Arizona Form 165

Arizona Form 165 - Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year. Arizona partnership income tax return: Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web form 165 is an arizona corporate income tax form. Tax forms, instructions, and other tax information. Web arizona form 2020 arizona partnership income tax return 165. Web amendment to arizona form 165pa amendment to arizona form 165pa. If you need tax forms, instructions, and other tax information, go. Tax forms, instructions, and other tax information. Starting with the 2020 tax year, electronic filing of arizona partnership income tax returns.

Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web amendment to arizona form 165pa amendment to arizona form 165pa. Web az form 165 (2016) page 3 of 3 mail to: Tax forms, instructions, and other tax information. Yearly partnership income tax return. Ador 10343 (21) name (as shown on page 1) ein az form 165 (2021) page 2 of 4 schedule c apportionment formula (multistate partnerships only) Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year. Web if a partnership does not receive a federal imputedunderpayment assessment from the irs, it will fileits federal changes to arizona on an amendedarizona form 165. Web arizona partnership income tax return. For information or help, call one of the numbers listed:

Starting with the 2020 tax year, electronic filing of arizona partnership income tax returns. If the amount on line 15 is negative, enter the amount from line 15, column (a) on schedule b, line b5 of arizona form 165. Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web form 165 is an arizona corporate income tax form. Tax forms, instructions, and other tax information. Web amendment to arizona form 165pa amendment to arizona form 165pa. If you need tax forms, instructions, and other tax information, go. Ador 10343 (21) name (as shown on page 1) ein az form 165 (2021) page 2 of 4 schedule c apportionment formula (multistate partnerships only) While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. Web az form 165 (2016) page 3 of 3 mail to:

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

Arizona partnership income tax return: While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year. Form year form instructions publish date; Web arizona form 165 arizona partnership income tax return.

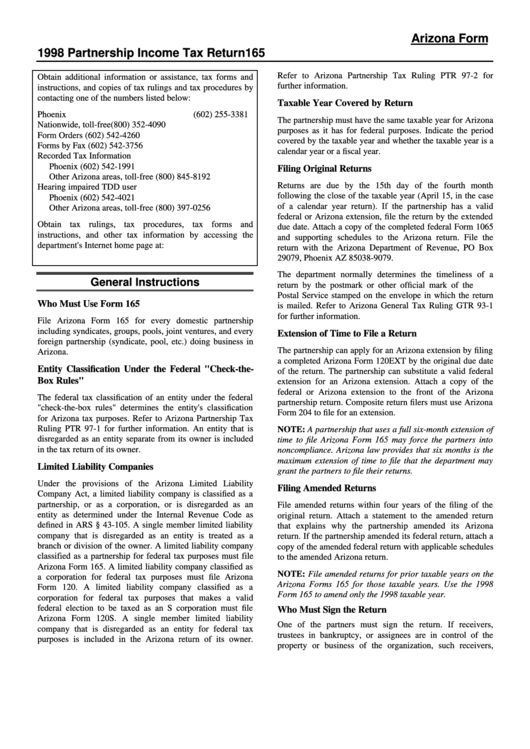

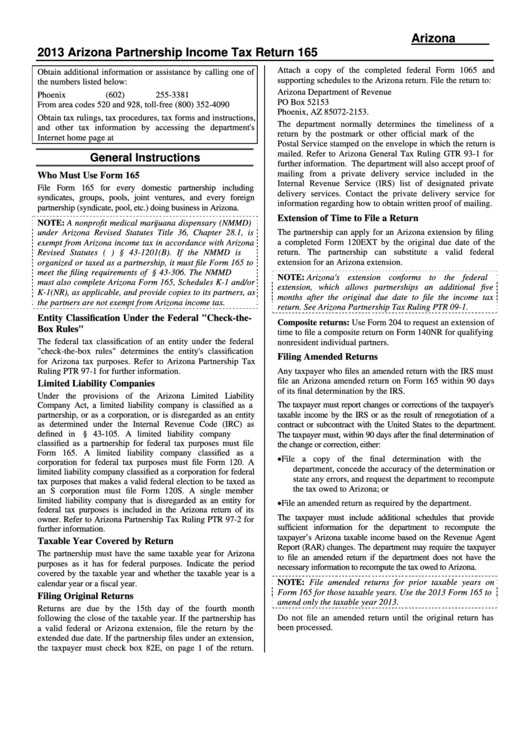

Instructions For Partnership Tax Return Arizona Form 165 1998

Web az form 165 (2016) page 3 of 3 mail to: Electronic filing of partnership tax returns. Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web amendment to arizona form 165pa amendment to arizona form 165pa. If.

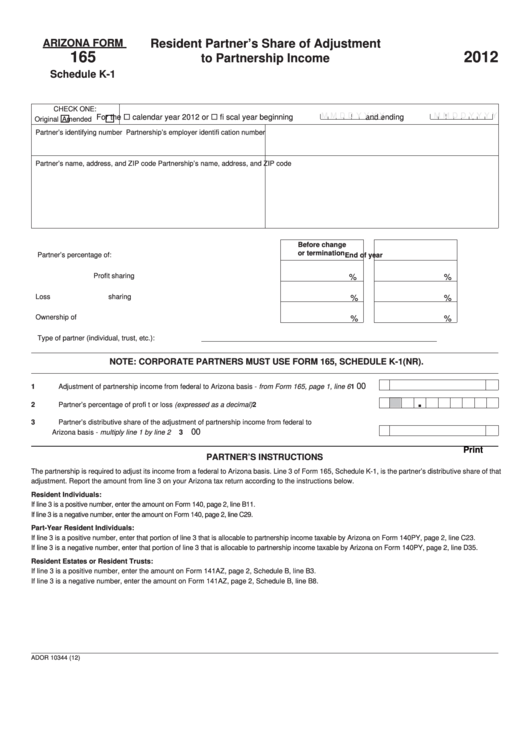

Fillable Arizona Form 165 Schedule K1 Resident Partner'S Share Of

If you need tax forms, instructions, and other tax information, go Electronic filing of partnership tax returns. Web form 165 is an arizona corporate income tax form. For information or help, call one of the numbers listed: Form year form instructions publish date;

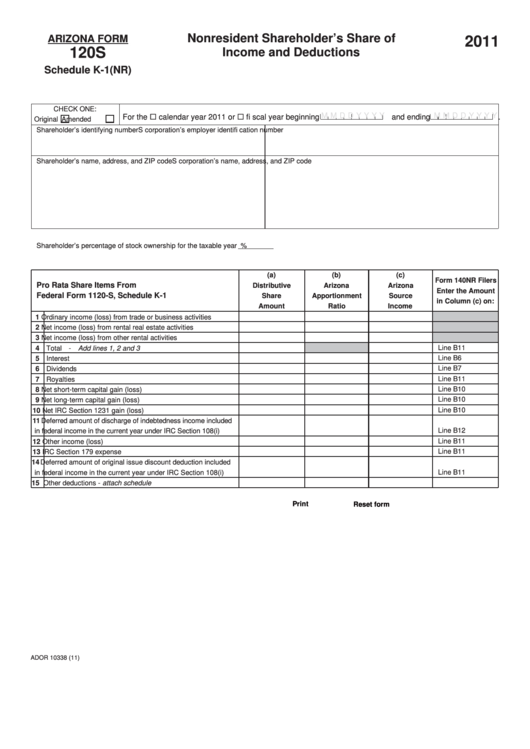

Fillable Arizona Form 120s Schedule K1(Nr) Nonresident Shareholder

If you need tax forms, instructions, and other tax information, go If you need tax forms, instructions, and other tax information, go. Electronic filing of partnership tax returns. For information or help, call one of the numbers listed: Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year.

