Arkansas State Tax Withholding Form 2022

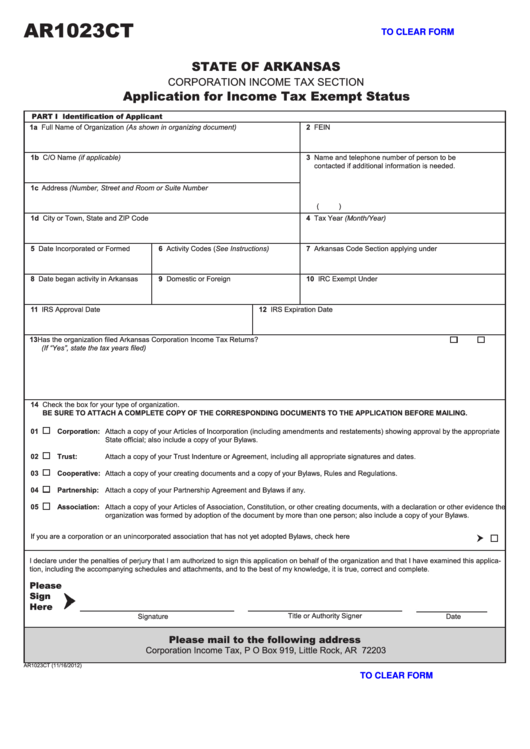

Arkansas State Tax Withholding Form 2022 - Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. A brief synopsis of when a form should be used is also listed. Try it for free now! Web arkansas 2022 individual income tax forms and instructions full year resident.ar1000f non. Arkansas income tax withholding rates are updated effective october 1, 2022 to reflect law lowering the top income tax rate. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Ar1023ct application for income tax exempt status. Claim additional amounts of withholding tax if desired. Ar1100esct corporation estimated tax vouchers. 10 by the state department of finance and administration.

Claim additional amounts of withholding tax if desired. 10 by the state department of finance and administration. Web arkansas’s withholding formula, effective jan. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. If too little is withheld, you will generally owe tax when you file your tax return. Web arkansas 2022 individual income tax forms and instructions full year resident.ar1000f non. For the complete set of. Try it for free now! The arkansas department of revenue. Ar1023ct application for income tax exempt status.

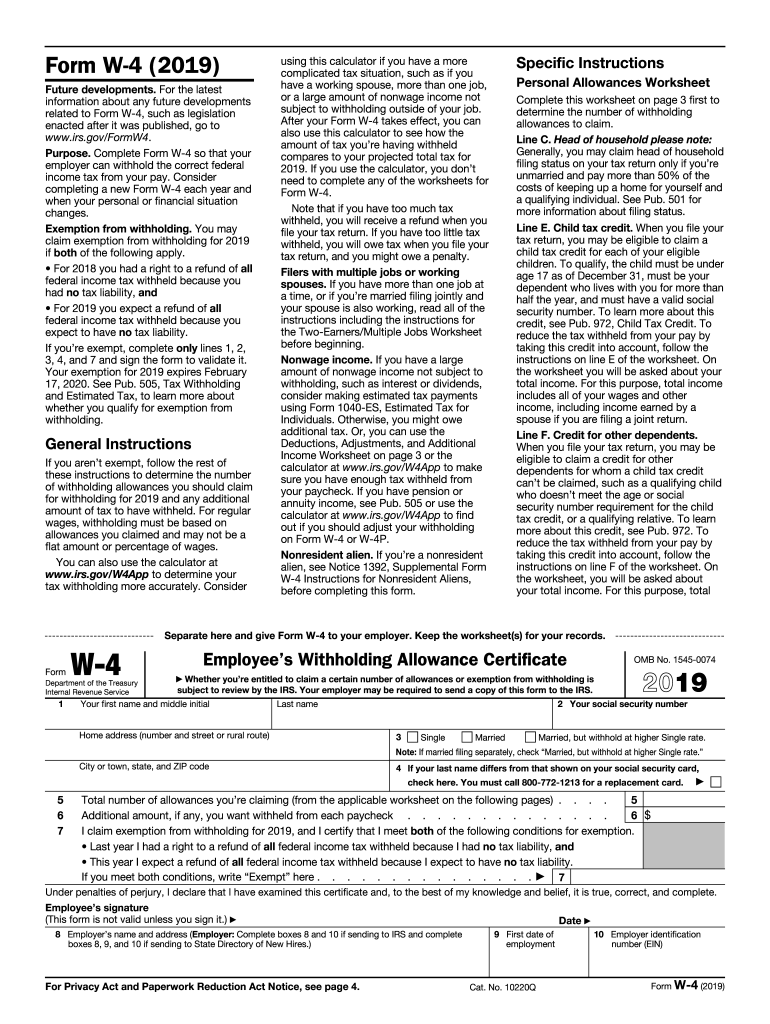

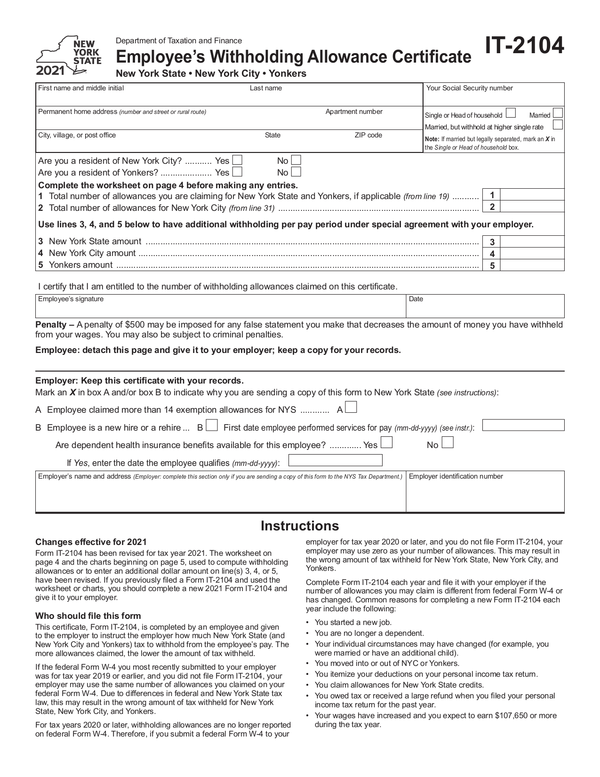

A brief synopsis of when a form should be used is also listed. 10 by the state department of finance and administration. Web prices of the fuels during 2022 as published by the energy information administration of the united. Ar1023ct application for income tax exempt status. Web employee’s state withholding exemption certificate (form ar4ec) contact. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Web 2022 tax tables the two tax tables used for individual income tax are listed below. Web updated versions of arkansas’ withholding certificates, which make annual adjustments to the thresholds used for exemption from withholding and the state’s low. If you make $70,000 a year living in arkansas you will be taxed $11,683. Future developments for the latest information about.

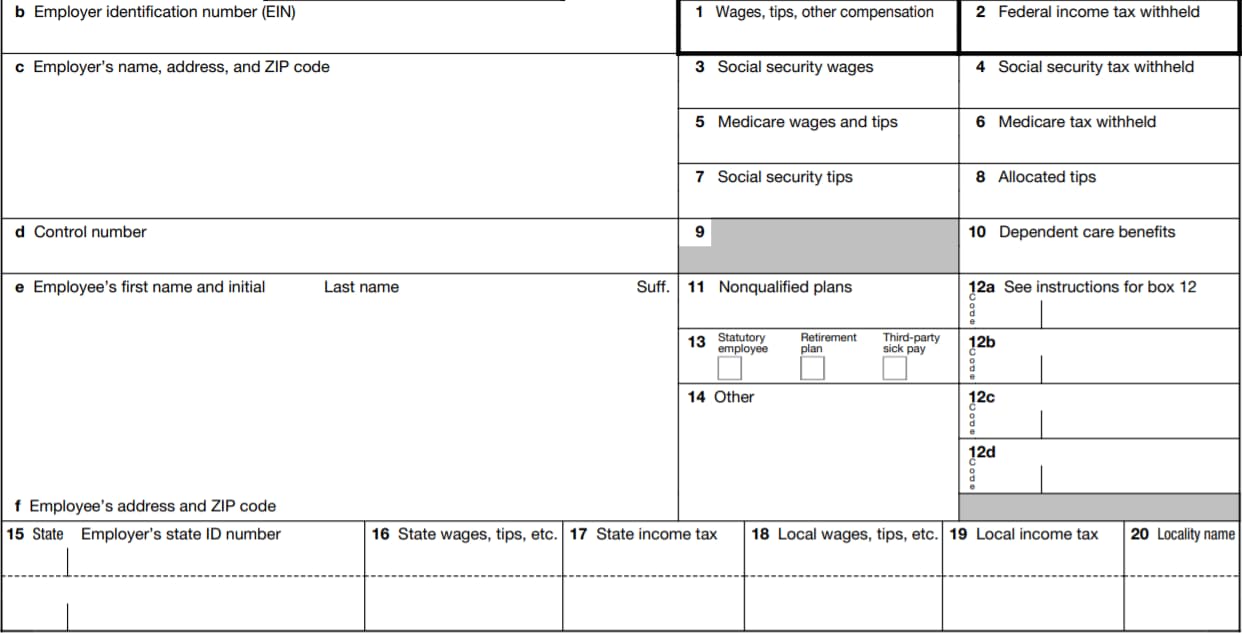

W2 Form 2022 Fillable PDF

Web arkansas has a state income tax that ranges between 2% and 6.6% , which is administered by the arkansas department of revenue. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. 10 by the state department of finance and.

logodesignlabor Arkansas Tax Exempt Form

For the complete set of. 1, 2022, was released jan. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Complete, edit or print tax forms instantly. Web arkansas’s withholding formula, effective jan.

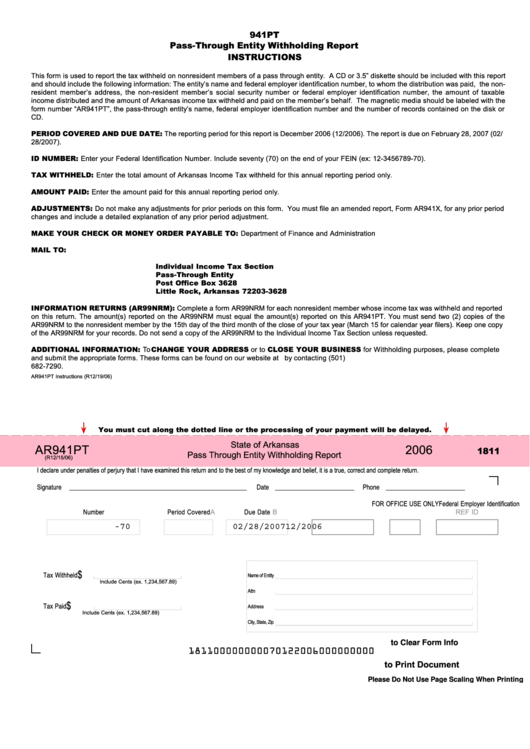

Fillable Form Ar941pt State Of Arkansas Pass Through Entity

Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. A brief synopsis of when a form should be used is also listed. If too little is withheld, you will generally owe tax when you file your tax return. Future developments.

Arkansas Employee Withholding Form 2022

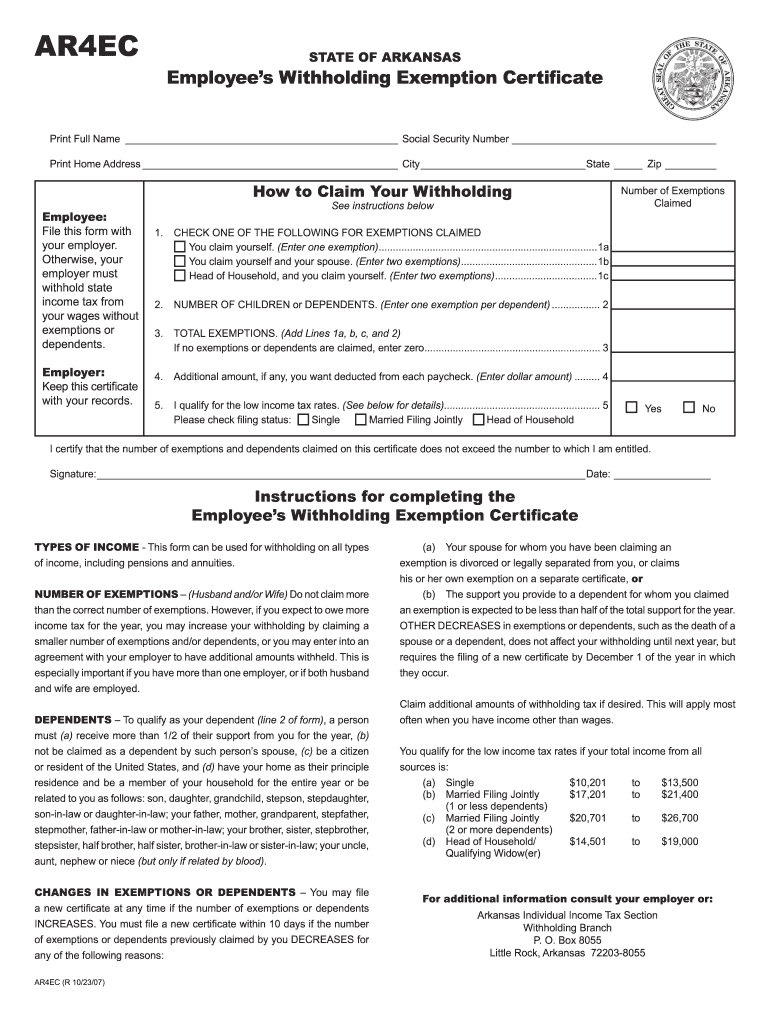

For the complete set of. Upload, modify or create forms. 10 by the state department of finance and administration. You qualify for the low income tax rates if your. Ar1023ct application for income tax exempt status.

Ar4ec Form Fill Online, Printable, Fillable, Blank pdfFiller

If you make $70,000 a year living in arkansas you will be taxed $11,683. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web prices of the fuels during 2022 as published by the energy information administration.

Fillable Form Ar1023ct Application For Tax Exempt Status

Arkansas income tax withholding rates are updated effective october 1, 2022 to reflect law lowering the top income tax rate. If too little is withheld, you will generally owe tax when you file your tax return. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of.

Arkansas State Tax Withholding Tables 2018

For the complete set of. Web employee’s state withholding exemption certificate (form ar4ec) contact. Try it for free now! If too little is withheld, you will generally owe tax when you file your tax return. Web you can download pdfs of the new forms from the following links:

Arkansas State Withholding Form

Web for the tax year beginning on january 1, 2022, the top rate is reduced to 5.5%. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Future developments for the latest information about. Web 2022 tax tables.

Arkansas State Withholding Form 2022

A brief synopsis of when a form should be used is also listed. Web arkansas’s withholding formula, effective jan. If too little is withheld, you will generally owe tax when you file your tax return. For the complete set of. Arkansas income tax withholding rates are updated effective october 1, 2022 to reflect law lowering the top income tax rate.

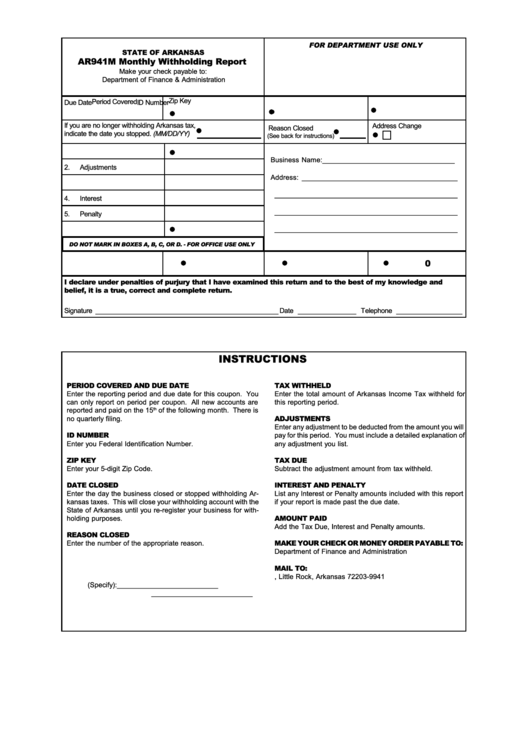

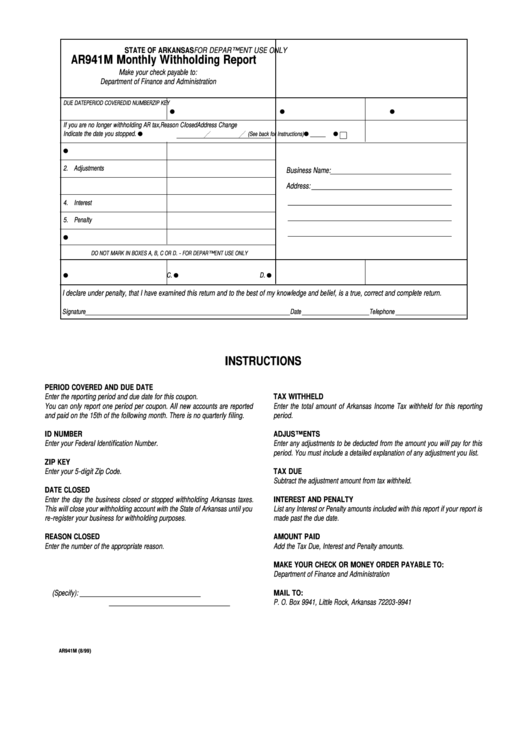

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Web arkansas has a state income tax that ranges between 2% and 6.6% , which is administered by the arkansas department of revenue. Upload, modify or create forms. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Web arkansas’s withholding formula, effective jan. Future developments for the latest information about.

Future Developments For The Latest Information About.

The arkansas department of revenue. Arkansas income tax withholding rates are updated effective october 1, 2022 to reflect law lowering the top income tax rate. Web you can download pdfs of the new forms from the following links: Ssc 425 little rock, ar.

Vice Chancellor For Finance & Administration 2801 S.

Web arkansas’s withholding formula, effective jan. 10 by the state department of finance and administration. Upload, modify or create forms. Claim additional amounts of withholding tax if desired.

1, 2022, Was Released Jan.

Web arkansas 2022 individual income tax forms and instructions full year resident.ar1000f non. If too little is withheld, you will generally owe tax when you file your tax return. A brief synopsis of when a form should be used is also listed. For the complete set of.

Web For The Tax Year Beginning On January 1, 2022, The Top Rate Is Reduced To 5.5%.

Web arkansas has a state income tax that ranges between 2% and 6.6% , which is administered by the arkansas department of revenue. Ar1100esct corporation estimated tax vouchers. You qualify for the low income tax rates if your. Web prices of the fuels during 2022 as published by the energy information administration of the united.