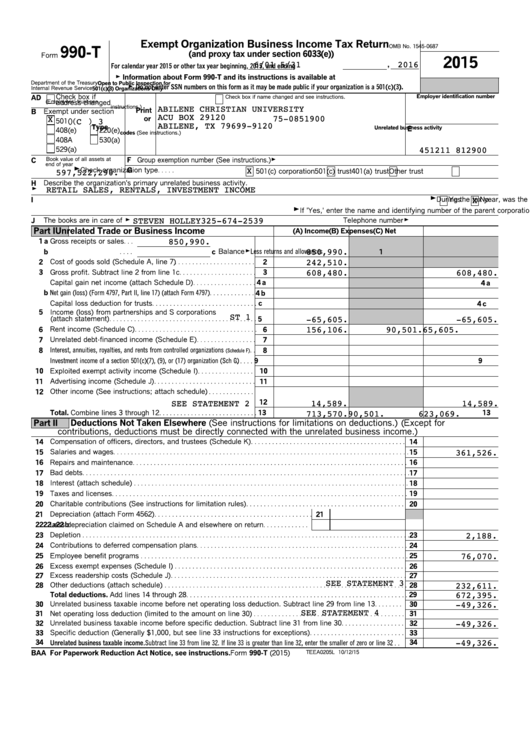

990T Tax Form

990T Tax Form - The custodian of your ira files it. G b total tax (form 4720, part iii, line 1) 7b part ii declaration and signature authorization of officer. Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. This return must also be filed annually. Web tax filings and audits by year. (and proxy tax under section 6033(e)) for calendar year. Check box if reporting two or more periodicals on a consolidated basis. Web exempt organization business income tax return. Web part i, line 11 from: An organization must pay estimated tax if.

Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. And form 4720, return of. Supports current & prior year filings. Web part i, line 11 from: 3a $ b if this application is for. For calendar year 2020 or other. Web tax filings and audits by year. Ad access irs tax forms. The custodian of your ira files it. (and proxy tax under section 6033(e)) for calendar year.

Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. (and proxy tax under section 6033(e)) department of the treasury internal revenue service. Check box if reporting two or more periodicals on a consolidated basis. Web part i, line 11 from: Generating/preparing a short year return;. And form 4720, return of. Nols can be provided using the. Complete, edit or print tax forms instantly.

What Is A 990T bmpspatula

Web part i, line 11 from: See instructions alternative minimum tax (trusts only). Ad access irs tax forms. Tax rate schedule or schedule d (form 1041) proxy tax. Exempt organization business income tax return.

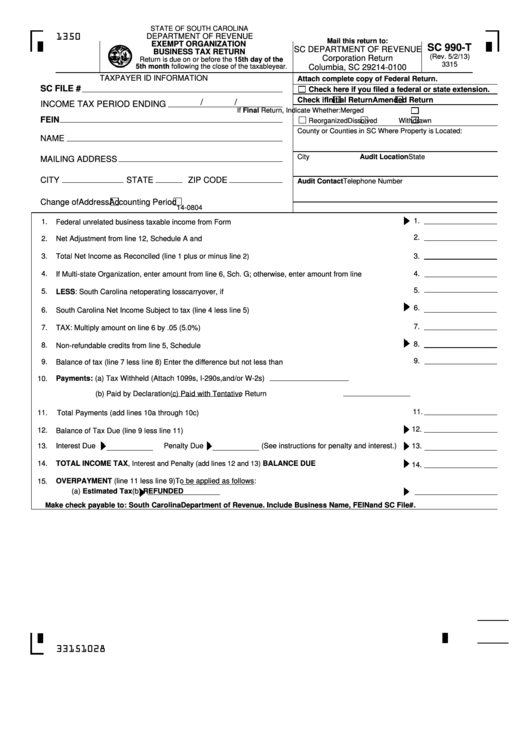

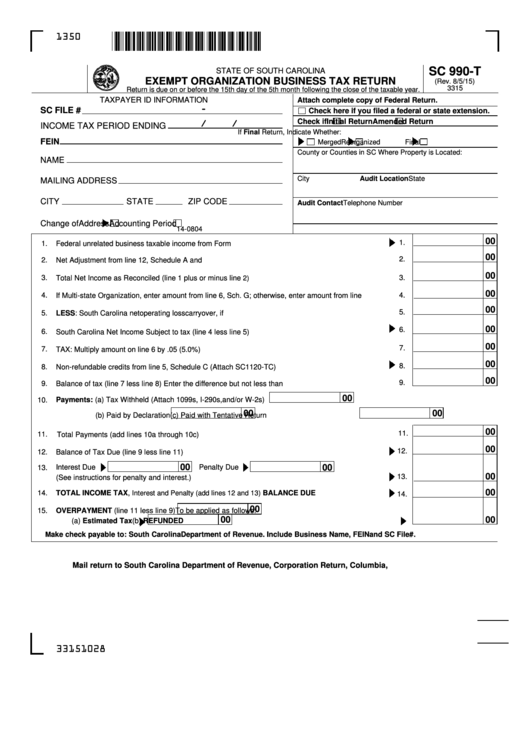

Top 16 Form 990t Templates free to download in PDF format

3a $ b if this application is for. Web part i, line 11 from: In a nutshell, the form gives the irs an overview of the. Generating/preparing a short year return;. And form 4720, return of.

Form Sc 990T Exempt Organization Business Tax Return printable pdf

Get ready for tax season deadlines by completing any required tax forms today. See instructions alternative minimum tax (trusts only). Supports current & prior year filings. Luke’s health system is required to file an irs form 990 annually. The custodian of your ira files it.

Form Ct990t Ext Application For Extension Of Time To File Unrelated

And form 4720, return of. Complete, edit or print tax forms instantly. (and proxy tax under section 6033(e)) for calendar year. A quick & easy breakdown. Check box if reporting two or more periodicals on a consolidated basis.

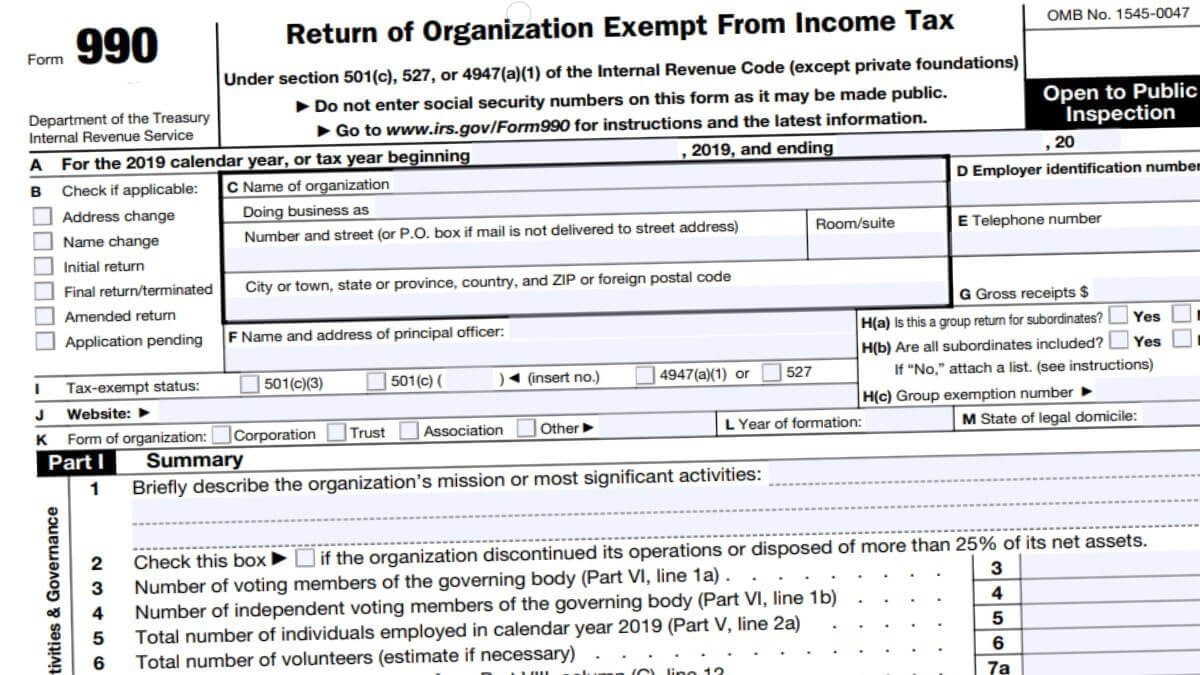

990 Form 2021

The custodian of your ira files it. Web exempt organization business income tax return. G b total tax (form 4720, part iii, line 1) 7b part ii declaration and signature authorization of officer. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on.

Blog 1 Tips on How to Read Form 990

Web exempt organization business income tax return. Department of the treasury internal revenue service. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. G b total tax (form 4720, part iii, line 1) 7b part ii declaration and signature authorization.

Form 990T by Hawaii Community Foundation Issuu

Web tax filings and audits by year. See instructions other tax amounts. Web federal form 1120 (such as federal forms 1120pol, 1120h, 1120sf, 1120reit, 990t, or 1120c), shall attach a copy of the appropriate federal form and make the computations. Get ready for tax season deadlines by completing any required tax forms today. This return must also be filed annually.

Form Sc 990T Exempt Organization Business Tax Return printable pdf

G b total tax (form 4720, part iii, line 1) 7b part ii declaration and signature authorization of officer. See instructions alternative minimum tax (trusts only). Exempt organization business income tax return. Supports current & prior year filings. Generating/preparing a short year return;.

Form 990T Exempt Organization Business Tax Return (and proxy…

Nols can be provided using the. Tax rate schedule or schedule d (form 1041) proxy tax. 3a $ b if this application is for. Web federal form 1120 (such as federal forms 1120pol, 1120h, 1120sf, 1120reit, 990t, or 1120c), shall attach a copy of the appropriate federal form and make the computations. Get ready for tax season deadlines by completing.

Nols Can Be Provided Using The.

Web federal form 1120 (such as federal forms 1120pol, 1120h, 1120sf, 1120reit, 990t, or 1120c), shall attach a copy of the appropriate federal form and make the computations. An organization must pay estimated tax if. Check box if reporting two or more periodicals on a consolidated basis. Luke’s health system is required to file an irs form 990 annually.

Generating/Preparing A Short Year Return;.

Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. The custodian of your ira files it. (and proxy tax under section 6033(e)) for calendar year. In a nutshell, the form gives the irs an overview of the.

(And Proxy Tax Under Section 6033(E)) Department Of The Treasury Internal Revenue Service.

See instructions alternative minimum tax (trusts only). See instructions other tax amounts. For calendar year 2020 or other. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web part i, line 11 from: And form 4720, return of. Supports current & prior year filings. Department of the treasury internal revenue service.