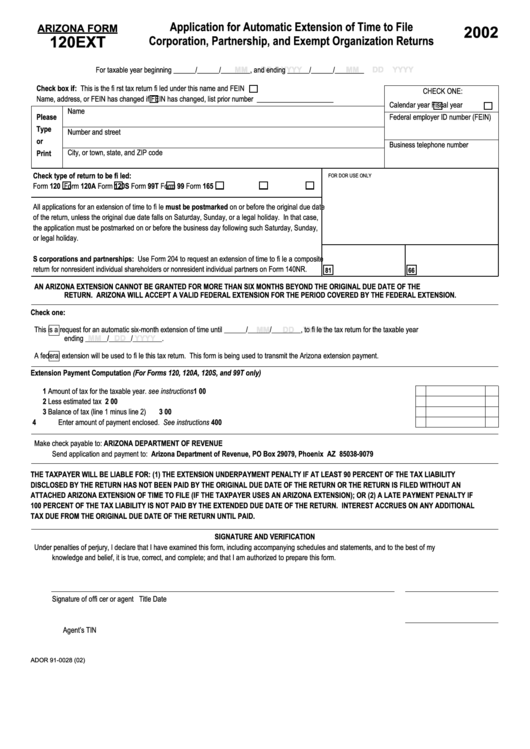

Arizona Form 120ext Application For Automatic Extension Of Time To

Yearly partnership income tax return. Arizona partnership income tax return: Web arizona form 2022 arizona partnership income tax return 165. Web arizona partnership income tax return. Tax forms, instructions, and other tax information.

Instructions For Arizona Form 165 2013 printable pdf download

If the amount on line 15 is negative, enter the amount from line 15, column (a) on schedule b, line b5 of arizona form 165. Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year. Web az form 165 (2016) page 3 of 3 mail to: Web amendment to arizona form 165pa amendment to arizona.

DD Form 165 Fill Out, Sign Online and Download Fillable PDF

Web az form 165 (2016) page 3 of 3 mail to: Arizona partnership income tax return: Arizona allows individuals, estates and trusts a subtraction While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. Electronic filing of partnership tax returns.

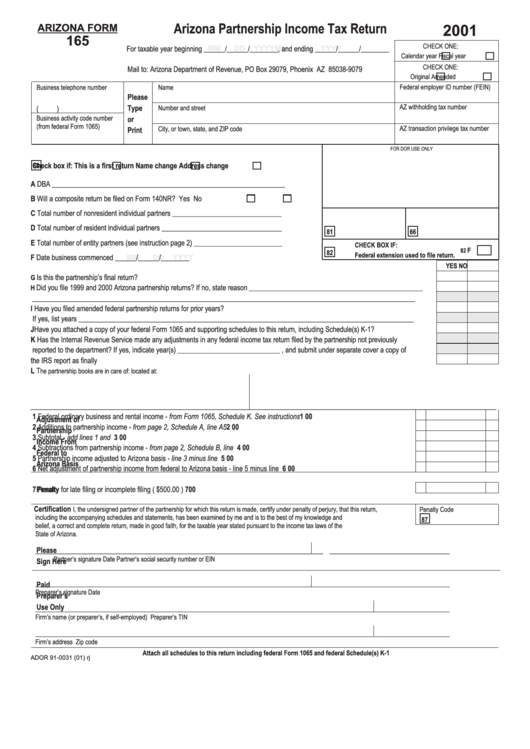

Arizona Form 165 Arizona Partnership Tax Return 2001

Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year. Tax forms, instructions, and other tax information. Yearly partnership income tax return. For information or help, call one of the numbers listed: Starting with the 2020 tax year, electronic filing of arizona partnership income tax returns.

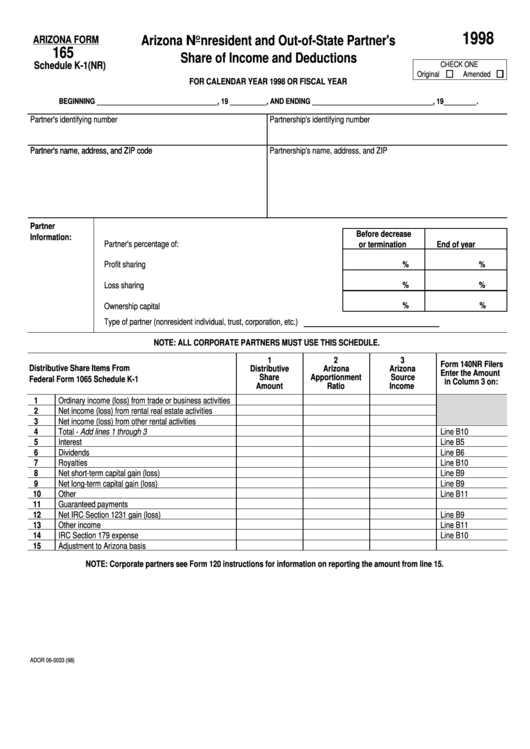

Fillable Arizona Form 165 Schedule K1 (Nr) Arizona Nonresident And

If you need tax forms, instructions, and other tax information, go. Web arizona partnership income tax return. Web arizona form 2022 arizona partnership income tax return 165. While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. Web arizona form 2020 arizona partnership income tax.

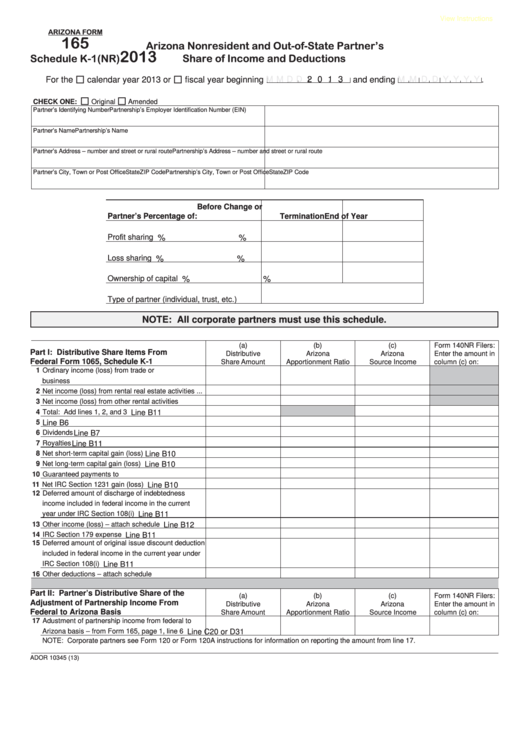

Fillable Arizona Form 165 Schedule K1(Nr) Arizona Nonresident And

Web arizona form 2022 arizona partnership income tax return 165. Tax forms, instructions, and other tax information. Electronic filing of arizona partnership income tax returns is required for the 2022 taxable year. Web amendment to arizona form 165pa amendment to arizona form 165pa. Arizona partnership income tax return:

Web Arizona Partnership Income Tax Return.

For information or help, call one of the numbers listed: Electronic filing of partnership tax returns. Yearly partnership income tax return. Ador 10343 (21) name (as shown on page 1) ein az form 165 (2021) page 2 of 4 schedule c apportionment formula (multistate partnerships only)

Electronic Filing Of Arizona Partnership Income Tax Returns Is Required For The 2022 Taxable Year.

While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. If you need tax forms, instructions, and other tax information, go. Web az form 165 (2016) page 3 of 3 mail to: Tax forms, instructions, and other tax information.

Web Arizona Form 2020 Arizona Partnership Income Tax Return 165.

Tax forms, instructions, and other tax information. Web if a partnership does not receive a federal imputedunderpayment assessment from the irs, it will fileits federal changes to arizona on an amendedarizona form 165. If the amount on line 15 is negative, enter the amount from line 15, column (a) on schedule b, line b5 of arizona form 165. Web form 165 is an arizona corporate income tax form.

Web Amendment To Arizona Form 165Pa Amendment To Arizona Form 165Pa.

Web arizona form 2022 arizona partnership income tax return 165. Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Starting with the 2020 tax year, electronic filing of arizona partnership income tax returns. For information or help, call one of the numbers listed: