Az Extension Form

Az Extension Form - Web 120ext application for automatic extension of time to file corporation, partnership, and exempt organization returns corporations and partnerships: Prior to any extension consider the health, readiness and capability of the resource. Of liquor licenses and control. Web to apply for an arizona personal tax extension, use arizona form 204 (application for filing extension). If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. The health and safety of incident personnel and resources will. (a) the taxpayer pays at least 90% of the tax liability by the original due date of the return and (b) arizona form. Arizona will also accept the federal extension for the. Web the department may grant an automatic arizona extension if:

Use form 204 to request. Application for automatic extension of time to file corporation, partnership, and. Of liquor licenses and control. Web to file an extension on a return, individuals use arizona form 204 to apply for an automatic extension to file. This will extend your filing deadline for 6 months for form 140, 140a,. Prior to any extension consider the health, readiness and capability of the resource. Web request for a 6 month extension and payment must be submitted by mail, over the counter or online. Arizona will also accept the federal extension for the. Application for filing extension for fiduciary. • you may file form 120/165ext.

Web • the extension request can be made by filing an arizona extension request, arizona form 120/165ext, or by filing a federal extension. Web what form does the state of arizona require to apply for an extension? Web this form is being used to transmit the arizona extension payment. Web the department may grant an automatic arizona extension if: Web to apply for an arizona personal tax extension, use arizona form 204 (application for filing extension). Web arizona tax extension form: An arizona extension cannot be granted for more than six months beyond the original due date of. Prior to any extension consider the health, readiness and capability of the resource. If you include a payment with the arizona extension, mail forms 120/165 ext to the. Web 120ext application for automatic extension of time to file corporation, partnership, and exempt organization returns corporations and partnerships:

