Arizona Form 165 Instructions 2021

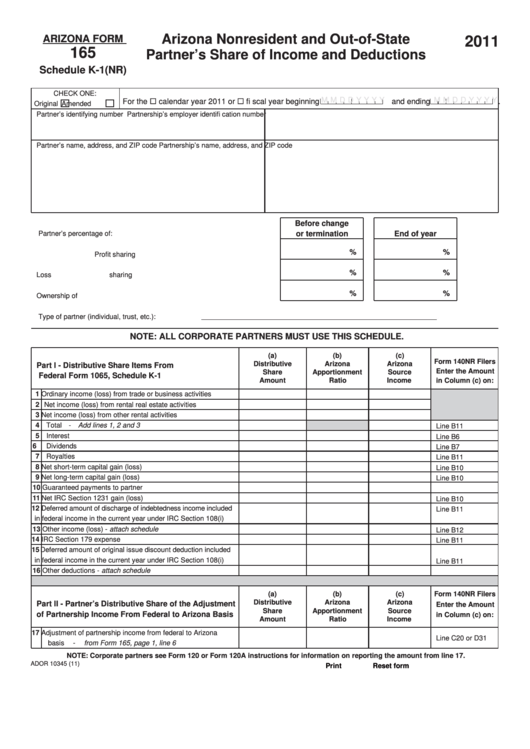

Arizona Form 165 Instructions 2021 - Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every. Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Web corporate payment type options include: Nonresident individuals should report the amounts in column (c). Line 29 or 41 note: Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web arizona form 2021 arizona partnership income tax return 165 for information or help, call one of the numbers listed: Starting with the 2020 tax.

Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165. Sign it in a few clicks draw your signature, type it,. Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. Line 29 or 41 note: Web 8 rows form year form instructions publish date; Web 24 rows yearly partnership income tax return. Corporate partners see form 120 or form 120a instructions for information on reporting the amount from. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every.

Web 24 rows yearly partnership income tax return. If there is no net adjustment, the resident partner. Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Web arizona form 2021 arizona partnership income tax return 165 for information or help, call one of the numbers listed: • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web 8 rows form year form instructions publish date; Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web the bottom of arizona form 165pa. Corporate partners see form 120 or form 120a instructions for information on reporting the amount from. Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165.

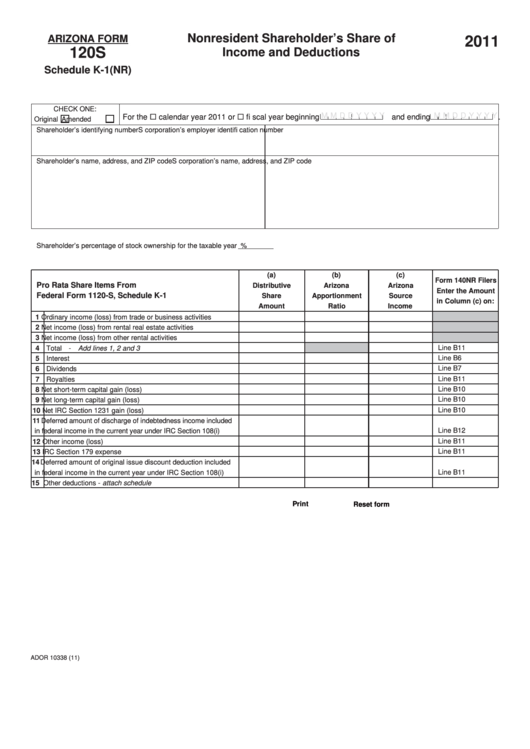

Fillable Arizona Form 120s Schedule K1(Nr) Nonresident Shareholder

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165..

