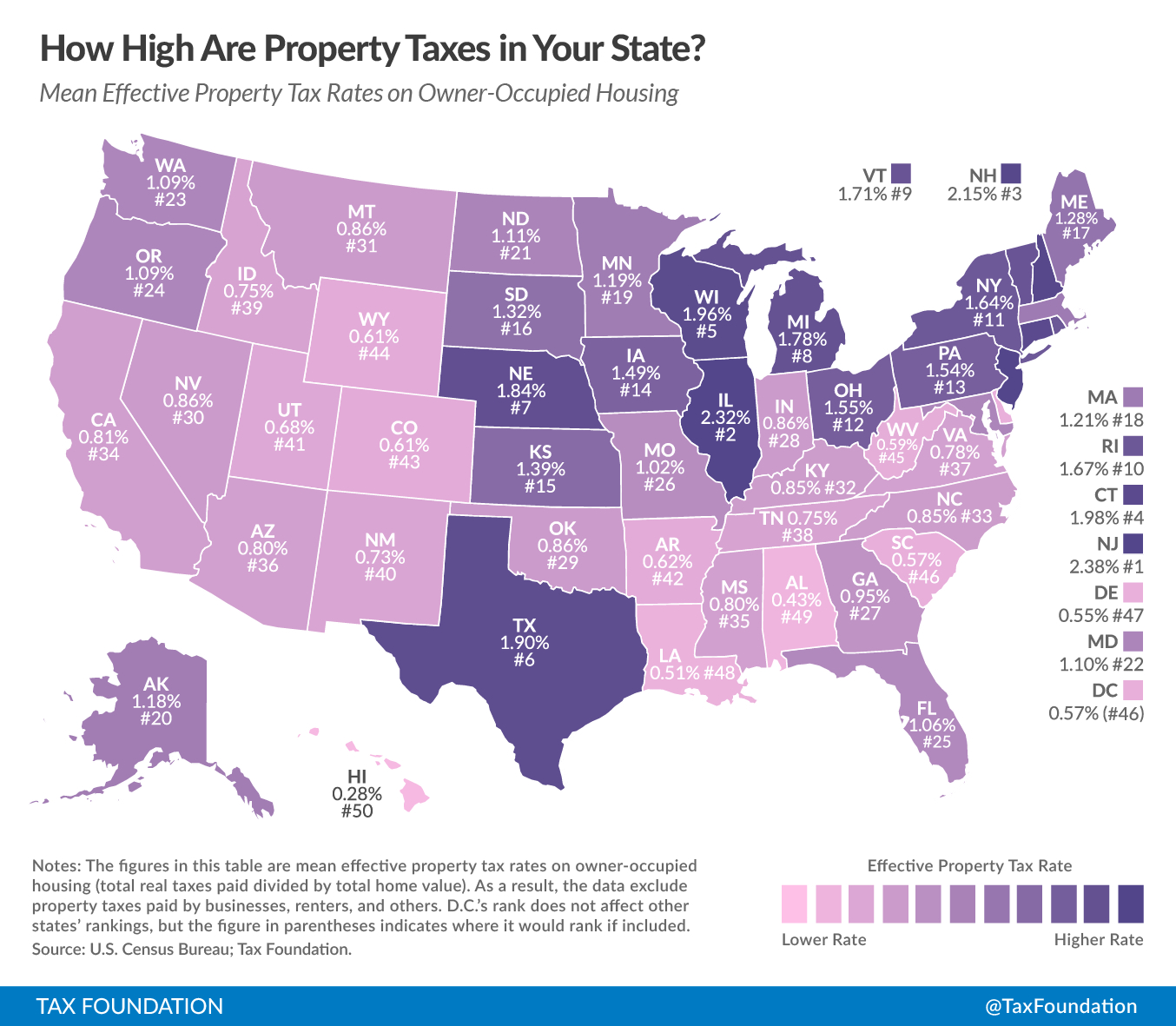

How High Are Property Taxes In Your State? Tax Foundation Texas

(1) the entity is a general or limited partnership or a trust,. Penalty for failure to pay tax or file report 171.363. Web texas tax code (ttc) 171.0003(b). Adjustment of eligibility for no tax due, discounts, and compensation deduction. Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b.

Texas Pattern Jury Charges Business, Consumer, Insurance & Employment

(1) 0.25 percent per year of privilege period of net taxable capital; (a) an entity is a passive entity only if: To the extent the irc treats the recapture of depreciation under these sections as ordinary income, the recaptured amount. A periodic (usually annual) payment of a fixed sum of money for either the life of the. Section 171.0002, definition.

