Ca Form 568 Instructions 2021

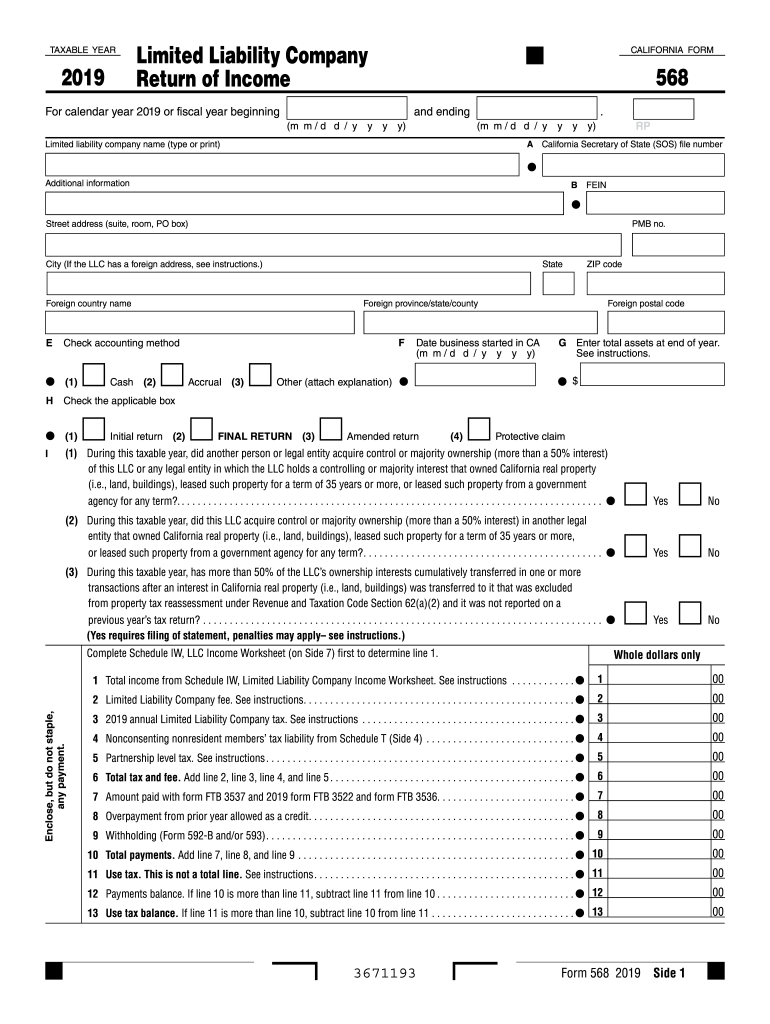

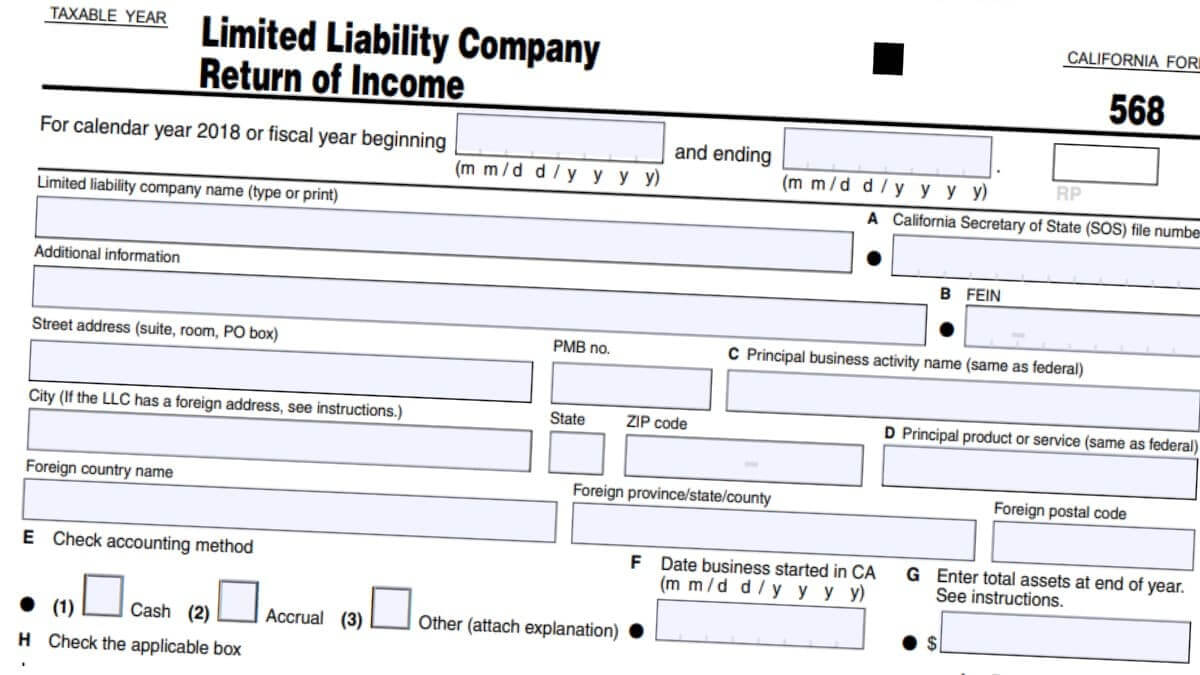

Ca Form 568 Instructions 2021 - I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. Download past year versions of this tax form as pdfs here: Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. Enter the amount of the llc fee. File a tax return (form 568) pay the llc annual tax. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. 2022 form 568 limited liability company return of income. Web 2021 instructions for form 568, limited liability company return of income. Current year net income/loss and other increases/decreases are now separately reported in columns (c) and (d), respectively. Web you still have to file form 568 if the llc is registered in california.

File a tax return (form 568) pay the llc annual tax. Download past year versions of this tax form as pdfs here: 2022 form 568 limited liability company return of income. Web you still have to file form 568 if the llc is registered in california. You and your clients should be aware that a disregarded smllc is required to: Current year net income/loss and other increases/decreases are now separately reported in columns (c) and (d), respectively. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Enter the amount of the llc fee. Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. Web 2021 instructions for form 568, limited liability company return of income.

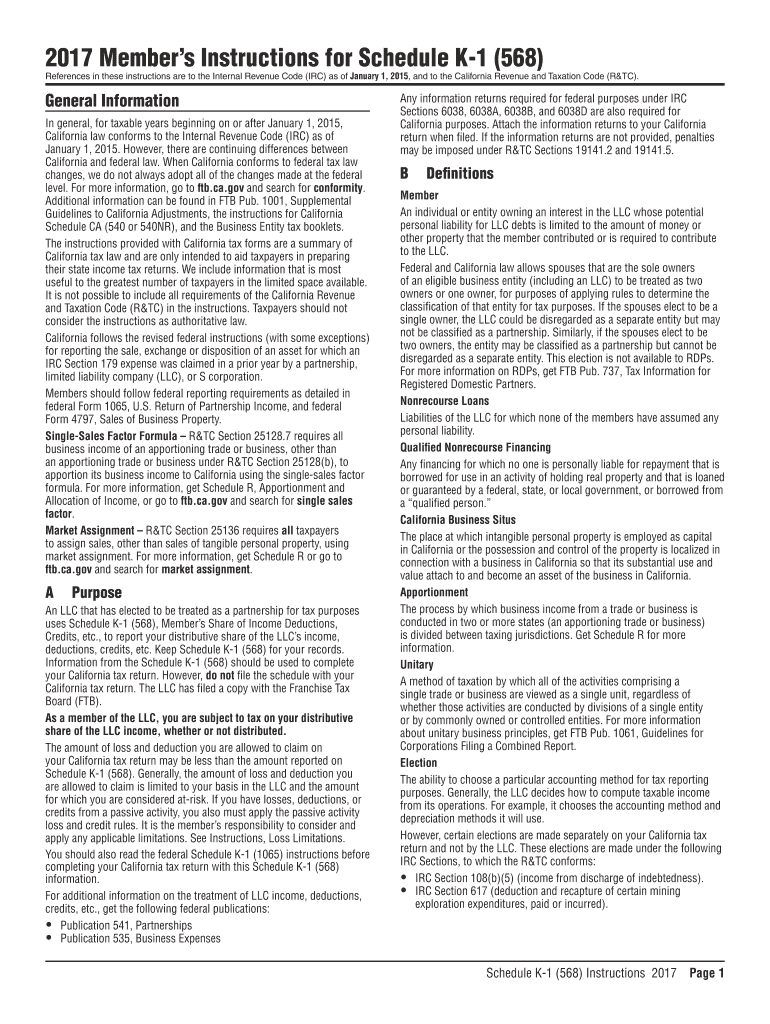

You and your clients should be aware that a disregarded smllc is required to: Download past year versions of this tax form as pdfs here: Enter the amount of the llc fee. Current year net income/loss and other increases/decreases are now separately reported in columns (c) and (d), respectively. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information. File a tax return (form 568) pay the llc annual tax. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. I believe the correct answer for first year llc's established in 2021 is $0. Web you still have to file form 568 if the llc is registered in california.

Form 568 Instructions 2022 2023 State Tax TaxUni

Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that are specially allocated to any members. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. 2022 form 568 limited liability company return of income..

NEW! Ca Form 568 Instructions 2020 Coub

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. Download past year versions of this tax form as pdfs.

2019 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

You and your clients should be aware that a disregarded smllc is required to: Web 2021 instructions for form 568, limited liability company return of income. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). I believe the correct answer for first year llc's.

Download Instructions for Form 568 Schedule EO PassThrough Entity

Current year net income/loss and other increases/decreases are now separately reported in columns (c) and (d), respectively. Download past year versions of this tax form as pdfs here: I believe the correct answer for first year llc's established in 2021 is $0. You and your clients should be aware that a disregarded smllc is required to: File a tax return.

Form 568 instructions 2013

2022 form 568 limited liability company return of income. You and your clients should be aware that a disregarded smllc is required to: I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or.

california form 568 LLC Bible

Line 1—total income from schedule iw. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Download past year versions of this tax form as pdfs here: I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this.

20172022 Form CA FTB Schedule K1 (568) Instructions Fill Online

Enter the amount of the llc fee. Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). You and your.

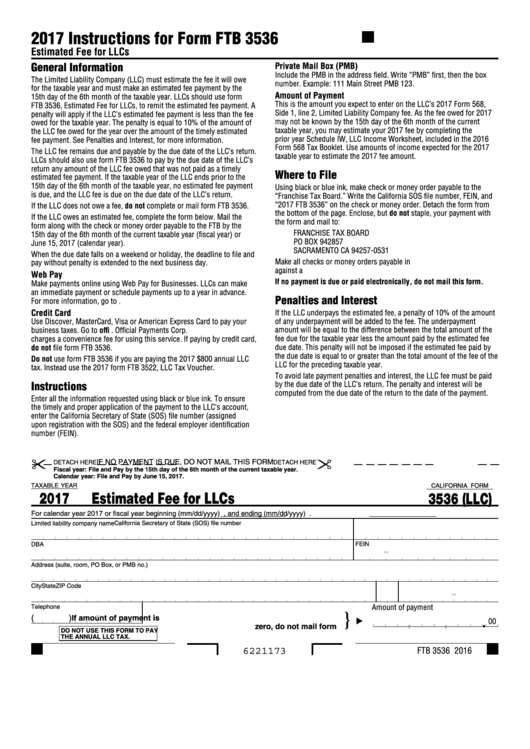

Fillable Form Ftb 3536 Estimated Fee For Llcs 2017 printable pdf

Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information. 2022 form 568 limited liability company return of income. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. File a tax return (form 568) pay the llc annual tax. References in these instructions are to the.

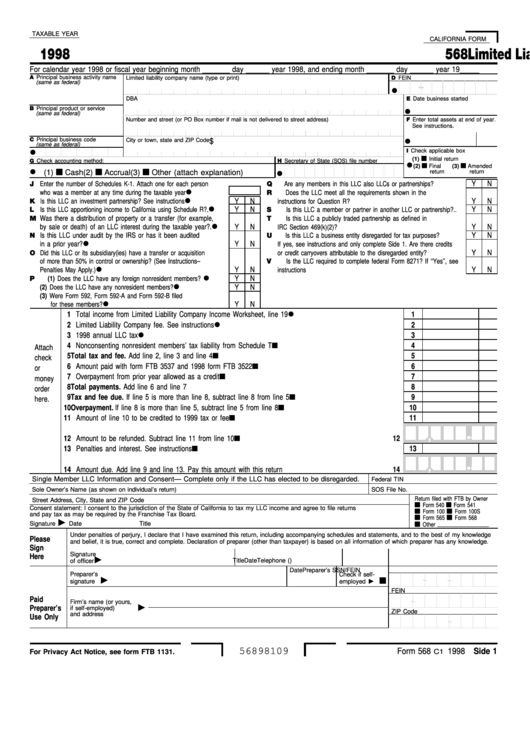

Fillable Form 568 Limited Liability Company Return Of 1998

I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. Pay the llc fee (if.

I Believe The Correct Answer For First Year Llc's Established In 2021 Is $0.

Do not use this form to report the sale of. Download past year versions of this tax form as pdfs here: 2022 form 568 limited liability company return of income. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35.

File A Tax Return (Form 568) Pay The Llc Annual Tax.

Current year net income/loss and other increases/decreases are now separately reported in columns (c) and (d), respectively. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that are specially allocated to any members. Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information.

Enter The Amount Of The Llc Fee.

You and your clients should be aware that a disregarded smllc is required to: How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Line 1—total income from schedule iw. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc).

Web You Still Have To File Form 568 If The Llc Is Registered In California.

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web 2021 instructions for form 568, limited liability company return of income.