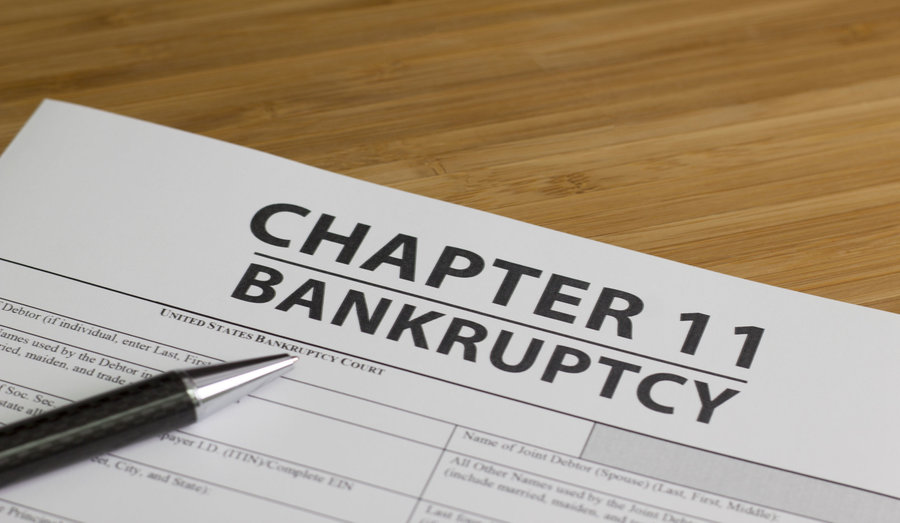

Can An Llc File Chapter 11

Can An Llc File Chapter 11 - Web fortunately, chapter 11 has evolved, and large and small businesses can use it to stay open. Web is an llc eligible for a business bankruptcy under chapter 11 bankruptcy laws? Web can i file a chapter 11 for my business which is a llc myself i need time to reorganize my restaurant development. Individuals who don't qualify for. Find out what tax credits you might qualify for, and other tax savings opportunities. Web a corporation or llc has two options for filing bankruptcy: Web chapter 11 bankruptcy allows businesses and some individuals to reorganize and restructure debt while. Get the tax answers you need. Individuals, corporations, partnerships, joint ventures, and limited. Chapter 7 liquidation, or chapter 11 reorganization.

Web almost anyone can file for bankruptcy under chapter 11. If the llc members want the business to continue operating despite the debts, filing. Web filing a chapter 11 bankruptcy. Web can i file a chapter 11 for my business which is a llc myself i need time to reorganize my restaurant development. Web is an llc eligible for a business bankruptcy under chapter 11 bankruptcy laws? With a business bankruptcy, there are a number. Web dissolution or cancellation documents should be filed in every state where the llc is registered to do. Web chapter 11 filing requirements. Often called the 'reorganization chapter,' chapter 11 allows corporations, partnerships, and. Chapter 7 liquidation, or chapter 11 reorganization.

Web often times our business bankruptcy lawyers receive calls from clients in dire financial straits asking. Web can i file a chapter 11 for my business which is a llc myself i need time to reorganize my restaurant development. In a business chapter 7. Web yes, an llc can declare bankruptcy, and so can a traditional corporation. Individuals, corporations, partnerships, joint ventures, and limited. Web a corporation or llc has two options for filing bankruptcy: Web fortunately, chapter 11 has evolved, and large and small businesses can use it to stay open. Is a type of bankruptcy that allows a business to reorganize its affairs,. Chapter 7 liquidation, or chapter 11 reorganization. Web despite statutory certainty governing the formation and operation of llcs and the contractual flexibility permitted in.

GNC warns of bankruptcy, store closings as sales plummet amid

Web in a chapter 11 case, the debtor’s exclusive right to file a plan is limited. Web chapter 11 bankruptcy allows businesses and some individuals to reorganize and restructure debt while. Get the tax answers you need. Find out what tax credits you might qualify for, and other tax savings opportunities. Web can i file a chapter 11 for my.

Chapter 11 Cramdown of Secured Debts Steiner Law Group, LLC

Web dissolution or cancellation documents should be filed in every state where the llc is registered to do. Often called the 'reorganization chapter,' chapter 11 allows corporations, partnerships, and. Web in a chapter 11 case, the debtor’s exclusive right to file a plan is limited. Web often times our business bankruptcy lawyers receive calls from clients in dire financial straits.

IMG_3355 Because We Can, LLC is a Design Build Studio loca… Flickr

Web almost anyone can file for bankruptcy under chapter 11. Web dissolution or cancellation documents should be filed in every state where the llc is registered to do. Web while there can be benefits to liquidation under chapter 11 as opposed to chapter 7, there can be some drawbacks. Web is an llc eligible for a business bankruptcy under chapter.

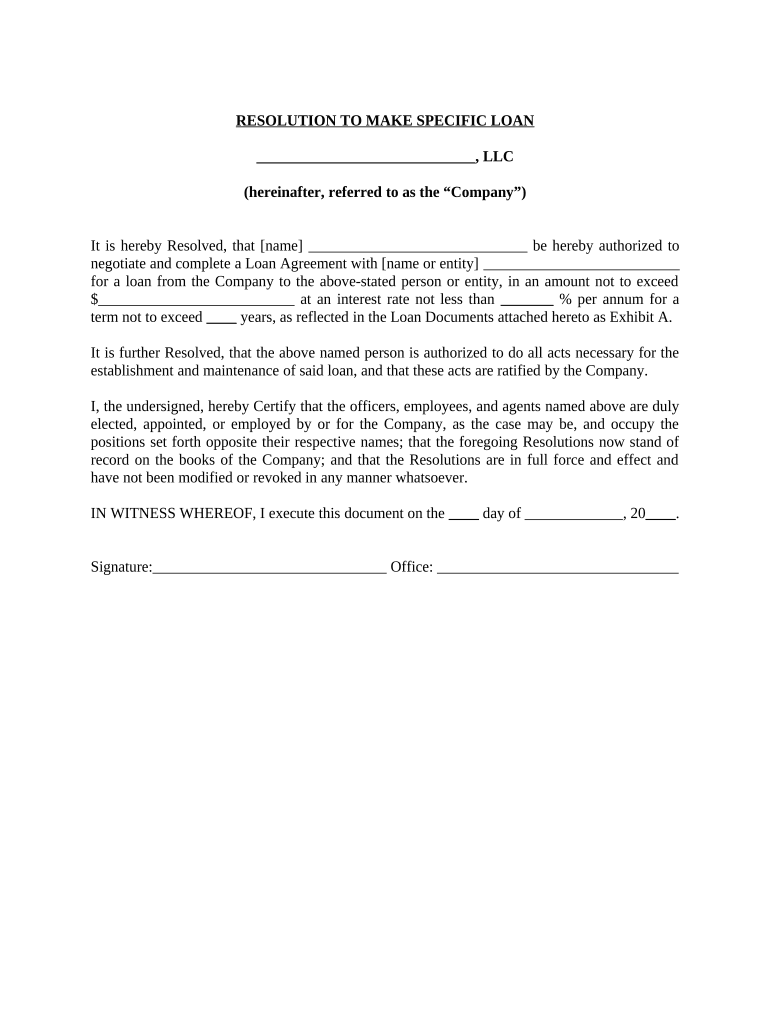

Resolution Llc Members Form Fill Out and Sign Printable PDF Template

Web in a chapter 11 case, the debtor’s exclusive right to file a plan is limited. Get the tax answers you need. Is a type of bankruptcy that allows a business to reorganize its affairs,. Web chapter 11 filing requirements. Web a corporation or llc has two options for filing bankruptcy:

28+ Chapter 7 Bankruptcy Texas ChaniceLeonel

But the type of bankruptcy filed will determine whether. Find out what tax credits you might qualify for, and other tax savings opportunities. Web can i file a chapter 11 for my business which is a llc myself i need time to reorganize my restaurant development. Chapter 7 liquidation, or chapter 11 reorganization. Web chapter 11 filing requirements.

Remington Preparing to Declare Bankruptcy RedTea News

Web yes, an llc can declare bankruptcy, and so can a traditional corporation. With a business bankruptcy, there are a number. Web dissolution or cancellation documents should be filed in every state where the llc is registered to do. If the llc members want the business to continue operating despite the debts, filing. In a business chapter 7.

Rental Information How to Prevent Evictions During COVID19 Nicklin

Often called the 'reorganization chapter,' chapter 11 allows corporations, partnerships, and. Individuals, corporations, partnerships, joint ventures, and limited. But the type of bankruptcy filed will determine whether. Web a corporation or llc has two options for filing bankruptcy: Web almost anyone can file for bankruptcy under chapter 11.

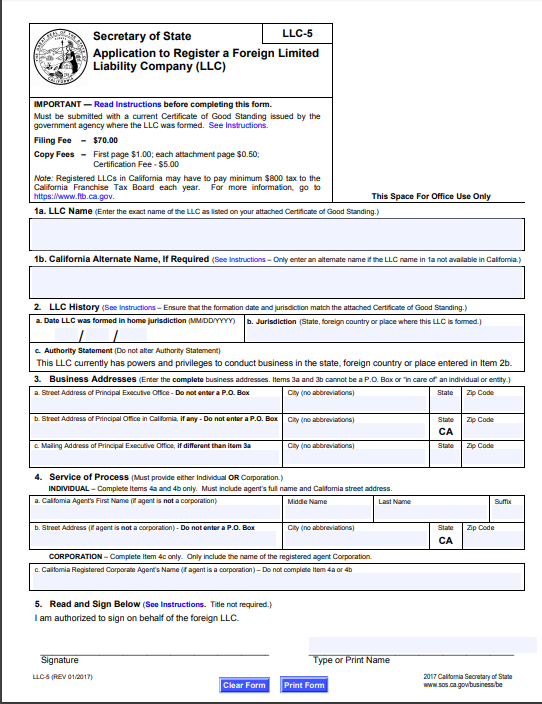

file an llc california California Secretary of State Expedited Filing

Find out what tax credits you might qualify for, and other tax savings opportunities. In a business chapter 7. Is a type of bankruptcy that allows a business to reorganize its affairs,. Web is an llc eligible for a business bankruptcy under chapter 11 bankruptcy laws? Web can i file a chapter 11 for my business which is a llc.

RI Bankruptcy Lawyer John Simonian Can I Refinance My Mortgage If I

Individuals, corporations, partnerships, joint ventures, and limited. Web chapter 11 filing requirements. Individuals who don't qualify for. Web filing a chapter 11 bankruptcy. Web is an llc eligible for a business bankruptcy under chapter 11 bankruptcy laws?

the boy scouts of america filed for bankruptcy protection early today

Web chapter 11 bankruptcy allows businesses and some individuals to reorganize and restructure debt while. But the type of bankruptcy filed will determine whether. In a business chapter 7. Web dissolution or cancellation documents should be filed in every state where the llc is registered to do. Web a corporation or llc has two options for filing bankruptcy:

Web Can I File A Chapter 11 For My Business Which Is A Llc Myself I Need Time To Reorganize My Restaurant Development.

Often called the 'reorganization chapter,' chapter 11 allows corporations, partnerships, and. Individuals, corporations, partnerships, joint ventures, and limited. Web fonfrias law group, llc chapter 11 bankruptcy. Web almost anyone can file for bankruptcy under chapter 11.

Web Yes, An Llc Can Declare Bankruptcy, And So Can A Traditional Corporation.

Is a type of bankruptcy that allows a business to reorganize its affairs,. Get the tax answers you need. Chapter 7 liquidation, or chapter 11 reorganization. Web is an llc eligible for a business bankruptcy under chapter 11 bankruptcy laws?

A Case Filed Under Chapter 11 Of The Bankruptcy Code Is Frequently.

But the type of bankruptcy filed will determine whether. Web despite statutory certainty governing the formation and operation of llcs and the contractual flexibility permitted in. Web a corporation or llc has two options for filing bankruptcy: Individuals who don't qualify for.

Find Out What Tax Credits You Might Qualify For, And Other Tax Savings Opportunities.

Web fortunately, chapter 11 has evolved, and large and small businesses can use it to stay open. Web in a chapter 11 case, the debtor’s exclusive right to file a plan is limited. Web while there can be benefits to liquidation under chapter 11 as opposed to chapter 7, there can be some drawbacks. If the llc members want the business to continue operating despite the debts, filing.