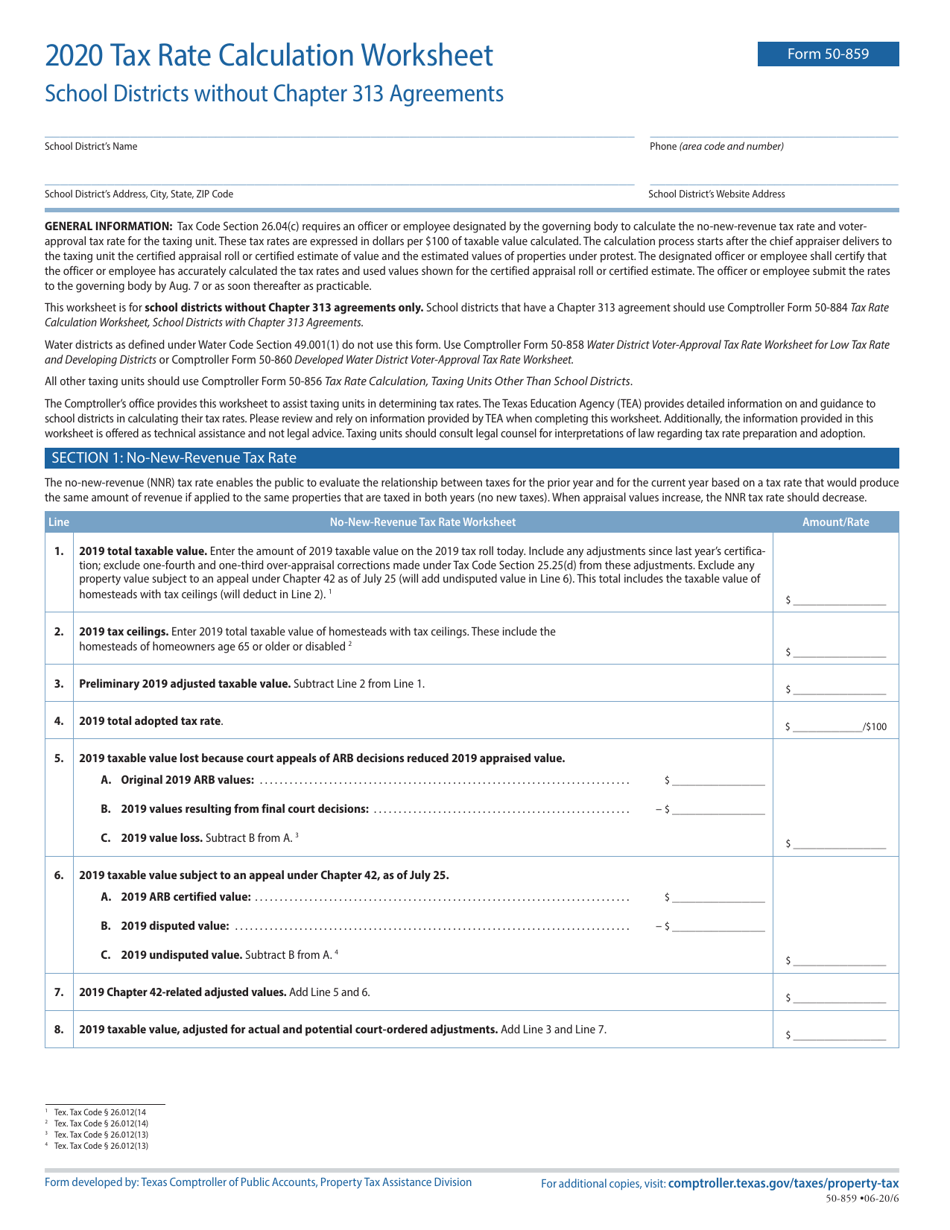

Form 50859 Download Fillable PDF or Fill Online Tax Rate Calculation

Definition of conducting active trade or business. (1) affiliated group means a group of one or more entities in which a controlling interest is owned by a common owner or owners, either corporate or noncorporate,. Web acts 2017, 85th leg., r.s., ch. Section 171.0002, definition of taxable entity. Read the code on findlaw.

(B) The Tax Imposed Under This Chapter Extends To.

(a) dividends, interest, foreign currency exchange gain, periodic and nonperiodic. Nonprofit entities that have requested and been granted an exemption from the comptroller's office do not have to file franchise tax. The exemption applies only to a period for which no tax is due. Web a taxable entity that does not owe any tax under this chapter for any period is not required to file a report under section 171.201 or 171.202.

(1) The Entity Is A General Or Limited Partnership Or A Trust, Other Than A Business Trust;

This entity's annualized total revenue is below the no tax. It also provides the source and amendment. Web if any of the statements below are true, you qualify to file this no tax due information report: Web this section of the texas tax code defines a passive entity as a general or limited partnership or a trust that meets certain income and activity requirements.

Web Certain Exemptions From The Franchise Tax Are Outlined In Texas Tax Code Chapter 171, Subchapter B.

Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250 and 1254 considered passive income? Adjustment of eligibility for no tax due, discounts, and compensation deduction. Wilful and fraudulent acts 171… Web amended by acts 1993, 73rd leg., ch.

Penalty For Failure To Pay Tax Or File Report 171.363.

(a) a franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. Tx tax code § 171… A periodic (usually annual) payment of a fixed sum of money for either the life of the. Forfeiture by secretary of state.