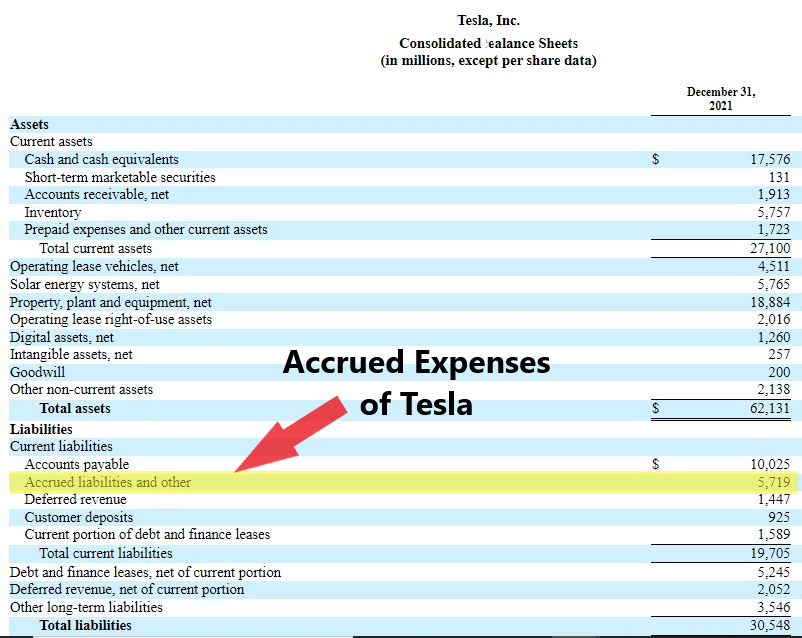

Accrued In Balance Sheet

Accrued In Balance Sheet - The accrual of an expense will usually involve an. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Web the amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. Web accruals recorded as current liabilities. Accrual accounting requires more journal entries than simple cash balance. Web key takeaways accrued expenses are recognized on the books when they are incurred, not when they are paid. It could be described as accrued.

Web key takeaways accrued expenses are recognized on the books when they are incurred, not when they are paid. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. Web accruals recorded as current liabilities. Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Web the amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. The accrual of an expense will usually involve an. It could be described as accrued. Accrual accounting requires more journal entries than simple cash balance.

If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. It could be described as accrued. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Web accruals recorded as current liabilities. Web the amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. The accrual of an expense will usually involve an. Accrual accounting requires more journal entries than simple cash balance. Web key takeaways accrued expenses are recognized on the books when they are incurred, not when they are paid.

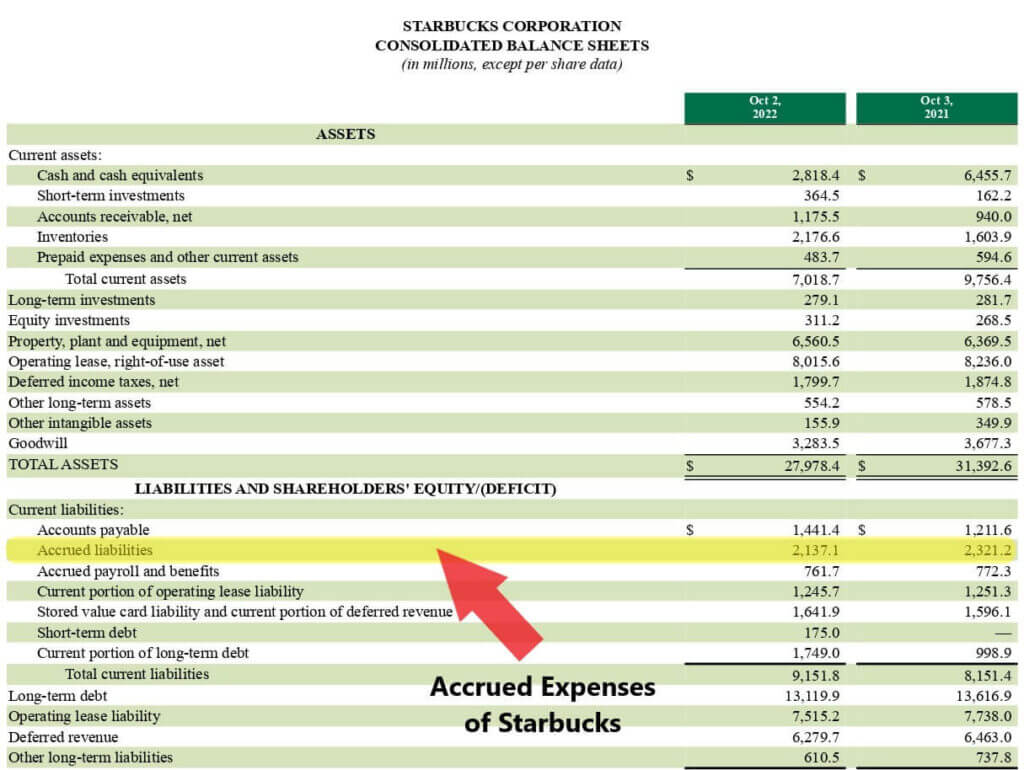

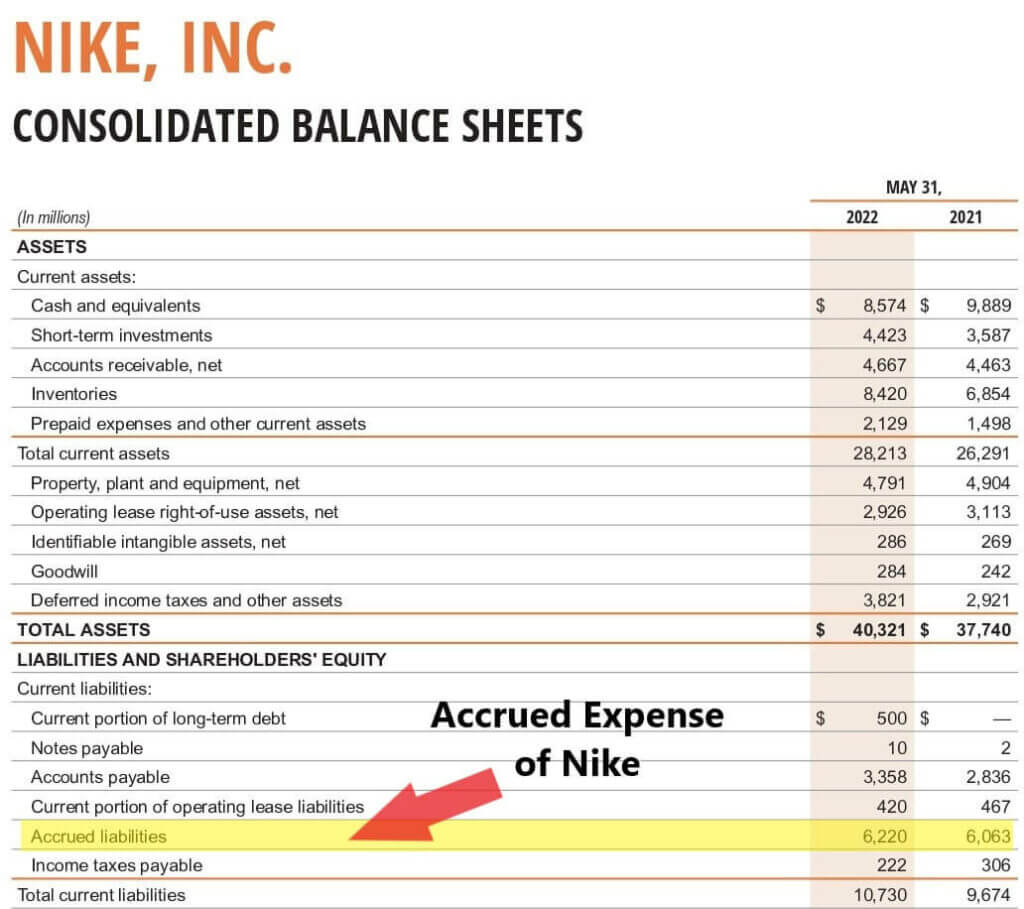

Accrued Expense Examples of Accrued Expenses

If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Web the amount of accrued.

Accrued Expense Examples of Accrued Expenses

The accrual of an expense will usually involve an. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has.

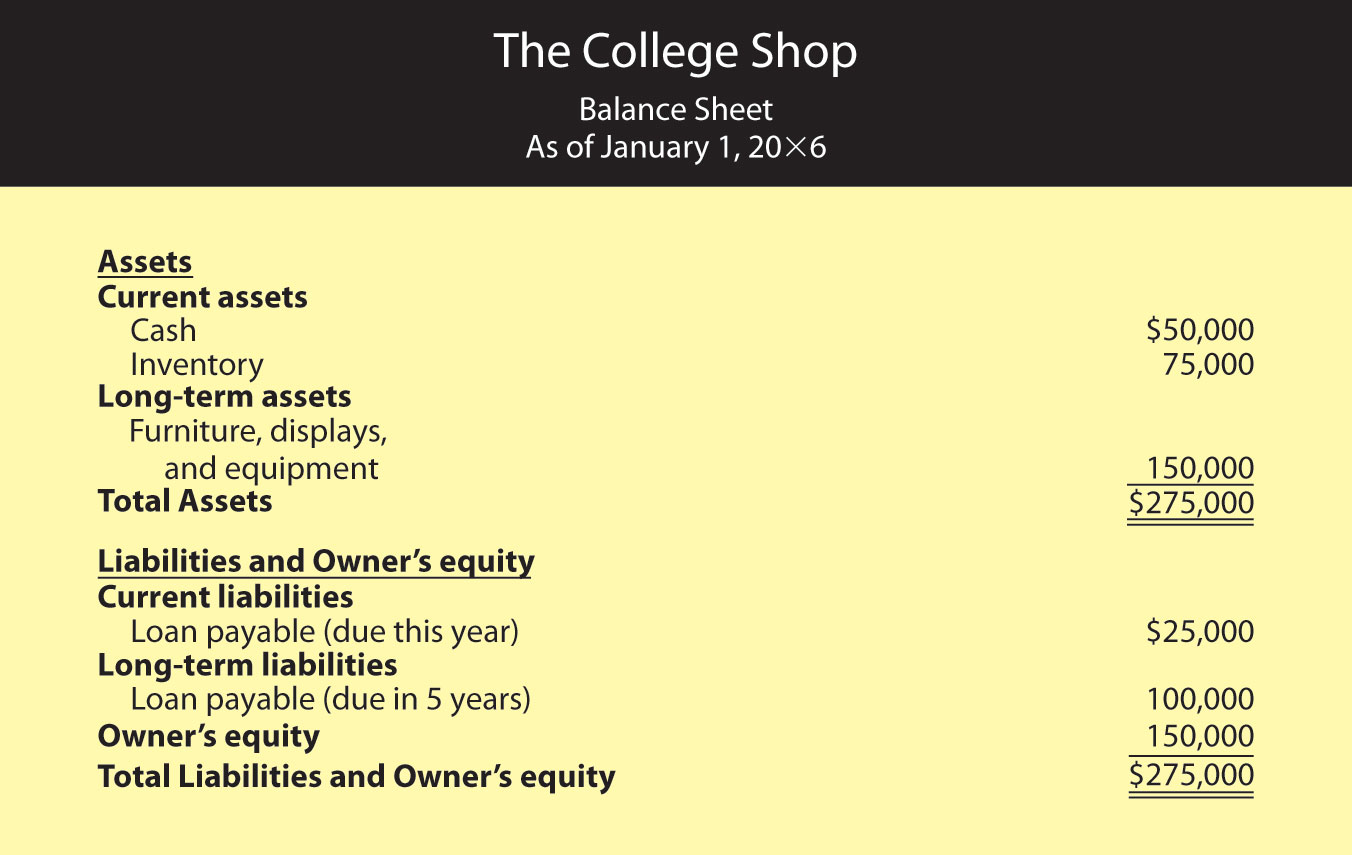

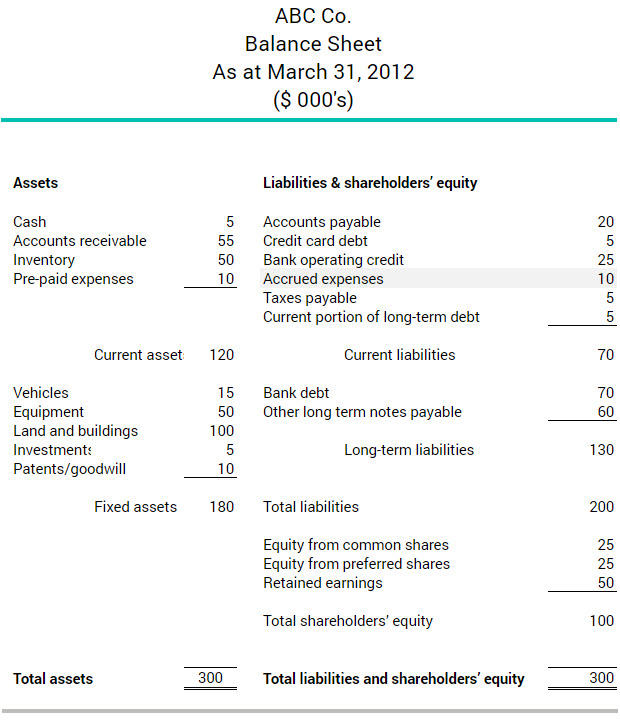

Understanding Your Balance Sheet Financial Accounting Protea

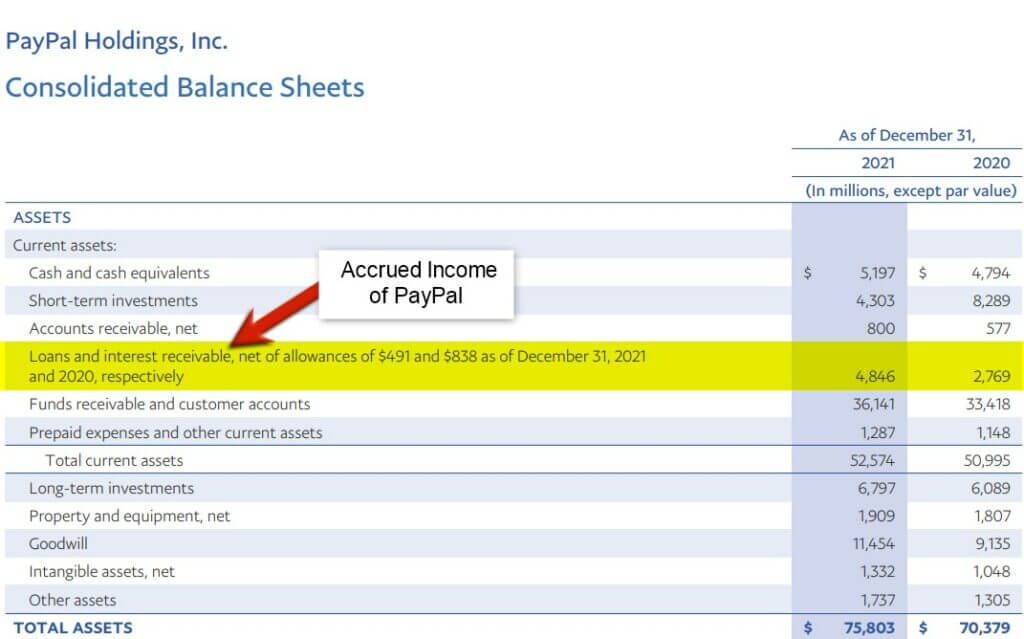

Web accruals recorded as current liabilities. Web the amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account.

12.3 Accrual Accounting Exploring Business

If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. Accrual accounting requires more journal entries than simple cash balance. Web the amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be.

What is Accrued Journal Entry, Examples, How it Works?

Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. The accrual of an expense will usually involve an. Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

The accrual of an expense will usually involve an. It could be described as accrued. Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Web key takeaways accrued expenses are recognized on the books when they are incurred, not when they.

Accrued revenue how to record it in 2023 QuickBooks

Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Web key takeaways accrued expenses are recognized on the books when they are incurred, not when they are paid. The accrual of an expense will usually involve an. Web accruals recorded as.

Balance sheet example Accounting Play

Web accruals recorded as current liabilities. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue.

Accrued Expense Examples of Accrued Expenses

If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Web key takeaways accrued expenses.

What are accrued expenses BDC.ca

Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. It could be described as accrued. Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not.

Web Accruals Recorded As Current Liabilities.

The accrual of an expense will usually involve an. Web the amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. It could be described as accrued. Web the accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction.

If You Record An Accrual For Revenue That You Have Not Yet Billed, Then You Are Crediting The Revenue Account And Debiting An Unbilled Revenue Account.

Web accruals are revenues earned or expenses incurred that impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Accrual accounting requires more journal entries than simple cash balance. Web key takeaways accrued expenses are recognized on the books when they are incurred, not when they are paid.