Chapter 13 Bankruptcy Idaho

Chapter 13 Bankruptcy Idaho - We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer. Web chapter 13 bankruptcy is also known as wage earner’s plan. Web you cannot file for chapter 13 bankruptcy if you have more than $419, 275 in unsecured debt, such as credit card bills or personal loans, or if you have more than $1,257,859 in secured debts, such as. Web learn about chapter 13 bankruptcy on idaho today. An experienced chapter 13 bankruptcy. Web bankruptcy county assignments. Web this brochure details what to expect during a chapter 7 or chapter 13 bankruptcy case. You can file for chapter 13 bankruptcy as long as:. Web in a nutshell filing for bankruptcy doesn’t have to be scary and confusing. Written by attorney andrea wimmer.

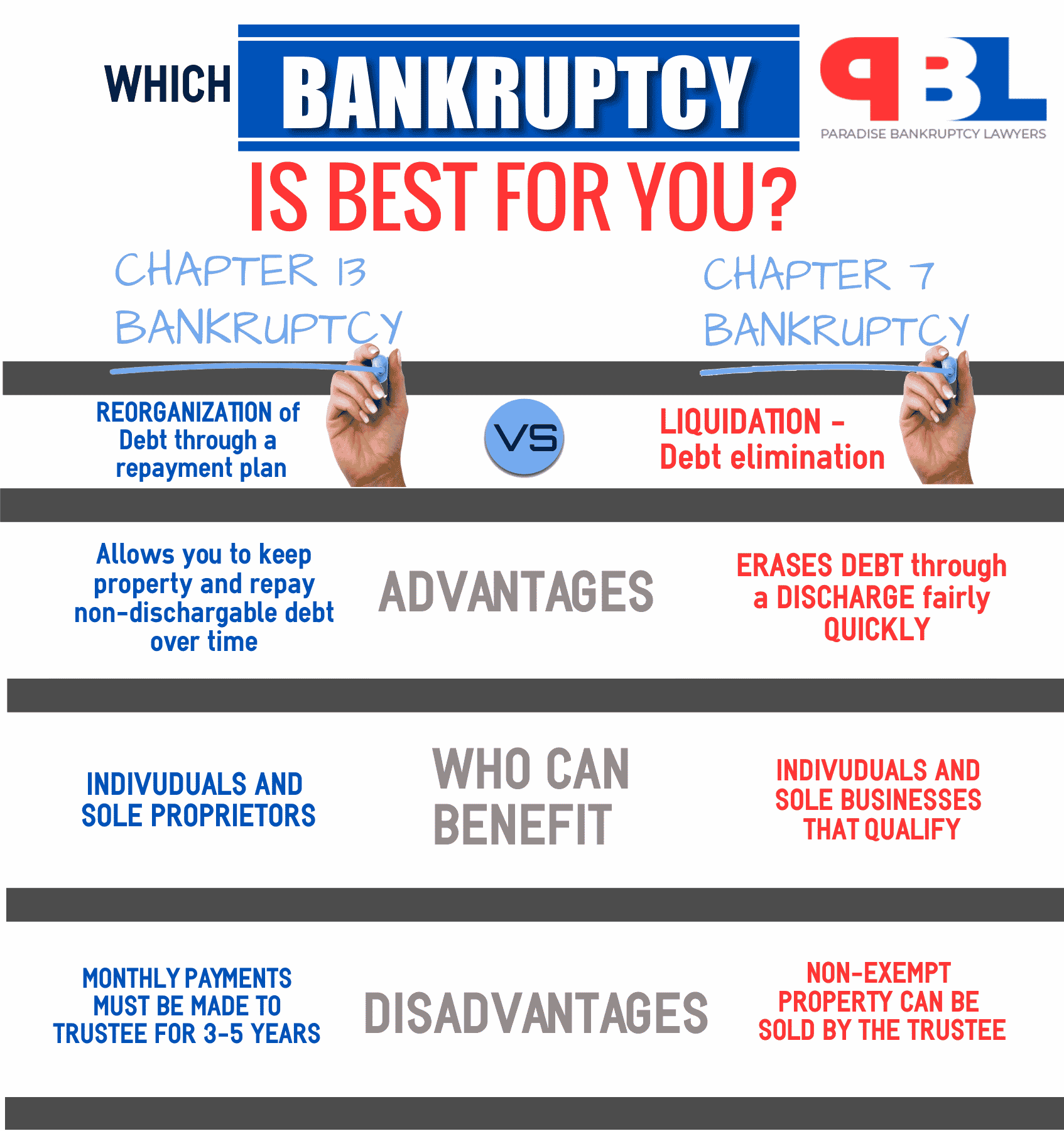

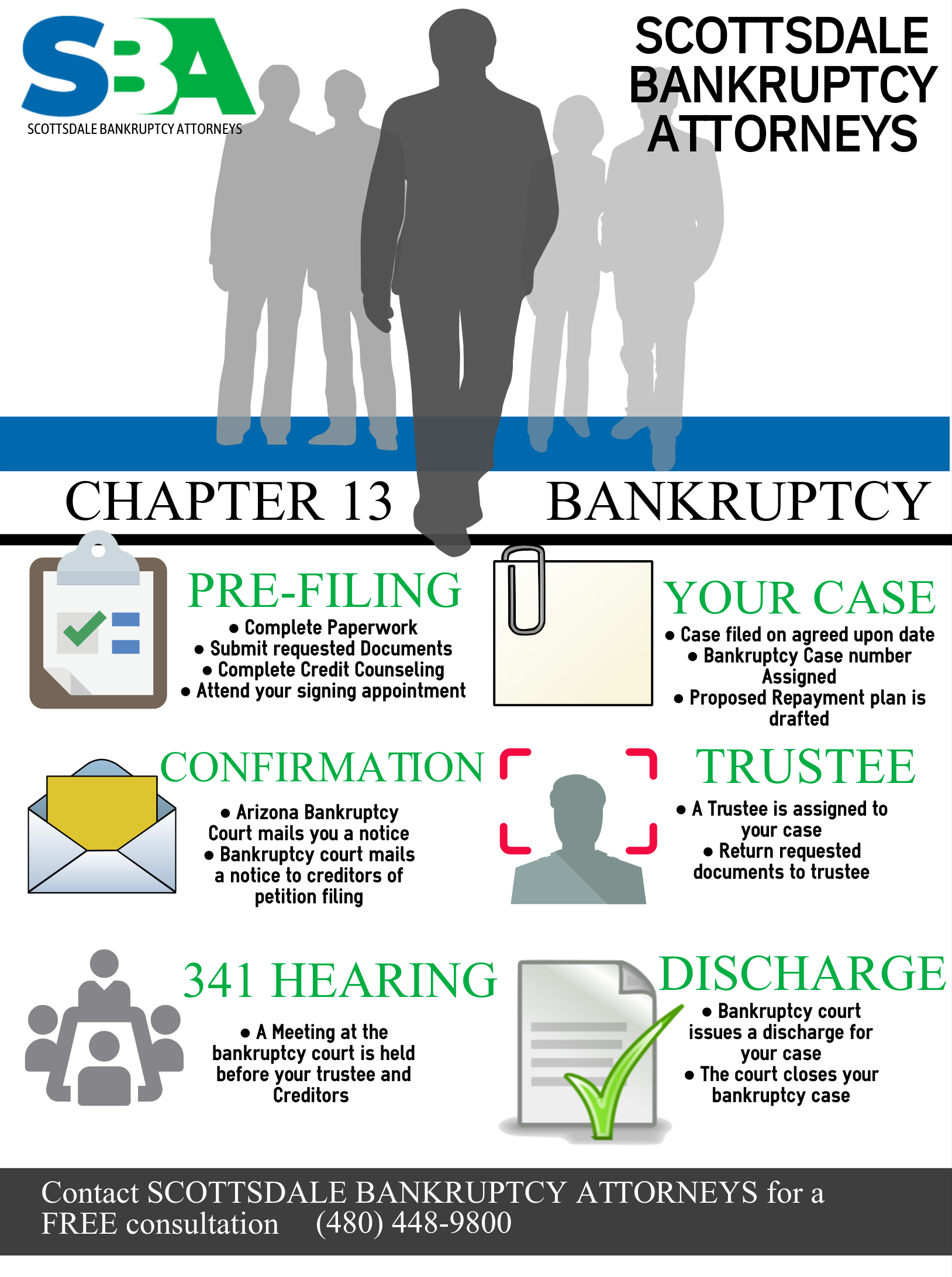

Written by attorney andrea wimmer. Chapter 13 bankruptcy is a reorganization whereas chapter 7 bankruptcy. Updated on sep 17, 2014. You can file for chapter 13 bankruptcy as long as:. Debtor certification and notice re 11 usc 522 (q) evidentiary. Web it is essential to speak with a lawyer if possible before filing for chapter 13 bankruptcy because creating a repayment plan is a tough thing to do. Ada, adams, boise, canyon, elmore, gem, owyhee, payette, valley, washington. Web chapter 13 bankruptcy allows individuals with a regular income to restructure their debts into a more manageable 3 to 5 year repayment plan. We will cover these in greater detail idaho bankruptcy filing process the bankruptcy filing process in idaho is similar to other states. 11 usc 522 (q) and 1328 flowchart.

Under this chapter, debtors propose a repayment plan. Web in a nutshell filing for bankruptcy doesn’t have to be scary and confusing. Web bankruptcy county assignments. This can allow consumers to keep their property while repaying some or. Web chapter 13 bankruptcy is generally used by debtors who want to keep secured assets, such as a home or car, when they have more equity in the secured assets than they can protect with their idaho bankruptcy exemptions. Web welcome to the u.s. Web you cannot file for chapter 13 bankruptcy if you have more than $419, 275 in unsecured debt, such as credit card bills or personal loans, or if you have more than $1,257,859 in secured debts, such as. You can file for chapter 13 bankruptcy as long as:. We hope this website will provide useful information about the court, its operations and its processes, and answer many of the. Understand bankruptcy qualification decide whether to file chapter 7 or chapter 13

Chapter 13 Bankruptcy Idaho Ascend Blog

An experienced chapter 13 bankruptcy. Web you cannot file for chapter 13 bankruptcy if you have more than $419, 275 in unsecured debt, such as credit card bills or personal loans, or if you have more than $1,257,859 in secured debts, such as. Web chapter 13 bankruptcy allows individuals with a regular income to restructure their debts into a more.

Chapter 13 Bankruptcy Idaho

Web chapter 13 bankruptcy is generally used by debtors who want to keep secured assets, such as a home or car, when they have more equity in the secured assets than they can protect with their idaho bankruptcy exemptions. An experienced chapter 13 bankruptcy. Web in a nutshell filing for bankruptcy doesn’t have to be scary and confusing. Written by.

Everything You Need to Know About Chapter 13 Bankruptcy

Web this brochure details what to expect during a chapter 7 or chapter 13 bankruptcy case. Web chapter 13 bankruptcy allows individuals with a regular income to restructure their debts into a more manageable 3 to 5 year repayment plan. Web it is essential to speak with a lawyer if possible before filing for chapter 13 bankruptcy because creating a.

Chapter 13 Bankruptcy Lawyer in Tucson Judge Law Firm

This can allow consumers to keep their property while repaying some or. Web learn about chapter 13 bankruptcy on idaho today. Quickly find answers to your chapter 13 bankruptcy questions with the help of a local lawyer. Web chapter 13 bankruptcy allows individuals with a regular income to restructure their debts into a more manageable 3 to 5 year repayment.

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

It enables individuals with regular income to develop a plan to repay all or part of their debts. Bankruptcy court for the district of idaho. Quickly find answers to your chapter 13 bankruptcy questions with the help of a local lawyer. Updated on sep 17, 2014. An experienced chapter 13 bankruptcy.

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Written by attorney andrea wimmer. We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer. Web welcome to the u.s. Web it is essential to speak with a lawyer if possible before filing for chapter 13 bankruptcy because creating a repayment plan is a tough thing to do. Debtor certification and.

How Will My House/Mortgage Be Treated In A Chapter 13 Bankruptcy? 4

Updated may 11, 2023 table of contents how to file bankruptcy in idaho for free idaho bankruptcy means test idaho bankruptcy. Web chapter 13 bankruptcy is also known as wage earner’s plan. Debtor certification and notice re 11 usc 522 (q) evidentiary. Court rules that same sex parent can move forward with discrimination suit against the state of idaho… Benewah,.

What Is Chapter 13 Bankruptcy? CT Bankruptcy Attorneys

Web learn about chapter 13 bankruptcy on idaho today. Chapter 13 allows a debtor to keep property and pay debts over time,. We will cover these in greater detail idaho bankruptcy filing process the bankruptcy filing process in idaho is similar to other states. Generally, the process is as follows for chapter 7 bankruptcy: Web chapter 13 bankruptcy is generally.

Filing Chapter 13 Bankruptcy in Idaho Idaho Bankruptcy Center

Web this brochure details what to expect during a chapter 7 or chapter 13 bankruptcy case. Web bankruptcy county assignments. Debtor certification and notice re 11 usc 522 (q) evidentiary. This can allow consumers to keep their property while repaying some or. Web chapter 13 bankruptcy allows individuals with a regular income to restructure their debts into a more manageable.

10 Reasons People File Chapter 13 Bankruptcy Callahan Law Firm

An experienced chapter 13 bankruptcy. Understand bankruptcy qualification decide whether to file chapter 7 or chapter 13 Web bankruptcy county assignments. Generally, the process is as follows for chapter 7 bankruptcy: Chapter 13 bankruptcy is a reorganization whereas chapter 7 bankruptcy.

Updated On Sep 17, 2014.

This document will list important information such as deadlines and the date, time and location of your. Bankruptcy court for the district of idaho. Quickly find answers to your chapter 13 bankruptcy questions with the help of a local lawyer. Under this chapter, debtors propose a repayment plan.

It Enables Individuals With Regular Income To Develop A Plan To Repay All Or Part Of Their Debts.

Court rules that same sex parent can move forward with discrimination suit against the state of idaho… Web bankruptcy county assignments. Benewah, bonner, boundary, kootenai, shoshone. Web welcome to the u.s.

Web In A Nutshell Filing For Bankruptcy Doesn’t Have To Be Scary And Confusing.

Web learn about chapter 13 bankruptcy on idaho today. Web chapter 13 bankruptcy is generally used by debtors who want to keep secured assets, such as a home or car, when they have more equity in the secured assets than they can protect with their idaho bankruptcy exemptions. Understand bankruptcy qualification decide whether to file chapter 7 or chapter 13 Chapter 13 bankruptcy is a reorganization whereas chapter 7 bankruptcy.

Web Chapter 13 Bankruptcy Allows Individuals With A Regular Income To Restructure Their Debts Into A More Manageable 3 To 5 Year Repayment Plan.

Generally, the process is as follows for chapter 7 bankruptcy: Web chapter 13 bankruptcy is also known as wage earner’s plan. Chapter 13 allows a debtor to keep property and pay debts over time,. Web a chapter 13 bankruptcy is also called a wage earner’s plan.