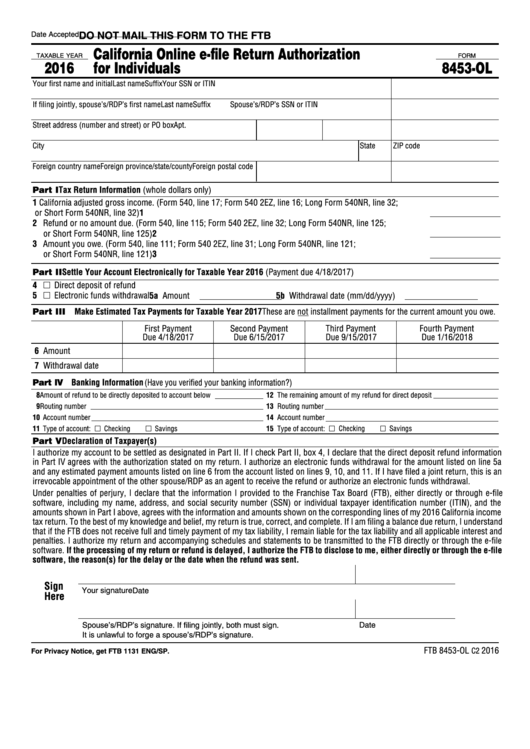

Ca Form 8453-Ol

Ca Form 8453-Ol - Web schedule rdp, california registered domestic partnership adjustments worksheet. This form is for income earned in tax year 2022, with tax returns due in april. By signing this form, you. And 1099r, distributions from pensions, annuities,. Inspect a copy of the. Web do not mail this form to the ftb. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. By signing this form, you. • inspect a copy of the return. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted.

Web schedule rdp, california registered domestic partnership adjustments worksheet. You are supposed to sign it after acceptance but you don't actually mail it to ca. If a joint return, or request for refund, your spouse must also sign. By signing this form, you. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. • inspect a copy of the return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Sign it in a few clicks draw your signature, type it,. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted.

Reconfirm your routing and account numbers. By signing this form, you. Web do not mail this form to the ftb. • inspect a copy of the return. Reconfirm your routing and account numbers. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. If a joint return, or request for refund, your spouse must also sign. And 1099r, distributions from pensions, annuities,. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must.

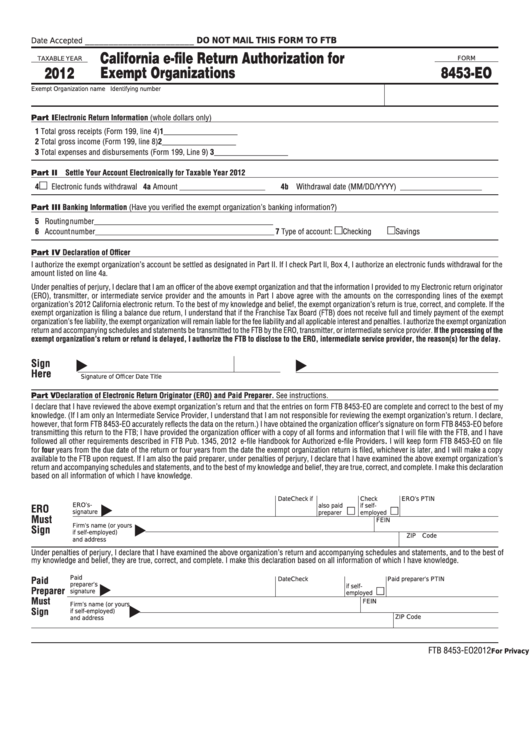

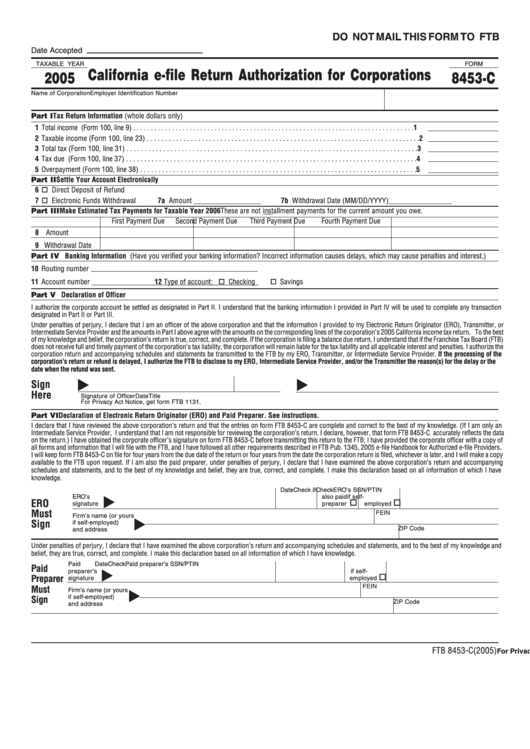

Fillable Form 8453Eo California EFile Return Authorization For

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web do not mail this.

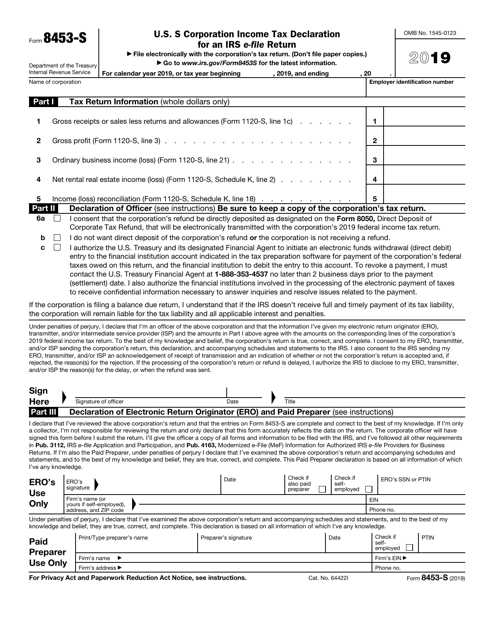

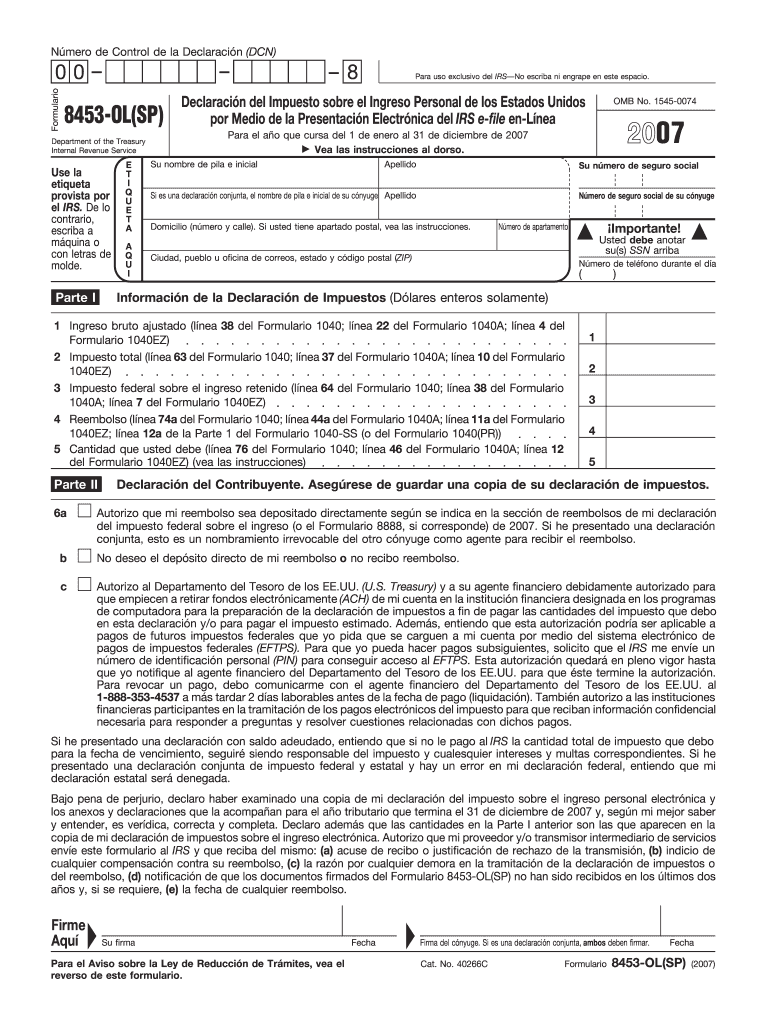

What Is IRS Form 8453OL? IRS Tax Attorney

Reconfirm your routing and account numbers. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more. Reconfirm your routing and account numbers. By signing.

IRS Form 8453S Download Fillable PDF or Fill Online U.S. S Corporation

Inspect a copy of the. Reconfirm your routing and account numbers. You are supposed to sign it after acceptance but you don't actually mail it to ca. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. • inspect a copy of the return.

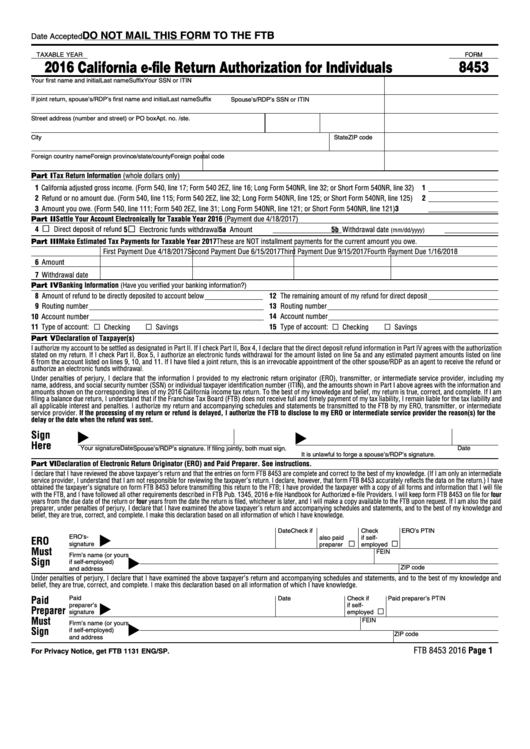

Fillable Form 8453 California EFile Return Authorization For

This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it,. Web schedule rdp, california registered domestic partnership adjustments worksheet. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue.

