Alabama Form Pte-C Instructions 2022

Alabama Form Pte-C Instructions 2022 - All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Web read guidelines, find documents, and access forms in accordance with the alabama accountability act. Click on view a return link under the appropriate account. Make payment on behalf of the owners/shareholders in lieu of individual reporting. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Do not include losses on this form.) Click on the periods and balances tab. Do not include losses on this form.) make remittance payable to:

Do not include losses on this form.) make remittance payable to: All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Do not include losses on this form.) Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Click on the periods and balances tab. Make payment on behalf of the owners/shareholders in lieu of individual reporting. Click on view a return link under the appropriate account. Web read guidelines, find documents, and access forms in accordance with the alabama accountability act.

Web read guidelines, find documents, and access forms in accordance with the alabama accountability act. Click on view a return link under the appropriate account. Do not include losses on this form.) All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Do not include losses on this form.) make remittance payable to: Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Click on the periods and balances tab. Make payment on behalf of the owners/shareholders in lieu of individual reporting.

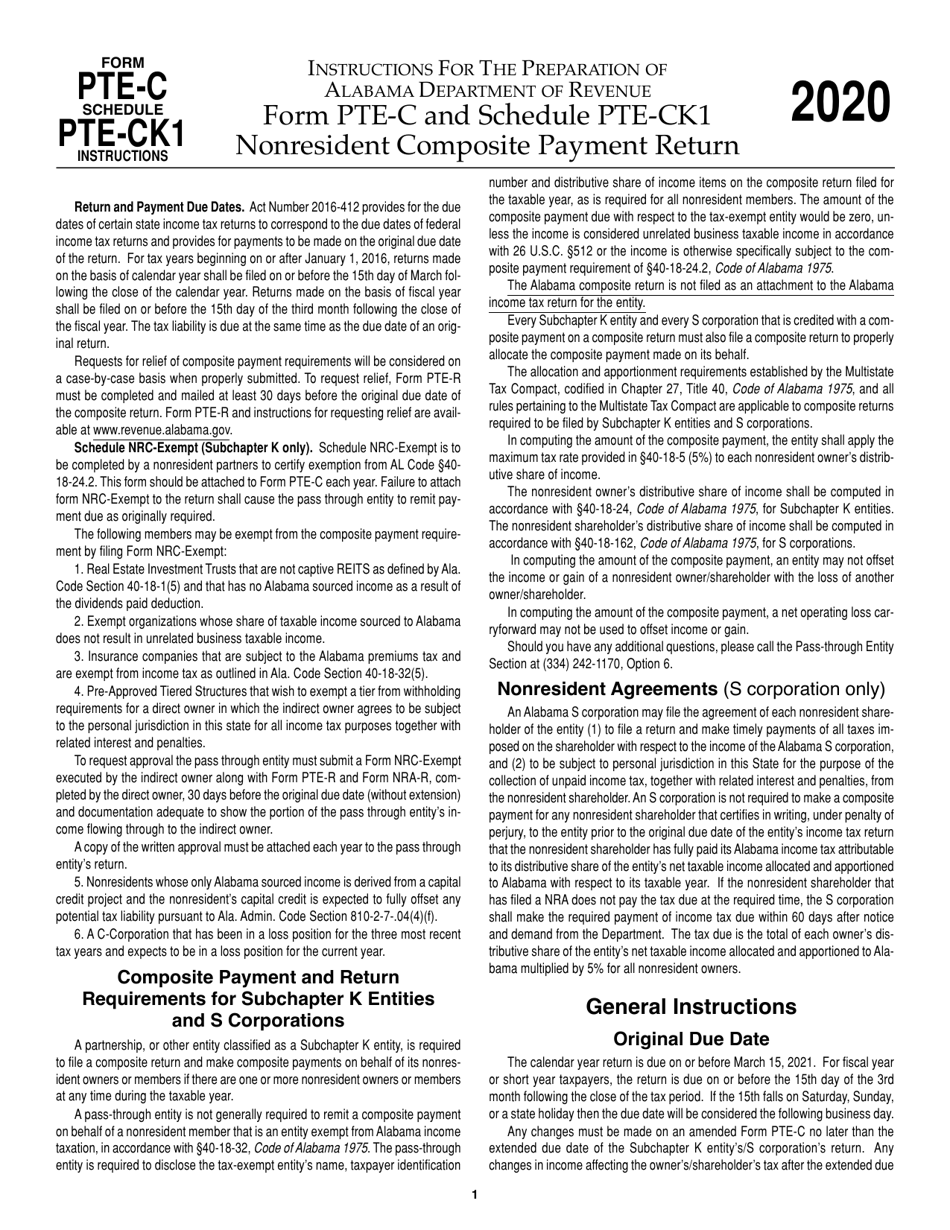

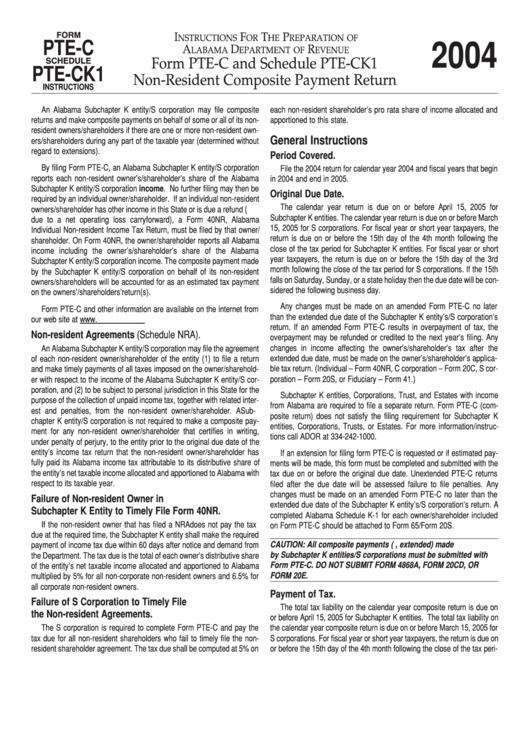

Download Instructions for Form PTEC Schedule PTECK1 Nonresident

Click on the periods and balances tab. Do not include losses on this form.) Web read guidelines, find documents, and access forms in accordance with the alabama accountability act. All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Federation of tax administrators project for the electronic filing.

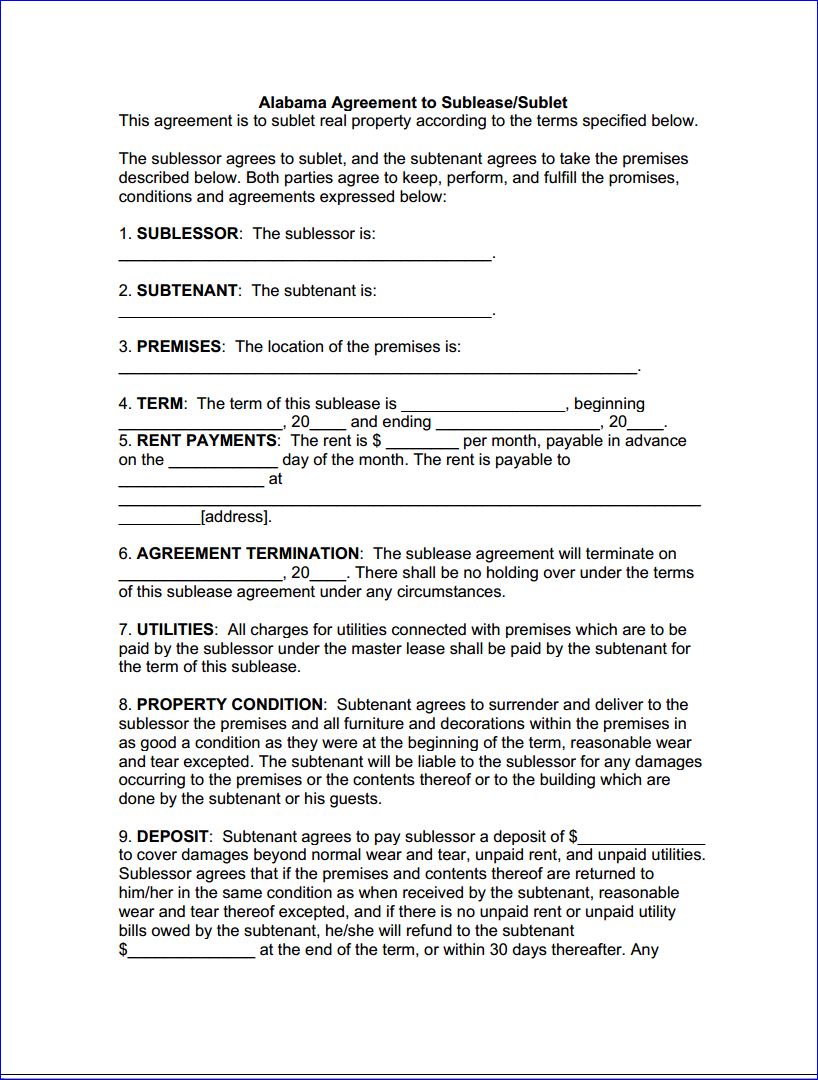

Download Free Alabama Sublease Agreement Form Printable Lease Agreement

Do not include losses on this form.) make remittance payable to: Click on view a return link under the appropriate account. All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income.

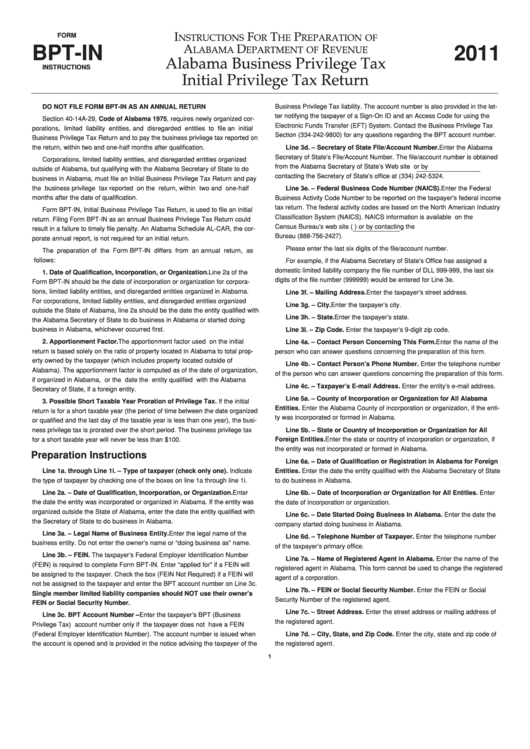

Top 14 Alabama Form Bptin Templates free to download in PDF format

Do not include losses on this form.) Click on the periods and balances tab. Do not include losses on this form.) make remittance payable to: Web read guidelines, find documents, and access forms in accordance with the alabama accountability act. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns.

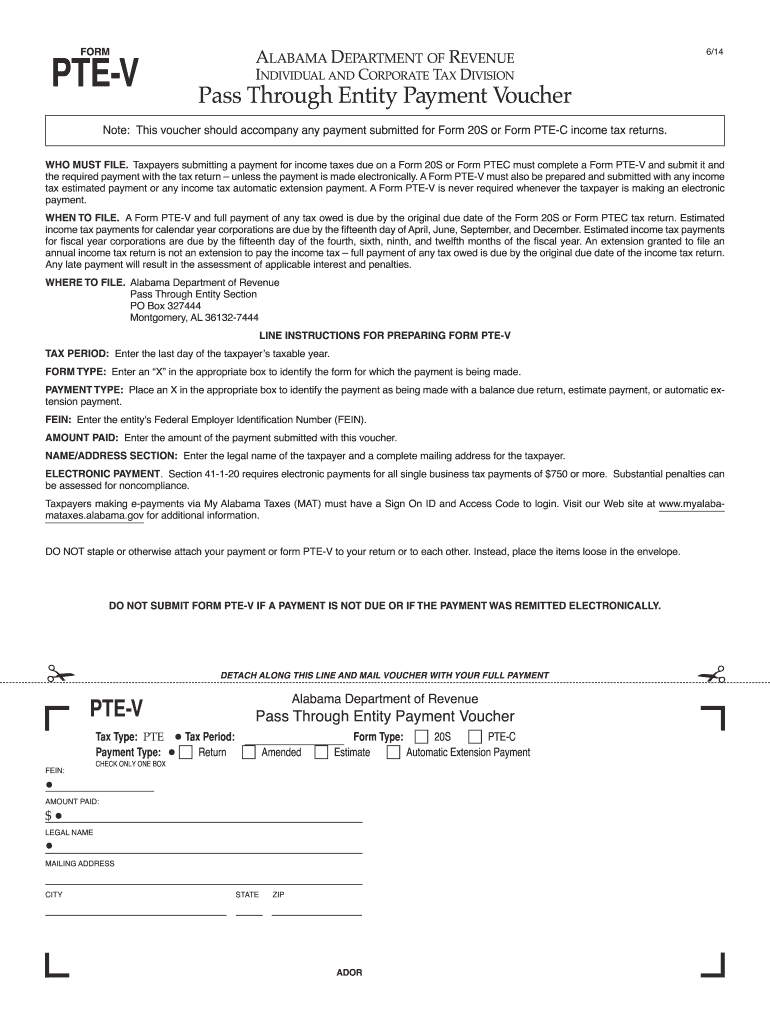

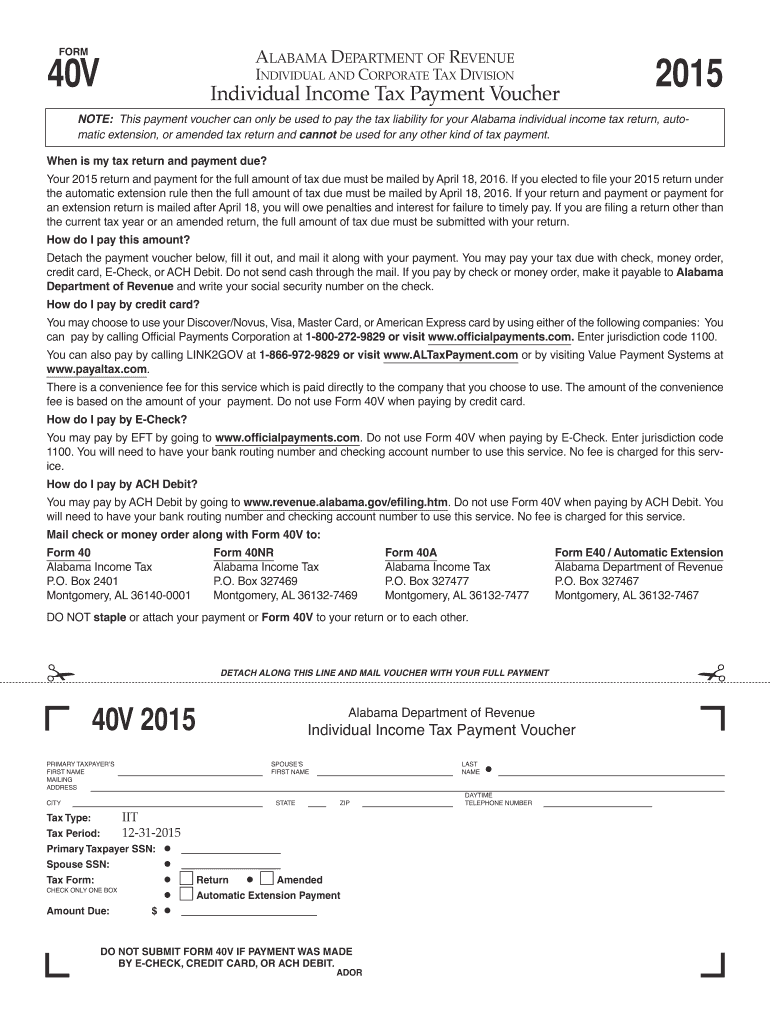

Alabama Pte V Form Fill Out and Sign Printable PDF Template signNow

Make payment on behalf of the owners/shareholders in lieu of individual reporting. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Do not include losses on this form.) Click on view a return link under the appropriate account. Do not include losses on this form.) make remittance payable to:

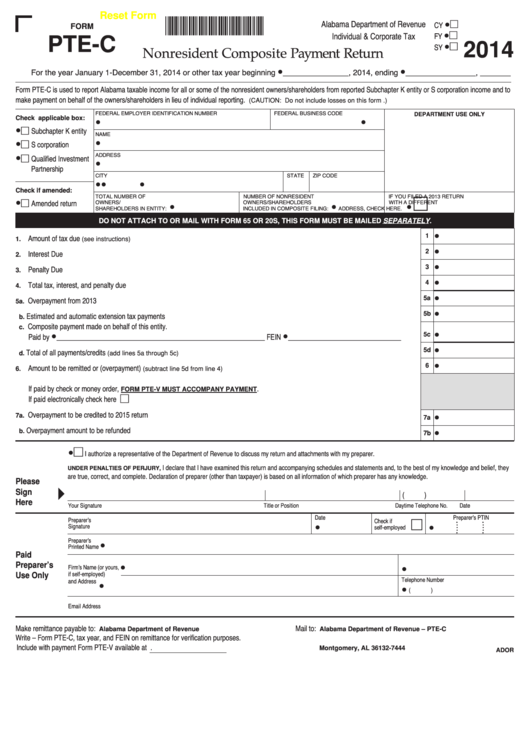

Fillable Form PteC Alabama Nonresident Composite Payment Return

Do not include losses on this form.) make remittance payable to: All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Click on view a return link under the appropriate account. Do not include losses on this form.) Make payment on behalf of the owners/shareholders in lieu of.

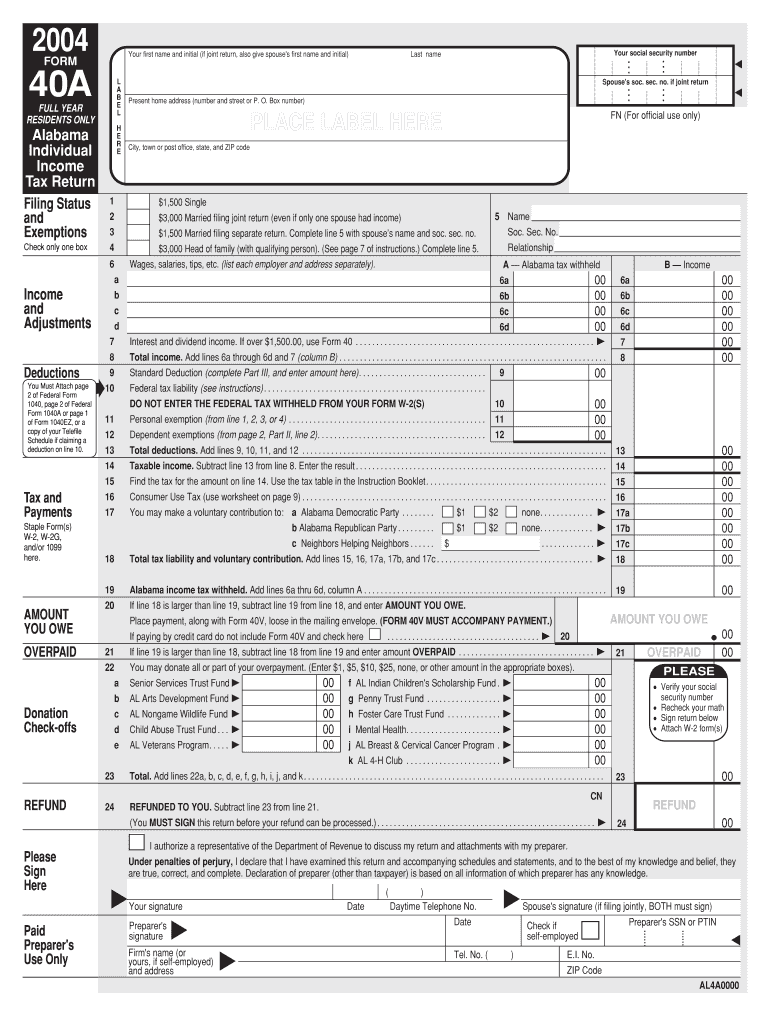

Alabama Form 40 Instructions 2019 Fill Out and Sign Printable PDF

Click on the periods and balances tab. All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Click on view a return link under the appropriate account. Do not include.

Alabama Tax Form 40 Instructions 2020 Fill Online, Printable

Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Do not include losses on this form.) Click on view a return link under the appropriate account. All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Do not include.

Form PteC And Schedule PteCk1 NonResident Composite Payment Return

Do not include losses on this form.) Make payment on behalf of the owners/shareholders in lieu of individual reporting. All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Click.

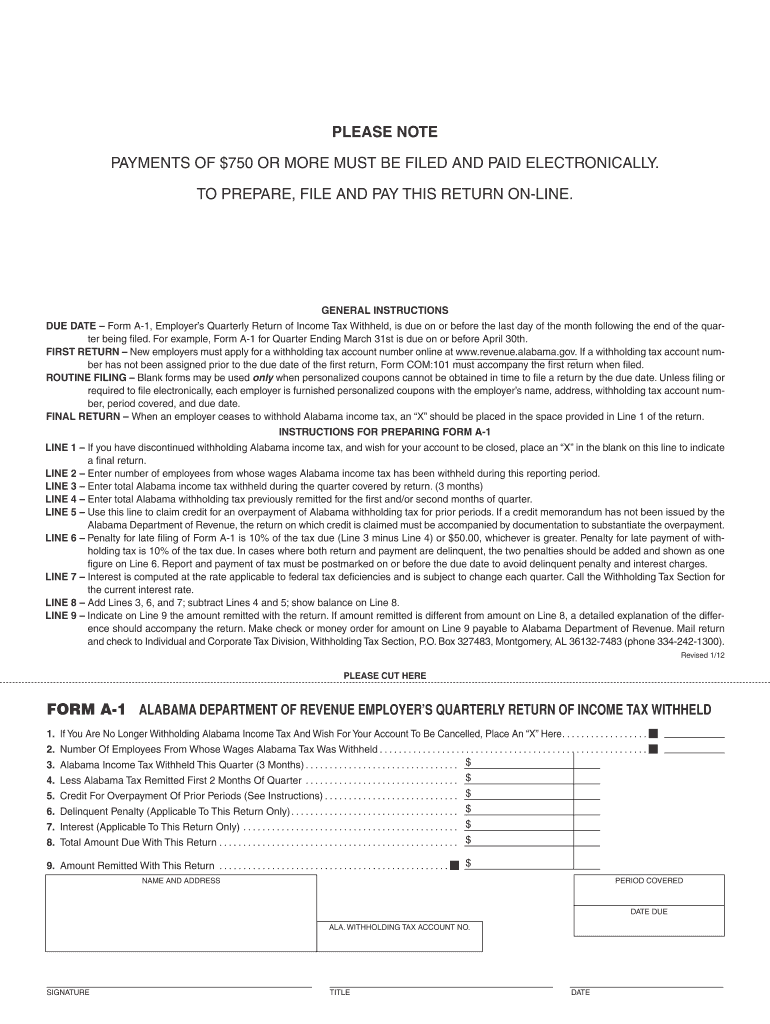

2012 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Click on view a return link under the appropriate account. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Do not include losses on this form.) make remittance payable.

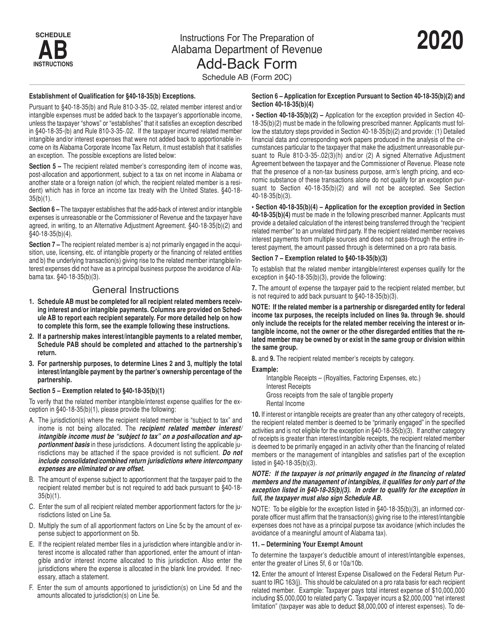

Download Instructions for Form 20C Schedule AB AddBack Form PDF, 2020

Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Make payment on behalf of the owners/shareholders in lieu of individual reporting. Web read guidelines, find documents, and access forms in accordance with the alabama accountability act. Do not include losses on this form.) make remittance payable to: Click on view a.

Click On View A Return Link Under The Appropriate Account.

All nonresident partners are included in the composite return except for qualified investment partnerships (qip), which under certain circumstances may be exempt. Federation of tax administrators project for the electronic filing of business privilege, fiduciary, corporate and partnership income returns. Web read guidelines, find documents, and access forms in accordance with the alabama accountability act. Click on the periods and balances tab.

Make Payment On Behalf Of The Owners/Shareholders In Lieu Of Individual Reporting.

Do not include losses on this form.) Do not include losses on this form.) make remittance payable to: