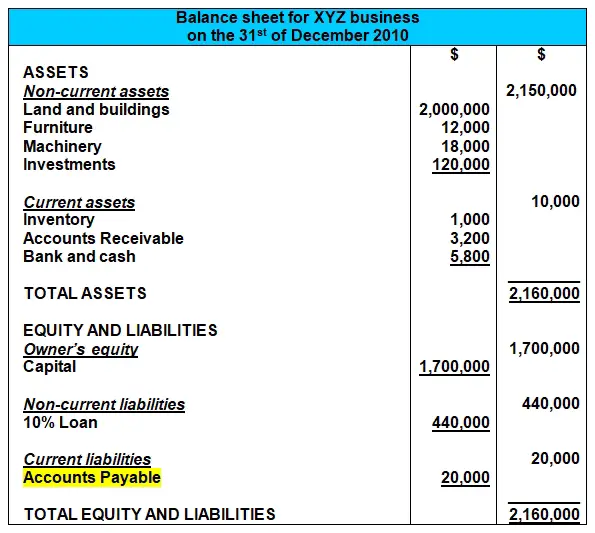

Balance Sheet Accounts Payable

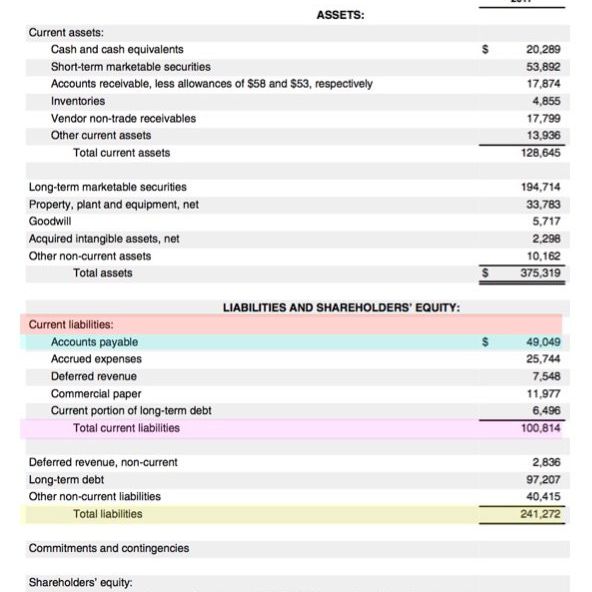

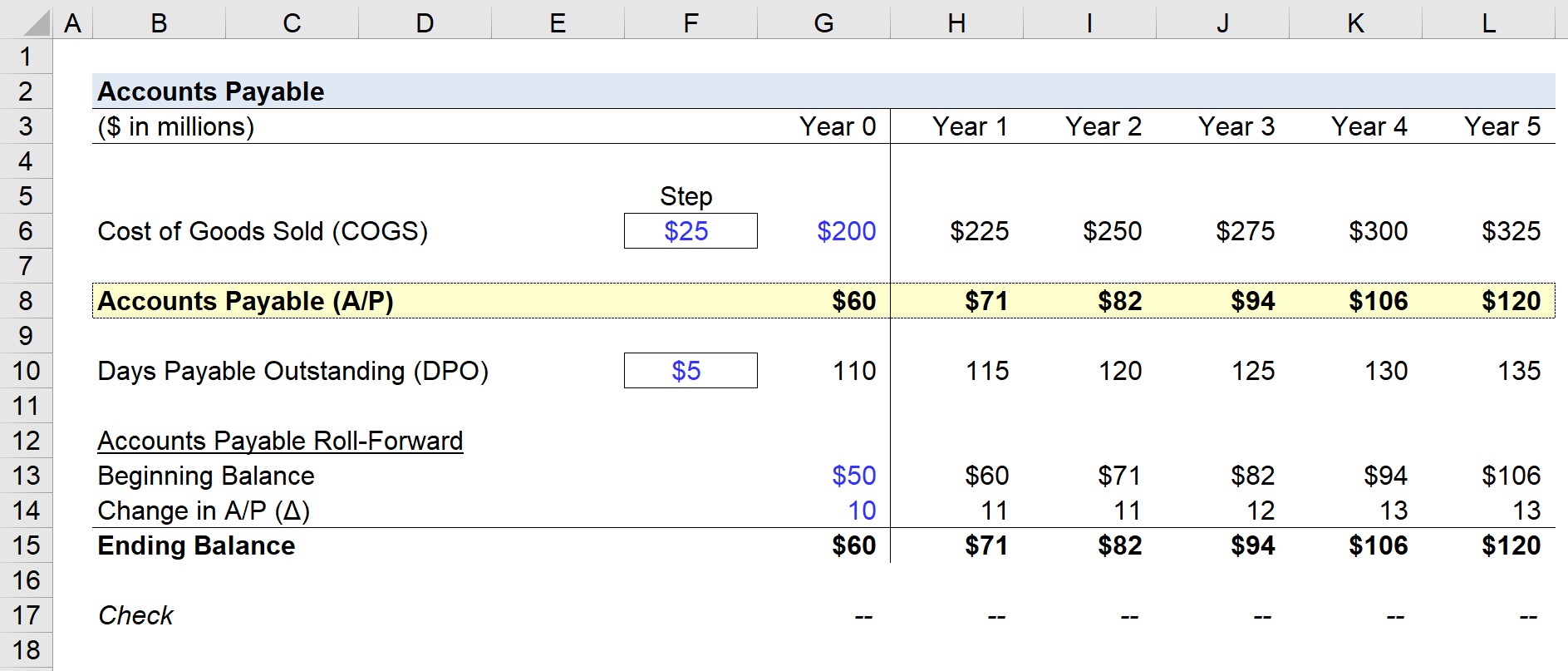

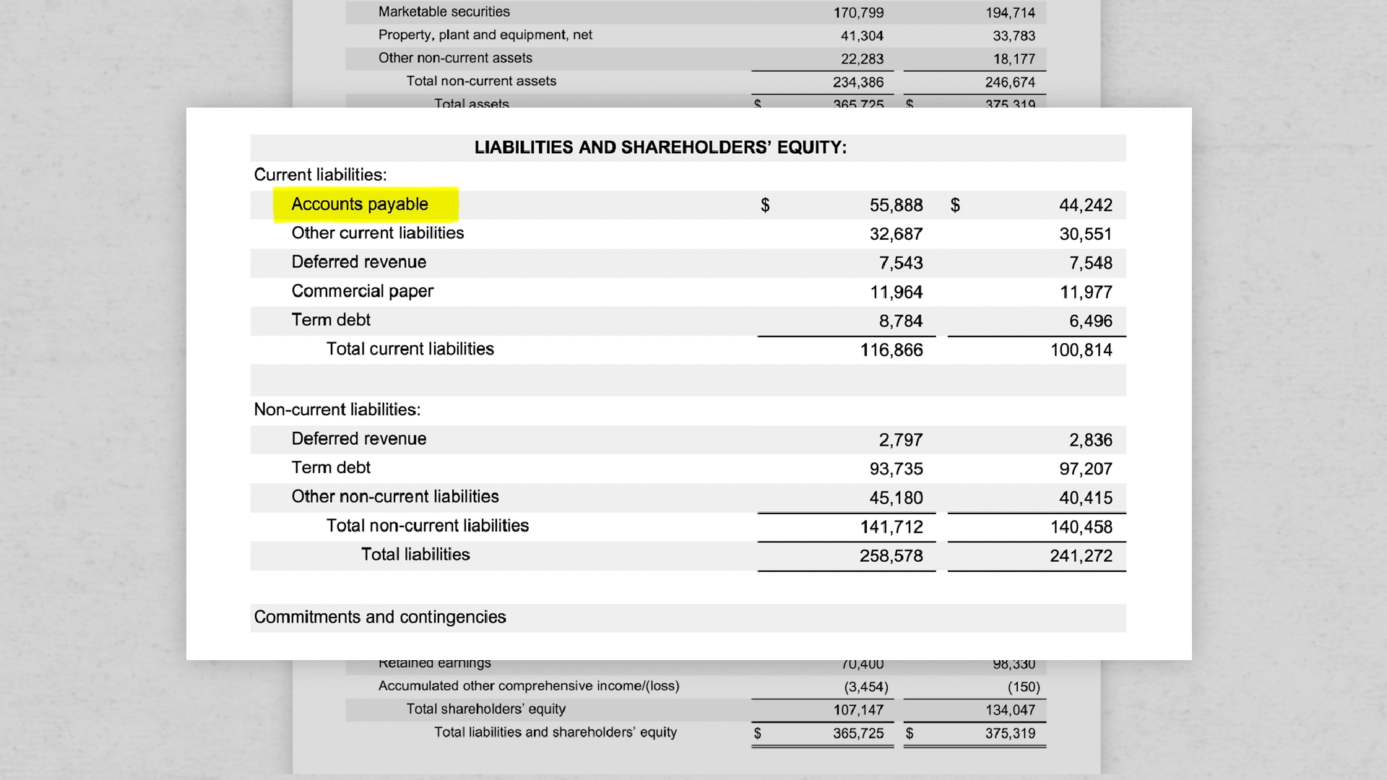

Balance Sheet Accounts Payable - It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. The sum of all outstanding amounts owed to vendors is. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. They appear as current liabilities on the balance sheet. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Accounts payable are the opposite of accounts receivable, which.

Accounts payable are the opposite of accounts receivable, which. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. They appear as current liabilities on the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position. The sum of all outstanding amounts owed to vendors is. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as.

Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. It can also be referred to as a statement of net worth or a statement of financial position. The sum of all outstanding amounts owed to vendors is. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. They appear as current liabilities on the balance sheet. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Accounts payable are the opposite of accounts receivable, which. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid.

Everything there is to know about accounts payable

It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. They appear as current liabilities on the balance sheet. Web ap is considered one of.

Accounts Payable Meaning, Importance, Example & Days

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The sum of all outstanding amounts owed to vendors is. It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on.

Accounts Receivable Report Template (4) PROFESSIONAL TEMPLATES

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. They appear as current liabilities on the balance sheet. Accounts payable are the opposite of accounts receivable, which. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Web under accrual accounting, the.

What is accounts payable? Definition and examples

It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Accounts payables turnover is a key metric used in calculating the liquidity of a company,.

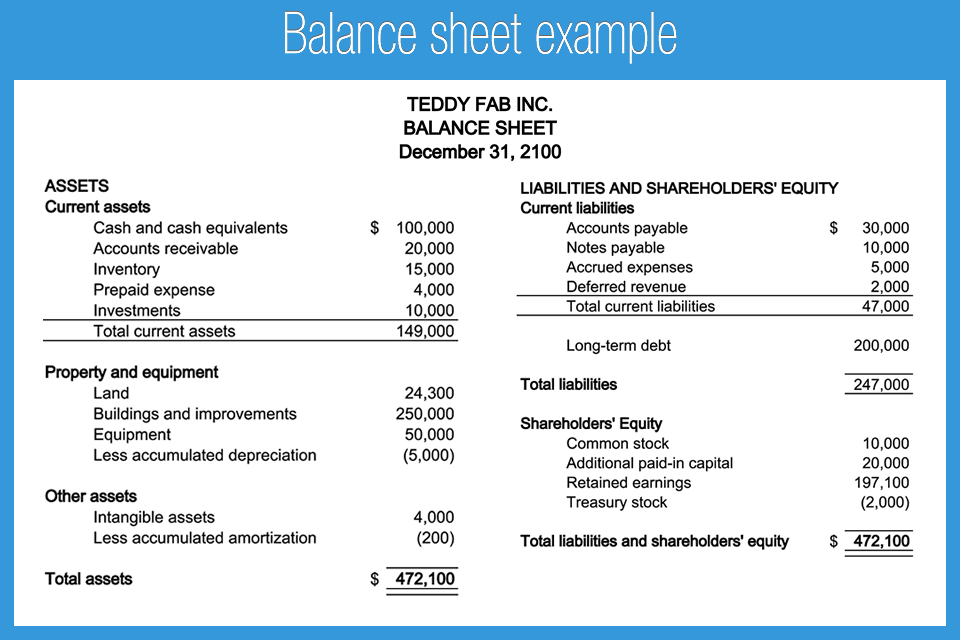

Balance sheet example Accounting Play

It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Accounts payable are the opposite of accounts receivable, which. Web ap is considered one of.

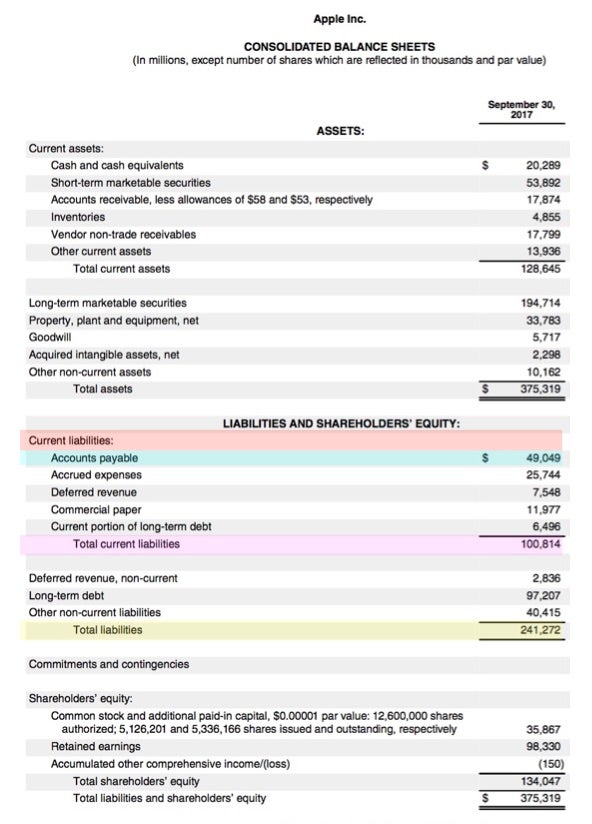

How do accounts payable show on the balance sheet? Investopedia

Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. The sum of all outstanding amounts owed to vendors is. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. It can also be referred to as a statement of.

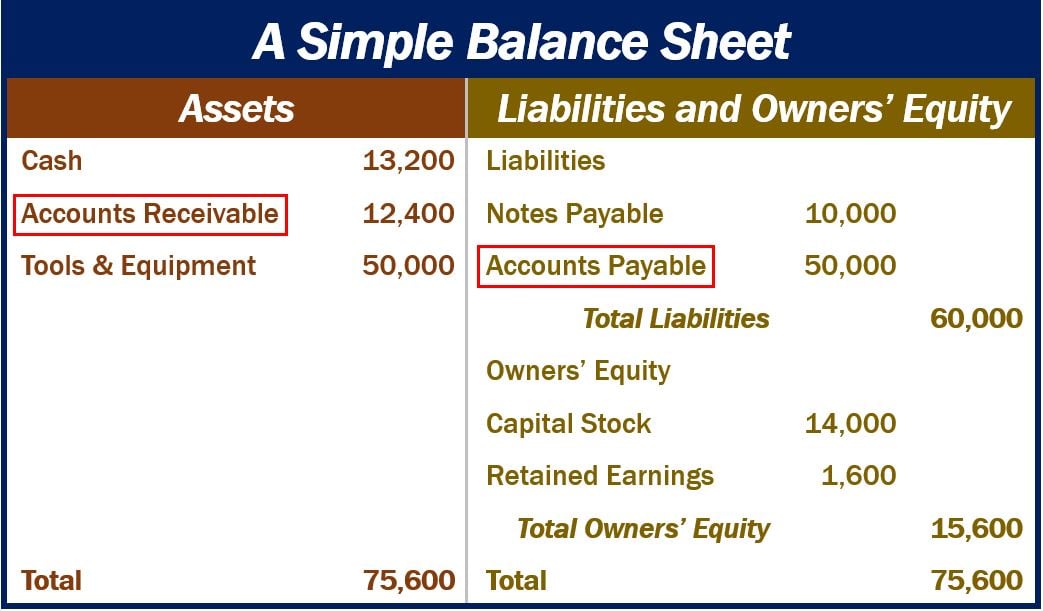

What is accounts receivable? Definition and examples

Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Accounts payable are the opposite of accounts receivable, which. Web key takeaways.

Accounts Receivable vs Accounts Payable

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. They appear as current liabilities on the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position. Accounts payable are the opposite of accounts receivable, which. The sum of all outstanding amounts owed to.

Accounts Payable (A/P) Current Liability Definition

Accounts payable are the opposite of accounts receivable, which. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors..

Accounts Payable (AP) What They Are and How to Interpret Pareto Labs

They appear as current liabilities on the balance sheet. Accounts payable are the opposite of accounts receivable, which. It can also be referred to as a statement of net worth or a statement of financial position. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Web the balance sheet displays the.

They Appear As Current Liabilities On The Balance Sheet.

Accounts payable are the opposite of accounts receivable, which. The sum of all outstanding amounts owed to vendors is. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position.

Accounts Payables Turnover Is A Key Metric Used In Calculating The Liquidity Of A Company, As.

Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.