Arizona 529 Plan Tax Deduction Form

Arizona 529 Plan Tax Deduction Form - Web tax deduction for single filers $2,000/yr for joint filers $4,000/yr program manager fidelity investments program distributor 829 tappan ave apt 105, ann arbor, mi is a apartment home that contains 850 sq ft. Web the most common benefit offered is a state income tax deduction for 529 plan contributions. Web states where you can get a tax break for using any 529 plan. Web july 27, 2023 many states offer state income tax deductions or credits for contributions to a 529 plan. Web to enter the deductible portion of the contributions that were made in the desktop program, from the main menu of the arizona return, select: Web before investing in any 529 plan, you should consider whether your or the beneficiary’s home state offers a 529 plan that provides its taxpayers with favorable state tax and. It contains 2 bedrooms and 1 bathroom. Web the fidelity arizona college savings plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education. Web arizona offers a state tax deduction for contributions to a 529 plan of up to $2,000 for single filers and $4,000 for married filing jointly tax filers.

The plan is designed to pay for qualified expenses for fees,. Contributions to any state’s 529 plan up to $2,000 ($4,000 if married) are deductible. 14529 arizona st, fontana, ca is a single family home that contains 2,484 sq ft and was built in 1998. Web is there a deduction for 529 plan payments for tax year 2022? Web states where you can get a tax break for using any 529 plan. Web tax deduction for single filers $2,000/yr for joint filers $4,000/yr program manager fidelity investments program distributor Web arizona offers a state tax deduction for contributions to a 529 plan of up to $2,000 for single filers and $4,000 for married filing jointly tax filers. Arizona residents and taxpayers are eligible for a state tax deduction on 529 contributions. However, indiana, utah and vermont offer a state income tax credit. Arizona is one of the few states.

The annual tax deduction cannot exceed $2,000 per. Contributions to any state’s 529 plan up to $2,000 ($4,000 if married) are deductible. Web the fidelity arizona college savings plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education. The arizona 529 plan is a college savings plan named after section 529 of the internal revenue code sponsored by the state of arizona. Arizona taxpayers are now eligible for a new incentive effective september 29, 2021,. Web the state of arizona offers a tax deduction each year for investing in the arizona 529 plan of up to $4,000 for married tax filers who file a joint return and up to $2,000 for individual tax. Most states only offer this benefit to. Web take advantage of the arizona tax deduction based on contributions to the bank plan! The plan is designed to pay for qualified expenses for fees,. For tax year 2022, taxpayers may subtract the amount contributed during the year up to a total of $2,000 per.

How Does an NC 529 Tax Deduction Work? CFNC

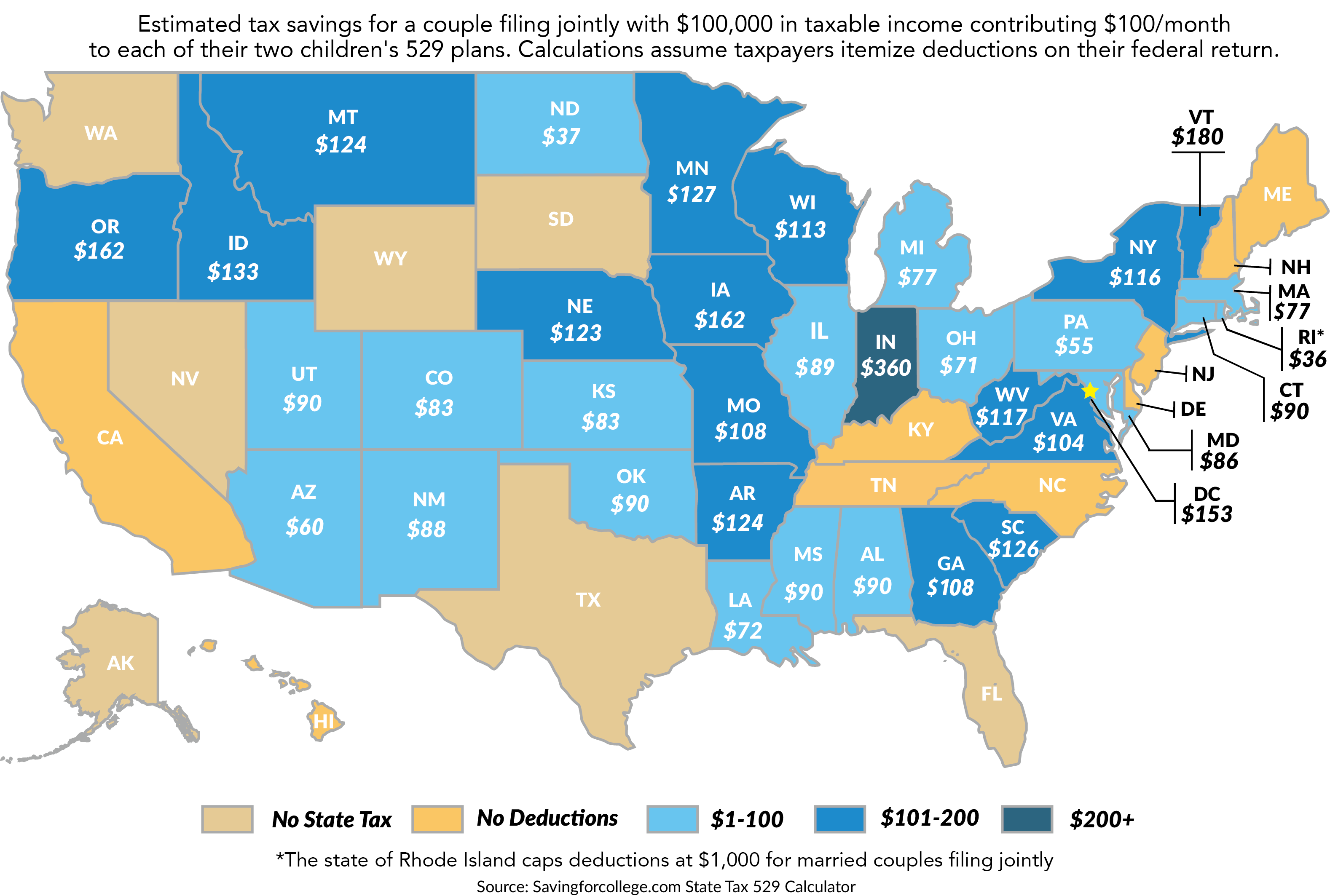

Web currently, over 30 states including the district of columbia offer a full or partial tax credit or deduction on 529 plan contributions. Web july 27, 2023 many states offer state income tax deductions or credits for contributions to a 529 plan. The arizona 529 plan is a college savings plan named after section 529 of the internal revenue code.

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Tax

Contributions to any state’s 529 plan up to $2,000 ($4,000 if married) are deductible. Arizona is one of the few states. Web the most common benefit offered is a state income tax deduction for 529 plan contributions. Web to enter the deductible portion of the contributions that were made in the desktop program, from the main menu of the arizona.

Tax Deduction Rules for 529 Plans What Families Need to Know College

Web take advantage of the arizona tax deduction based on contributions to the bank plan! The annual tax deduction cannot exceed $2,000 per. The arizona 529 plan is a college savings plan named after section 529 of the internal revenue code sponsored by the state of arizona. Web states where you can get a tax break for using any 529.

What States Offer a Tax Deduction for 529 Plans? Sootchy

The annual tax deduction cannot exceed $2,000 per. Web arizona offers a state tax deduction for contributions to a 529 plan of up to $2,000 for single filers and $4,000 for married filing jointly tax filers. Web is there a deduction for 529 plan payments for tax year 2022? Arizona taxpayers are now eligible for a new incentive effective september.

Tax Deduction Rules for 529 Plans What Families Need to Know College

Arizona is one of the few states. Web states where you can get a tax break for using any 529 plan. 14529 arizona st, fontana, ca is a single family home that contains 2,484 sq ft and was built in 1998. The arizona 529 plan is a college savings plan named after section 529 of the internal revenue code sponsored.

Colorado 529 Plan Tax Deduction Benefits for College Savings

Web arizona offers a state tax deduction for contributions to a 529 plan of up to $2,000 for single filers and $4,000 for married filing jointly tax filers. However, indiana, utah and vermont offer a state income tax credit. Web the most common benefit offered is a state income tax deduction for 529 plan contributions. Web this provides a state.

How Much Is Your State's 529 Plan Tax Deduction Really Worth?

Arizona residents and taxpayers are eligible for a state tax deduction on 529 contributions. Web july 27, 2023 many states offer state income tax deductions or credits for contributions to a 529 plan. Web currently, over 30 states including the district of columbia offer a full or partial tax credit or deduction on 529 plan contributions. 14529 arizona st, fontana,.

529 Tax Deduction The Amount Depends Your State and Plan

Arizona is one of the few states. Web the state of arizona offers a tax deduction each year for investing in the arizona 529 plan of up to $4,000 for married tax filers who file a joint return and up to $2,000 for individual tax. Contributions to any state’s 529 plan up to $2,000 ($4,000 if married) are deductible. However,.

Colorado 529 Plan Tax Deduction Benefits for College Savings

For tax year 2022, taxpayers may subtract the amount contributed during the year up to a total of $2,000 per. Web the most common benefit offered is a state income tax deduction for 529 plan contributions. Web take advantage of the arizona tax deduction based on contributions to the bank plan! Arizona taxpayers are now eligible for a new incentive.

Arizona 529 Plans Learn the Basics + Get 30 Free for College Savings

Web is there a deduction for 529 plan payments for tax year 2022? 829 tappan ave apt 105, ann arbor, mi is a apartment home that contains 850 sq ft. Web currently, over 30 states including the district of columbia offer a full or partial tax credit or deduction on 529 plan contributions. Web the fidelity arizona college savings plan.

Web To Enter The Deductible Portion Of The Contributions That Were Made In The Desktop Program, From The Main Menu Of The Arizona Return, Select:

Web july 27, 2023 many states offer state income tax deductions or credits for contributions to a 529 plan. For tax year 2022, taxpayers may subtract the amount contributed during the year up to a total of $2,000 per. Contributions to any state’s 529 plan up to $2,000 ($4,000 if married) are deductible. The plan is designed to pay for qualified expenses for fees,.

Web Take Advantage Of The Arizona Tax Deduction Based On Contributions To The Bank Plan!

14529 arizona st, fontana, ca is a single family home that contains 2,484 sq ft and was built in 1998. Web is there a deduction for 529 plan payments for tax year 2022? The amount of your 529 state tax deduction will depend on. Web the state of arizona offers a tax deduction each year for investing in the arizona 529 plan of up to $4,000 for married tax filers who file a joint return and up to $2,000 for individual tax.

Web The Fidelity Arizona College Savings Plan Is A Traditional 529 Plan That Allows You To Invest Money Today And Reap Tax Benefits When You Withdraw It To Pay For Qualified Education.

Web tax deduction for single filers $2,000/yr for joint filers $4,000/yr program manager fidelity investments program distributor Web currently, over 30 states including the district of columbia offer a full or partial tax credit or deduction on 529 plan contributions. Arizona taxpayers are now eligible for a new incentive effective september 29, 2021,. Web the most common benefit offered is a state income tax deduction for 529 plan contributions.

However, Indiana, Utah And Vermont Offer A State Income Tax Credit.

It contains 2 bedrooms and 1 bathroom. Web this provides a state of arizona income tax deduction for contributions made to 529 plan. Web before investing in any 529 plan, you should consider whether your or the beneficiary’s home state offers a 529 plan that provides its taxpayers with favorable state tax and. Arizona residents and taxpayers are eligible for a state tax deduction on 529 contributions.