Blank 941 Form 2019

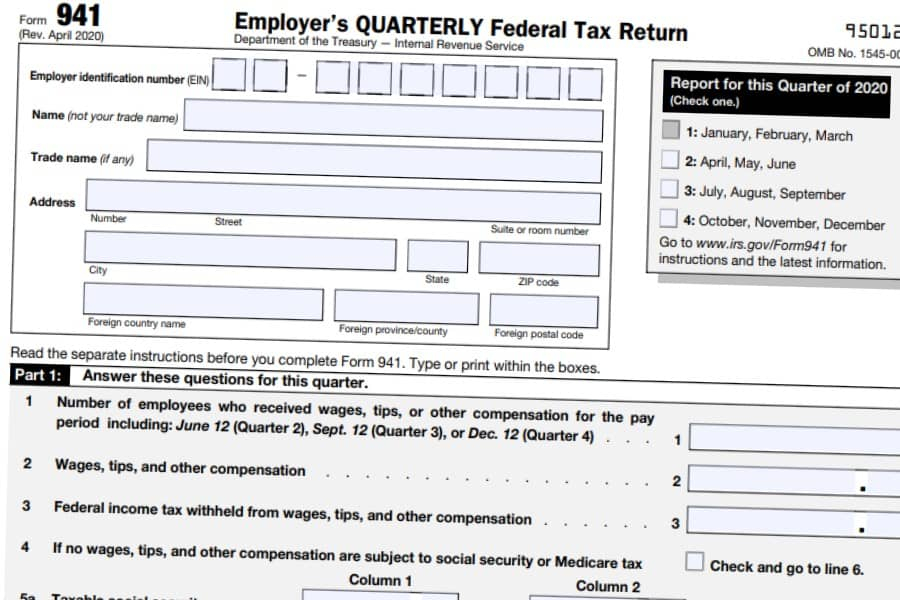

Blank 941 Form 2019 - Obtain access to a hipaa and gdpr compliant solution for maximum simpleness. I can type in the correct amount, but they i try to print the 941 form to mail to the irs, it prints with a watermark that says do not file. Form 941 is used to determine Web form 941 for 2019:(rev. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. We need it to figure and collect the right amount of tax. January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no. Pay the employer's portion of social security or medicare tax. Save or instantly send your ready documents. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.

We need it to figure and collect the right amount of tax. Web first of all, open a blank 941 form. Web employer's quarterly federal tax return for 2021. Web how to fill out form 941: January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no. Form 941 is used to determine Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web we know how straining filling out documents can be. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Use fill to complete blank online irs pdf forms for free.

Employer identification number (ein) — name (not. We need it to figure and collect the right amount of tax. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Form 941 employer’s federal tax return. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. Web complete irs 941 2019 online with us legal forms. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. We need it to figure and collect the right amount of tax. Web about form 941, employer's quarterly federal tax return. Once completed you can sign your fillable form or send for signing.

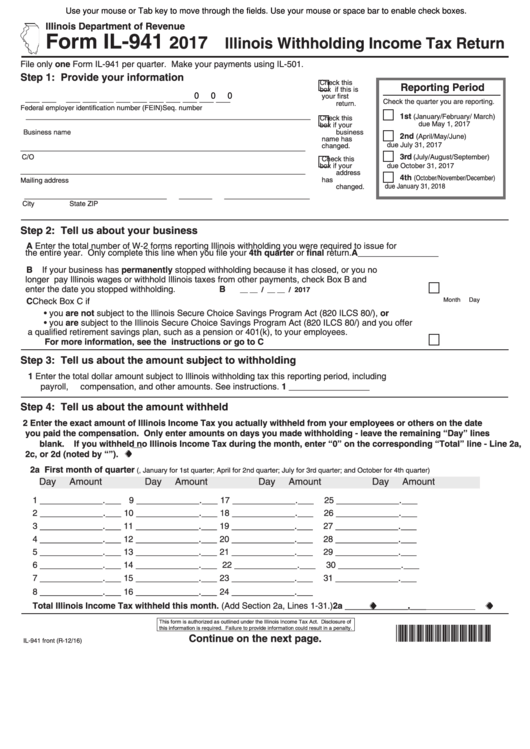

printable 941 form 2019 PrintableTemplates

Form 941 is used to determine Employer identification number (ein) — name (not your trade name) trade. Easily fill out pdf blank, edit, and sign them. Web the irs form 941, also known as employer's quarterly federal tax return, was scheduled to change in june 2022. Web we ask for the information on form 941 to carry out the internal.

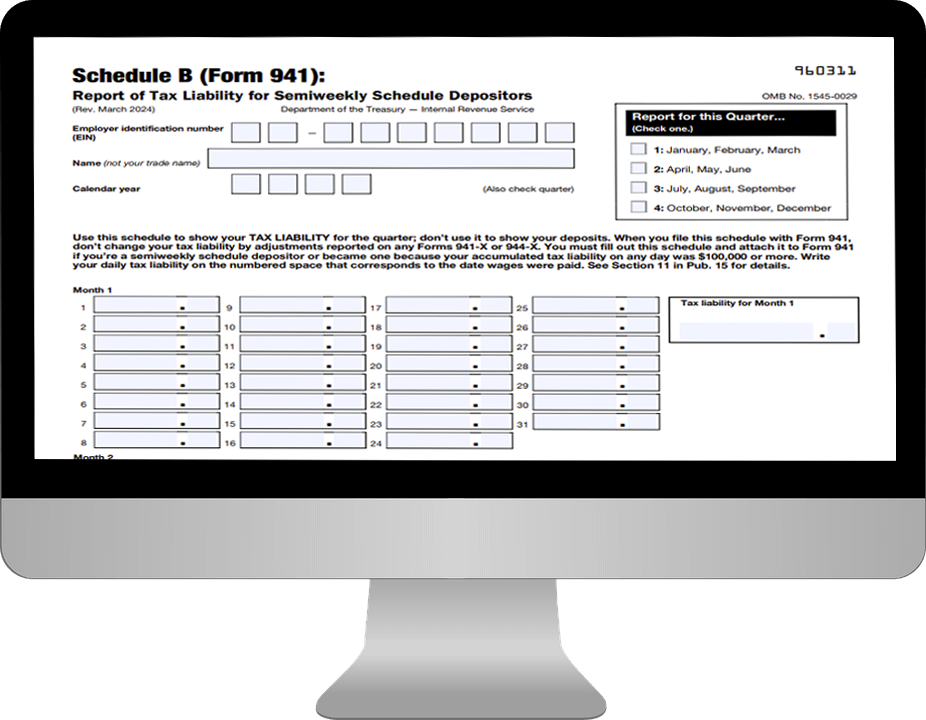

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Employer’s quarterly federal tax return. Form 941 employer’s federal tax return. Obtain access to a hipaa and gdpr compliant solution for maximum simpleness. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). March 2021) employer’s quarterly federal tax return department of the treasury.

Printable 941 Tax Form 2021 Printable Form 2022

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. We need it to figure and collect the right amount of tax. Web how to fill out form 941: January 2019) department of the treasury — internal revenue service. Form 941 employer’s federal.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941 for 2020? Once completed you can sign your fillable form or send for signing. Employer identification number (ein) — name (not. We need it to figure and collect the right amount of tax. Use fill to complete blank.

printable 941 form 2019 PrintableTemplates

Web form 941 for 2019:(rev. Web employer's quarterly federal tax return for 2021. We need it to figure and collect the right amount of tax. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Form 941 is used to determine

printable 941 form 2019 PrintableTemplates

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. All forms are printable and downloadable. Web about form 941, employer's quarterly federal tax return. Once completed you can sign your fillable form or send for signing. Employer identification number (ein) — name (not.

form 941 instructions Fill Online, Printable, Fillable Blank form

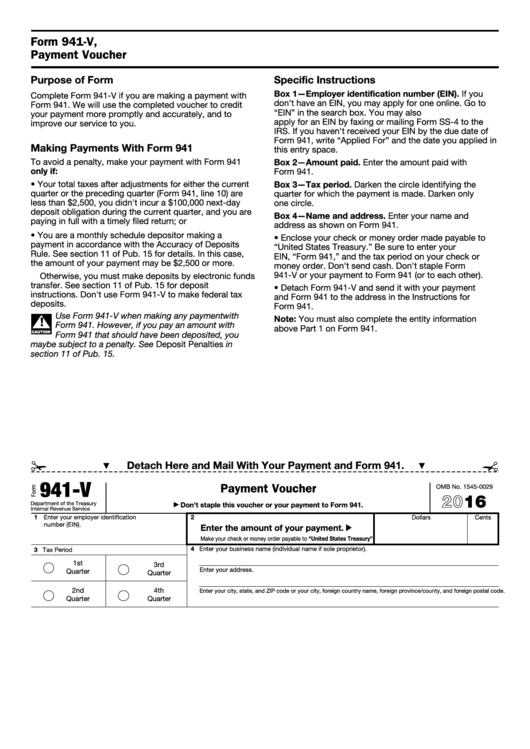

March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web employer's quarterly federal.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web form 941 for 2021: We need it to figure and collect the right amount of tax. At the top of the first page of the form, you need to enter the basic.

941 form 2020 Fill Online, Printable, Fillable Blank form941

Easily fill out pdf blank, edit, and sign them. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web how to fill out form 941: Web about form 941, employer's quarterly federal tax return. Web the irs form 941, also known as employer's quarterly federal tax return, was scheduled.

941 schedule b 2022 Fill Online, Printable, Fillable Blank form971

Web fill online, printable, fillable, blank form 941 employer’s federal tax return form. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Employer identification number (ein) — name (not your trade name) trade. Form 941 is used to determine Web form 941 for.

Web Fill Online, Printable, Fillable, Blank Form 941 Employer’s Federal Tax Return Form.

Gather all necessary information, such as employer identification number, business name, and mailing address. Obtain access to a hipaa and gdpr compliant solution for maximum simpleness. All forms are printable and downloadable. We need it to figure and collect the right amount of tax.

Subtitle C, Employment Taxes, Of The Internal Revenue Code Imposes Employment Taxes On Wages And Provides For Income Tax Withholding.

January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no. Employer identification number (ein) — name (not. I can type in the correct amount, but they i try to print the 941 form to mail to the irs, it prints with a watermark that says do not file. Easily fill out pdf blank, edit, and sign them.

Web Form 941 For 2021:

American samoa, guam, the commonwealth of the northern mariana islands, and the u.s. Employer identification number (ein) — name (not your trade name) trade. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

Web We Ask For The Information On Form 941 To Carry Out The Internal Revenue Laws Of The United States.

Web about form 941, employer's quarterly federal tax return. It should contain the dollar amount of the taxable social security wages. Form 941 employer’s federal tax return. At the top of the first page of the form, you need to enter the basic information about your company, such as ein, name, trade name, and address.