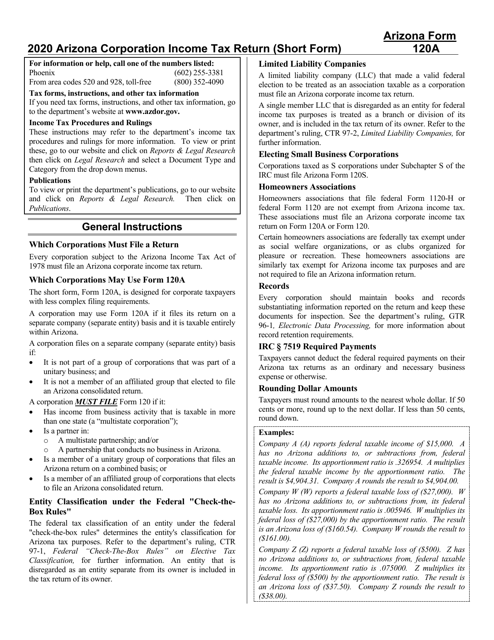

Arizona Form 120 Instructions

Arizona Form 120 Instructions - Web the year, arizona form 120/165ext may be used to transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext). Web form year form instructions publish date; For information or help, call one of the numbers listed: Web corporate tax forms. • s corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. Arizona corporation income tax return: • corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. Tax forms, instructions, and other tax information. M m d d y y y y g2 address at which tax records are located for. Web arizona corporation income tax return instructions (120) department of revenue home us arizona agencies department of revenue arizona corporation income tax.

Web form year form instructions publish date; • corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. For information or help, call one of the numbers listed: Web form year form instructions publish date; Arizona s corporation income tax return. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest. If you need tax forms, instructions, and other tax information, go to. M m d d y y y y g2 address at which tax records are located for. This government document is issued by department of revenue for use in arizona add to favorites file details: Arizona form 2020 arizona corporation income tax return 120.

Web the year, arizona form may be used to 120/165ext transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext). For information or help, call one of the numbers listed: Schedule g other information g1 date business began in arizona or date income was first derived from arizona sources: Web arizona corporation income tax return instructions (120) department of revenue home us arizona agencies department of revenue arizona corporation income tax. This government document is issued by department of revenue for use in arizona add to favorites file details: • s corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Web we last updated the arizona corporation income tax return in february 2023, so this is the latest. Arizona corporation income tax return: Web the year, arizona form 120/165ext may be used to transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext).

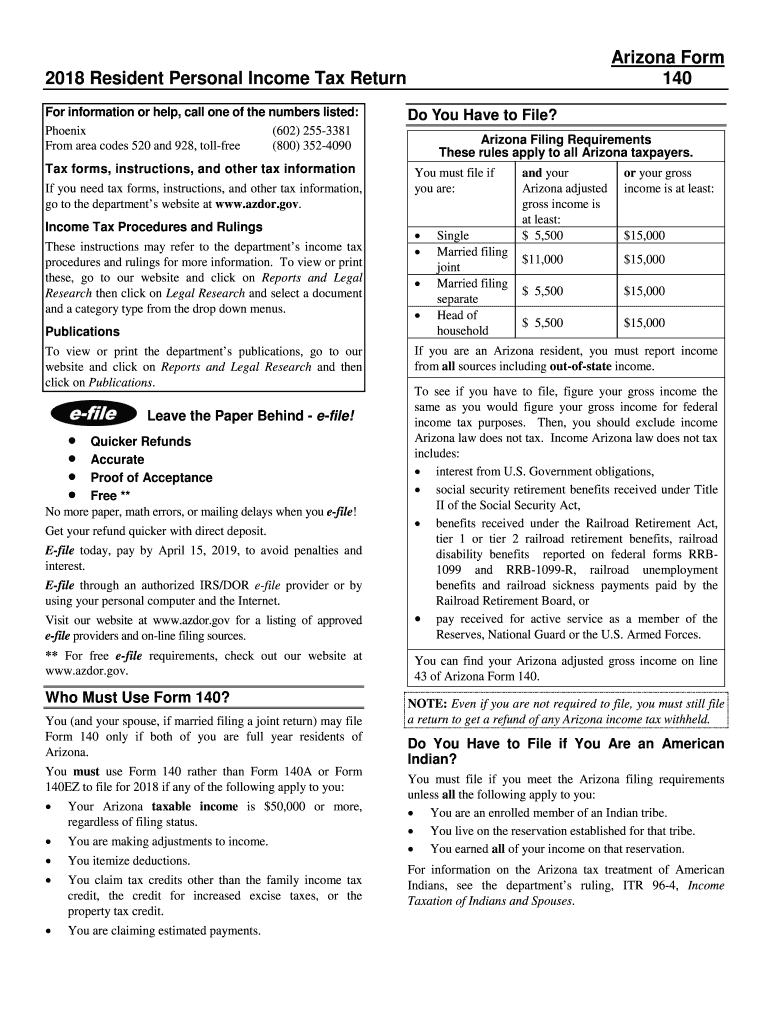

Arizona Instructions Tax Form Fill Out and Sign Printable PDF

Web the year, arizona form 120/165ext may be used to transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext). • corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. Web corporate tax.

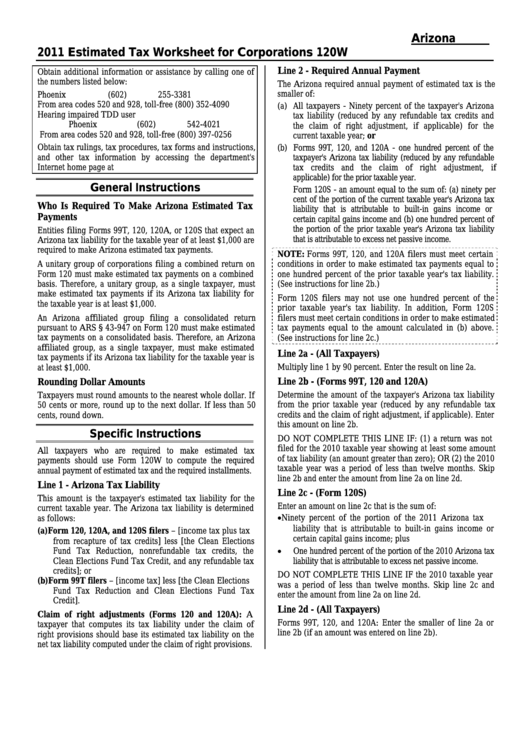

Instructions For Arizona Form 120w Estimated Tax Worksheet For

Web the year, arizona form 120/165ext may be used to transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext). Web form year form instructions publish date; If you need tax forms, instructions, and other tax information, go to. Web arizona corporation income tax return instructions (120).

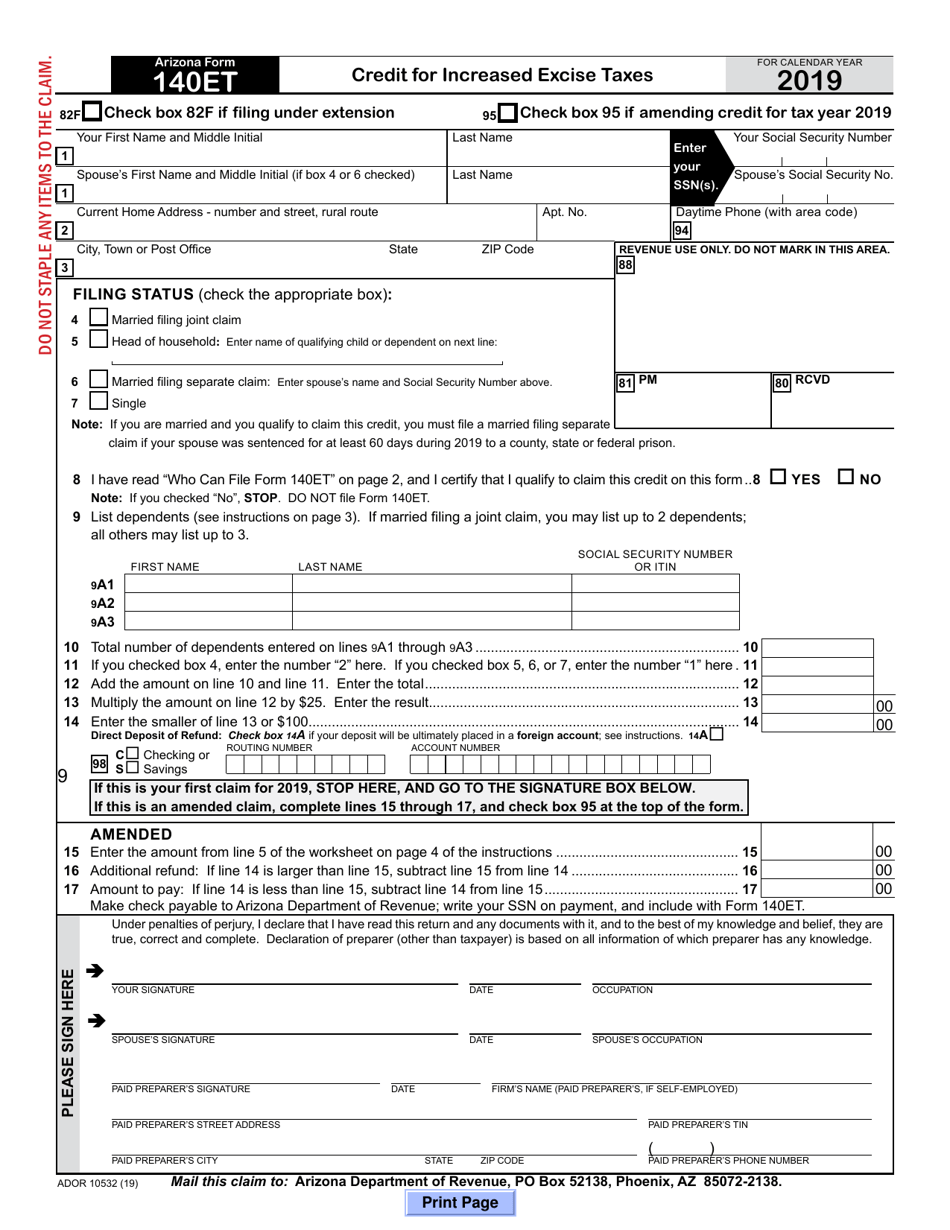

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

• s corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. • corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. This government document is issued by department of revenue for use.

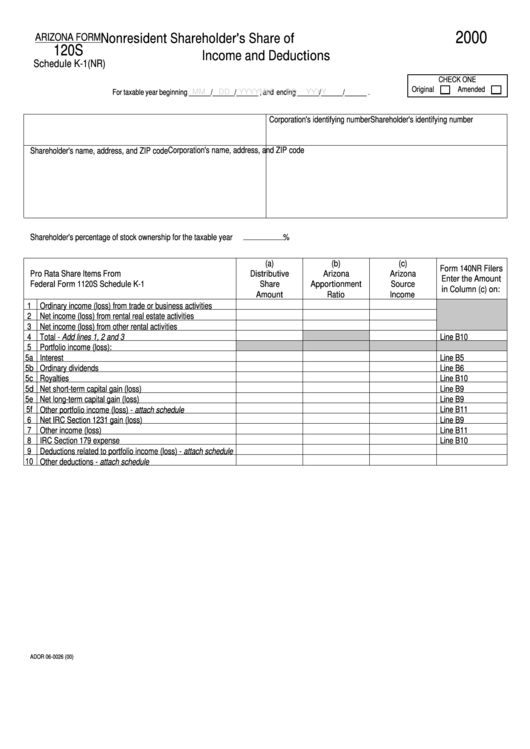

Arizona Form 120s Nonresident Shareholder'S Share Of And

• s corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest. • corporations with a tax liability of $500 or more for the 2022 taxable year must pay.

Download Instructions for Arizona Form 120A, ADOR10949 Arizona

Web we last updated the arizona corporation income tax return in february 2023, so this is the latest. Web corporate tax forms. Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Web form year form instructions publish date; Web arizona corporation income tax return instructions (120) department of revenue home us arizona agencies department of.

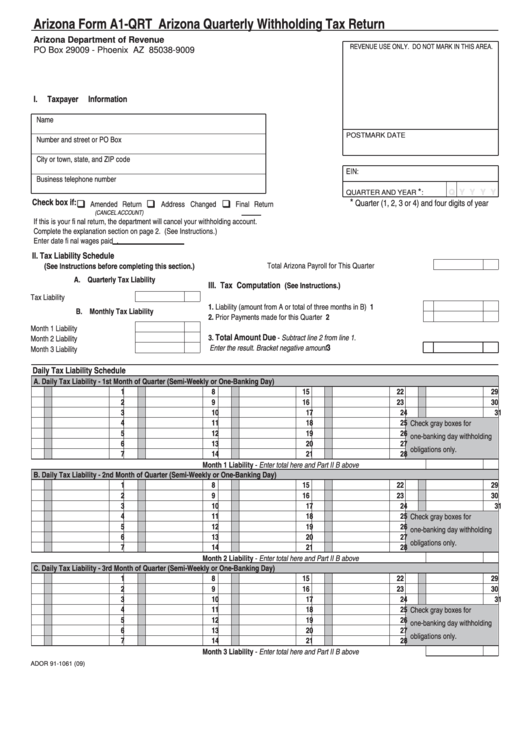

Fillable Arizona Form A1Qrt Arizona Quarterly Withholding Tax Return

Arizona corporation income tax return: Arizona s corporation income tax return. This government document is issued by department of revenue for use in arizona add to favorites file details: Web the year, arizona form 120/165ext may be used to transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona.

