Chapter 13 Bankruptcy Texas Payments

Chapter 13 Bankruptcy Texas Payments - What does it cost to file for bankruptcy? Background a chapter 13 bankruptcy is also called a wage earner's plan. The chapter 13 trustee shall not make payments. Procedures for obtaining relief from requirement to attend § 341 meeting of creditors: Web chapter 13 trustee for the southern district of texas for brownsville, corpus christi, victoria, laredo and mcallen divisions. Web chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years. The court may allow you to pay this filing fee in installments if you cannot pay. Web chapter 13 of the bankruptcy code generally authorizes the restructuring of a person’s debts so the person is able to use future earnings to pay all or a substantial portion of those debts without being burdened by. We can help you navigate the process so you can spend more time living your life. Jones was able to file for chapter 11 under the more lenient bankruptcy rules of the small business reorganization act.

Typically, chapter 13 bankruptcy is for debtors who: This means that once a case is filed, the trustee must have a payment. Web stay on track of all payment plans bankruptcy, managed. This article explains how to determine the amount you'd pay in a chapter 13 monthly payment. Since 2011, tfs has helped hundreds of thousands of people automate their success. What does it cost to file for bankruptcy? North carolina divorce law doesn’t need to be a mystery. You can also estimate your minimum chapter 13 payment using our chapter 13 payment. Web the amount you must pay back will depend on your income, expenses, and type of debt you have. Background a chapter 13 bankruptcy is also called a wage earner's plan.

Click here for chapter 13 dates and times. Fee applications for debtors' attorney: This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13 filers must pay. It now costs $306 to file for bankruptcy under chapter 7 and $281 to file for bankruptcy under chapter 13, whether for one person or a married couple. The next thing you’ll be. The chapter 13 trustee shall not make payments. Don’t qualify for chapter 7 but need debt relief (for instance, to lower credit card payments… Web paragraph 4a hereof, the chapter 13 trustee shall commence payments on the ongoing mortgagee in the changed amount beginning with the next payment due under the ongoing mortgage at least 21 days after the filing of the notice. Web how to file a divorce in north carolina. Typically, chapter 13 bankruptcy is for debtors who:

JC White Law Group Chapter 7 or Chapter 13 Bankruptcy Which is Right

May 11, 2023 · 6 min. It now costs $306 to file for bankruptcy under chapter 7 and $281 to file for bankruptcy under chapter 13, whether for one person or a married couple. This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13 filers must pay. The next.

Chapter 7 lawyer Ventura Ventura Foreclosure lawyer Ventura

Web paragraph 4a hereof, the chapter 13 trustee shall commence payments on the ongoing mortgagee in the changed amount beginning with the next payment due under the ongoing mortgage at least 21 days after the filing of the notice. Web how to file a divorce in north carolina. Web calculating required debt payments in chapter 13. Web chapter 13 of.

Can My Chapter 13 Bankruptcy Payments Go Down if I Lose My Job? YouTube

Web chapter 13 bankruptcy information: Don’t qualify for chapter 7 but need debt relief (for instance, to lower credit card payments… This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13 filers must pay. And even then, you might still be unable to afford the required chapter 13 payment….

Can You Stop Car Payments in Chapter 13 Bankruptcy?

Web although infowars has estimated revenues of some $70 million a year, mr. Web calculating required debt payments in chapter 13. We can help you navigate the process so you can spend more time living your life. Web stay on track of all payment plans bankruptcy, managed. Web epay quick reference guide:

What Is Chapter 13 Bankruptcy? CT Bankruptcy Attorneys

Web under the bankruptcy code, your first payment is due “not later than 30 days after the date of the filing of the plan or the order for relief.” 11 u.s.c. You can use chapter 13 to prevent a house. You can also estimate your minimum chapter 13 payment using our chapter 13 payment. Fee applications for debtors' attorney: Discover.

