Can Form 5558 Be Filed Electronically

Can Form 5558 Be Filed Electronically - Web the ein an ein is given to employers for tax purposes. Web the american retirement association (ara) in a dec. A separate form 5558 should be filed for each form 5500 for which an extension is desired. And (b) the date on line 2 and/or line 3 (above) is not later than the 15th day of the 3rd month after the norm. 5, 2022 letter to the irs has expressed strong support for the electronic submission of form 5558 via the department of labor’s (dol) erisa filing acceptance system (efast2). Web filing electronically is safe, easy to complete, and you have an immediate record that the return was filed. A social security number needs to be entered if extra contributions were made to a custodial account, or the filer is. Form 5558 is a multiple use form for filers to request an extension of time to file Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs. Web online — go to the irs website at irs.gov/businesses and click on employer id numbers. the ein is issued immediately once the application information is validated.

Web online — go to the irs website at irs.gov/businesses and click on employer id numbers. the ein is issued immediately once the application information is validated. Web filing electronically is safe, easy to complete, and you have an immediate record that the return was filed. A separate form 5558 should be filed for each form 5500 for which an extension is desired. Web the american retirement association (ara) in a dec. Web the ein an ein is given to employers for tax purposes. A social security number needs to be entered if extra contributions were made to a custodial account, or the filer is. 5, 2022 letter to the irs has expressed strong support for the electronic submission of form 5558 via the department of labor’s (dol) erisa filing acceptance system (efast2). Form 5558 is a multiple use form for filers to request an extension of time to file Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2.

Web the ein an ein is given to employers for tax purposes. Web the american retirement association (ara) in a dec. Web filing electronically is safe, easy to complete, and you have an immediate record that the return was filed. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. Web irs requests comments on form 5558 revisions to allow electronic filing by erisa news | october 07 2022 the irs has issued a notice and request for comments related to form 5558, application for extension of time to file certain employee plan returns. Form 5558 is a multiple use form for filers to request an extension of time to file Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs. 5, 2022 letter to the irs has expressed strong support for the electronic submission of form 5558 via the department of labor’s (dol) erisa filing acceptance system (efast2). A social security number needs to be entered if extra contributions were made to a custodial account, or the filer is. And (b) the date on line 2 and/or line 3 (above) is not later than the 15th day of the 3rd month after the norm.

Form 5558 Application for Extension of Time to File Certain Employee

Web the ein an ein is given to employers for tax purposes. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. 5, 2022 letter to the irs has expressed strong support for the electronic submission of form 5558 via the department of labor’s (dol) erisa filing acceptance system (efast2)..

IRS Form 4868 Online File 2020 IRS 4868

Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. And (b) the date on line 2 and/or line 3 (above) is not later than the 15th day of the 3rd month after the norm..

ELECTRONICALLY FILED Stamp ExcelMark

Web the ein an ein is given to employers for tax purposes. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs..

What are the Different Types of State Court Records?

Web irs requests comments on form 5558 revisions to allow electronic filing by erisa news | october 07 2022 the irs has issued a notice and request for comments related to form 5558, application for extension of time to file certain employee plan returns. Web on october 5, 2022 irs published notice and request for comments for proposed changes to.

Filing 20686047 Electronically Filed 11/18/2014 114328 AM

A social security number needs to be entered if extra contributions were made to a custodial account, or the filer is. And (b) the date on line 2 and/or line 3 (above) is not later than the 15th day of the 3rd month after the norm. A separate form 5558 should be filed for each form 5500 for which an.

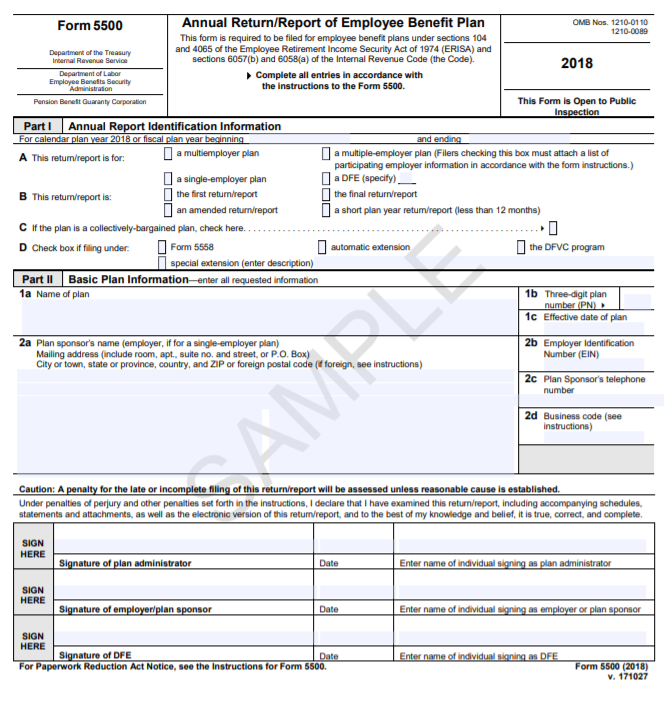

IRS Forms 5500 and 5558 Update

Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. Web the ein an ein.

Which IRS Form Can Be Filed Electronically?

Web irs requests comments on form 5558 revisions to allow electronic filing by erisa news | october 07 2022 the irs has issued a notice and request for comments related to form 5558, application for extension of time to file certain employee plan returns. Web the american retirement association (ara) in a dec. Web on october 5, 2022 irs published.

주간 회의록(간단양식) 부서별서식

Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs. Web the ein an ein is given to employers for tax purposes. Web filing electronically is safe, easy to complete, and you have an immediate record that the return was filed. Web.

Form 9 Deadline Is Form 9 Deadline Any Good? Ten Ways You Can Be

Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs. Web online — go to the irs website at irs.gov/businesses and click on employer id numbers. the ein is issued immediately once the application information is validated. 5, 2022 letter to the.

Fill Free fillable Form 5558 2018 Application for Extension of Time

Web filing electronically is safe, easy to complete, and you have an immediate record that the return was filed. A separate form 5558 should be filed for each form 5500 for which an extension is desired. Form 5558 is a multiple use form for filers to request an extension of time to file Web irs requests comments on form 5558.

Web Irs Requests Comments On Form 5558 Revisions To Allow Electronic Filing By Erisa News | October 07 2022 The Irs Has Issued A Notice And Request For Comments Related To Form 5558, Application For Extension Of Time To File Certain Employee Plan Returns.

Web the american retirement association (ara) in a dec. Web although form 5500 must be filed electronically with the dol (with limited exceptions for certain retirement plans), form 5558 is filed in paper form with the irs. Web online — go to the irs website at irs.gov/businesses and click on employer id numbers. the ein is issued immediately once the application information is validated. Extensions for up to 2 ½ months may be requested in advance by filing the form 5558 with the irs.

And (B) The Date On Line 2 And/Or Line 3 (Above) Is Not Later Than The 15Th Day Of The 3Rd Month After The Norm.

Web filing electronically is safe, easy to complete, and you have an immediate record that the return was filed. Form 5558 is a multiple use form for filers to request an extension of time to file Web the ein an ein is given to employers for tax purposes. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2.

A Separate Form 5558 Should Be Filed For Each Form 5500 For Which An Extension Is Desired.

5, 2022 letter to the irs has expressed strong support for the electronic submission of form 5558 via the department of labor’s (dol) erisa filing acceptance system (efast2). A social security number needs to be entered if extra contributions were made to a custodial account, or the filer is.