Arizona A 4 Form

Arizona A 4 Form - Ciaramella | 7.24.2023 3:46 pm. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. You can use your results. Arizona department of revenue subject: Web also, enter this amount on arizona form 301, part 1, line 21, column (c). (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Try it for free now! Web a form required for reaffirmation, candidacy, and ongoing compliance per as 4.0.3. Log in to the editor using your credentials or click on create. Ad upload, modify or create forms.

Web a form required for reaffirmation, candidacy, and ongoing compliance per as 4.0.3. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Try it for free now! Web the arizona department of revenue announced that sb 1828, enacted in 2021, substantially lowers individual income tax rates effective for tax year 2022 and 2023, and. Web also, enter this amount on arizona form 301, part 1, line 21, column (c). This form is for income earned in tax year 2022,. Register and log in to your account. Web 20 rows withholding forms. Web nfl network insider ian rapoport reported thursday that arizona cardinals star safety budda baker received a raise in the form of $2.4 million in bonuses and. Ad upload, modify or create forms.

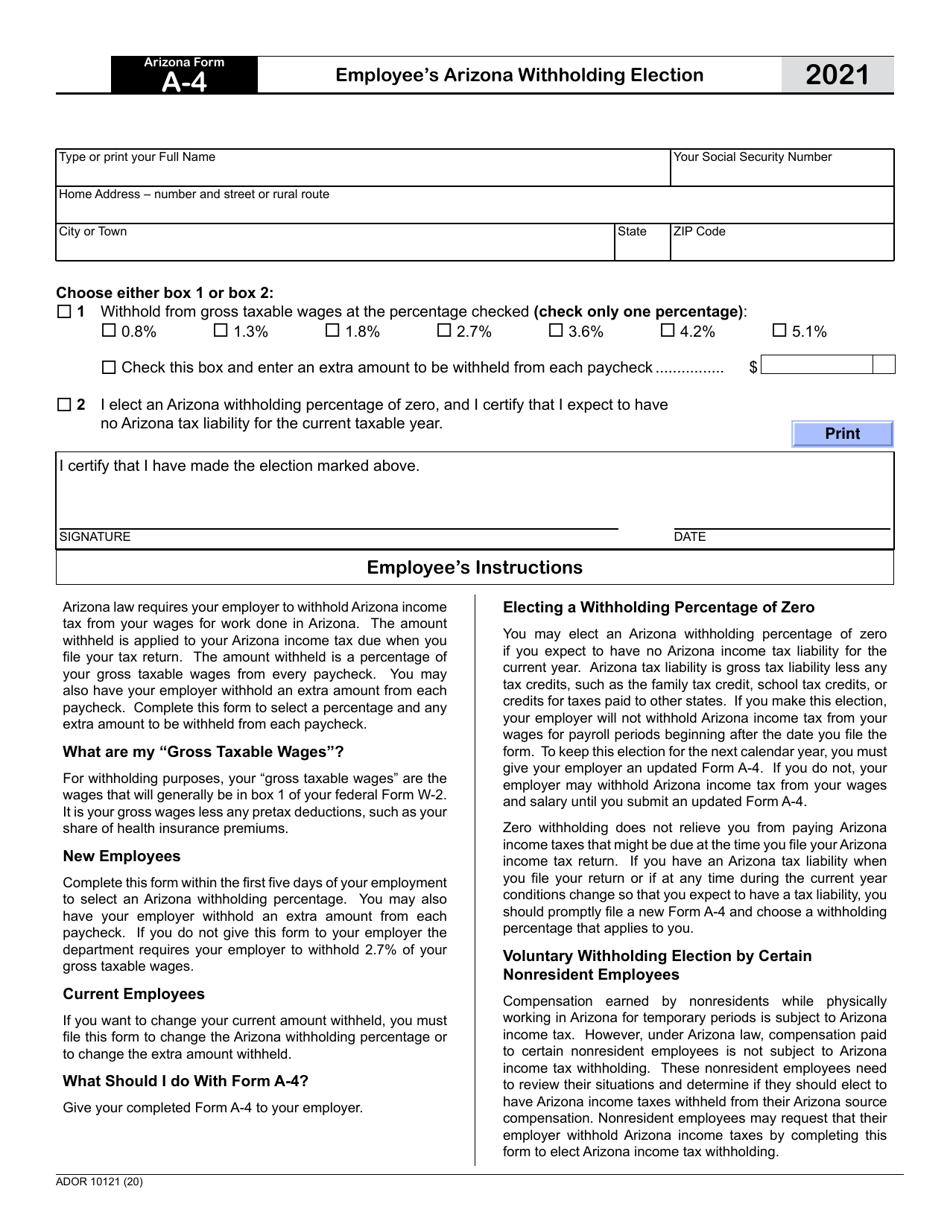

1 withhold from gross taxable wages at the percentage checked (check only one. All taxpayers must complete a new a. Web the arizona department of revenue announced that sb 1828, enacted in 2021, substantially lowers individual income tax rates effective for tax year 2022 and 2023, and. This form is submitted to the. Ciaramella | 7.24.2023 3:46 pm. The post arizona football lands 4. Log in to the editor using your credentials or click on create. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Arizona department of revenue subject:

Arizona Mortgage Pre Qualification Form Universal Network

Ciaramella | 7.24.2023 3:46 pm. Web also, enter this amount on arizona form 301, part 1, line 21, column (c). Web fec form 3x report of receipts and disbursements. You can use your results. Get ready for tax season deadlines by completing any required tax forms today.

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2. This form is for income earned in tax year 2022,. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: Ciaramella | 7.24.2023 3:46 pm. Get ready for tax season deadlines by completing any required tax forms today.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

(fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. The post arizona football lands 4. Web 20 rows withholding forms. You can use your results. Try it for free now!

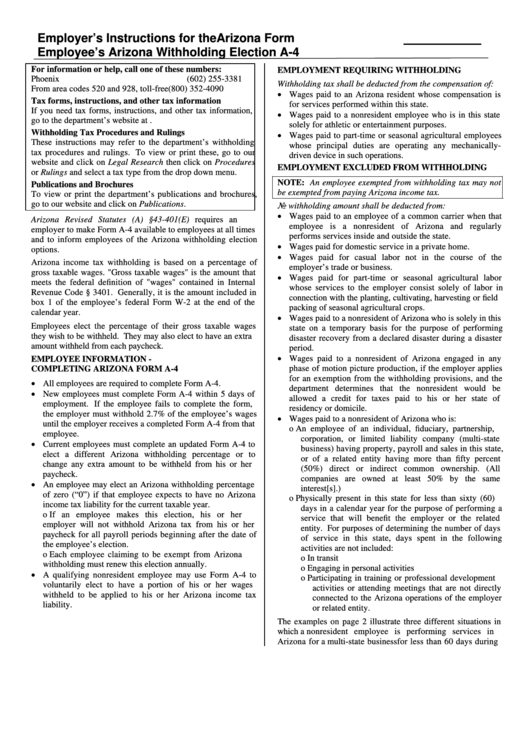

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Web make these fast steps to modify the pdf arizona a 4 form online free of charge: (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Try it for free now! This form is for income earned in tax year 2022,. All taxpayers must complete a new a.

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

All taxpayers must complete a new a. Web 20 rows withholding forms. Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Get ready for tax season deadlines by completing any required tax forms today.

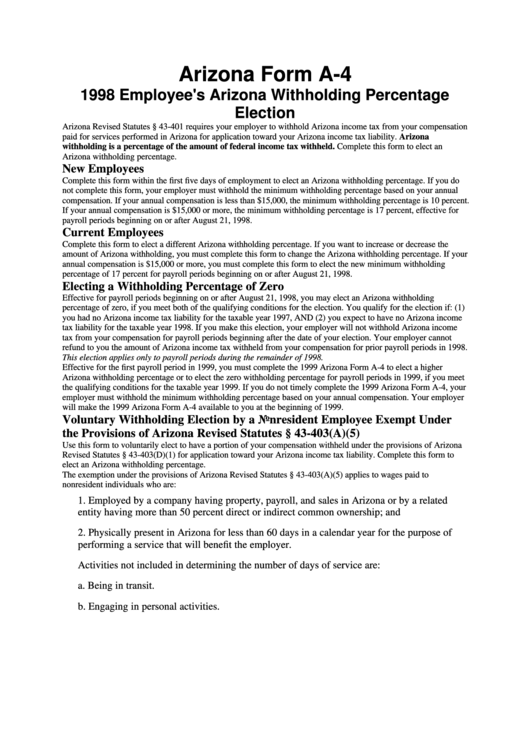

Arizona Form A4 1998 Employee'S Arizona Withholding Percentage

(fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Web the arizona department of revenue announced that sb 1828, enacted in 2021, substantially lowers individual income tax rates effective for tax year 2022 and 2023, and. Try it for free now! Web fec form 3x report of receipts and disbursements. Ad upload, modify.

Arizona

You can use your results. Register and log in to your account. The post arizona football lands 4. Web 20 rows withholding forms. Log in to the editor using your credentials or click on create.

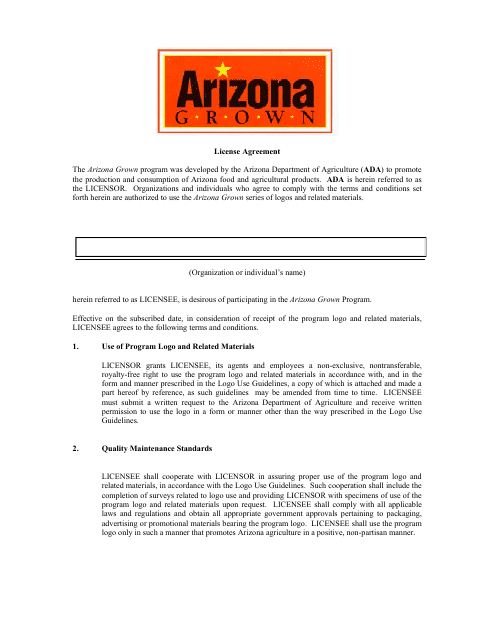

Arizona Arizona Grown License Agreement Form Download Fillable PDF

Ciaramella | 7.24.2023 3:46 pm. You can use your results. Get ready for tax season deadlines by completing any required tax forms today. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Log in to the editor using your credentials or click on create.

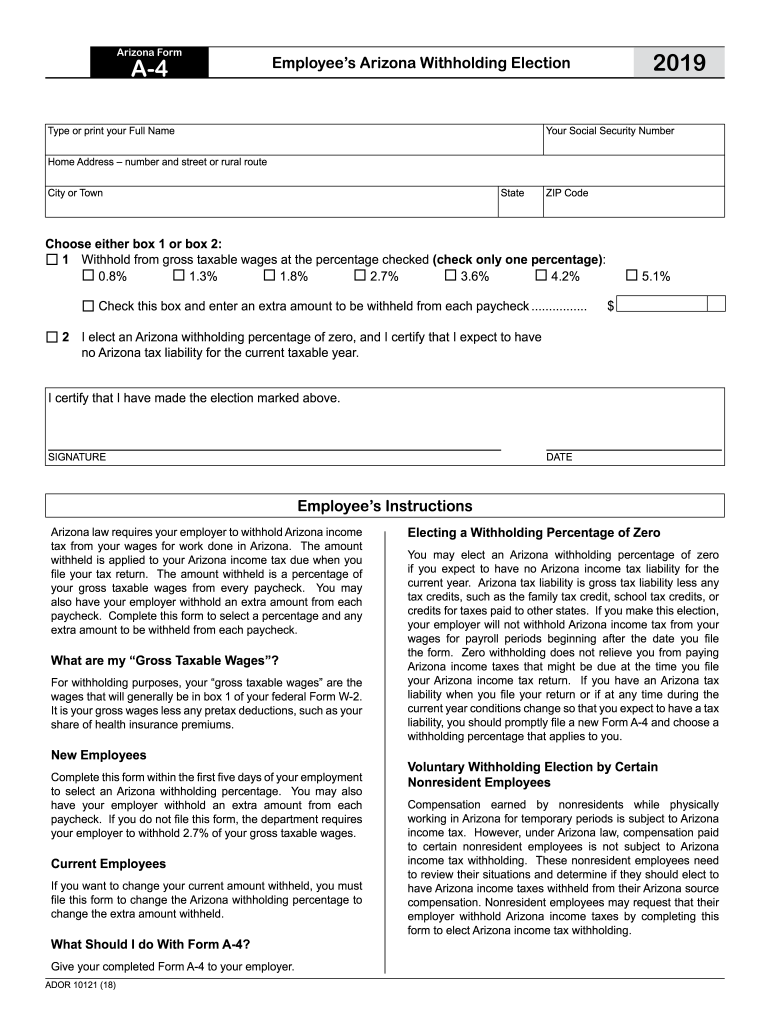

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

Web the arizona department of revenue announced that sb 1828, enacted in 2021, substantially lowers individual income tax rates effective for tax year 2022 and 2023, and. You can use your results. Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2. All taxpayers must complete a new a. Web fec form 3x report of receipts and disbursements.

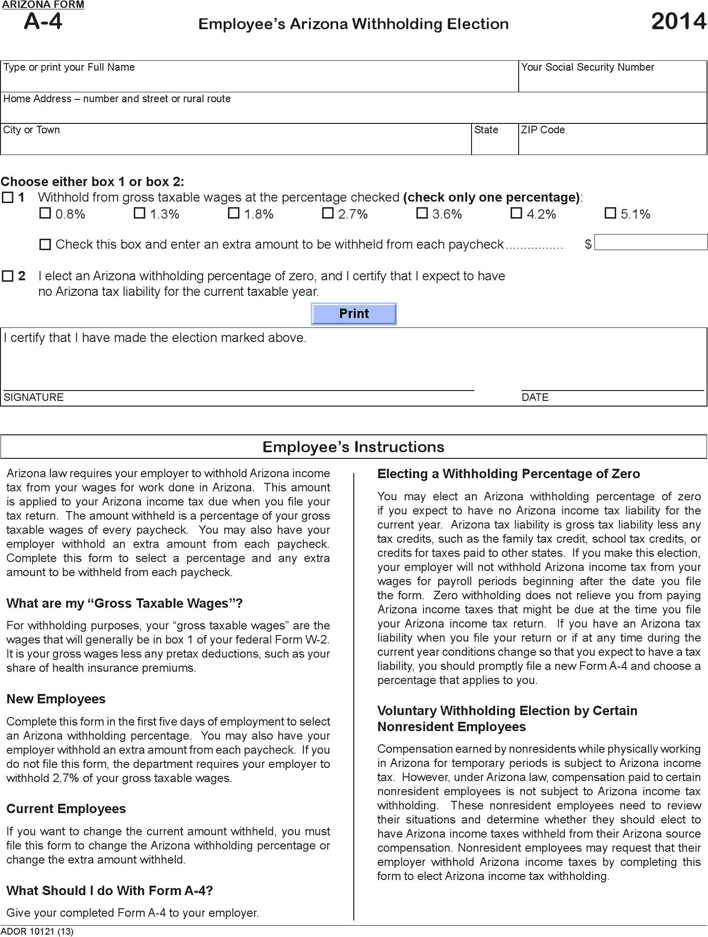

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

1 withhold from gross taxable wages at the percentage checked (check only one. Get ready for tax season deadlines by completing any required tax forms today. You can use your results. Ciaramella | 7.24.2023 3:46 pm. Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2.

Ciaramella | 7.24.2023 3:46 Pm.

Web make these fast steps to modify the pdf arizona a 4 form online free of charge: Get ready for tax season deadlines by completing any required tax forms today. Web a form required for reaffirmation, candidacy, and ongoing compliance per as 4.0.3. This form is submitted to the.

Web Also, Enter This Amount On Arizona Form 301, Part 1, Line 21, Column (C).

The post arizona football lands 4. This form is for income earned in tax year 2022,. Arizona department of revenue subject: Web file this form to change the arizona withholding percentage or to change the extra amount withheld.

Web The Arizona Department Of Revenue Announced That Sb 1828, Enacted In 2021, Substantially Lowers Individual Income Tax Rates Effective For Tax Year 2022 And 2023, And.

Register and log in to your account. All taxpayers must complete a new a. (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2.

Web Arizona Residents Employed Outside Of Arizona Complete This Form To Elect To Have Arizona Income Tax Withheld From Their Paychecks.

Web fec form 3x report of receipts and disbursements. Try it for free now! Web 20 rows withholding forms. Log in to the editor using your credentials or click on create.