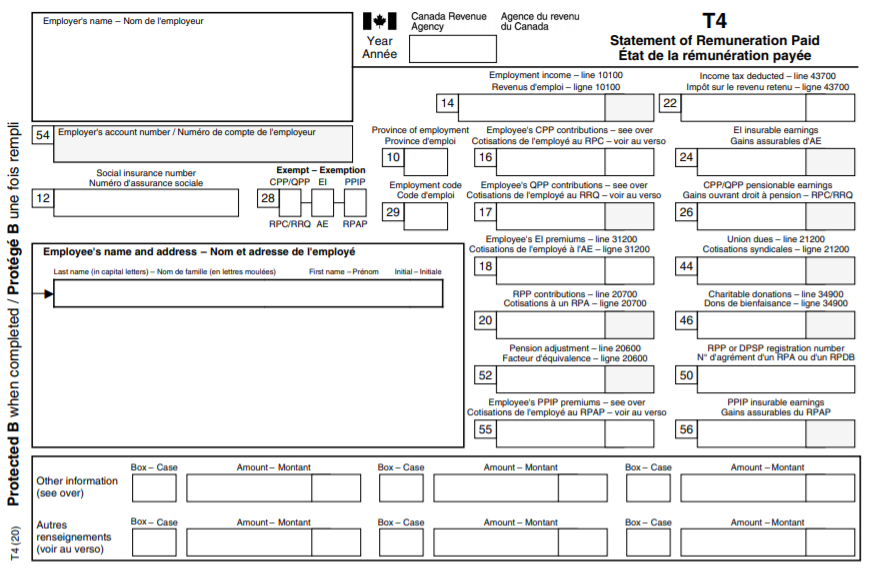

Canadian T4 Form

Canadian T4 Form - Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. All canadian taxpayers must submit their t1 form by april 30 of the current year. Web personal income tax t4 slip: If you are new to t4 web forms, we suggest that you print this section. Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. For example, for the 2022 tax year, the t1 needs to. Slips are prepared by your employer, payer, administrator or financial institution. Web 1 i am a u.s. Web if i have a t4 (canada) instead of a w2 can i file with turbotax us? Web when is the t1 tax form due?

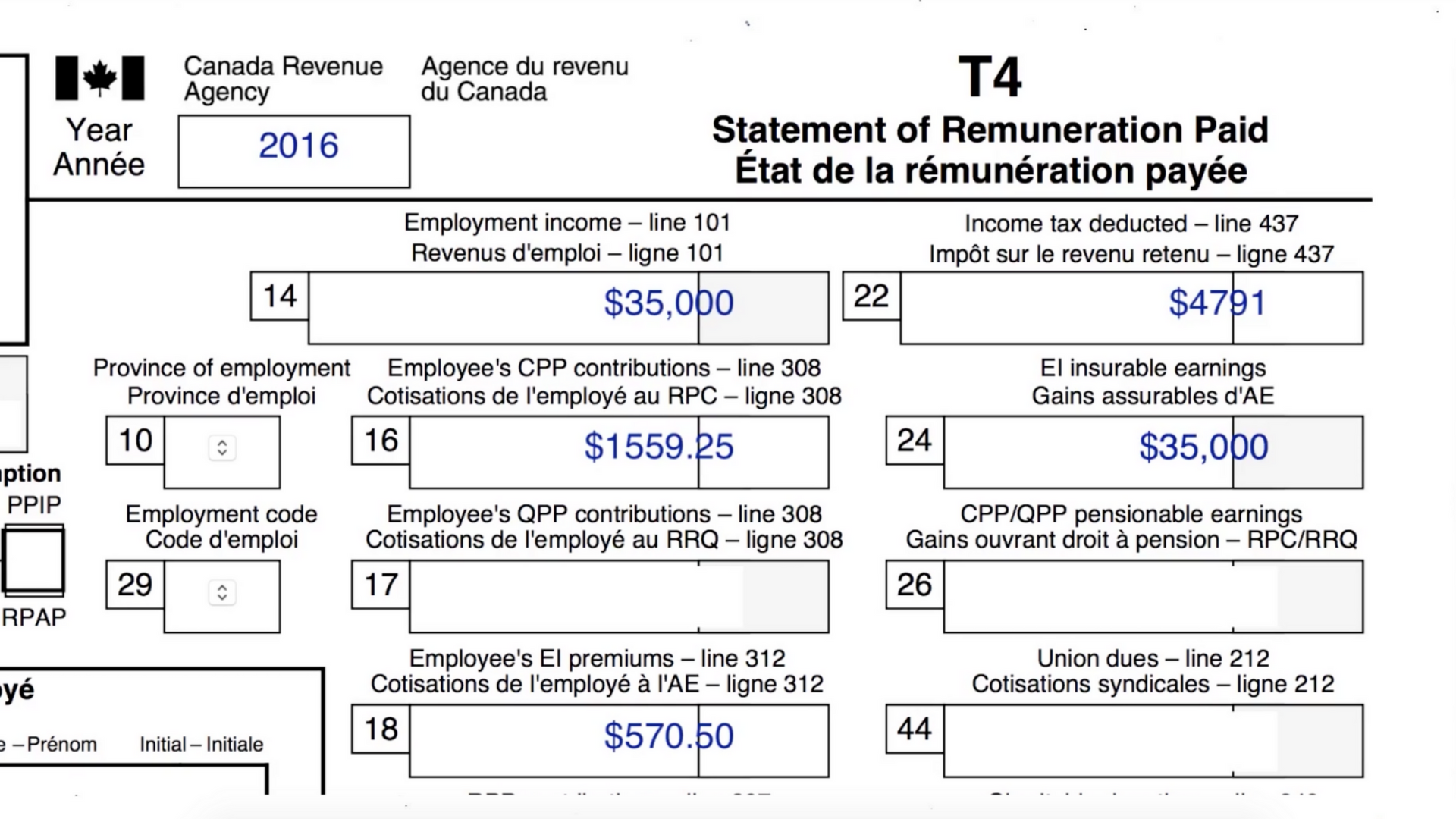

For example, for the 2022 tax year, the t1 needs to. Web t4 statement of remuneration paid. Web when is the t1 tax form due? No matter what you call it, the t4 is a tax. You will need to add any amounts shown in box e (quebec income tax) on the relevé 1 to the total income tax paid amount shown on. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. If you are new to t4 web forms, we suggest that you print this section. Slips are prepared by your employer, payer, administrator or financial institution. Hairdressers, taxi drivers, indians, fishing income, and. All canadian taxpayers must submit their t1 form by april 30 of the current year.

Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. Hairdressers, taxi drivers, indians, fishing income, and. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding. Web if i have a t4 (canada) instead of a w2 can i file with turbotax us? No matter what you call it, the t4 is a tax. Web personal income tax t4 slip: Web when is the t1 tax form due? If you are new to t4 web forms, we suggest that you print this section. Slips are prepared by your employer, payer, administrator or financial institution.

What is a T4 slip? Canada.ca

Web its official title is a “t4 statement of remuneration paid” form, though most canadians just refer to it as a t4 slip. Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Statement of remuneration paid for detailed.

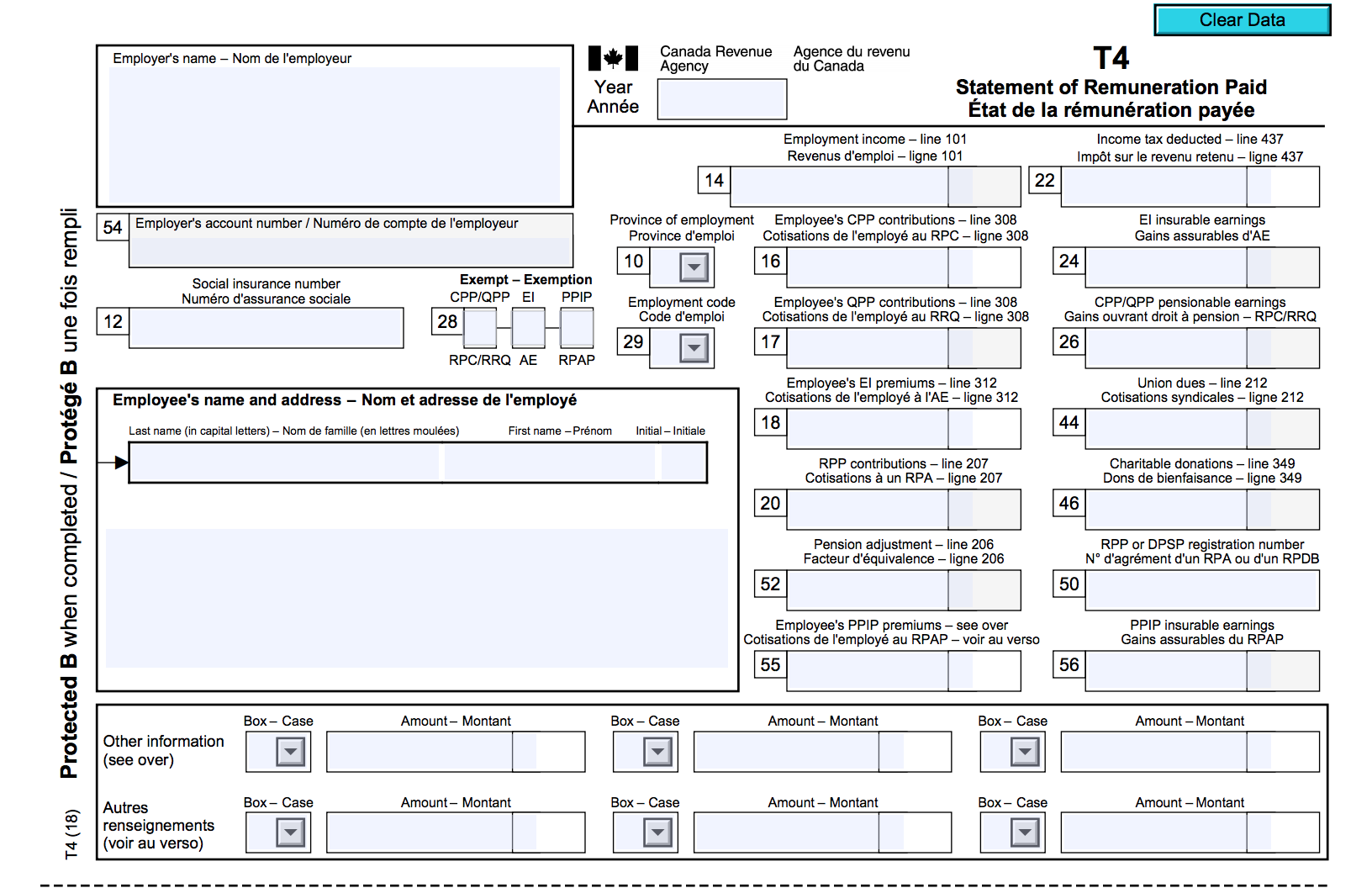

2012 Form Canada T4 summary Fill Online, Printable, Fillable, Blank

If you are new to t4 web forms, we suggest that you print this section. Web if i have a t4 (canada) instead of a w2 can i file with turbotax us? Web personal income tax t4 slip: Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding. No.

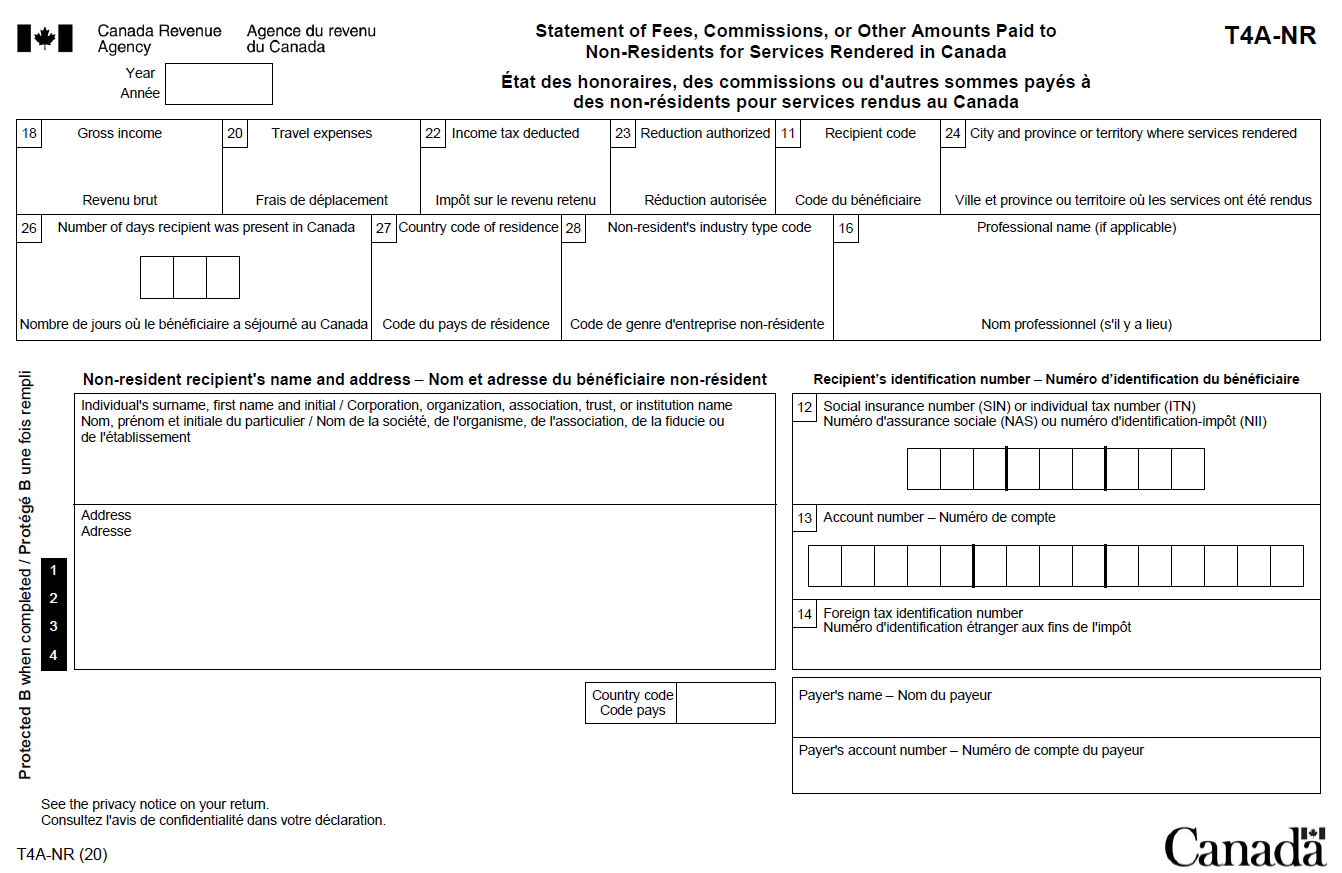

ProWeb Entering Canadian Form T4 & T4ANR Support

For example, for the 2022 tax year, the t1 needs to. Slips are prepared by your employer, payer, administrator or financial institution. Web when is the t1 tax form due? You will need to add any amounts shown in box e (quebec income tax) on the relevé 1 to the total income tax paid amount shown on. If you are.

Desktop Entering Canadian Form T4 & T4ANR Support

Web if i have a t4 (canada) instead of a w2 can i file with turbotax us? All canadian taxpayers must submit their t1 form by april 30 of the current year. Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. Web when is the t1 tax form due?.

The Canadian Employer's Guide to the T4 Bench Accounting

If you are new to t4 web forms, we suggest that you print this section. For example, for the 2022 tax year, the t1 needs to. Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. Web when is the t1 tax form due? Slips are prepared by your employer,.

T4 form PaymentEvolution

Web t4 statement of remuneration paid. For example, for the 2022 tax year, the t1 needs to. You will need to add any amounts shown in box e (quebec income tax) on the relevé 1 to the total income tax paid amount shown on. Web 1 i am a u.s. All canadian taxpayers must submit their t1 form by april.

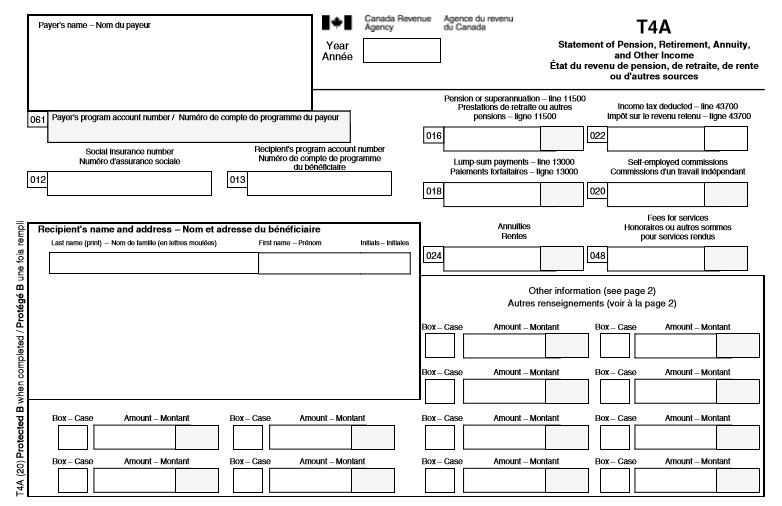

T4A slip Statement of Pension, Retirement, Annuity, and Other

Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Web you will receive t4 and relevé 1 tax slips. Web its official title is a “t4 statement of remuneration paid” form, though most canadians just refer to it.

the SUPER BASIC story of Canadian Tax From Rags to Reasonable

Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding. Web personal income tax t4 slip: Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. No matter what you call it, the t4 is a tax. Web also.

Print T4 Slips

Hairdressers, taxi drivers, indians, fishing income, and. Slips are prepared by your employer, payer, administrator or financial institution. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. Web when is the t1 tax form due? Web t4 statement of remuneration paid.

How to Prepare a T4 Slip in 12 Easy Steps Madan CPA

Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. Slips are prepared by your employer, payer, administrator or financial institution. Web personal income tax t4 slip: Web when is the t1 tax form due? All canadian taxpayers must submit their t1 form by april 30 of the current year.

Web T4 Statement Of Remuneration Paid.

Web when to fill out a t4 slip, filling out t4 slips, distributing t4 slips to employees, customized t4 slips. Web if i have a t4 (canada) instead of a w2 can i file with turbotax us? Web 1 i am a u.s. For example, for the 2022 tax year, the t1 needs to.

Slips Are Prepared By Your Employer, Payer, Administrator Or Financial Institution.

All canadian taxpayers must submit their t1 form by april 30 of the current year. Web get your t4, t5, t3, t2202, rc62, rc210 or rrsp slips. If you are new to t4 web forms, we suggest that you print this section. No matter what you call it, the t4 is a tax.

You Will Need To Add Any Amounts Shown In Box E (Quebec Income Tax) On The Relevé 1 To The Total Income Tax Paid Amount Shown On.

Web personal income tax t4 slip: Web its official title is a “t4 statement of remuneration paid” form, though most canadians just refer to it as a t4 slip. Web when is the t1 tax form due? Statement of remuneration paid for detailed information on the amounts shown in the boxes of your t4 slip, see the corresponding.

Hairdressers, Taxi Drivers, Indians, Fishing Income, And.

Web also called a statement of remuneration paid, a t4 slip is a document you receive from your employer that summarizes all the money they’ve paid you over the previous year. Web you will receive t4 and relevé 1 tax slips.