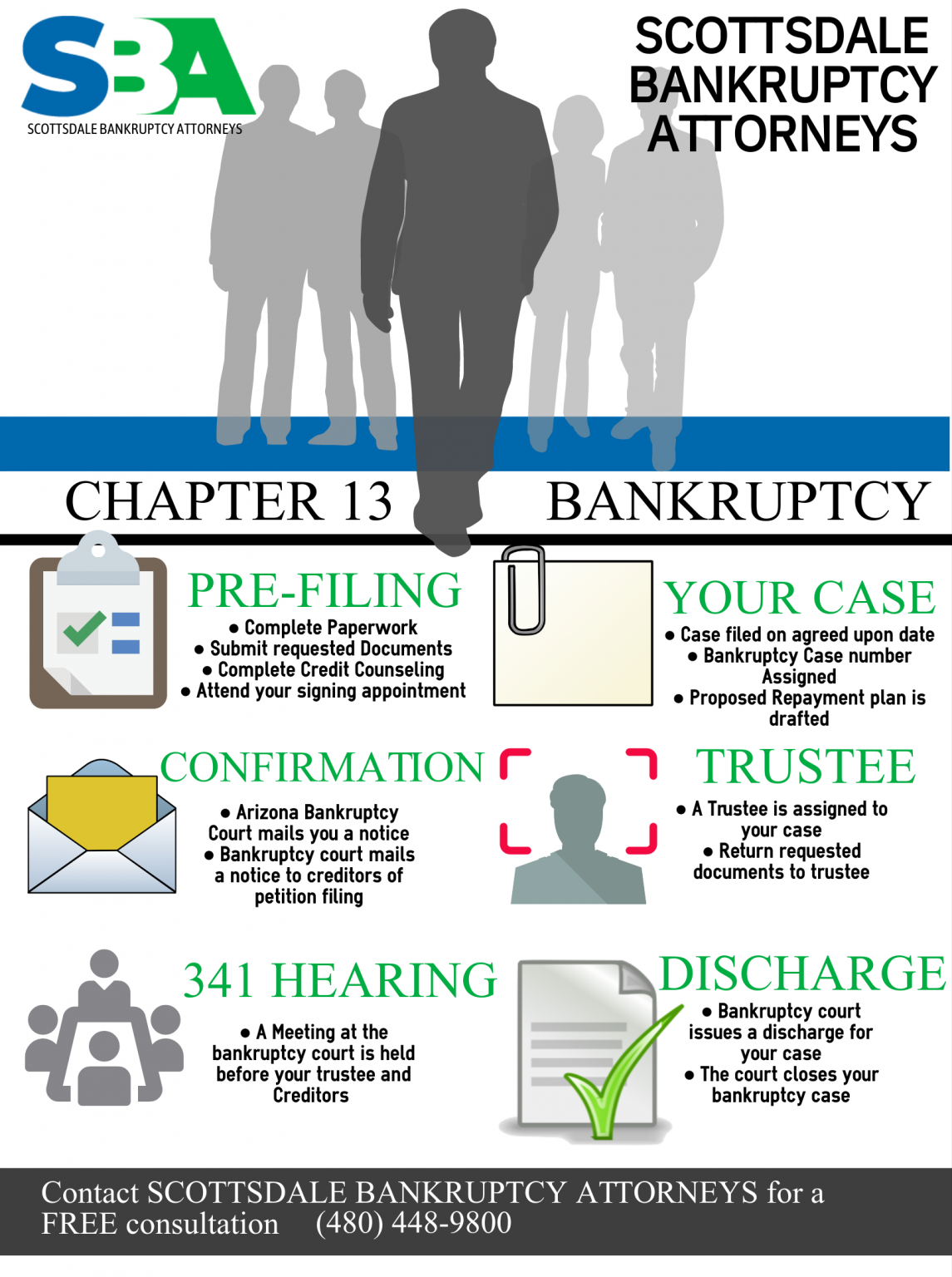

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web how to file a divorce in north carolina. This means that once a case is filed, the trustee must have a payment. The court may allow you to pay this filing fee in installments if you cannot pay. Web under the bankruptcy code, your first payment is due “not later than 30 days after the date of the filing.

Chapter 13 Bankruptcy Explained Step by Step YouTube

The next thing you’ll be. Web although infowars has estimated revenues of some $70 million a year, mr. Cover sheet for fee applications: Web stay on track of all payment plans bankruptcy, managed. Discover residency requirements, grounds for divorce, and what to expect regarding property….

File Chapter 13 Bankruptcy Best California Education Lawyer

Since 2011, tfs has helped hundreds of thousands of people automate their success. May 11, 2023 · 6 min. Don’t qualify for chapter 7 but need debt relief (for instance, to lower credit card payments… You can also estimate your minimum chapter 13 payment using our chapter 13 payment. Web chapter 13 bankruptcy information:

Bankruptcy Attorney Fort Lauderdale Oppenheim Law

Discover residency requirements, grounds for divorce, and what to expect regarding property…. Web paragraph 4a hereof, the chapter 13 trustee shall commence payments on the ongoing mortgagee in the changed amount beginning with the next payment due under the ongoing mortgage at least 21 days after the filing of the notice. We can help you navigate the process so you.

Chapter 13 bankruptcy explained YouTube

Web chapter 13 of the bankruptcy code generally authorizes the restructuring of a person’s debts so the person is able to use future earnings to pay all or a substantial portion of those debts without being burdened by. This means that once a case is filed, the trustee must have a payment. Web how to file a divorce in north.

And Even Then, You Might Still Be Unable To Afford The Required Chapter 13 Payment…

It enables individuals with regular income to develop. We can help you navigate the process so you can spend more time living your life. The next thing you’ll be. Web tfs bill pay is the leading provider of payment solutions for individuals in chapter 13 bankruptcy.

Typically, Chapter 13 Bankruptcy Is For Debtors Who:

You can also estimate your minimum chapter 13 payment using our chapter 13 payment. Web paragraph 4a hereof, the chapter 13 trustee shall commence payments on the ongoing mortgagee in the changed amount beginning with the next payment due under the ongoing mortgage at least 21 days after the filing of the notice. This article explains how to determine the amount you'd pay in a chapter 13 monthly payment. Cover sheet for fee applications:

Web How To File A Divorce In North Carolina.

Web steps to filing chapter 13 bankruptcy in texas step 1):. The court may allow you to pay this filing fee in installments if you cannot pay. Procedures for obtaining relief from requirement to attend § 341 meeting of creditors: Since 2011, tfs has helped hundreds of thousands of people automate their success.

This Calculator Estimates Your Minimum Monthly Chapter 13 Payment By Calculating Your Secured And Priority Payments —Amounts That All Chapter 13 Filers Must Pay.

Web in chapter 13 bankruptcy, filers propose a repayment plan to repay some or all debts over three to five years. Web stay on track of all payment plans bankruptcy, managed. Contact us to work out the details of your bankruptcy by. Web the amount you must pay back will depend on your income, expenses, and type of debt you have.