Chapter 13 Fha Waiting Period

Chapter 13 Fha Waiting Period - If the chapter 13 bankruptcy has not been discharged for a minimum period of two years, the loan. Web the waiting period for getting an fha mortgage after chapter 13 bankruptcy is two years. However, if the chapter 13. Web lender documentation must show two years from the discharge date of a chapter 13 bankruptcy. Find out everything you need to know in this comprehensive guide. Web the fha guidelines specify a minimum waiting period of one year from the date of the chapter 13 bankruptcy discharge. As mentioned earlier, the fha bankruptcy waiting period is typically two years for chapter 7 bankruptcy and one year into the repayment plan for chapter 13 bankruptcy. Web you can apply for an fha loan just 2 years after a chapter 7 bankruptcy and 12 months after a chapter 13 discharge if you have made at least 12 on time bankruptcy payments and have written permission. However, they all need to be manual underwriting files if the waiting period after the bankruptcy is less than two years. If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a.

However, they all need to be manual underwriting files if the waiting period after the bankruptcy is less than two years. As mentioned earlier, the fha bankruptcy waiting period is typically two years for chapter 7 bankruptcy and one year into the repayment plan for chapter 13 bankruptcy. Web here’s what the handbook says about getting an fha loan after a chapter 13 filing: If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. Web length of the waiting period. However, if the chapter 13. Web confused about chapter 7 and chapter 13 bankruptcy waiting periods? Guidelines for credit report review, continued 4155.1 4.c.2.e paying off collections and judgments fha does not require that collection accounts be paid off as a condition of mortgage approval. Web you can apply for an fha loan just 2 years after a chapter 7 bankruptcy and 12 months after a chapter 13 discharge if you have made at least 12 on time bankruptcy payments and have written permission. Fha will consider approving a borrower who is still paying on a chapter 13 bankruptcy if those payments have been satisfactorily made and verified for a period.

Web the waiting period for getting an fha mortgage after chapter 13 bankruptcy is two years. Fha loans after chapter 13 bankruptcy works like any other fha loan requirements. Home buyers start here fha loan requirements fha. Web you can apply for an fha loan just 2 years after a chapter 7 bankruptcy and 12 months after a chapter 13 discharge if you have made at least 12 on time bankruptcy payments and have written permission. Guidelines for credit report review, continued 4155.1 4.c.2.e paying off collections and judgments fha does not require that collection accounts be paid off as a condition of mortgage approval. Web here’s what the handbook says about getting an fha loan after a chapter 13 filing: Web the true and real answer per va and fha chapter 13 bankruptcy guidelines is that there is no waiting period to qualify for va and fha loans after the chapter 13 bankruptcy discharge. Web manual underwriting mortgage process. Fha loan plus home interest rates today articles questions about fha loans connect with us: If the chapter 13 bankruptcy has not been discharged for a minimum period of two years, the loan.

43+ Fha Waiting Period After Chapter 13 Discharge KylaTomilola

Fha will consider approving a borrower who is still paying on a chapter 13 bankruptcy if those payments have been satisfactorily made and verified for a period. However, if the chapter 13. Web manual underwriting mortgage process. Web the true and real answer per va and fha chapter 13 bankruptcy guidelines is that there is no waiting period to qualify.

Freddie Mac Chapter 7 Bankruptcy Waiting Period

Fha loans after chapter 13 bankruptcy works like any other fha loan requirements. Web a consumer who just had a chapter 13 bankruptcy discharge can qualify for an fha loan right after the chapter 13 bankruptcy discharge date with no waiting period. Web the fha guidelines specify a minimum waiting period of one year from the date of the chapter.

36+ Fha Waiting Period After Chapter 7 KasamKatarina

Web the true and real answer per va and fha chapter 13 bankruptcy guidelines is that there is no waiting period to qualify for va and fha loans after the chapter 13 bankruptcy discharge. Web lender documentation must show two years from the discharge date of a chapter 13 bankruptcy. If the chapter 13 bankruptcy has not been discharged for.

FHA Guidelines On Chapter 13 Versus Chapter 7 Bankruptcy

Web the fha guidelines specify a minimum waiting period of one year from the date of the chapter 13 bankruptcy discharge. Fha loans after chapter 13 bankruptcy works like any other fha loan requirements. Web length of the waiting period. As mentioned earlier, the fha bankruptcy waiting period is typically two years for chapter 7 bankruptcy and one year into.

43+ Fha Waiting Period After Chapter 13 Discharge KylaTomilola

If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. Find out everything you need to know in this comprehensive guide. However, if the chapter 13. Web the true and real answer per va and fha chapter 13 bankruptcy guidelines is that there is no waiting period to qualify for va.

36+ Fha Waiting Period After Chapter 7 KasamKatarina

Web length of the waiting period. However, they all need to be manual underwriting files if the waiting period after the bankruptcy is less than two years. Web a consumer who just had a chapter 13 bankruptcy discharge can qualify for an fha loan right after the chapter 13 bankruptcy discharge date with no waiting period. Find out everything you.

FHA Guidelines During Versus After Chapter 13 Bankruptcy

Fha loan plus home interest rates today articles questions about fha loans connect with us: Fha will consider approving a borrower who is still paying on a chapter 13 bankruptcy if those payments have been satisfactorily made and verified for a period. Web you can apply for an fha loan just 2 years after a chapter 7 bankruptcy and 12.

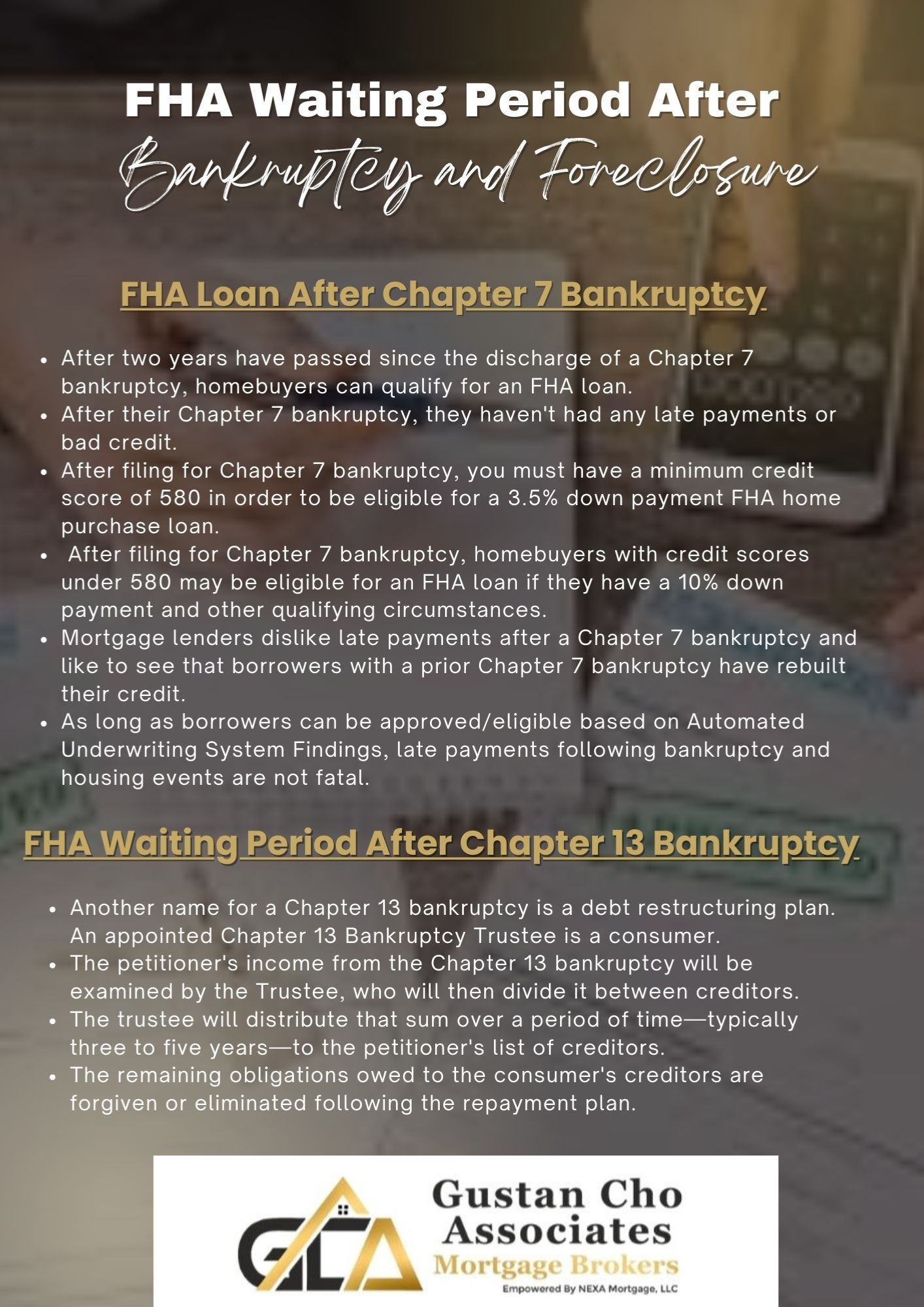

FHA Waiting Period After Bankruptcy And Foreclosure Guidelines

Web however, in the event a borrower does not have sufficient credit on their credit report the fha will allow substitute forms. However, they all need to be manual underwriting files if the waiting period after the bankruptcy is less than two years. Web confused about chapter 7 and chapter 13 bankruptcy waiting periods? Web lender documentation must show two.

43+ Fha Waiting Period After Chapter 13 Discharge KylaTomilola

Web however, in the event a borrower does not have sufficient credit on their credit report the fha will allow substitute forms. Fha states that if an fha borrower has a chapter 13 bankruptcy discharge, there is no waiting period to qualify for an fha. If the chapter 13 bankruptcy has not been discharged for a minimum period of two.

FHA 203k Rehab Loan After Bankruptcy Mortgage Guidelines

However, if the bankruptcy case is dismissed rather than discharged, the. Web a consumer who just had a chapter 13 bankruptcy discharge can qualify for an fha loan right after the chapter 13 bankruptcy discharge date with no waiting period. Web you can apply for an fha loan just 2 years after a chapter 7 bankruptcy and 12 months after.

However, If The Chapter 13.

Fha states that if an fha borrower has a chapter 13 bankruptcy discharge, there is no waiting period to qualify for an fha. However, if the bankruptcy case is dismissed rather than discharged, the. Web you can apply for an fha loan just 2 years after a chapter 7 bankruptcy and 12 months after a chapter 13 discharge if you have made at least 12 on time bankruptcy payments and have written permission. Web the true and real answer per va and fha chapter 13 bankruptcy guidelines is that there is no waiting period to qualify for va and fha loans after the chapter 13 bankruptcy discharge.

Home Buyers Start Here Fha Loan Requirements Fha.

Web the fha guidelines specify a minimum waiting period of one year from the date of the chapter 13 bankruptcy discharge. If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. Fha loans after chapter 13 bankruptcy works like any other fha loan requirements. However, they all need to be manual underwriting files if the waiting period after the bankruptcy is less than two years.

Find Out Everything You Need To Know In This Comprehensive Guide.

Web length of the waiting period. As mentioned earlier, the fha bankruptcy waiting period is typically two years for chapter 7 bankruptcy and one year into the repayment plan for chapter 13 bankruptcy. Guidelines for credit report review, continued 4155.1 4.c.2.e paying off collections and judgments fha does not require that collection accounts be paid off as a condition of mortgage approval. Web here’s what the handbook says about getting an fha loan after a chapter 13 filing:

Web Lender Documentation Must Show Two Years From The Discharge Date Of A Chapter 13 Bankruptcy.

Fha loan plus home interest rates today articles questions about fha loans connect with us: Web however, in the event a borrower does not have sufficient credit on their credit report the fha will allow substitute forms. Web confused about chapter 7 and chapter 13 bankruptcy waiting periods? Web manual underwriting mortgage process.