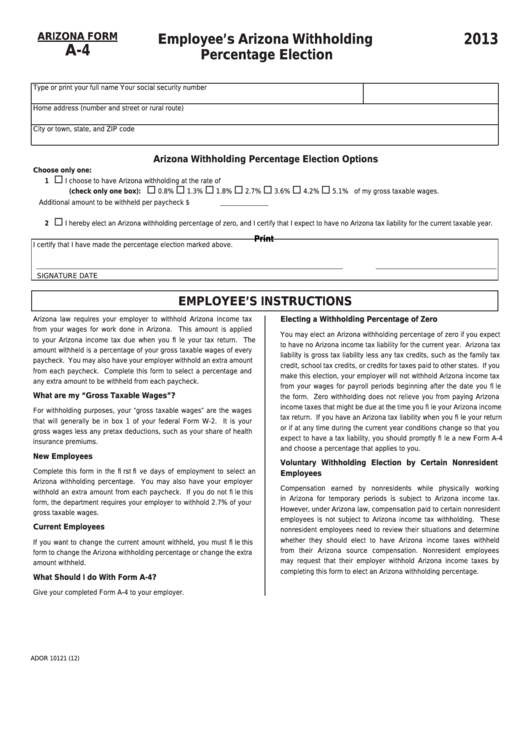

Az A4 Form

Az A4 Form - This form is submitted to the employer, not the department. You can use your results from the formula to help you complete the form and adjust your income tax withholding. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Keep in mind that the results will only be as accurate as the information you provide. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. 0.8% 1.3% 1.8% 2.7% 3.6% 4. Employer's election to not withhold arizona taxes in december (includes instructions) Arizona annual payment withholding tax return: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck.

Employer's election to not withhold arizona taxes in december (includes instructions) 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. This form is submitted to the employer, not the department. 0.8% 1.3% 1.8% 2.7% 3.6% 4. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): You can use your results from the formula to help you complete the form and adjust your income tax withholding. Web withholding forms : Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return:

0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 1 withhold from gross taxable wages at the percentage checked (check only one percentage): You can use your results from the formula to help you complete the form and adjust your income tax withholding. Arizona annual payment withholding tax return: Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Employer's election to not withhold arizona taxes in december (includes instructions) Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. 0.8% 1.3% 1.8% 2.7% 3.6% 4. Voluntary withholding request for arizona resident employed outside of arizona:

ASOP Application FormA4.docx Fill and Sign Printable Template Online

Web withholding forms : Arizona annual payment withholding tax return: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Voluntary withholding request for arizona resident employed outside of arizona: You can use your results from the formula to help you complete the form and adjust your income tax withholding.

Form_A4 Breeyark!

1 withhold from gross taxable wages at the percentage checked (check only one percentage): You can use your results from the formula to help you complete the form and adjust your income tax withholding. Employer's election to not withhold arizona taxes in december (includes instructions) Web withholding forms : Web arizona residents employed outside of arizona complete this form to.

2021 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

0.8% 1.3% 1.8% 2.7% 3.6% 4. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if.

Vehicles Printwise Online News

This form is submitted to the employer, not the department. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Keep in mind that the results will only be as accurate as the information you provide. 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each.

Employee Evaluation A4 Form Template by Keboto GraphicRiver

Arizona annual payment withholding tax return: 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. 0.8% 1.3% 1.8% 2.7% 3.6% 4. Employer's election to not withhold arizona taxes in december (includes instructions) This form is submitted to the employer, not the department.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. Web withholding forms : 1 withhold from gross taxable wages at the percentage checked (check only one percentage): This form is submitted to the employer, not the department. 1 withhold from gross taxable wages at the percentage checked (check.

irstaxesw4form2020 Alloy Silverstein

0.8% 1.3% 1.8% 2.7% 3.6% 4. Employer's election to not withhold arizona taxes in december (includes instructions) 1 withhold from gross taxable wages at the percentage checked (check only one percentage): You can use your results from the formula to help you complete the form and adjust your income tax withholding. 1 withhold from gross taxable wages at the percentage.

Køb DIN 6797 rustfrit stål A4, form AZ online

Keep in mind that the results will only be as accurate as the information you provide. 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have.

Printable A4 Order Form Turquoise Blue Form Business Etsy

1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return: Keep in mind that the results will only be as accurate as the information you provide. Employer's election to not withhold arizona taxes in december (includes instructions) Voluntary withholding request for arizona resident employed outside of arizona:

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. 0.8% 1.3% 1.8% 2.7% 3.6% 4. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Arizona.

You Can Use Your Results From The Formula To Help You Complete The Form And Adjust Your Income Tax Withholding.

Web withholding forms : 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check this box and enter an extra amount to be withheld from each paycheck. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. This form is submitted to the employer, not the department.

1 Withhold From Gross Taxable Wages At The Percentage Checked (Check Only One Percentage):

0.8% 1.3% 1.8% 2.7% 3.6% 4. Employer's election to not withhold arizona taxes in december (includes instructions) Arizona annual payment withholding tax return: 1 withhold from gross taxable wages at the percentage checked (check only one percentage):

Keep In Mind That The Results Will Only Be As Accurate As The Information You Provide.

Voluntary withholding request for arizona resident employed outside of arizona: Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks.