990 Ez Form Instructions

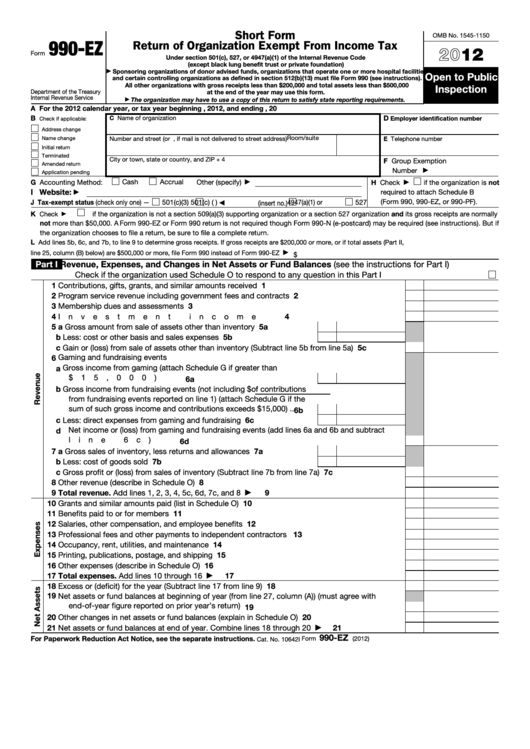

990 Ez Form Instructions - Complete, edit or print tax forms instantly. Luckily, the irs has defined the qualities that. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Public charity status and public support. Basic organization information according to the irs, organizations must provide the following details: Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Complete, edit or print tax forms instantly. Web solved • by intuit • 66 • updated 1 year ago for tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. Ad get ready for tax season deadlines by completing any required tax forms today.

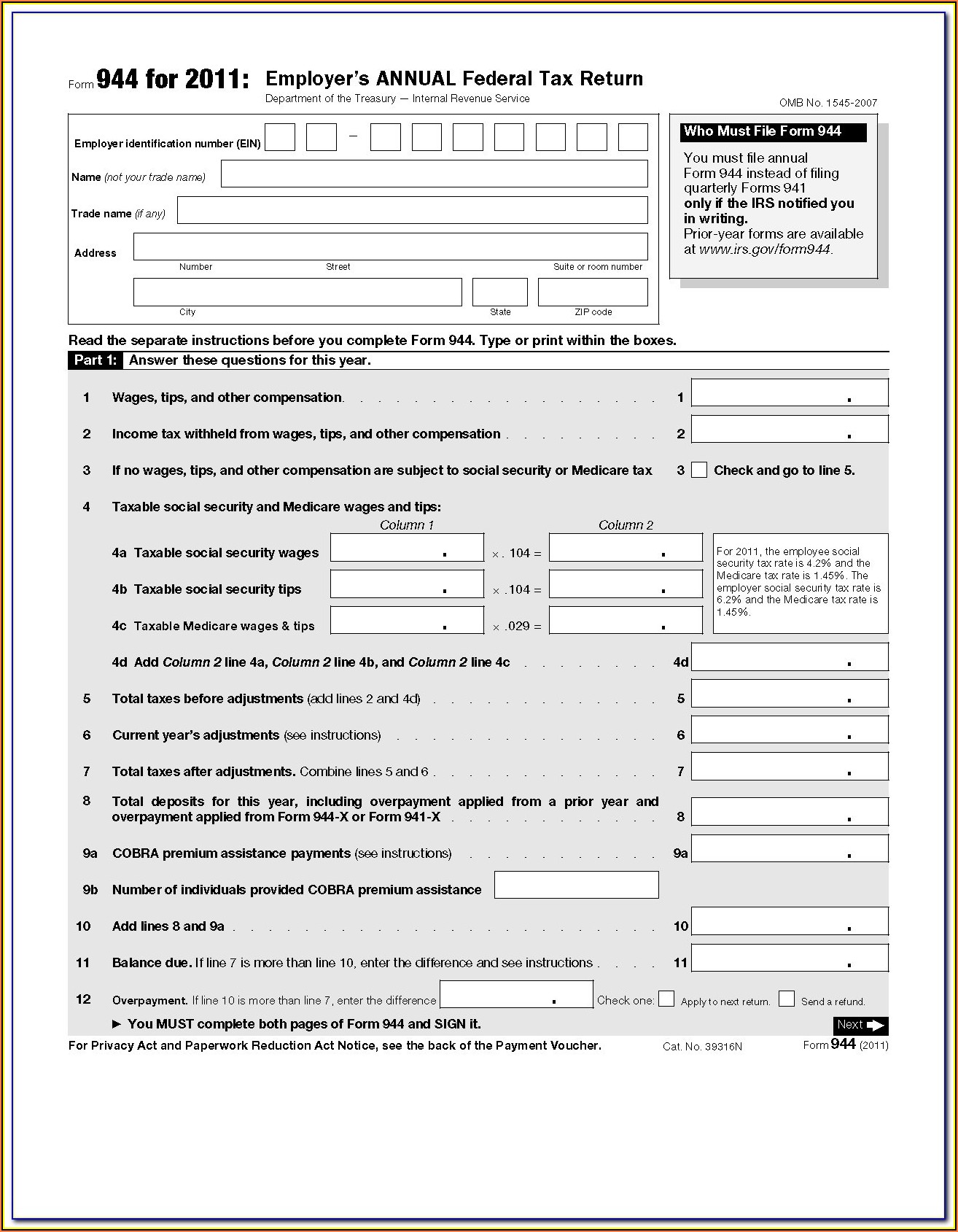

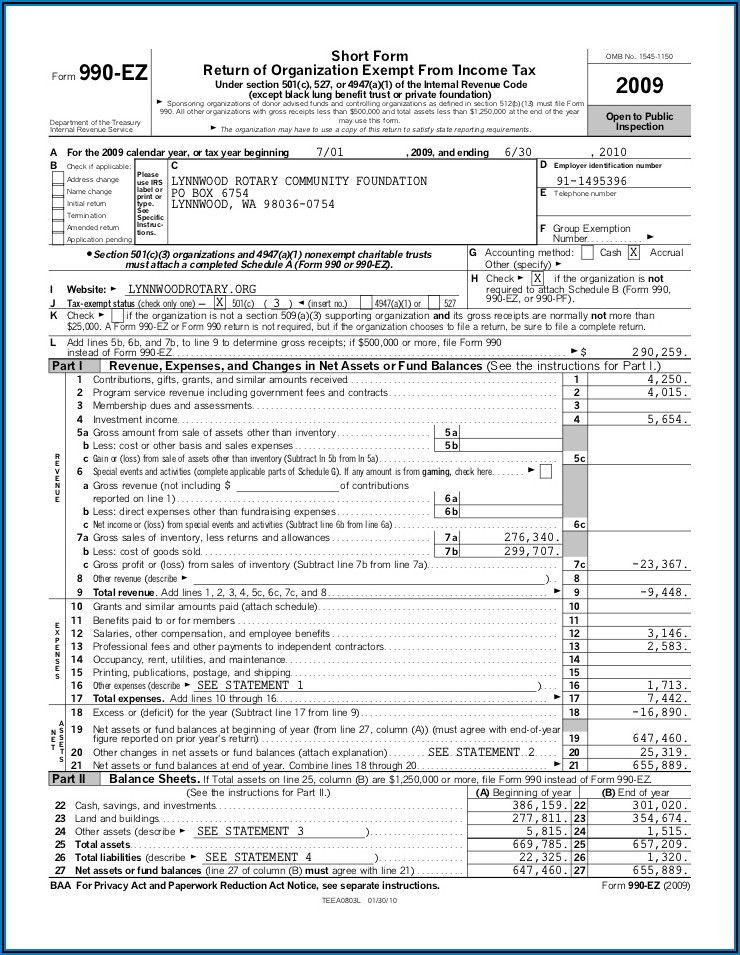

The organizations with gross receipts less. Web solved • by intuit • 66 • updated 1 year ago for tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. Short form return of organization exempt from income tax. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). Ad get ready for tax season deadlines by completing any required tax forms today. Basic organization information according to the irs, organizations must provide the following details: A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Ad get ready for tax season deadlines by completing any required tax forms today. Complete if the organization is a section 501(c)(3).

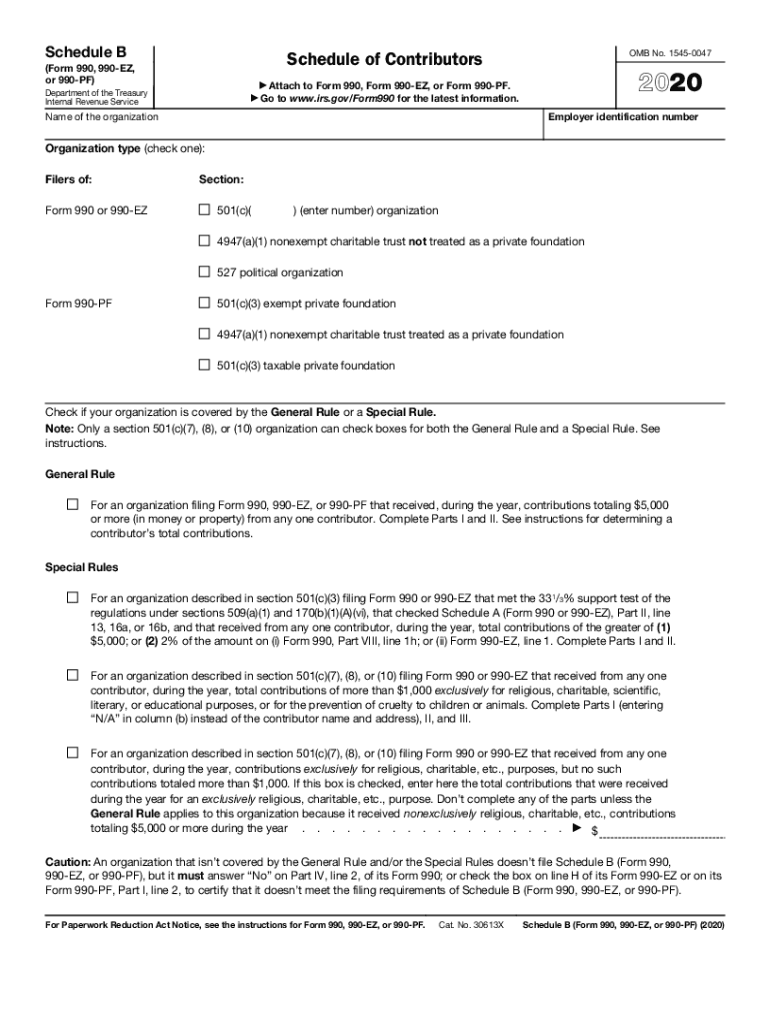

Basic organization information according to the irs, organizations must provide the following details: A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. Web short form return of organization exempt from income tax. The organizations with gross receipts less. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). Instructions for these schedules are. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Public charity status and public support. Basic organization information according to the irs, organizations must provide the following details: Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web short form return of organization exempt from income tax. Complete, edit or print tax forms instantly.

Irs Forms 990 Ez Form Resume Examples emVKvWnYrX

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Ad get.

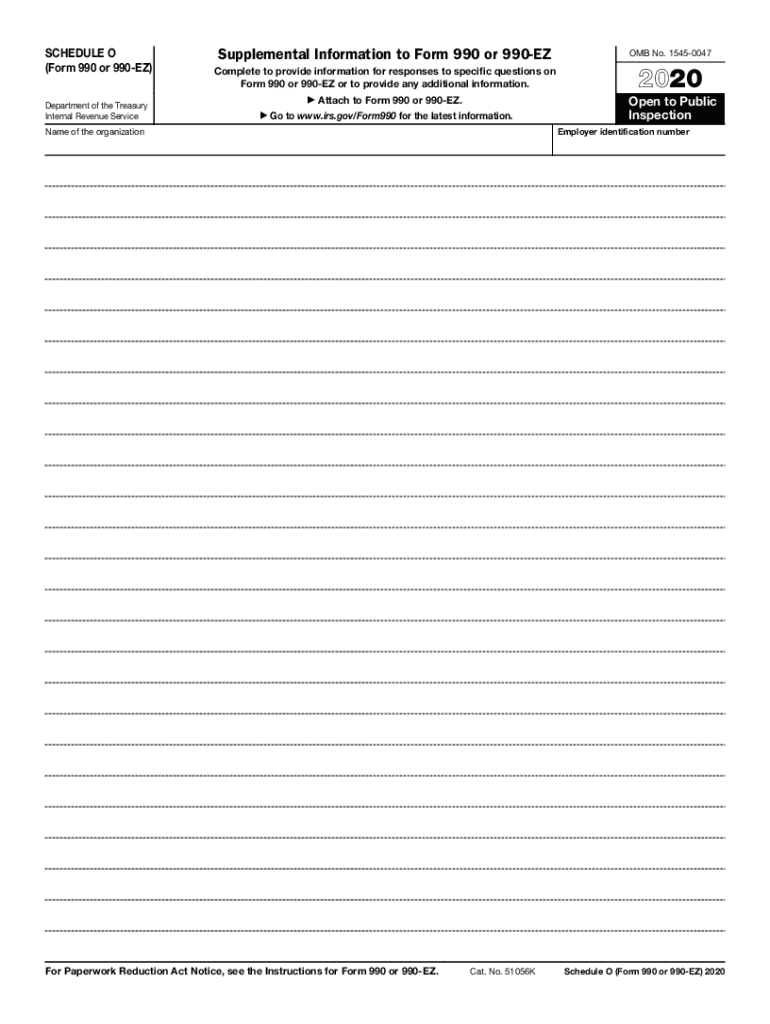

990 Schedule O Fill Out and Sign Printable PDF Template signNow

The organizations with gross receipts less. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Basic organization information according to the irs, organizations must provide the following details: Instructions for these schedules are. Complete, edit or print tax forms instantly.

Form 990EZ Short Form Return of Organization Exempt from Tax

The organizations with gross receipts less. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web solved • by intuit • 66 • updated 1 year ago for tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. Basic organization information according to the irs, organizations must provide the.

Irs Form 990 Ez Schedule A Instructions Form Resume Examples

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Basic organization information according to the irs, organizations must provide the following details: Complete if the organization is a section 501(c)(3). Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Public charity.

Fillable Form 990Ez Short Form Return Of Organization Exempt From

Public charity status and public support. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. The organizations with gross receipts less.

Printable Form Instructions 990EZ Broward Florida Fill Exactly for

Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). Complete, edit or print tax forms instantly. Short form return of organization exempt from income tax. Web short form return of organization exempt from income tax. Public charity status and public support.

Federal Tax Form 990 Ez Instructions Form Resume Examples 0g27lBAx9P

Complete, edit or print tax forms instantly. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web short form return of organization exempt from income tax. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations.

Federal Tax Form 990 Ez Form Resume Examples Kw9k4GbZYJ

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Complete if the organization is a section 501(c)(3). Web solved • by intuit • 66 • updated 1 year ago for tax years beginning on.

2020 Form IRS Instructions Schedule A (990 or 990EZ) Fill Online

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Basic organization information according to the irs, organizations must provide the following details: Luckily, the irs has defined the qualities that. Public charity status and public support. Ad get ready for tax season deadlines by completing any required tax forms today.

Ad Download Or Email Irs 990Ez & More Fillable Forms, Register And Subscribe Now!

Public charity status and public support. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29). Web short form return of organization exempt from income tax. Ad get ready for tax season deadlines by completing any required tax forms today.

Web The 2020 Form 990 Instructions Contain Reminders That, Starting With Tax Years Beginning On Or After July 2, 2019, All Organizations Must File Form 990 Series Returns Electronically.

Complete if the organization is a section 501(c)(3). Instructions for these schedules are. Complete, edit or print tax forms instantly. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social.

The Organizations With Gross Receipts Less.

Complete, edit or print tax forms instantly. Basic organization information according to the irs, organizations must provide the following details: Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web solved • by intuit • 66 • updated 1 year ago for tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns.

A Supporting Organization Described In Section 509 (A) (3) Is Required To File Form 990 (Or.

Luckily, the irs has defined the qualities that. Short form return of organization exempt from income tax. Ad get ready for tax season deadlines by completing any required tax forms today.