Change In Accounting Method Form

Change In Accounting Method Form - Web listen as our panel of federal income tax experts explains what constitutes a change in accounting method, completing form 3115, and calculating the necessary. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. However, in some situations, it is possible to change a method of. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. Web automatic change procedures: Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method. Web liability company (llc), requesting an accounting method change. The calendar year is the most. Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. The irs today informed taxpayers and practitioners.

However, in some situations, it is possible to change a method of. Revised form 3115 for applications for change in accounting method. Web automatic change procedures: Refer to the instructions for form 3115 for a list of the automatic accounting method changes. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Even when the irs's consent is not required, taxpayers. Web liability company (llc), requesting an accounting method change. The calendar year is the most. Web march 31, 1998 related topics tax executive summary the irs issued procedures, terms and conditions for obtaining the irss consent to an.

The irs today informed taxpayers and practitioners. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web process overview identifying and handling claims for changes in accounting methods this practice unit discusses how to determine whether a claim is a request for a change. Web under those rules, a taxpayer that has a form 3115 pending with the national office on january 31, 2021, may choose to make the accounting method change under the. However, in some situations, it is possible to change a method of. The calendar year is the most. Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. See section 9.02 of rev. Web listen as our panel of federal income tax experts explains what constitutes a change in accounting method, completing form 3115, and calculating the necessary. However, identical accounting method changes for two or more of the.

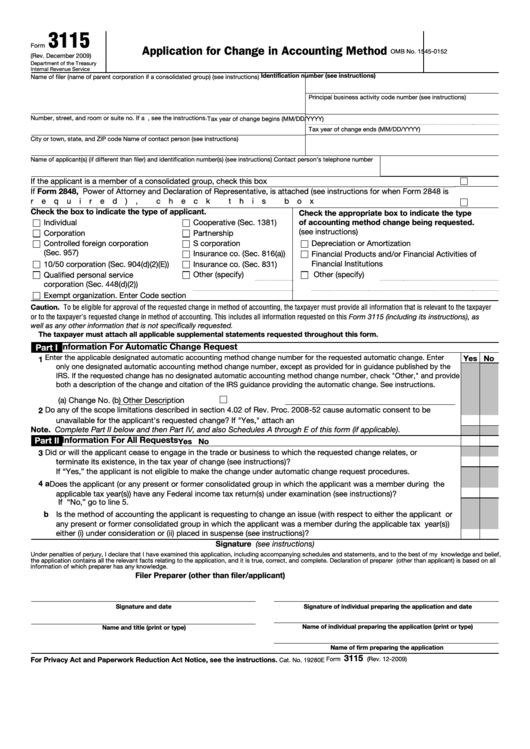

Fillable Form 3115 Application For Change In Accounting Method

Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web under those rules, a taxpayer that has a form 3115 pending with the national office on january 31, 2021, may choose.

Accounting Software When to Switch

Web liability company (llc), requesting an accounting method change. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Even when the irs's consent is not required, taxpayers. Web under those rules, a taxpayer that has a form 3115 pending with the national office on january 31, 2021, may choose to make the.

☑ Lifo Accounting Method Change

Web under those rules, a taxpayer that has a form 3115 pending with the national office on january 31, 2021, may choose to make the accounting method change under the. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. Web introduction every taxpayer.

PPT AND CHANGES IN RETAINED EARNINGS PowerPoint Presentation

Web typically, this is accomplished by filing form 3115, application for change in accounting method. Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. Web process overview identifying and handling claims for changes in accounting methods this practice unit discusses how to determine whether a claim is a.

Form 3115 Application for Change in Accounting Method Editorial Stock

Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method. Web automatic change procedures: Revised form 3115 for applications for change in accounting method. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section.

FREE 9+ Sample Accounting Forms in PDF

The irs today informed taxpayers and practitioners. See section 9.02 of rev. Web typically, this is accomplished by filing form 3115, application for change in accounting method. Web accounting method changes are most commonly related to how (and when) an organization reports its revenue and expenses (i.e., cash vs. Web under those rules, a taxpayer that has a form 3115.

Accounting Method Changes for Construction Companies

Web a new automatic accounting method change has been added to rev. However, identical accounting method changes for two or more of the. The irs today informed taxpayers and practitioners. See section 9.02 of rev. Web enter the change number for the automatic change request in the statement.

Choosing the right accounting method for tax purposes Kehlenbrink

Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue. Web listen as our panel of federal income tax experts explains what constitutes a change in accounting method, completing form 3115, and calculating the necessary. Web automatic change procedures: The requirement to file form.

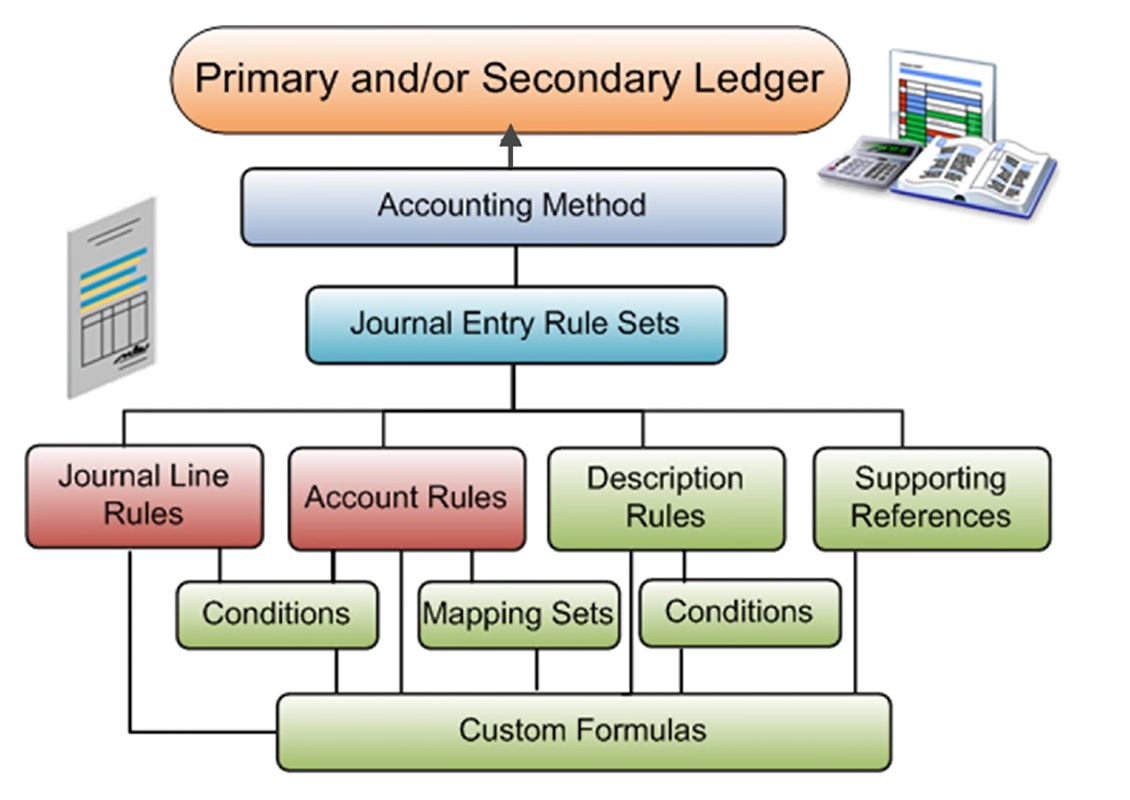

The Oracle Prodigy Overview of Configuring Accounting Rules in Oracle

Web the irs recently issued an updated list of automatic accounting method changes that replaces the existing list and includes numerous modifications. Web liability company (llc), requesting an accounting method change. Web typically, this is accomplished by filing form 3115, application for change in accounting method. However, identical accounting method changes for two or more of the. Revised form 3115.

Tax Accounting Methods

Web automatic change procedures: Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Even when the irs's consent is not required, taxpayers. Web typically, this is accomplished by filing form 3115, application for change in accounting method. However, identical accounting method changes for two or more of the.

Web March 31, 1998 Related Topics Tax Executive Summary The Irs Issued Procedures, Terms And Conditions For Obtaining The Irss Consent To An.

See section 9.02 of rev. Web enter the change number for the automatic change request in the statement. The requirement to file form 3115,. Web in completing a form 3115, application for change in accounting method, to make the change in method of accounting under section 7.02 of this revenue.

Web The Irs Recently Issued An Updated List Of Automatic Accounting Method Changes That Replaces The Existing List And Includes Numerous Modifications.

Web a new automatic accounting method change has been added to rev. Refer to the instructions for form 3115 for a list of the automatic accounting method changes. However, in some situations, it is possible to change a method of. Web typically, this is accomplished by filing form 3115, application for change in accounting method.

Web Listen As Our Panel Of Federal Income Tax Experts Explains What Constitutes A Change In Accounting Method, Completing Form 3115, And Calculating The Necessary.

However, identical accounting method changes for two or more of the. The calendar year is the most. A taxpayer must typically file form 3115, application for change in accounting method, when requesting any accounting. Web in most cases, a taxpayer requests consent to change an accounting method by filing a form 3115, application for change in accounting method.

Web Liability Company (Llc), Requesting An Accounting Method Change.

Web automatic change procedures: The irs today informed taxpayers and practitioners. Web under those rules, a taxpayer that has a form 3115 pending with the national office on january 31, 2021, may choose to make the accounting method change under the. Even when the irs's consent is not required, taxpayers.