Capital Improvement Form

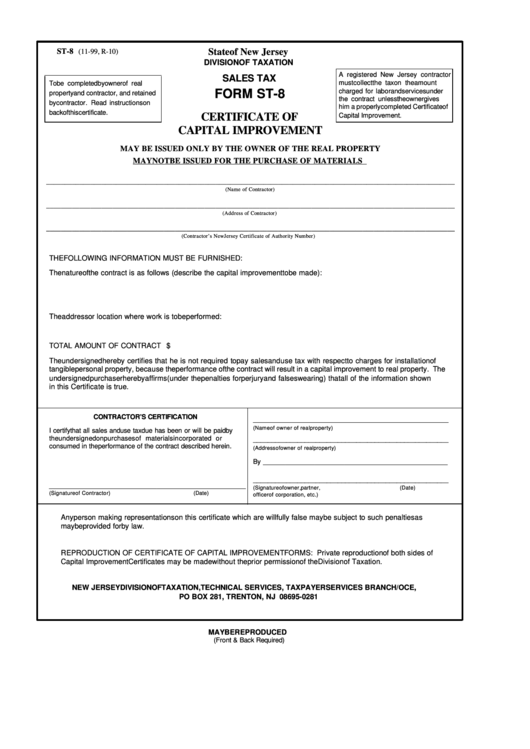

Capital Improvement Form - Capital improvements can reduce this tax by increasing the cost basis for a home. Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. However, the retail purchase of floor covering (such as carpet or padding) itself is subject to tax. You must give the contractor a properly completed form within 90 days after the service is rendered. The receipt of an affidavit of capital improvement for services to real. Web capital improvement regardless of the method of installation. Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for the capital improvement. The original cost basis is the purchase price of the home, including closing and other costs. Web a certificate of capital improvement is a form that a property owner or other customer gives a contractor or project manager to certify that the project qualifies as a capital improvement and that no sales tax should be collected.

If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for the capital improvement. The receipt of an affidavit of capital improvement for services to real. Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. However, the retail purchase of floor covering (such as carpet or padding) itself is subject to tax. Web a certificate of capital improvement is a form that a property owner or other customer gives a contractor or project manager to certify that the project qualifies as a capital improvement and that no sales tax should be collected. Web capital improvement regardless of the method of installation. Capital improvements can reduce this tax by increasing the cost basis for a home. Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. As a capital improvement, the charge to the property owner for the installation of floor covering is not subject to new york state and local sales and use taxes. You must give the contractor a properly completed form within 90 days after the service is rendered.

Web a certificate of capital improvement is a form that a property owner or other customer gives a contractor or project manager to certify that the project qualifies as a capital improvement and that no sales tax should be collected. Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for the capital improvement. The original cost basis is the purchase price of the home, including closing and other costs. As a capital improvement, the charge to the property owner for the installation of floor covering is not subject to new york state and local sales and use taxes. Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. The receipt of an affidavit of capital improvement for services to real. Web capital improvement regardless of the method of installation. Web to the property owner: You must give the contractor a properly completed form within 90 days after the service is rendered.

Capital Improvement Program City of Belton

Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. Web capital improvement regardless of the method of installation. Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis..

About Privacy Policy Copyright TOS Contact Sitemap

Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they may not charge you any sales tax if you issue them a.

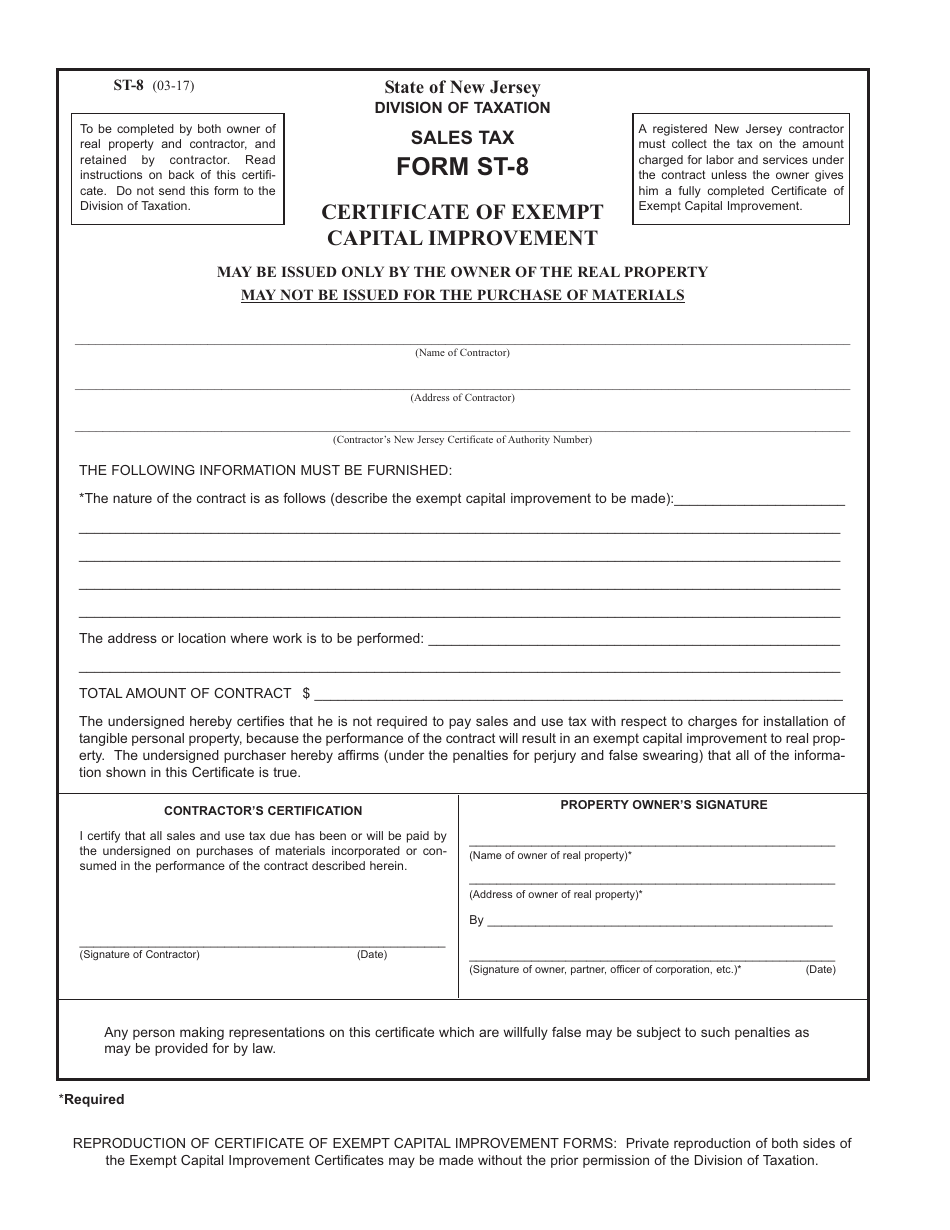

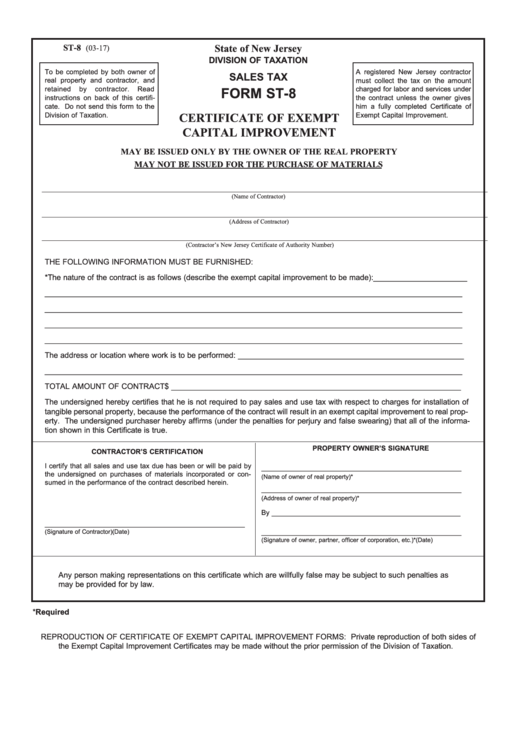

Form ST8 Download Printable PDF or Fill Online Certificate of Exempt

Web a certificate of capital improvement is a form that a property owner or other customer gives a contractor or project manager to certify that the project qualifies as a capital improvement and that no sales tax should be collected. The original cost basis is the purchase price of the home, including closing and other costs. Web a capital improvement.

