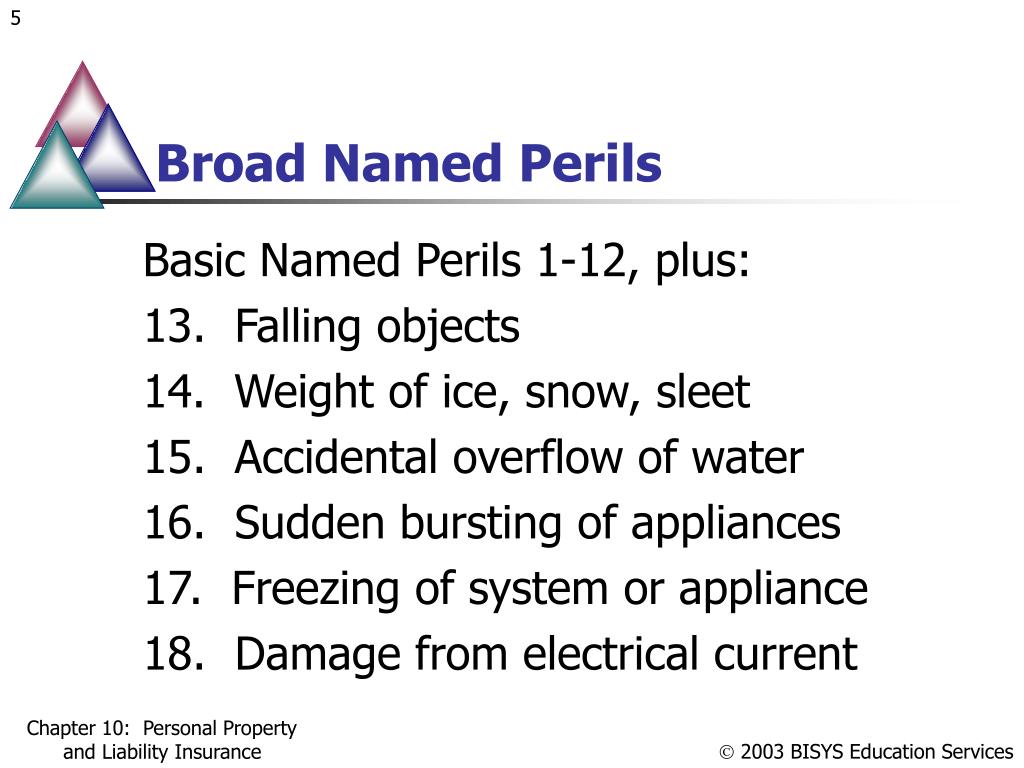

Broad Form Perils

Broad Form Perils - Broad form policies balance the wide protection of a. Web the broad form is built to cover everything the basic form, and the most common perils expected. Web broad form the named perils which cover your belongings under a broad form property insurance policy are: In the most common broad form insurance policy, you will. Web the meaning of broad form is covering more property or hazards than the standard form by naming additional specific perils or having fewer restrictions. The key difference between the two is that broad form covers 6. With broad form property insurance, you get comprehensive coverage on the building, while your contents (aka: Broad form the dwelling fire policy broad form is also a “named perils” policy and covers the same perils as the basic form, with additional coverages such as: Fire or lightning explosion or implosion smoke. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid

Fire or lightning explosion or implosion smoke. Broad form policies balance the wide protection of a. In the most common broad form insurance policy, you will. The key difference between the two is that broad form covers 6. In the broad form insurance policy, you will also see the following coverages:. A broad form policy that adds more coverage,. Web broad form the named perils which cover your belongings under a broad form property insurance policy are: With broad form property insurance, you get comprehensive coverage on the building, while your contents (aka: Web the meaning of broad form is covering more property or hazards than the standard form by naming additional specific perils or having fewer restrictions. Only the perils listed are covered.

The broad form is made to cover all perils the basic form covers, along with some additional common. With broad form property insurance, you get comprehensive coverage on the building, while your contents (aka: Web broad form like basic form coverage, broad form covers only the perils listed in your policy. A broad form policy that adds more coverage,. Web broad form takes the middle slot on the list for a reason: Broad form the dwelling fire policy broad form is also a “named perils” policy and covers the same perils as the basic form, with additional coverages such as: Fire or lightning explosion or implosion smoke. Web broad form the named perils which cover your belongings under a broad form property insurance policy are: In the most common broad form insurance policy, you will. Belongings) are covered on a named perils basis.