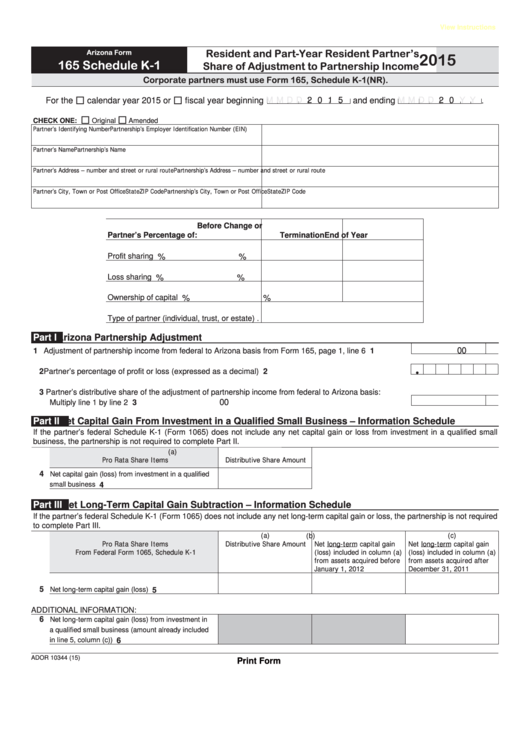

Fillable Arizona Form 165 (Schedule K1) Resident And PartYear

Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it,. Web arizona.

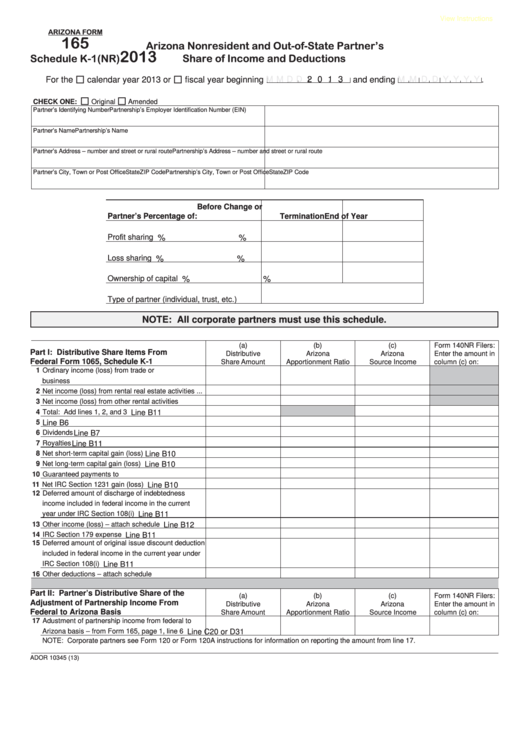

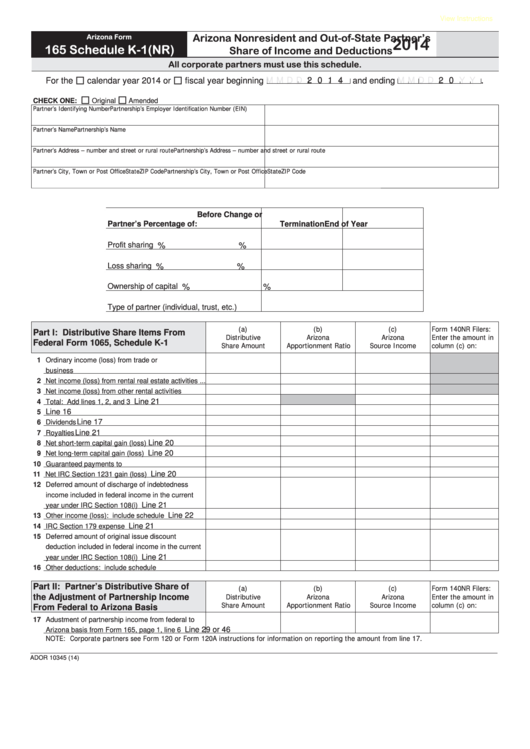

Fillable Arizona Form 165 Schedule K1(Nr) Arizona Nonresident And

Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Line 29 or 41 note: Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. Sign it in a few.

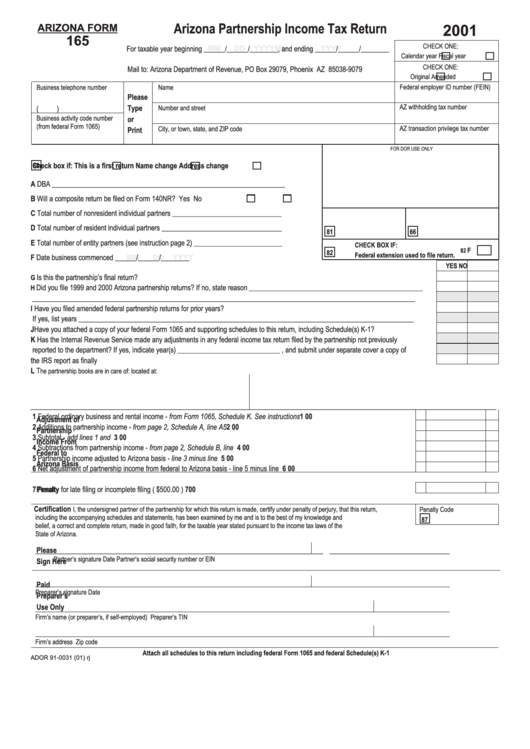

Arizona Form 165 Arizona Partnership Tax Return 2001

Web the bottom of arizona form 165pa. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. Corporate partners see form 120 or.

Fillable Schedule K1(Nr) (Arizona Form 165) Arizona Nonresident And

If there is no net adjustment, the resident partner. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every. Web the bottom of arizona form 165pa. Web 24 rows.

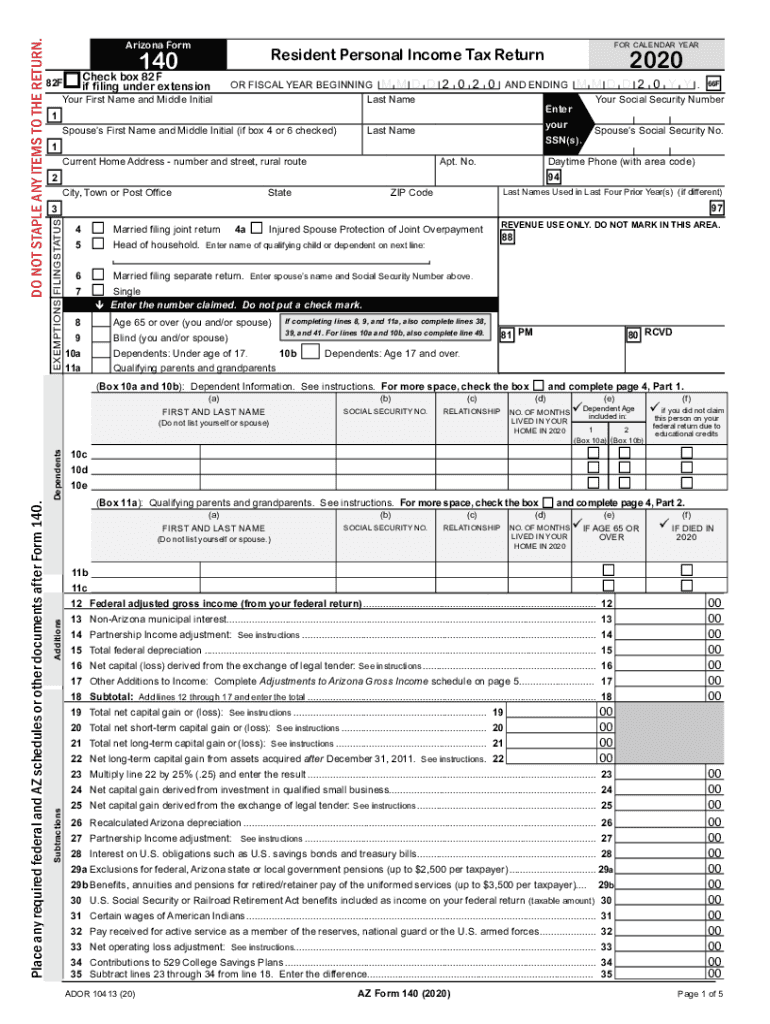

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Payments, and, • use form 120ext only to apply for an extension of time to file forms 120, 120a, 120s, 99t, 99m, or 165. Corporate partners see form 120 or form 120a instructions for information on reporting the amount from. If there is no net adjustment, the resident partner. Web 24 rows yearly partnership income tax return. Web for taxable.

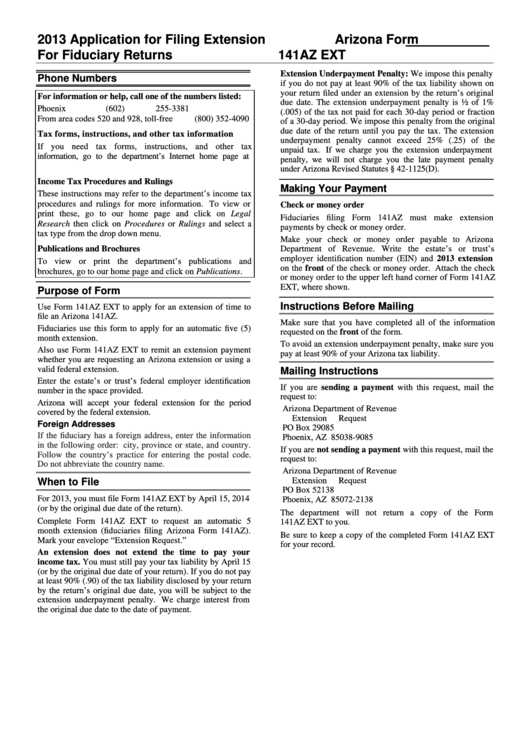

Instructions For Arizona Form 141az Ext 2013 printable pdf download

Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Line 29 or 41 note: Web arizona form 2021 arizona partnership income tax.

DD Form 165 Fill Out, Sign Online and Download Fillable PDF

• all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web the bottom of arizona form 165pa. Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Web 8 rows form year form instructions publish date; Web arizona basis from form 165, page.

Fillable Arizona Form 165 Schedule K1(Nr) Arizona Nonresident And

Web arizona form 165 arizona partnership income tax return 2021 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. Web.

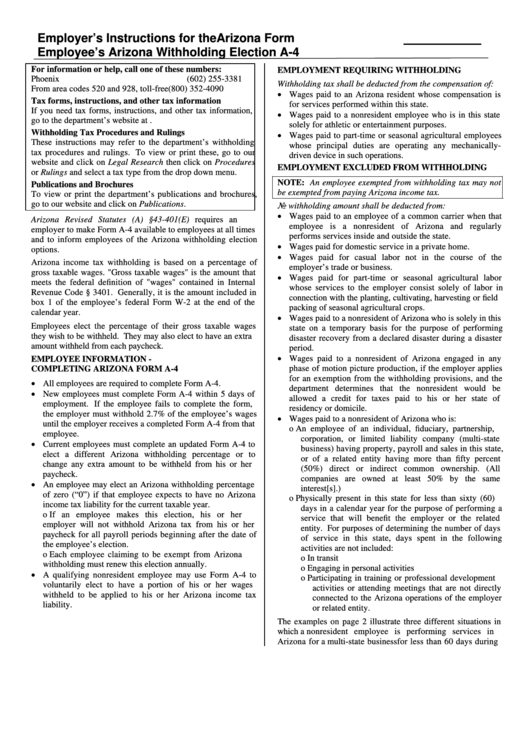

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

If there is no net adjustment, the resident partner. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web 8 rows form year form instructions publish date;.

Web Arizona Form 2021 Arizona Partnership Income Tax Return 165 For Information Or Help, Call One Of The Numbers Listed:

Submit the 2021 arizona form 165pa to report a federal imputed underpayment for tax year 2021 or an aar filed. Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. Web 24 rows yearly partnership income tax return. Web arizona basis from form 165, page 1, line 6.

If There Is No Net Adjustment, The Resident Partner.

• all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web arizona partnership income tax return instructions (165) department of revenue home us arizona agencies department of revenue arizona partnership income tax. Web corporate payment type options include: You can download or print.

Web 8 Rows Form Year Form Instructions Publish Date;

Nonresident individuals should report the amounts in column (c). Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web the bottom of arizona form 165pa. Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021.

Corporate Partners See Form 120 Or Form 120A Instructions For Information On Reporting The Amount From.

Starting with the 2020 tax. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every. Sign it in a few clicks draw your signature, type it,. Line 29 or 41 note: