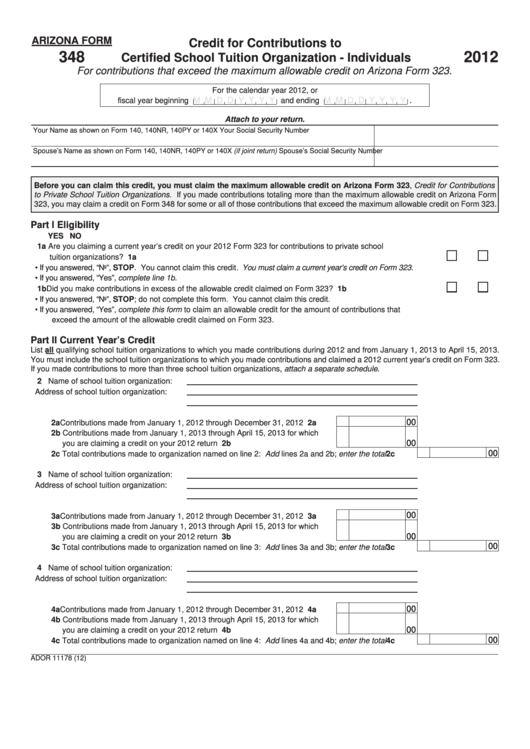

Arizona Form 348

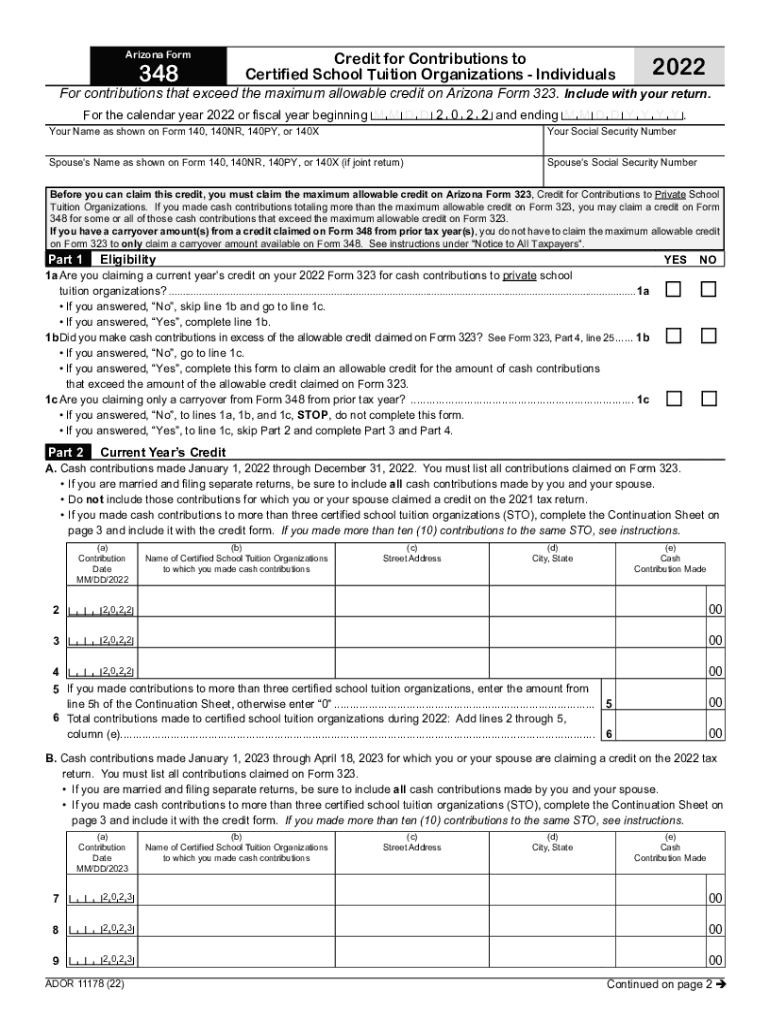

Arizona Form 348 - Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. This form is for income earned in tax year 2022, with tax returns due in april. To claim a current year’s credit on form 348, you must first claim the maximum current year’s credit allowed on arizona form 323, credit for. Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. Web notice to all taxpayers note: Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. Web we last updated arizona form 348 in february 2023 from the arizona department of revenue. For the calendar year 2022 or fiscal year. Web 12 rows a nonrefundable individual tax credit for cash contributions to a. For contributions that exceed the maximum.

Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. For contributions that exceed the maximum. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. Web arizona form 348 author: Web your name as shown on form 140, 140nr, 140py, or 140x your social security number spouse’s name as shown on form 140, 140nr, 140py, or 140x (if joint return). Web notice to all taxpayers note: Web 12 rows a nonrefundable individual tax credit for cash contributions to a. Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323. Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Arizona department of revenue subject:

To claim a current year’s credit on form 348, you must first claim the maximum current year’s credit allowed on arizona form 323, credit for. For contributions that exceed the maximum. For the calendar year 2022 or fiscal year. Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. Web notice to all taxpayers note: Arizona department of revenue subject: Web your name as shown on form 140, 140nr, 140py, or 140x your social security number spouse’s name as shown on form 140, 140nr, 140py, or 140x (if joint return). Web we last updated arizona form 348 in february 2023 from the arizona department of revenue. If you have a carryover amount(s) from a credit claimed on form 348 from.

Arizona Form Fill Out and Sign Printable PDF Template

For the calendar year 2022 or fiscal year. Web we last updated arizona form 348 in february 2023 from the arizona department of revenue. For contributions that exceed the maximum. Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. This form is for income earned in tax year 2022, with.

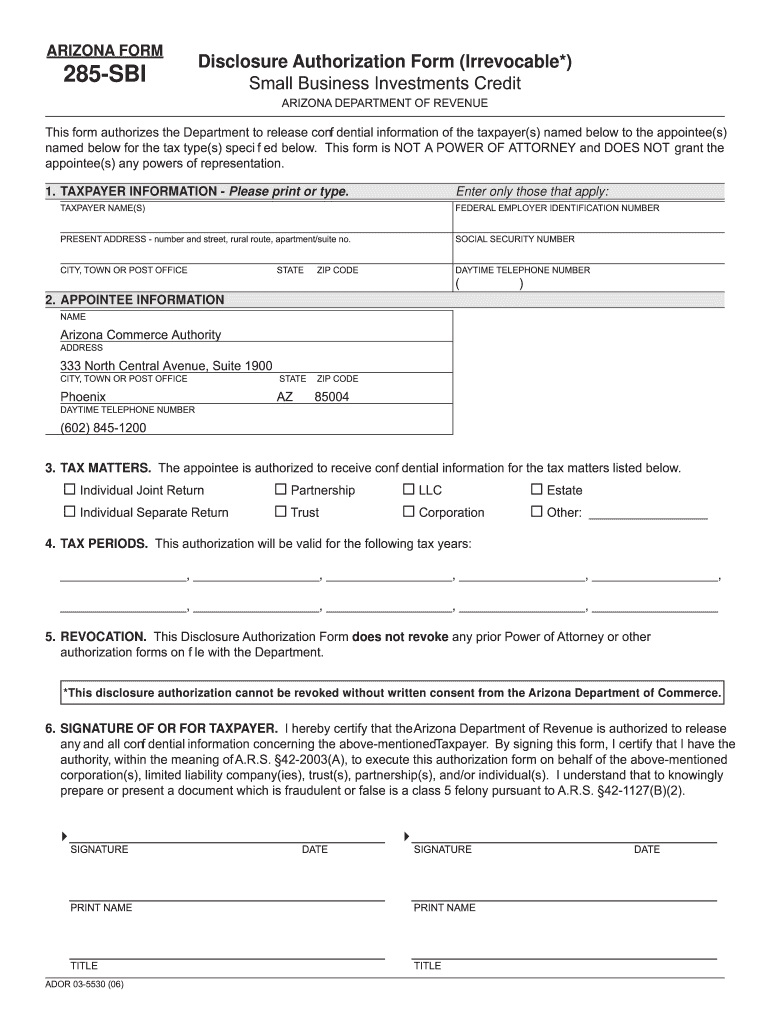

Arizona Form 285Up Fill Out and Sign Printable PDF Template signNow

Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. Web arizona form 348 author: Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for.

Fillable Arizona Form 348 Credit For Contributions To Certified

Web arizona form 348 author: Web 12 rows a nonrefundable individual tax credit for cash contributions to a. For contributions that exceed the maximum. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. Web we last updated arizona.

Arizona Form 348 Credit for Contributions to Certified School Tuition

To claim a current year’s credit on form 348, you must first claim the maximum current year’s credit allowed on arizona form 323, credit for. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. For contributions that exceed.

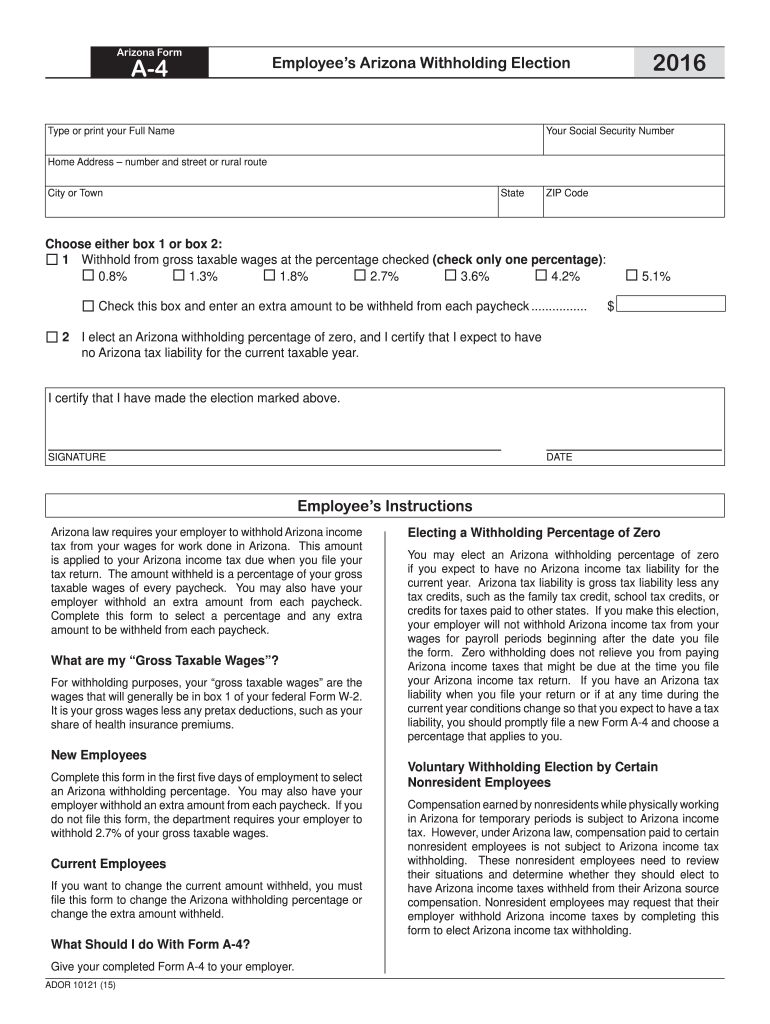

Download Arizona Form A4 (2013) for Free FormTemplate

This form is for income earned in tax year 2022, with tax returns due in april. Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017.

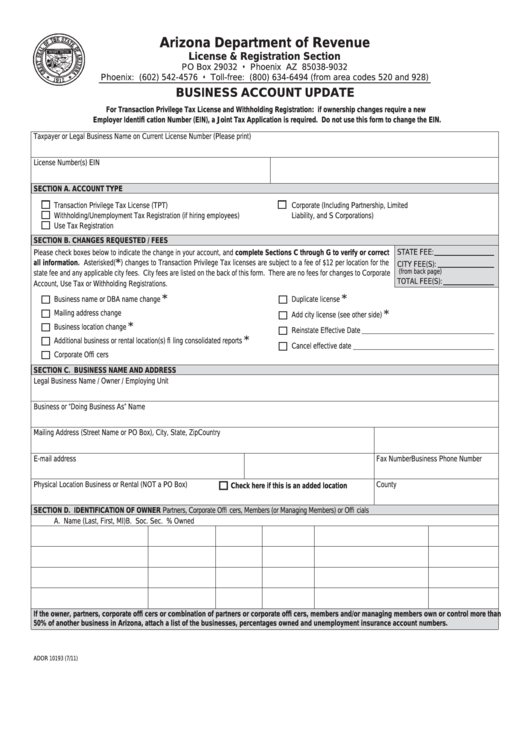

Fillable Arizona Form 10193 Business Account Update printable pdf

Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. Web we last updated arizona form 348 in february 2023.

DA form 348 Master Driver Handbook

This form is for income earned in tax year 2022, with tax returns due in april. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. For the calendar year 2022 or fiscal year. Web arizona form 348 author: Arizona.

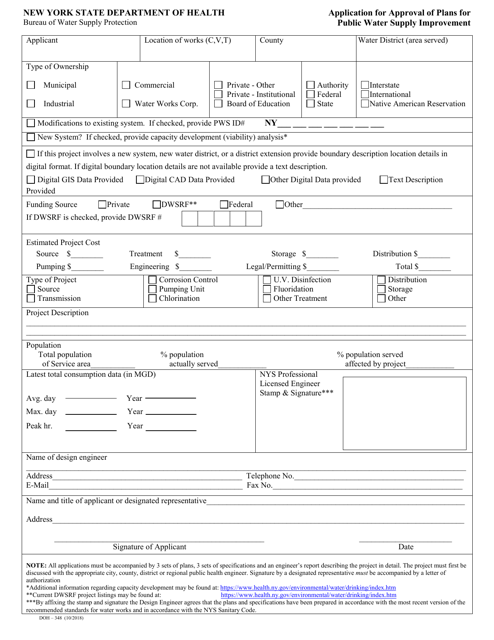

Form DOH348 Download Printable PDF or Fill Online Application for

Web we last updated arizona form 348 in february 2023 from the arizona department of revenue. Web notice to all taxpayers note: If you have a carryover amount(s) from a credit claimed on form 348 from. For the calendar year 2022 or fiscal year. Web 348 for some or all of those cash contributions that exceed the maximum allowable credit.

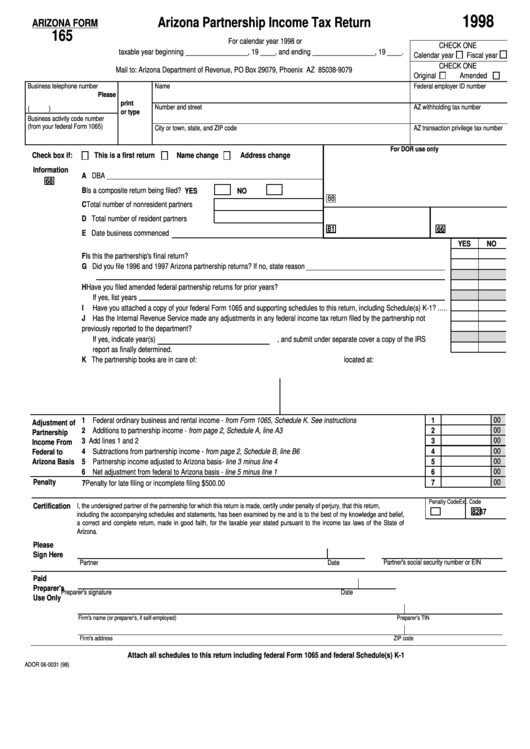

Fillable Arizona Form 165 Arizona Partnership Tax Return

Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. Web 12 rows a nonrefundable individual tax credit for cash contributions to a. If you have a carryover amount(s) from a credit claimed on form 348 from. Web 348 for.

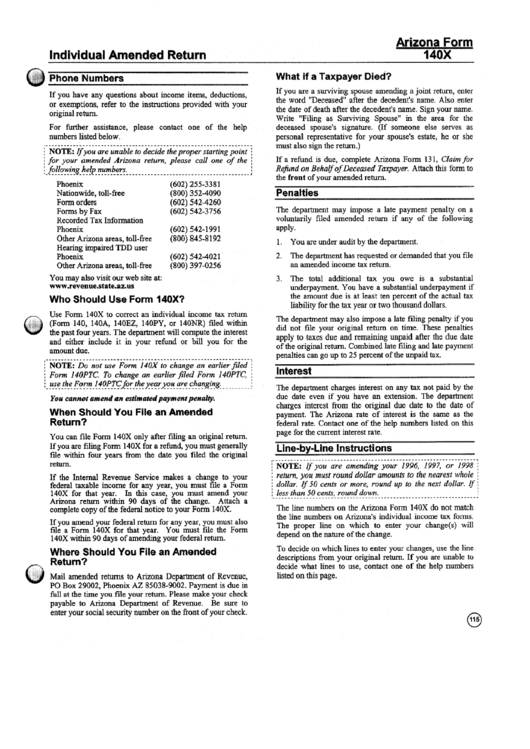

Instructions For Arizona Form 140x Individual Amended Return

Web arizona form 348 author: Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323. For contributions that exceed the maximum. Web 12 rows a nonrefundable individual tax credit for cash contributions to a. Arizona department of revenue subject:

Web Arizona Form 348 Author:

Web notice to all taxpayers note: If you have a carryover amount(s) from a credit claimed on form 348 from. Web your name as shown on form 140, 140nr, 140py, or 140x your social security number spouse’s name as shown on form 140, 140nr, 140py, or 140x (if joint return). Web we last updated arizona form 348 in february 2023 from the arizona department of revenue.

To Claim A Current Year’s Credit On Form 348, You Must First Claim The Maximum Current Year’s Credit Allowed On Arizona Form 323, Credit For.

Web this tax credit is claimed on form 348 and is available to individual taxpayers who donate the maximum amount allowed under the credit for contributions to private school. Arizona department of revenue subject: Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2017 through 2021 tax returns and your tax liability. For contributions that exceed the maximum.

Web 12 Rows A Nonrefundable Individual Tax Credit For Cash Contributions To A.

Web 348 for some or all of those cash contributions that exceed the maximum allowable credit on form 323. Web arizona form 348 ao 111 (22) for contributions that exceed the maximum allowable credit on arizona form 323. Web arizona form 348 credit carryover amount from prior tax years if you claimed an allowable credit on form 348 on your 2013, through 2017 tax returns and your tax. For the calendar year 2022 or fiscal year.