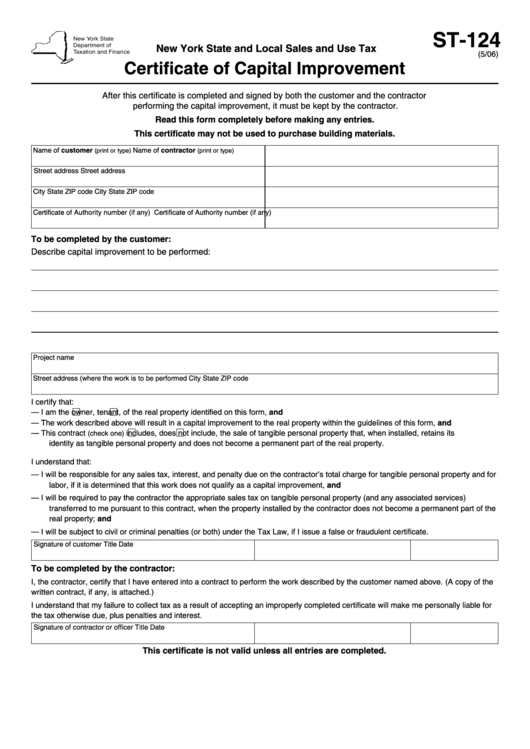

Fillable Form St124 (5/06) Certificate Of Capital Improvement

However, the retail purchase of floor covering (such as carpet or padding) itself is subject to tax. Capital improvements can reduce this tax by increasing the cost basis for a home. In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they may not charge you any sales tax.

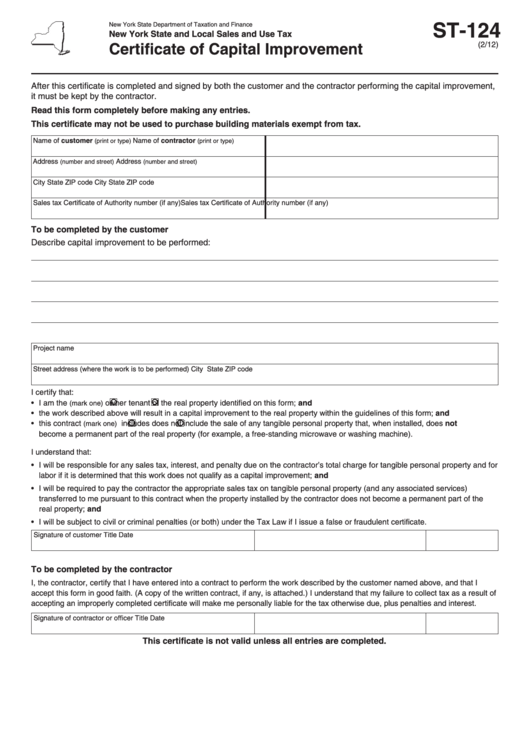

Certificate Of Capital Improvement St124 printable pdf download

Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. Web a certificate of capital improvement is a form that a property owner or other customer gives a contractor or project manager to certify that the project qualifies as a capital improvement and that.

Form St8 Certificate Of Exempt Capital Improvement printable pdf

In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they may not charge you any sales tax if you issue them a fully completed certificate. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other.

Capital Improvement (CapitalImprove) Twitter

As a capital improvement, the charge to the property owner for the installation of floor covering is not subject to new york state and local sales and use taxes. Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. Web when a home is sold,.

Gallery of Nys Capital Improvement form Inspirational 24 Fresh Gallery

Capital improvements can reduce this tax by increasing the cost basis for a home. Web a certificate of capital improvement is a form that a property owner or other customer gives a contractor or project manager to certify that the project qualifies as a capital improvement and that no sales tax should be collected. However, the retail purchase of floor.

Form St8 Certificate Of Capital Improvement printable pdf download

Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. Capital improvements can reduce this tax by increasing the cost basis for a home. You must give the contractor a properly completed form within 90 days after the service is rendered. The original cost basis.

Gallery of Nys Capital Improvement form Inspirational 24 Fresh Gallery

Capital improvements can reduce this tax by increasing the cost basis for a home. Web capital improvement regardless of the method of installation. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for.

Web A Certificate Of Capital Improvement Is A Form That A Property Owner Or Other Customer Gives A Contractor Or Project Manager To Certify That The Project Qualifies As A Capital Improvement And That No Sales Tax Should Be Collected.

Capital improvements can reduce this tax by increasing the cost basis for a home. Web capital improvement regardless of the method of installation. You must give the contractor a properly completed form within 90 days after the service is rendered. As a capital improvement, the charge to the property owner for the installation of floor covering is not subject to new york state and local sales and use taxes.

The Receipt Of An Affidavit Of Capital Improvement For Services To Real.

Web a capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. Web to the property owner: In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they may not charge you any sales tax if you issue them a fully completed certificate. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for the capital improvement.

However, The Retail Purchase Of Floor Covering (Such As Carpet Or Padding) Itself Is Subject To Tax.

Web when a home is sold, the seller may have to pay capital gains taxes on the difference between the sale price and the cost basis. The original cost basis is the purchase price of the home, including closing and other costs.