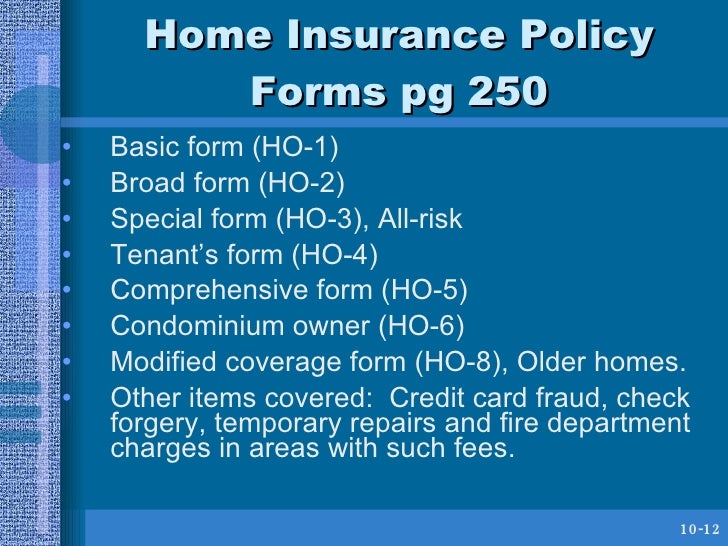

PPT Chapter 10 PowerPoint Presentation, free download ID68509

In the broad form insurance policy, you will also see the following coverages:. A broad form policy that adds more coverage,. Basic dwelling perils (fli) 3 terms. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid Broad form the dwelling fire policy broad form is also.

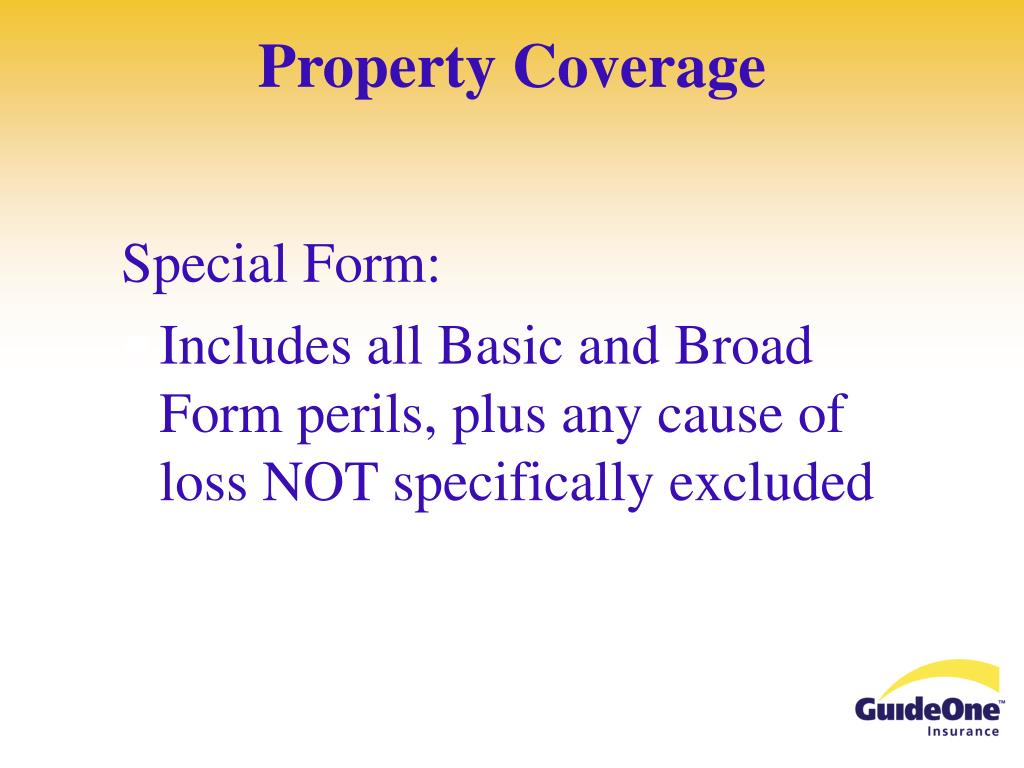

PPT CORNERSTONE PLUS PowerPoint Presentation, free download ID1330197

With broad form property insurance, you get comprehensive coverage on the building, while your contents (aka: Broad form the dwelling fire policy broad form is also a “named perils” policy and covers the same perils as the basic form, with additional coverages such as: Web broad form the named perils which cover your belongings under a broad form property insurance.

Basic, Broad Form Coverage and Special Form Insurance Coverage

Web broad form like basic form coverage, broad form covers only the perils listed in your policy. Web broad form coverage is more encompassing than basic form coverage. In the most common broad form insurance policy, you will. Belongings) are covered on a named perils basis. In the broad form insurance policy, you will also see the following coverages:.

Is It Covered? Burst Pipes • National Real Estate Insurance Group

The key difference between the two is that broad form covers 6. Web broad form takes the middle slot on the list for a reason: Web broad form like basic form coverage, broad form covers only the perils listed in your policy. The broad form is made to cover all perils the basic form covers, along with some additional common..

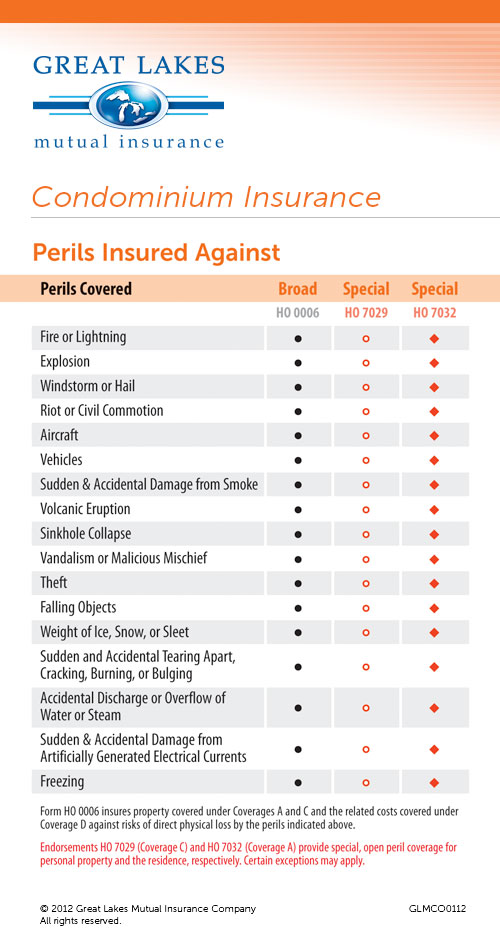

Great Lakes Mutual Insurance Condominium Insurance

Web the meaning of broad form is covering more property or hazards than the standard form by naming additional specific perils or having fewer restrictions. Web the broad form is built to cover everything the basic form, and the most common perils expected. In the broad form insurance policy, you will also see the following coverages:. Web a basic form.

Ho2 Broad Form Homeowners Insurance Types Of Home Insurance

Fire or lightning explosion or implosion smoke. Web the meaning of broad form is covering more property or hazards than the standard form by naming additional specific perils or having fewer restrictions. Web the broad form is built to cover everything the basic form, and the most common perils expected. A broad form policy that adds more coverage,. Web the.

Covered Perils Broad form vs. Basic Form • REI Choice Insurance

In the broad form insurance policy, you will also see the following coverages:. In the most common broad form insurance policy, you will. Web the broad form is built to cover everything the basic form, and the most common perils expected. Web broad form takes the middle slot on the list for a reason: Basic dwelling perils (fli) 3 terms.

HUSC 3366 Chapter 8 Home and Automobile Insurance

Web broad form like basic form coverage, broad form covers only the perils listed in your policy. With broad form property insurance, you get comprehensive coverage on the building, while your contents (aka: Web the meaning of broad form is covering more property or hazards than the standard form by naming additional specific perils or having fewer restrictions. Web the.

Revised ABC's and 123's Part 2 Non CA Specific

With broad form property insurance, you get comprehensive coverage on the building, while your contents (aka: Web broad form takes the middle slot on the list for a reason: Web broad form like basic form coverage, broad form covers only the perils listed in your policy. Web broad form the named perils which cover your belongings under a broad form.

Great Lakes Mutual Insurance Dwelling Properties Insurance

Web a basic form policy that typically covers fire, explosions, storms, smoke, riots, vandalism, and sprinkler leaks. Web broad form coverage is more encompassing than basic form coverage. A broad form policy that adds more coverage,. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid Only.

Web A Basic Form Policy That Typically Covers Fire, Explosions, Storms, Smoke, Riots, Vandalism, And Sprinkler Leaks.

Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid Basic dwelling perils (fli) 3 terms. The broad form is made to cover all perils the basic form covers, along with some additional common. A broad form policy that adds more coverage,.

In The Most Common Broad Form Insurance Policy, You Will.

Only the perils listed are covered. Web the broad form is built to cover everything the basic form, and the most common perils expected. Web the meaning of broad form is covering more property or hazards than the standard form by naming additional specific perils or having fewer restrictions. Broad form the dwelling fire policy broad form is also a “named perils” policy and covers the same perils as the basic form, with additional coverages such as:

Belongings) Are Covered On A Named Perils Basis.

Web broad form the named perils which cover your belongings under a broad form property insurance policy are: Fire or lightning explosion or implosion smoke. Broad form policies balance the wide protection of a. Web broad form coverage is more encompassing than basic form coverage.

Web Broad Form Like Basic Form Coverage, Broad Form Covers Only The Perils Listed In Your Policy.

In the broad form insurance policy, you will also see the following coverages:. Web broad form takes the middle slot on the list for a reason: The key difference between the two is that broad form covers 6. Web broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property insurance policy.