Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4

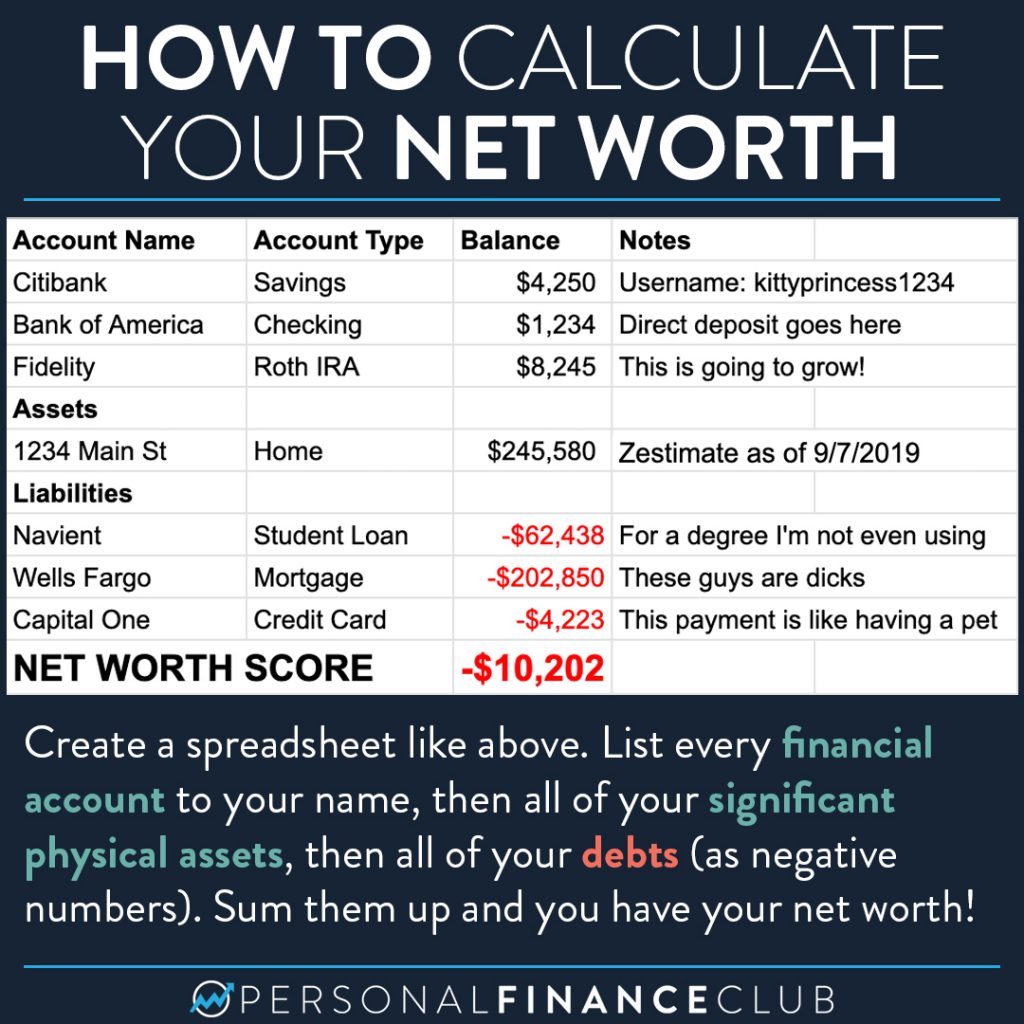

Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4 - Family a’s income is more than twice that of family b, yet family b has more equity, or positive value, on the things that they own. Ficycle direct instruction teacher version save print objective students will be able to: Web the formula for net worth can be derived by using the following steps: Net worth can be a useful tool to measure your. The first step is to make a thorough list of all your assets. The first step is to make a thorough list of all your assets. As you decrease your liabilities and/or increase assets your net worth goes up. By simply subtracting your liabilities from your assets, you have your net worth. Then subtract what you owe : What are assets and liabilities?

Estimate the value of your assets. Web follow these steps to calculate your net worth: Web how is net worth calculated? Estimate the value of your assets. Web calculating your net worth chapter 1, lesson 4 directions write your answers to the following questions and be ready to discuss your answers with the class. Web calculating your net worth worksheet answers chapter 1 lesson 4. Estimate the value of your assets. Remind the students that some income and expenses will need to be converted to monthly values. What are assets and liabilities? How do you account for the.

Their emergency fundis not fully funded, which shows. Web calculating your net worth worksheet answers chapter 1 lesson 4. What are assets and liabilities? Estimate the value of your assets. By simply subtracting your liabilities from your assets, you have your net worth. It is easy to forget some important items, so make sure to. Web web when you complete the net net worth worksheet, you separately total your assets and liabilities. The first step is to make a thorough list of all your assets. The information will then be used to calculate the person’s net worth and cash flow. Web name calculating your net worth chapter 1, lesson 4 family a family b occupation nurse and sales appliance installer annual income $105,000 combined $45,000 retirement investments $35,000 $22,000.

Net Worth MindWolves

By simply subtracting your liabilities from your assets, you have your net worth. Web , lesson integers and net worth time: Web we just made it easier for you to find that number with our net worth calculator. Web you can calculate their net worth by adding up all your assets while subtracting their outstanding liabilities from the total. Web.

How To Calculate Net Worth (FREE net worth worksheet!)

Web how is net worth calculated? Net worth can act as a financial report card. Web web when you complete the net net worth worksheet, you separately total your assets and liabilities. Estimate the value of your assets. Family a’s income is more than twice that.

Personal Net Worth Calculator Excel Spreadsheet Asset & Debt Tracker

As you decrease your liabilities and/or increase assets your net worth goes up. It is easy to forget some important items, so make sure to. Net worth can be a useful tool to measure your. Web , lesson integers and net worth time: Start with what you own :

Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4

Web calculating your net worth chapter 1, lesson 4 directions write your answers to the following questions and be ready to discuss your answers. Family a’s income is more than twice that. Web calculating your net worth chapter 1, lesson 4 directions write your answers to the following questions and be ready to discuss your answers with the class. Web.

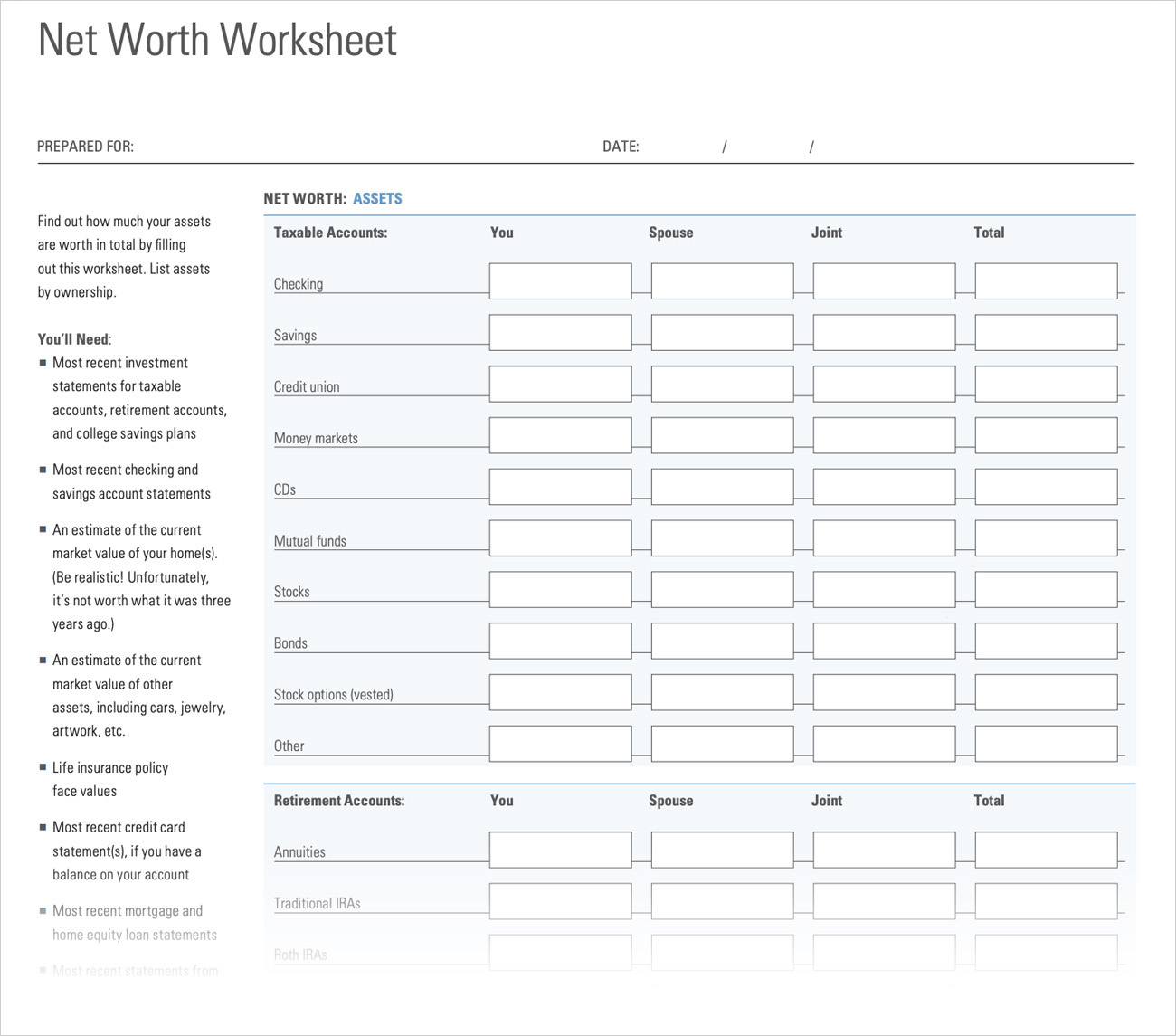

30 Personal Net Worth Worksheet Education Template

What are assets and liabilities? The first step is to make a thorough list of all your assets. Start with what you own : Family a’s income is more than twice that. Web calculating your net worth worksheet answers chapter 1 lesson 4.

Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4

Family a’s income is more than twice that of family b, yet family b has more equity, or positive value, on the things that they own. Web calculating your net worth worksheet answers chapter 1 lesson 4. The information will then be used to calculate the person’s net worth and cash flow. Figuring out your net worth: Web calculating your.

Balkoni Hijau Blog

Estimate the value of your assets. Web calculating your net worth worksheet answers chapter 1 lesson 4. Represent net worth using an integer number sentence. Web follow these steps to calculate your net worth: Represent net worth using a vertical number line.

Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4

Family a’s income is more than twice that of family b, yet family b has more equity, or positive value, on the things that they own. Shows cash inflows and cash outflows. It includes two examples of calculating net worth (one positive, one negative). Web follow these steps to calculate your net worth: Web you can calculate their net worth.

Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4

The information will then be used to calculate the person’s net worth and cash flow. Start with what you own : Web calculating your net worth chapter 1, lesson 4 directions write your answers to the following questions and be ready to discuss your answers with the class. Web show calculation of net worth formula: Figuring out your net worth:

Annuity time calculator LukeSandy

Their emergency fundis not fully funded, which shows. Web calculating your net worth chapter 1, lesson 4 1. Web 20+ calculating your net worth chapter 1 lesson 4 mhoragjaidev from mhoragjaidev.blogspot.com. Net worth can act as a financial report card. Shows cash inflows and cash outflows.

Model The Formula With Students To Check For Understanding.

Web the formula for net worth can be derived by using the following steps: Net worth can act as a financial report card. Web calculating your net worth worksheet answers chapter 1 lesson 4. Just answer a few simple questions, and you’ll find out your net worth in five minutes—that’s less time than it takes to drink your morning coffee!

The First Step Is To Make A Thorough List Of All Your Assets.

Then subtract what you owe : Web calculating your net worth worksheet answers chapter 1 lesson 4. What are assets and liabilities? Cash, retirement accounts, investment accounts, cars, real estate and anything else that you could sell for cash.

The First Step Is To Make A Thorough List Of All Your Assets.

Family a’s income is more than twice that of family b, yet family b has more equity, or positive value, on the things that they own. Web calculating your net worth chapter 1, lesson 4 directions write your answers to the following questions and be ready to discuss your answers. Web we just made it easier for you to find that number with our net worth calculator. Instruct the groups to now calculate a total for their category.

Web Calculating Your Net Worth Worksheet Answers Chapter 1 Lesson 4.

Estimate the value of your assets. Estimate the value of your assets. Web you can calculate their net worth by adding up all your assets while subtracting their outstanding liabilities from the total. Start with what you own :