California Form 3536 2023

California Form 3536 2023 - Web need to save time? California form 3536 (llc) title: This form is used to estimate and pay the annual. Instead use the 2020 form ftb 3522, llc tax voucher. Web follow the simple instructions below: Web use a form 3536 2023 template to make your document workflow more streamlined. 2023 form 3522, limited liability. After the first year, a new statement of information must be filed every other year. Instead use the 2010 form ftb 3522, llc tax voucher. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022.

Web file form ftb 3536. We last updated california form 3536 in april 2023 from the california. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web follow the simple instructions below: Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web 2023 instructions for form ftb 3522 llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. Northwest ($39 + state fee) legalzoom ($149 + state fee) contents statement of information filing fee ($20). This form is used to estimate and pay the annual. 2022 form 3536 (llc extension payment);

Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web the california franchise tax board june 1 released form ftb 3536, estimated fee for llcs, along with instructions, for individual income tax purposes. Instead use the 2020 form ftb 3522, llc tax voucher. Northwest ($39 + state fee) legalzoom ($149 + state fee) contents statement of information filing fee ($20). 2022 form 3536 (llc extension payment); Web use this screen to complete 2022 form 568, limited liability company return of income, side 1; California form 3536 (llc) title: Web do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. 16, 2023, to file and pay taxes. Instead use the 2010 form ftb 3522, llc tax voucher.

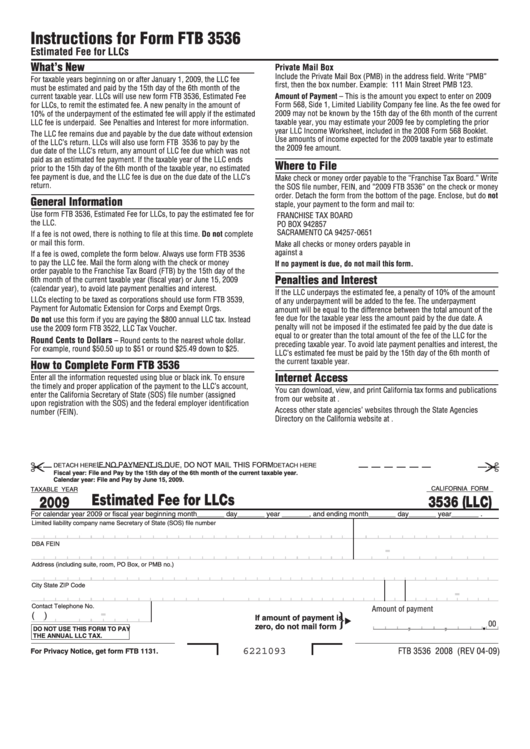

Fillable California Form Ftb 3536 (Llc) Estimated Fee For Llcs 2009

Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web use a form 3536 2023 template to make your document workflow more streamlined. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. Show details how it works open the ca form 3536 and follow the instructions.

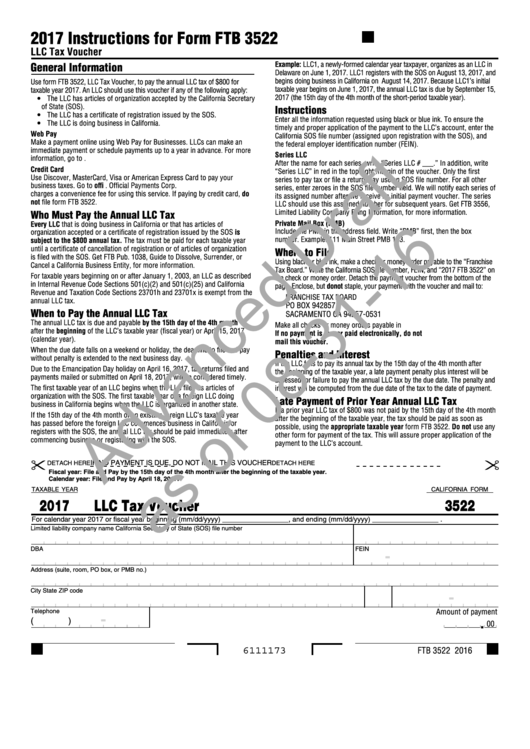

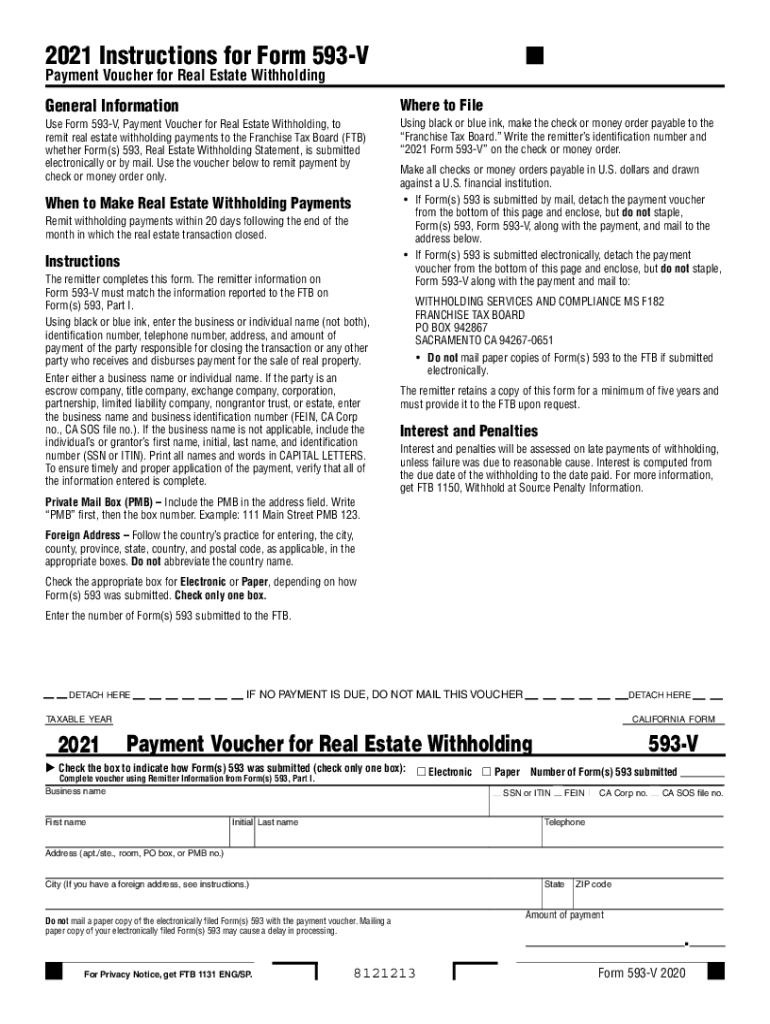

California Form 3522 (Draft) Llc Tax Voucher 2017 printable pdf

Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. View our emergency tax relief page. Show details how it works open the ca form 3536 and follow the instructions easily sign the. The fee is $2,500 for llcs that make between $500,000.

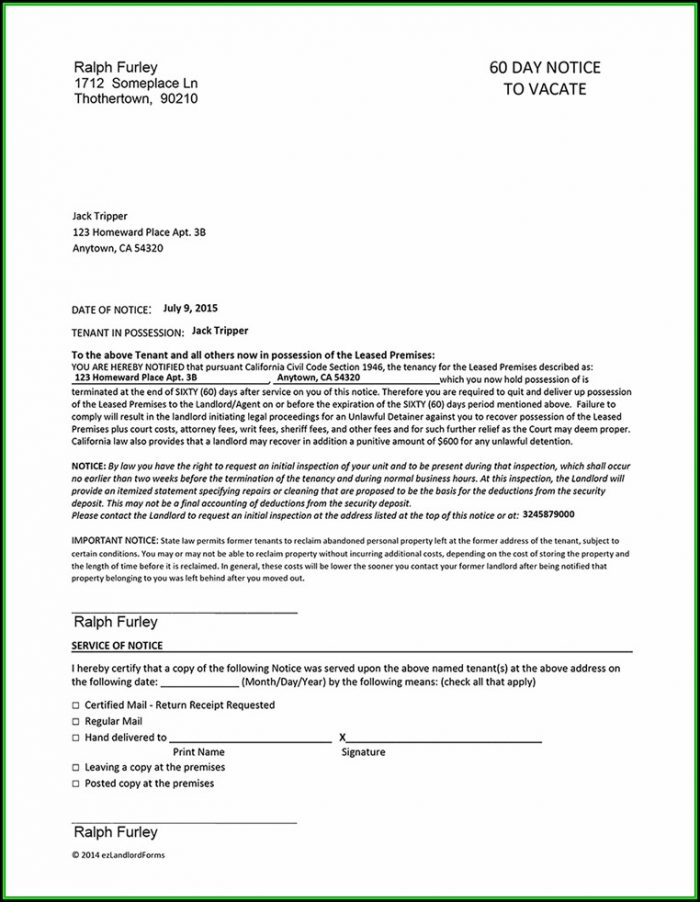

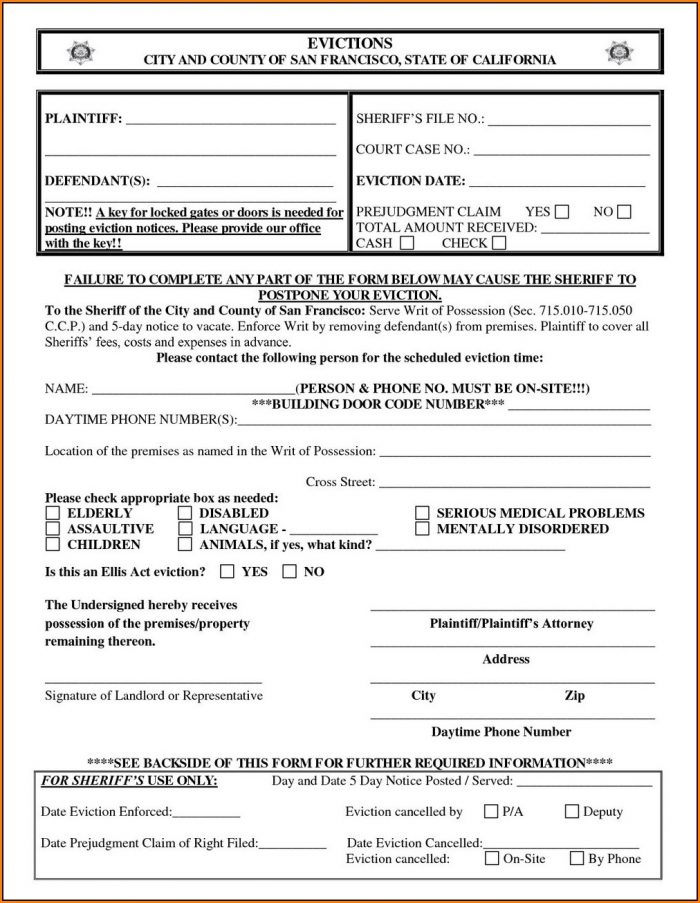

3 Day Eviction Notice Form California Template Form Resume Examples

Instead use the 2010 form ftb 3522, llc tax voucher. Web the california franchise tax board june 1 released form ftb 3536, estimated fee for llcs, along with instructions, for individual income tax purposes. This form is used to estimate and pay the annual. View our emergency tax relief page. When the tax season began unexpectedly or you just forgot.

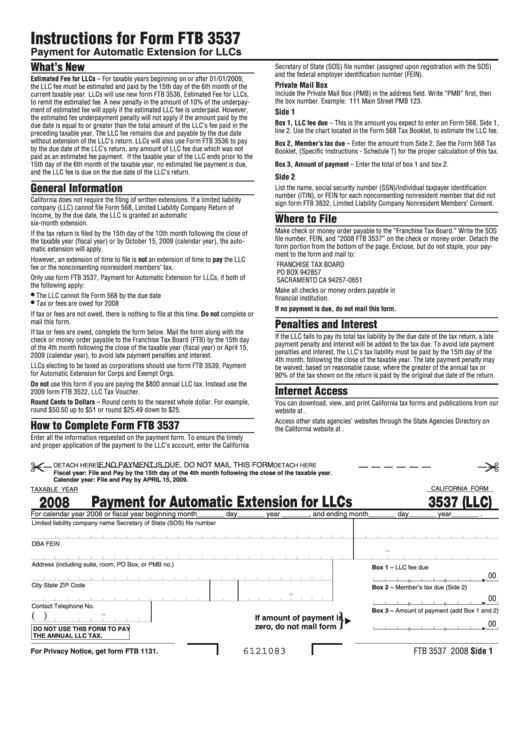

Fillable California Form 3537 (Llc) Payment For Automatic Extension

This form is used to estimate and pay the annual. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web use a form 3536 2023 template to make your document workflow more streamlined. View our emergency tax relief page. Web file form ftb 3536.

Animal Geometry Design Digital Technology Background Stock Vector

Web do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. Web file form ftb 3536. Instead use the 2020 form ftb 3522, llc tax voucher. 2023 instructions 2022 instructions how did we do? This form is used to estimate and pay the annual.

California Withholding Form 2021 2022 W4 Form

View our emergency tax relief page. Web follow the simple instructions below: Web people who set up a limited liability company or partnership in california won't have to pay the annual $800 minimum tax levied on business entities their first year, under the. Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. Web.

2022 Form CA FTB 3536 Fill Online, Printable, Fillable, Blank pdfFiller

This form is used to estimate and pay the annual. Use form ftb 3536 if you are paying the 2020 $800 annual llc tax. 2022 form 3536 (llc extension payment); 16, 2023, to file and pay taxes. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax.

California Form 3536

Web people who set up a limited liability company or partnership in california won't have to pay the annual $800 minimum tax levied on business entities their first year, under the. Web use this screen to complete 2022 form 568, limited liability company return of income, side 1; Web you'll need to file your company's statement of information within 90.

3 Day Eviction Notice Form California Template Form Resume Examples

Web do not use form ftb 3536 if you are paying the $800 annual llc tax. Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. Web need to save time? Web use a form 3536 2023 template to make your document workflow more streamlined. Instead use the 2021 form ftb 3522, llc tax.

Fill Free fillable forms for the state of California

2023 instructions 2022 instructions how did we do? Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. Web you'll need to file your company's statement of information within 90 days llc's formation date. Instead use the 2021 form ftb 3522, llc tax voucher. Instead use the 2020 form ftb 3522, llc tax voucher.

View Our Emergency Tax Relief Page.

16, 2023, to file and pay taxes. Instead use the 2010 form ftb 3522, llc tax voucher. Web file form ftb 3536. Northwest ($39 + state fee) legalzoom ($149 + state fee) contents statement of information filing fee ($20).

Web Follow The Simple Instructions Below:

You can download or print current or past. Use form ftb 3536 if you are paying the 2020 $800 annual llc tax. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Show details how it works open the ca form 3536 and follow the instructions easily sign the.

Web Do Not Use Form Ftb 3536 If You Are Paying The $800 Annual Llc Tax.

Web do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. 2023 form 3522, limited liability. 2022 form 3536 (llc extension payment); Web file form ftb 3536.

Instead Use The 2022 Form Ftb 3522, Llc Tax Voucher.

Web use this screen to complete 2022 form 568, limited liability company return of income, side 1; Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Web people who set up a limited liability company or partnership in california won't have to pay the annual $800 minimum tax levied on business entities their first year, under the. When the tax season began unexpectedly or you just forgot about it, it could probably create problems for you.