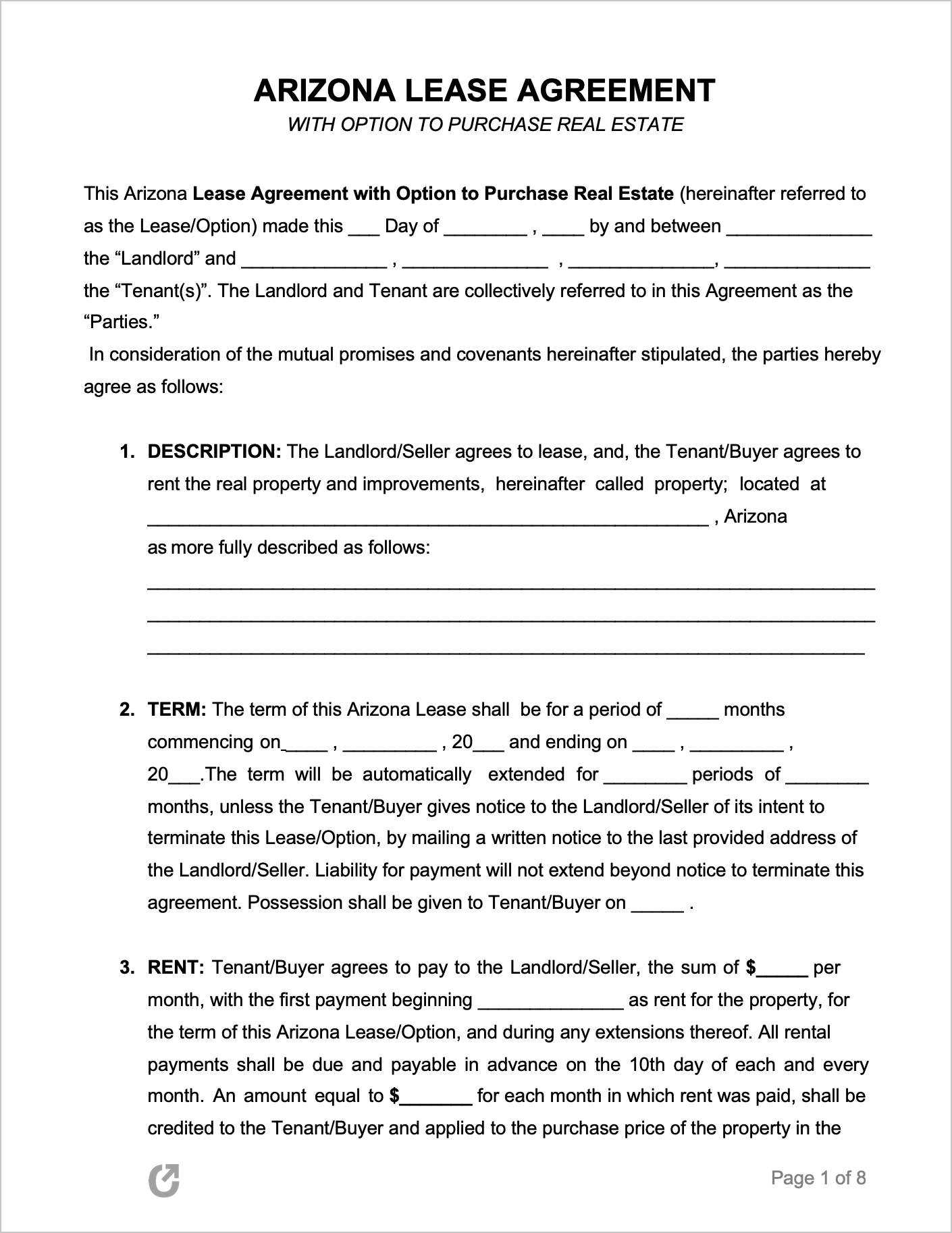

Free Arizona Lease to Own Agreement PDF WORD

• you may file form 120/165ext. Web to apply for an arizona personal tax extension, use arizona form 204 (application for filing extension). Web the department may grant an automatic arizona extension if: To request an arizona extension, file form 204 by the original due date of your return. (a) the taxpayer pays at least 90% of the tax liability.

AZ Residential Lease Agreement Fill and Sign Printable Template

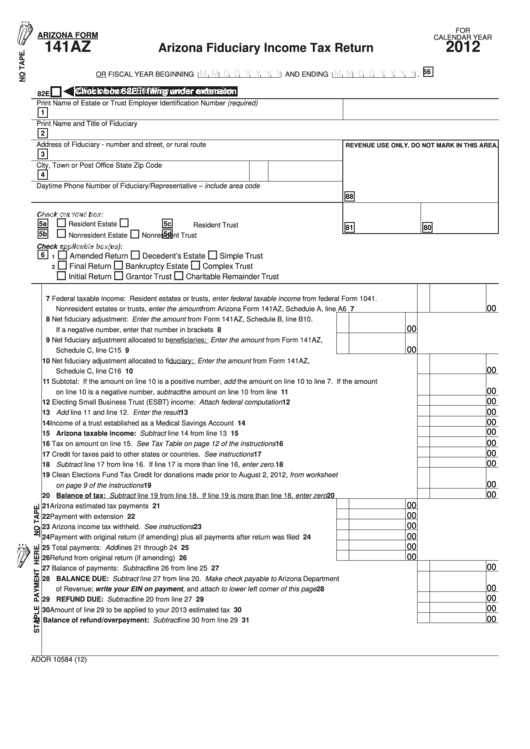

Web form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return (form 141az). An arizona extension will give you until october 15, 2021 to. Web to file an extension on a return, individuals use arizona form 204 to apply for an automatic extension to file. Web arizona will grant.

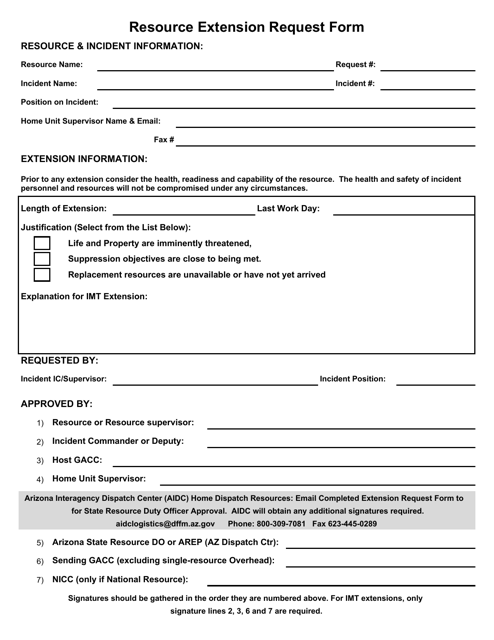

Arizona Resource Extension Request Form Download Printable PDF

Web this form is being used to transmit the arizona extension payment. Application for filing extension for fiduciary. Web the department may grant an automatic arizona extension if: Web form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return (form 141az). Refer to the fee schedule for the 6.

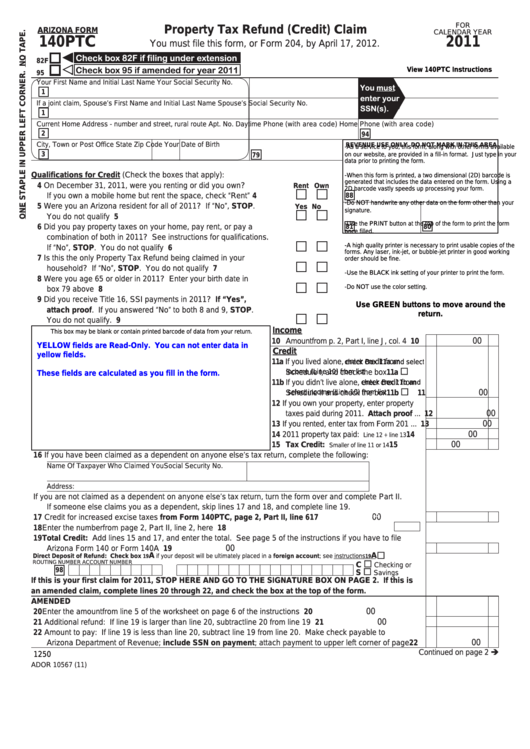

Fillable Arizona Form 140ptc Property Tax Refund (Credit) Claim

• you may file form 120/165ext. (a) the taxpayer pays at least 90% of the tax liability by the original due date of the return and (b) arizona form. The completed extension form must be filed by april 18,. The health and safety of incident personnel and resources will. Extended benefits are available only during periods of high unemployment within.

Arizona Form 120ext Application For Automatic Extension Of Time To

Web • the extension request can be made by filing an arizona extension request, arizona form 120/165ext, or by filing a federal extension. Web to apply for an arizona personal tax extension, use arizona form 204 (application for filing extension). Arizona will also accept the federal extension for the. Web the department may grant an automatic arizona extension if: Web.

2015 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller

Prior to any extension consider the health, readiness and capability of the resource. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Web form 120/165ext mailing address. An arizona extension cannot be granted for more than six months beyond the original due date of. If you are filing under a federal.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

If you include a payment with the arizona extension, mail forms 120/165 ext to the. Web to apply for an arizona personal tax extension, use arizona form 204 (application for filing extension). Web • the extension request can be made by filing an arizona extension request, arizona form 120/165ext, or by filing a federal extension. Web request for a 6.

Fillable Arizona Form 141az Arizona Fiduciary Tax Return

Web form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return (form 141az). Web a 2021 filing extension must be postmarked on or before april 18, 2022. An arizona extension cannot be granted for more than six months beyond the original due date of. Web request for a 6.

