Can Form 9465 Be Filed Electronically

Can Form 9465 Be Filed Electronically - If you are filing form 9465. If you are filing form 9465 with your return, attach it to the front of your return when you file. Form 9465 is available in all versions of taxact. Web english use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web federal communications commission 45 l street ne. Instead, call dec 23, 2021 cat. Web where to file your taxes for form 9465. Ad access irs tax forms. See option 4 below for details. Upload, modify or create forms.

Web where to file your taxes for form 9465. Ad access irs tax forms. Ad access irs tax forms. Web form 9465 is available in all versions of taxact and can be electronically filed with your return. Try it for free now! Web if the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file form 9465; Form 9465 is available in all versions of taxact. If you are filing form 9465 with your return, attach it to the front of your return when you file. Web june 7, 2019 3:58 pm. Web federal communications commission 45 l street ne.

See option 4 below for details. An irs online payment agreement (opa) can be requested online at. Web if the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file form 9465; Instead, call dec 23, 2021 cat. Web complete can you efile form 9465 in minutes, not hours. Web form 9465 is available in all versions of taxact® and can be electronically filed with your return. To enter or review information for form 9465 installment agreement request in. Web form 9465 is available in all versions of taxact and can be electronically filed with your return. Web federal communications commission 45 l street ne. Ad access irs tax forms.

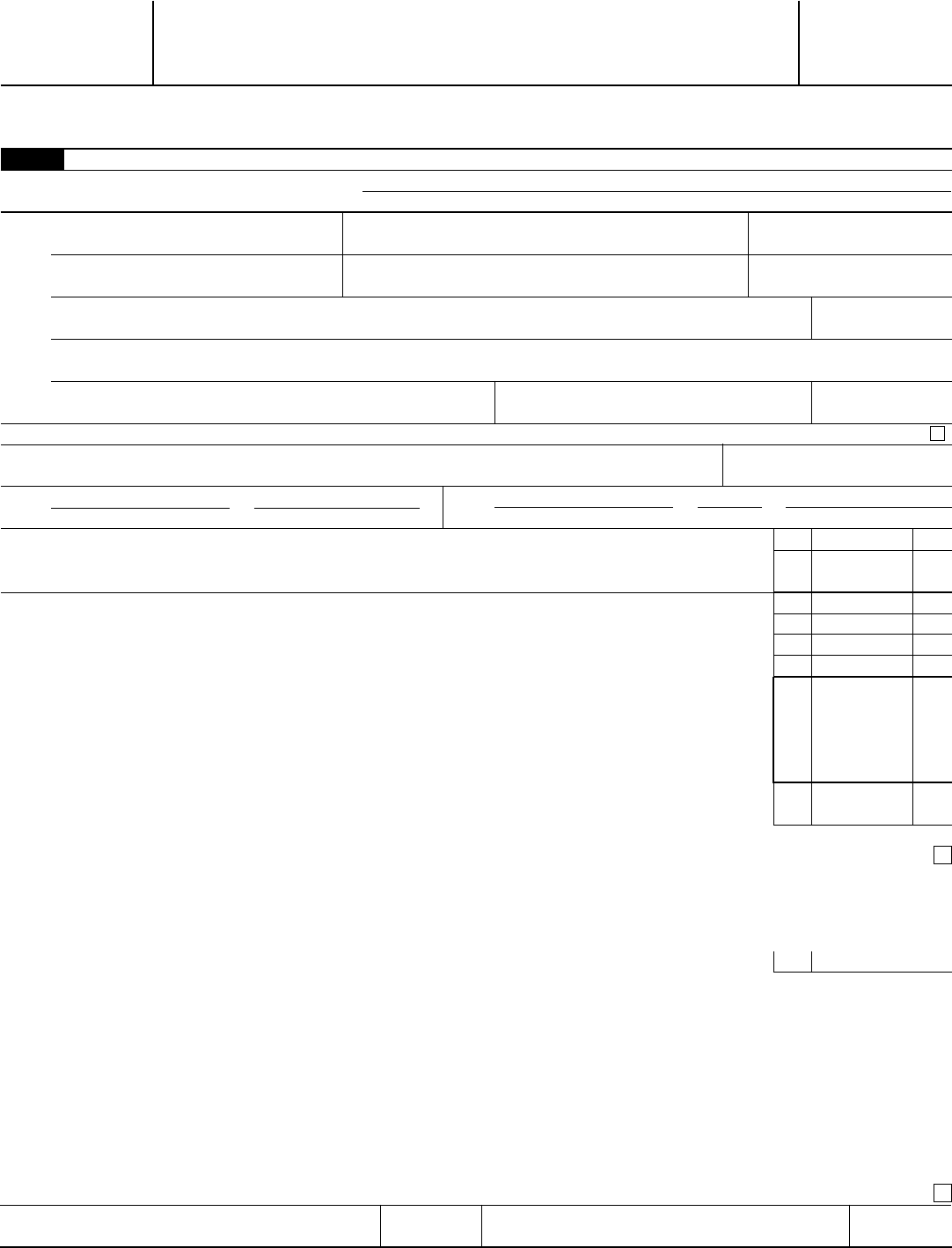

IRS Form 9465 Instructions for How to Fill it Correctly File

To apply for a payment plan with the irs online, click here. Web if the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file form 9465; Web where to file your taxes for form 9465. Instead, call dec 23, 2021 cat. Web form 9465 can also be filed.

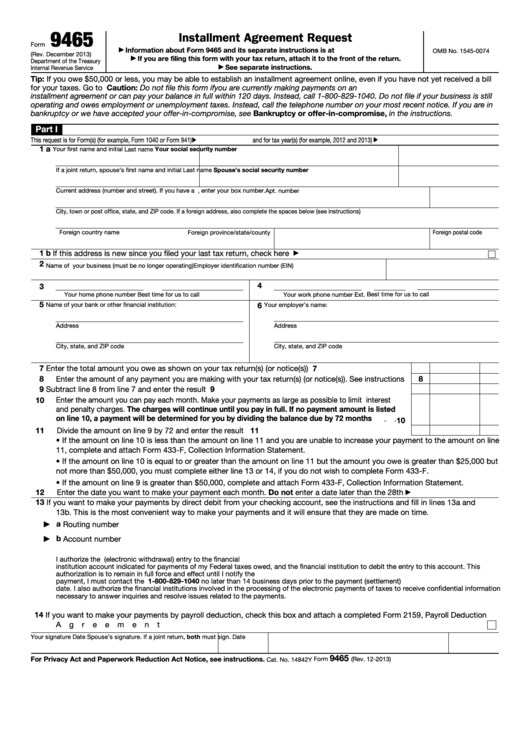

Stay on Top of your Tax Installments by Filing Form 9465

Instead, call dec 23, 2021 cat. If you are filing form 9465 with your return, attach it to the front of your return when you file. If you have already filed your return or you are filing this form in response to a. Ad access irs tax forms. Web if you already filed, or you can't find this option in.

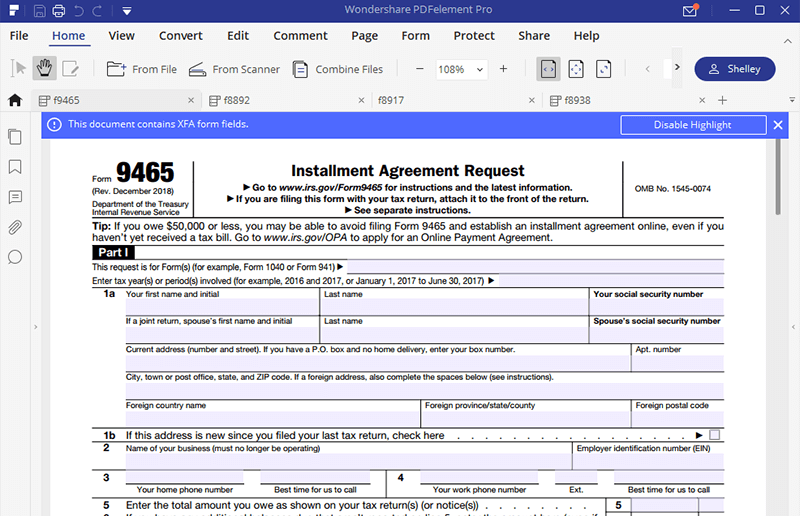

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

Get ready for tax season deadlines by completing any required tax forms today. An irs online payment agreement (opa) can be requested online at. Web june 7, 2019 3:58 pm. If you have already filed your return or you are filing this form in response to a. To apply for a payment plan with the irs online, click here.

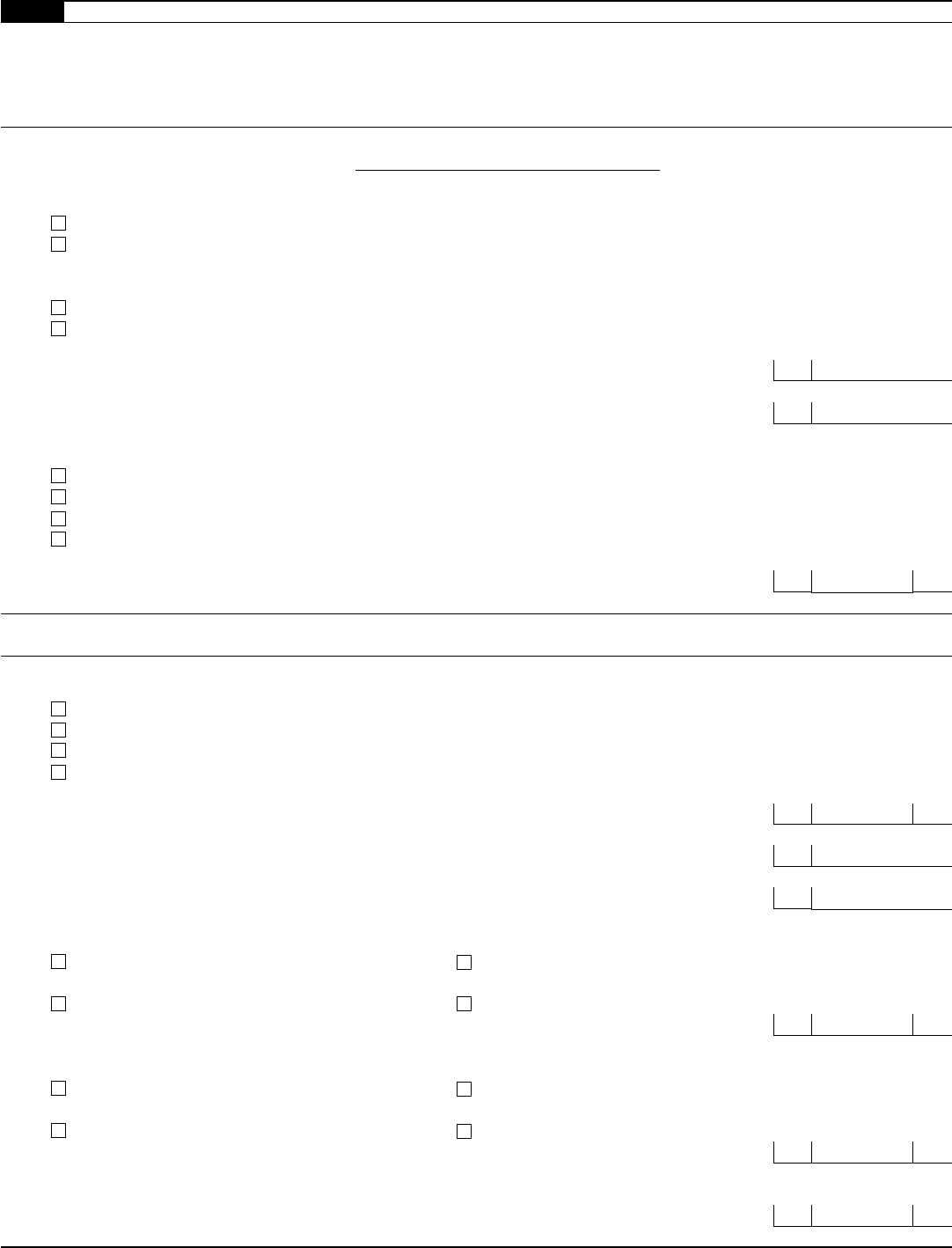

Irs Form 9465 Fillable and Editable PDF Template

Try it for free now! Web form 9465 is available in all versions of taxact® and can be electronically filed with your return. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. If you have already filed your return or you are filing this form in.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

Ad access irs tax forms. You can request an installment. Web if the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file form 9465; Web english use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax.

IRS Form 4868 Online File 2020 IRS 4868

Save your time needed to printing, putting your signature on, and scanning a paper copy of can you efile form 9465. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Ad access irs tax forms. To apply for a payment plan with the irs online, click.

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web if the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file form 9465; Web you can set up monthly electronic funds withdrawals for your.

Fillable Form 9465 Installment Agreement Request printable pdf download

Upload, modify or create forms. Web where to file your taxes for form 9465. Web june 7, 2019 3:58 pm. Try it for free now! Complete, edit or print tax forms instantly.

Which IRS Form Can Be Filed Electronically?

Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. See option 4 below for details. Web where to file your taxes for form 9465. Web if you already filed, or you can't find this option in turbotax, you can apply for a payment plan (form 9465) at the irs payment plans.

Filing 20686047 Electronically Filed 11/18/2014 114328 AM

Upload, modify or create forms. Ad access irs tax forms. Web if the total amount you owe isn't more than $50,000 (including any amounts you owe from prior years), you don't need to file form 9465; See option 4 below for details. If you are filing form 9465.

If You Have Already Filed Your Return Or You Are Filing This Form In Response To A.

Web form 9465 is available in all versions of taxact® and can be electronically filed with your return. Complete, edit or print tax forms instantly. See option 4 below for details. To enter or review information for form 9465 installment agreement request in.

Web Complete Can You Efile Form 9465 In Minutes, Not Hours.

Web form 9465 is available in all versions of taxact and can be electronically filed with your return. Save your time needed to printing, putting your signature on, and scanning a paper copy of can you efile form 9465. Web federal communications commission 45 l street ne. To apply for a payment plan with the irs online, click here.

Web English Use Form 9465 To Request A Monthly Installment Plan If You Cannot Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

Web where to file your taxes for form 9465. Web you can set up monthly electronic funds withdrawals for your installment request when you enter your information for form 9465 installment agreement request. Form 9465 is available in all versions of taxact. Web june 7, 2019 3:58 pm.

Web Form 9465 Can Also Be Filed Electronically With The Taxpayer's Return.

If you are filing form 9465. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web if you already filed, or you can't find this option in turbotax, you can apply for a payment plan (form 9465) at the irs payment plans and installment agreements. Try it for free now!

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/9465-usa-federal-tax-form-form-9465-instructions-ss-768x501.jpg)