Top 10 Form 8453c Templates free to download in PDF format

This form is for income earned in tax year 2022, with tax returns due in april. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. • inspect a copy of the return. Web schedule rdp, california registered.

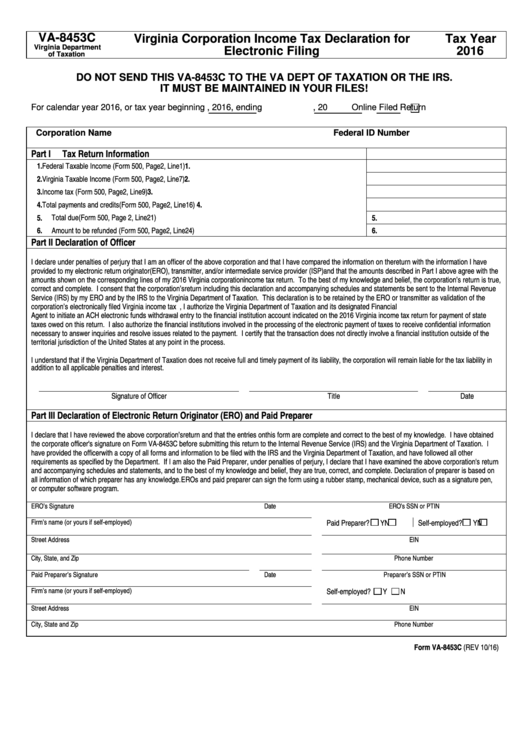

Form 8453C California EFile Return Authorization For Corporations

And 1099r, distributions from pensions, annuities,. • inspect a copy of the return. Web do not mail this form to the ftb. Reconfirm your routing and account numbers. Web do not mail this form to the ftb.

Fillable Form 8453Ol California Online EFile Return Authorization

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If a joint return, or request for refund, your spouse must also sign. Web schedule rdp, california registered domestic partnership adjustments worksheet. Reconfirm your routing and account numbers..

How Form 8453EMP Helps Completing the Form 941? YouTube

If a joint return, or request for refund, your spouse must also sign. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more. Your first name and initial last name suffix your ssn or itin. And 1099r, distributions from pensions, annuities,. This form is for income earned in tax year 2022, with.

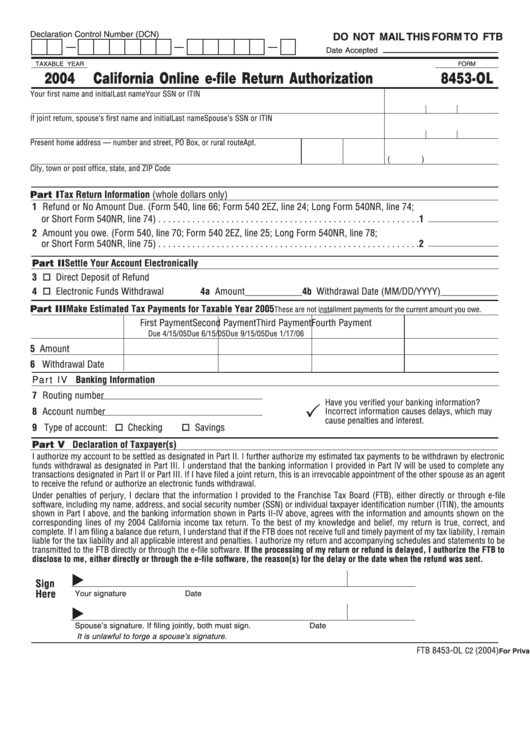

Form 8453Ol California Online EFile Return Authorization 2004

This form is for income earned in tax year 2022, with tax returns due in april. • inspect a copy of the return. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web schedule rdp, california registered domestic partnership adjustments worksheet. Your first name and initial.

Web Do Not Mail This Form To The Ftb.

This form is for income earned in tax year 2022, with tax returns due in april. Your first name and initial last name suffix your ssn or itin. If a joint return, or request for refund, your spouse must also sign. Reconfirm your routing and account numbers.

And 1099R, Distributions From Pensions, Annuities,.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. • inspect a copy of the return. By signing this form, you. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted.

Inspect A Copy Of The.

Reconfirm your routing and account numbers. Web do not mail this form to the ftb. Sign it in a few clicks draw your signature, type it,. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must.

You Are Supposed To Sign It After Acceptance But You Don't Actually Mail It To Ca.

Web schedule rdp, california registered domestic partnership adjustments worksheet. By signing this form, you. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more.