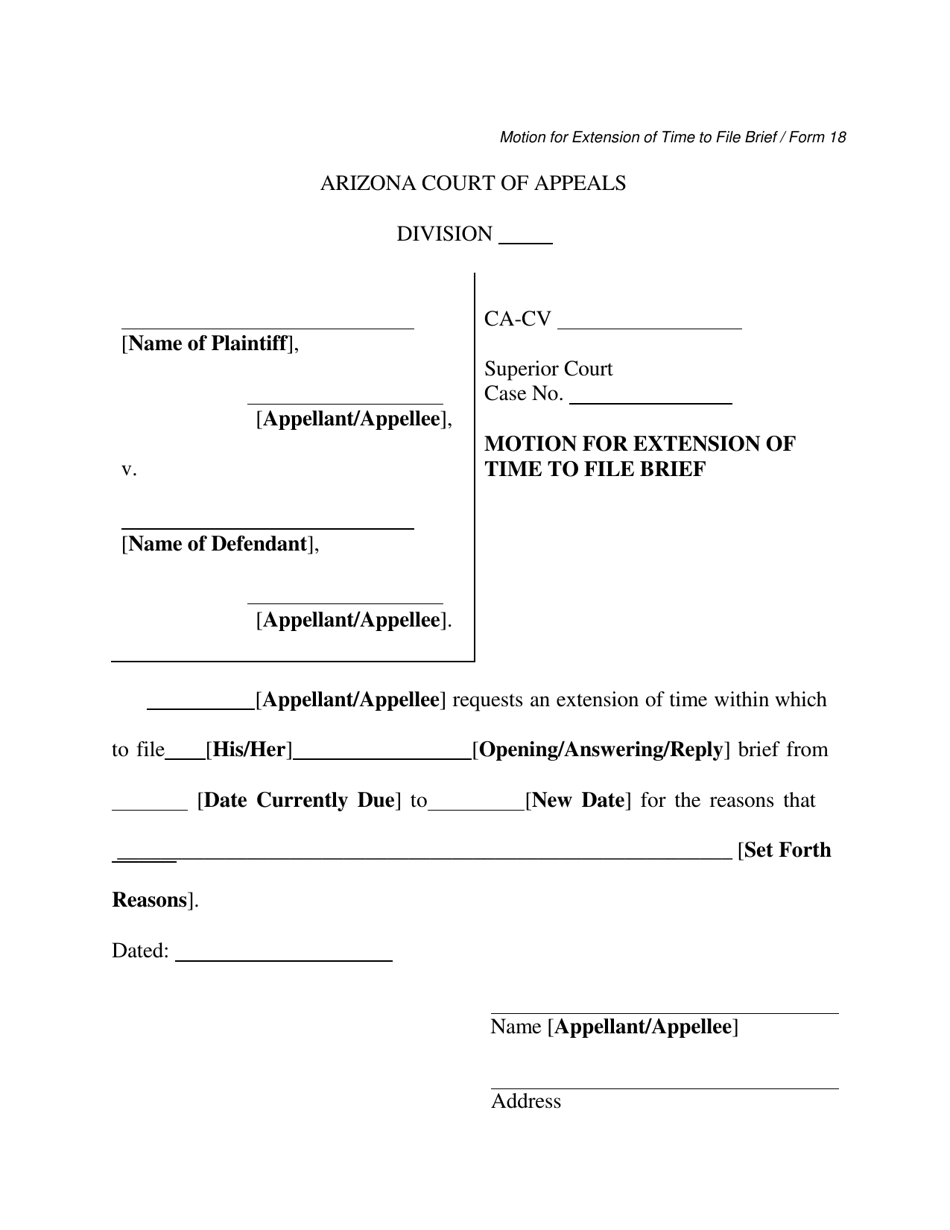

Form 18 Download Printable PDF or Fill Online Motion for Extension of

Web the department may grant an automatic arizona extension if: This will extend your filing deadline for 6 months for form 140, 140a,. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. To request an arizona extension, file form 204 by.