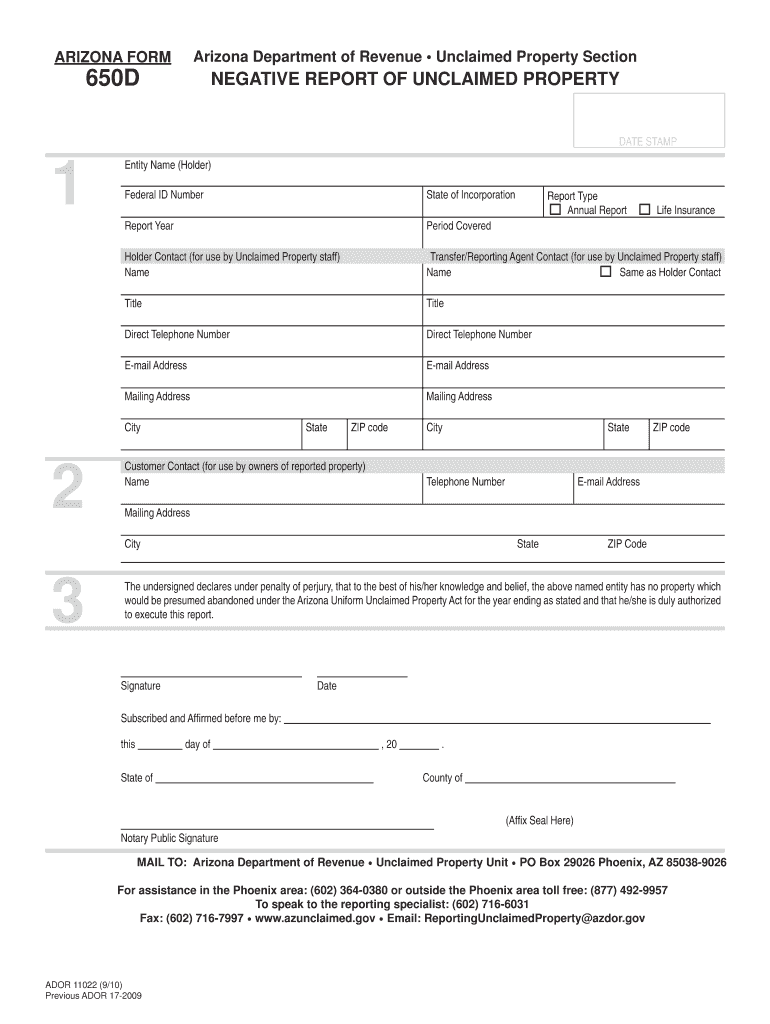

Arizona Form 11022 NEGATIVE REPORT of UNCLAIMED PROPERTY Fill Out and

If you need tax forms, instructions, and other tax information, go to. Web form year form instructions publish date; Application for automatic extension of time to file corporation, partnership, and exempt organization returns: For information or help, call one of the numbers listed: M m d d y y y y g2 address at which tax records are located for.

Arizona Form A4 Instructions Best Product Reviews

M m d d y y y y g2 address at which tax records are located for. Arizona corporation income tax return: This government document is issued by department of revenue for use in arizona add to favorites file details: • corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability.

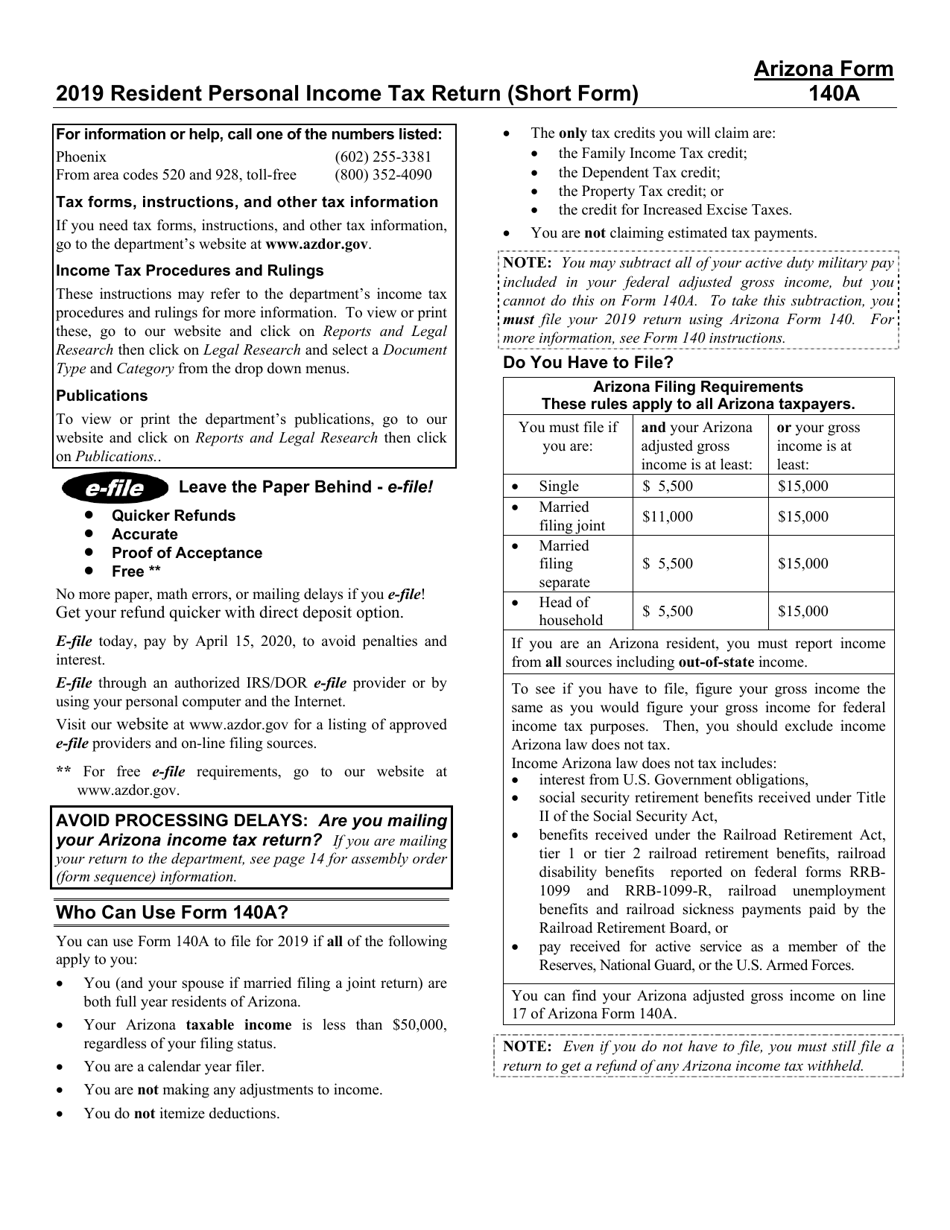

Download Instructions for Arizona Form 140A, ADOR10414 Resident

M m d d y y y y g2 address at which tax records are located for. Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Arizona s corporation income tax return. For information or help, call one of the numbers listed: Web the year, arizona form 120/165ext may be used to transmit extension payments.

Arizona Form 120V (ADOR11365) Download Fillable PDF or Fill Online

Tax forms, instructions, and other tax information. Schedule g other information g1 date business began in arizona or date income was first derived from arizona sources: Web form year form instructions publish date; M m d d y y y y g2 address at which tax records are located for. Arizona corporation income tax return:

Arizona Corporation Income Tax Return:

Web the year, arizona form 120/165ext may be used to transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext). Web arizona corporation income tax return instructions (120) department of revenue home us arizona agencies department of revenue arizona corporation income tax. Web form year form instructions publish date; M m d d y y y y g2 address at which tax records are located for.

Web Corporate Tax Forms.

Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Arizona s corporation income tax return. If you need tax forms, instructions, and other tax information, go to. Web the year, arizona form may be used to 120/165ext transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal extension or arizona form 120/165ext).

Schedule G Other Information G1 Date Business Began In Arizona Or Date Income Was First Derived From Arizona Sources:

• s corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. • corporations with a tax liability of $500 or more for the 2022 taxable year must pay their tax liability by electronic funds transfer. Arizona form 2020 arizona corporation income tax return 120. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest.

For Information Or Help, Call One Of The Numbers Listed:

This government document is issued by department of revenue for use in arizona add to favorites file details: Tax forms, instructions, and other tax information. Web form year form instructions publish date;