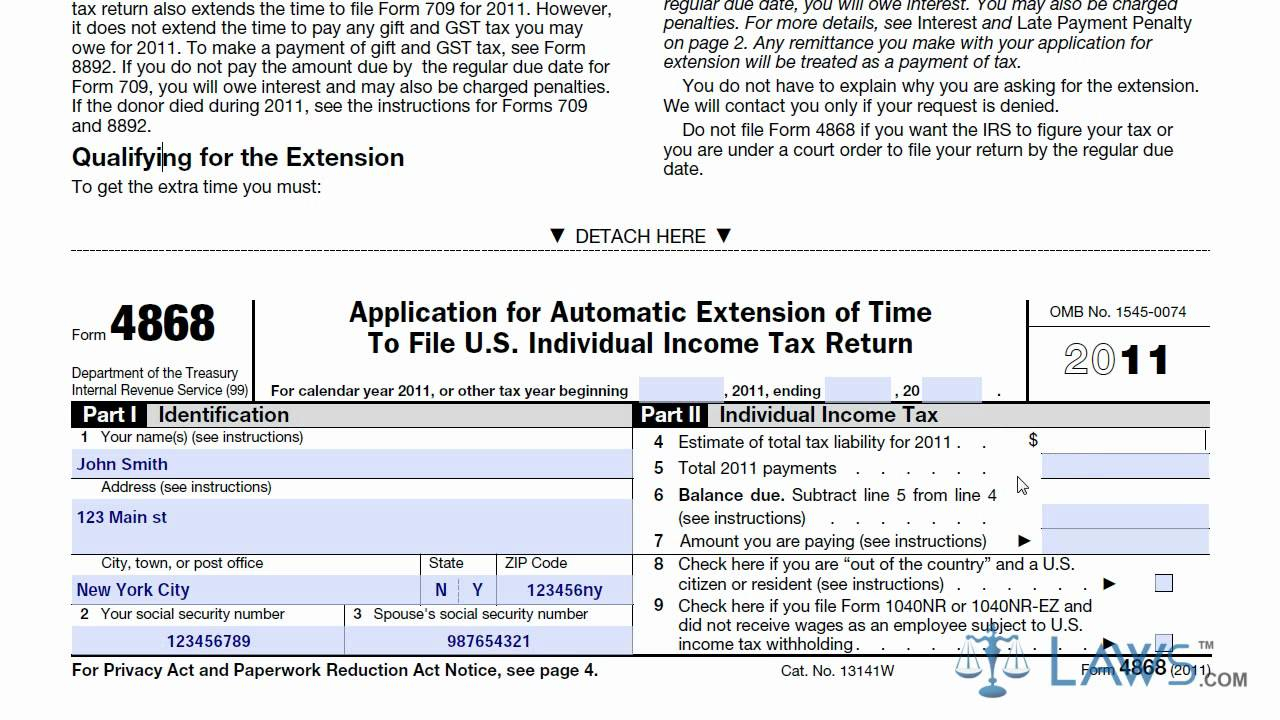

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

An arizona extension cannot be granted for more than six months beyond the original due date of. If you include a payment with the arizona extension, mail forms 120/165 ext to the. Web to file an extension on a return, individuals use arizona form 204 to apply for an automatic extension to file. Web arizona will grant an extension to.

Web Arizona Tax Extension Form:

Application for filing extension for fiduciary. Refer to the fee schedule for the 6 month extension cost. Web what form does the state of arizona require to apply for an extension? Web this form is being used to transmit the arizona extension payment.

Web Request For A 6 Month Extension And Payment Must Be Submitted By Mail, Over The Counter Or Online.

Prior to any extension consider the health, readiness and capability of the resource. Web the department may grant an automatic arizona extension if: Application for automatic extension of time to file corporation, partnership, and. An arizona extension cannot be granted for more than six months beyond the original due date of.

Arizona Will Also Accept The Federal Extension For The.

Web 120ext application for automatic extension of time to file corporation, partnership, and exempt organization returns corporations and partnerships: Web form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return (form 141az). Of liquor licenses and control. (a) the taxpayer pays at least 90% of the tax liability by the original due date of the return and (b) arizona form.

Web To File An Extension On A Return, Individuals Use Arizona Form 204 To Apply For An Automatic Extension To File.

The health and safety of incident personnel and resources will. Web • the extension request can be made by filing an arizona extension request, arizona form 120/165ext, or by filing a federal extension. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Extended benefits are available only during periods of high unemployment within the state.