941 N Form

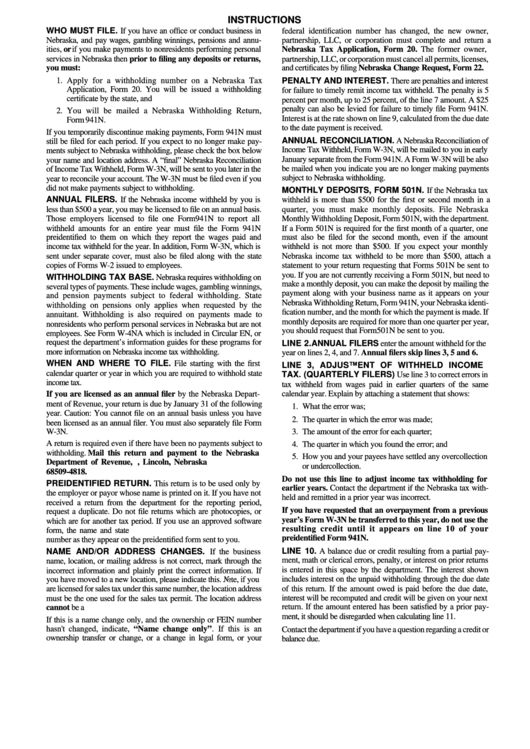

941 N Form - Complete the id number, tax period, name, and address information. Web form 941n name and location address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address information, see. Web form 941n name and location address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address information, see. Nebraska income tax withholding return (11/2022) 941n. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Enter the amount paid with form 941. Nebraska monthly income tax withholding deposit (10/2022) 501n. Form 941 is used by employers. Easily fill out pdf blank, edit, and sign them. Web mailing addresses for forms 941.

Web form 941 for 2022: Complete the id number, tax period, name, and address information. Web form 941n name and location address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address information, see. Nebraska recently updated forms 941n and 501n for tax year 2021. Save or instantly send your ready documents. Nebraska income tax withholding return (11/2022) 941n. Enter the amount paid with form 941. Web form 941n name and location address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address information, see. Form 941n is the nebraska income tax withholding return, used for. You must attach form 8974).

Web complete form 941n online with us legal forms. Save or instantly send your ready documents. Web form 941, write “applied for” and the date you applied in this entry space. Nonrefundable portion of credit for qualified sick and family leave wages for leave taken. See line 3 instructions if the income tax withholding was reported incorrectly. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers. Complete the id number, tax period, name, and address information. Enter the amount paid with form 941. (withholding payment/deposit uses same nebraska id number and pin) step 2.

W3N Fill Out and Sign Printable PDF Template signNow

Web mailing addresses for forms 941. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Complete the id number, tax period, name, and address information. Enter the amount paid with form 941. Connecticut, delaware, district of columbia,.

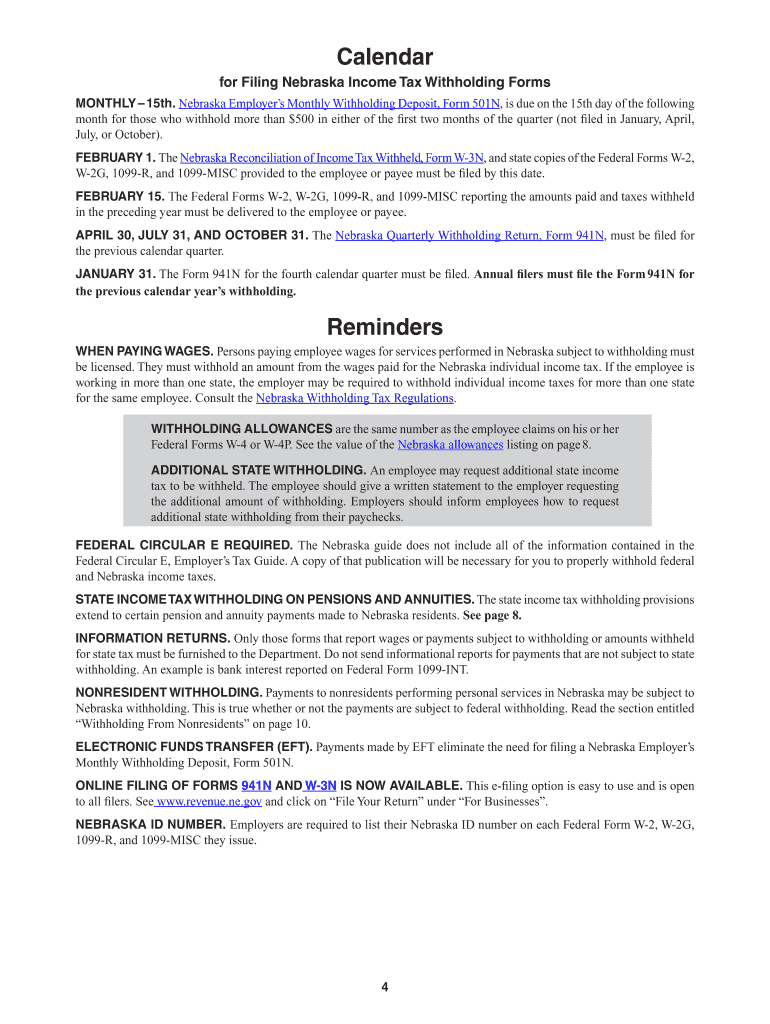

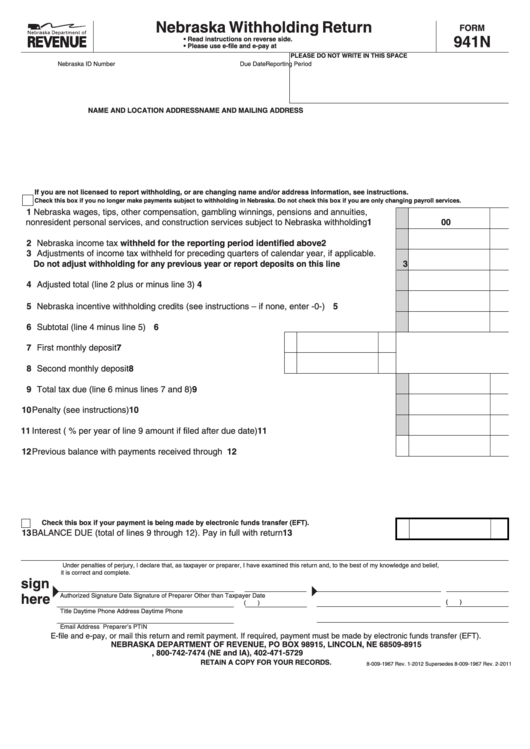

Form 941n Nebraska Withholding Return printable pdf download

Connecticut, delaware, district of columbia, georgia,. You must attach form 8974). Web form 941n name and location address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address information, see. Form 941n is the nebraska income tax withholding return, used for. See line 3 instructions if the income tax withholding was reported incorrectly.

Form 941 YouTube

See line 3 instructions if the income tax withholding was reported incorrectly. Form 941 is used by employers. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Nebraska monthly income tax withholding deposit (10/2022) 501n. Complete the id number, tax period, name, and address information.

Form 941N Download Fillable PDF or Fill Online Nebraska Tax

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. (withholding payment/deposit uses same nebraska id number and pin) step 2. Easily fill out pdf blank, edit, and sign them. Nebraska income tax withholding return (11/2022) 941n. Nebraska monthly income tax withholding deposit (10/2022) 501n.

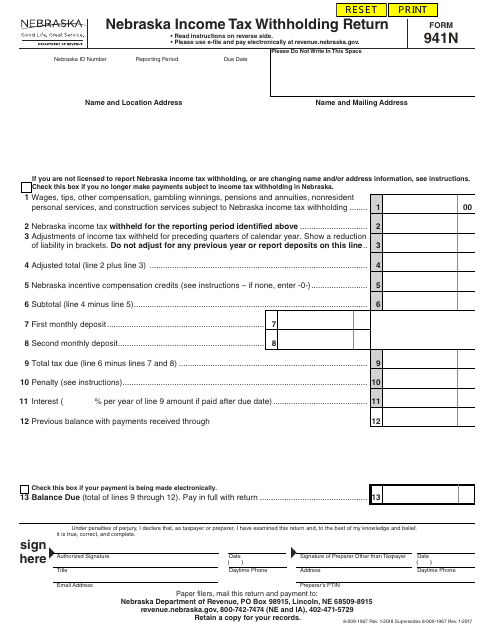

Instructions For Form 20 Nebraska Tax Application And Form 941n

See line 3 instructions if the income tax withholding was reported incorrectly. Nebraska monthly income tax withholding deposit (10/2022) 501n. Enter the amount paid with form 941. Web complete form 941n online with us legal forms. Connecticut, delaware, district of columbia, georgia,.

Your Ultimate Form 941 HowTo Guide Blog TaxBandits

June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web form 941 for 2022: Nebraska monthly income tax withholding deposit (10/2022) 501n. Enter the amount paid with form 941. Web december 6, 2021.

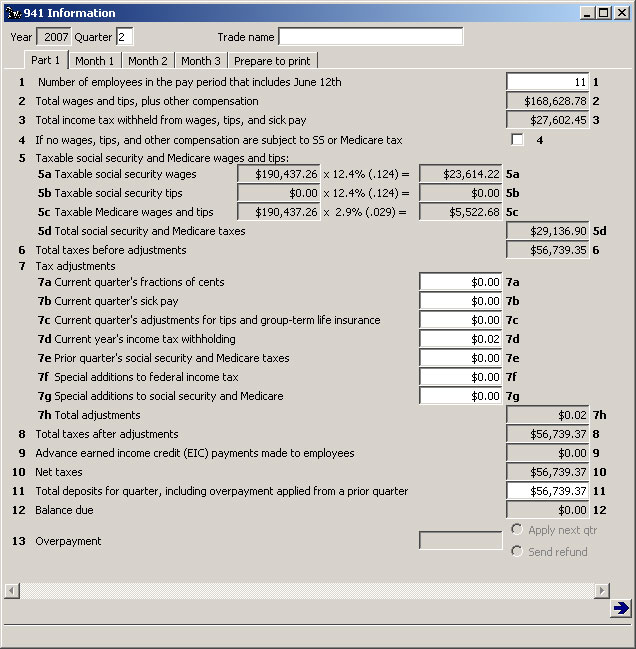

21st Century Accounting Print 941 Information

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Form 941n is the nebraska income tax withholding return, used for. (withholding payment/deposit uses.

Form 941

Web form 941 for 2022: Save or instantly send your ready documents. Web section 9501 of the american rescue plan act of 2021 (the arp) provided for cobra premium assistance in the form of a full reduction in the premium otherwise payable by. Web december 6, 2021. Form 941 is used by employers.

New 941 form for second quarter payroll reporting

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941, write “applied for” and the date you applied in this entry space. Income tax return for electing alaska native settlement trusts, including recent updates, related forms and instructions on how to file. See line 3 instructions.

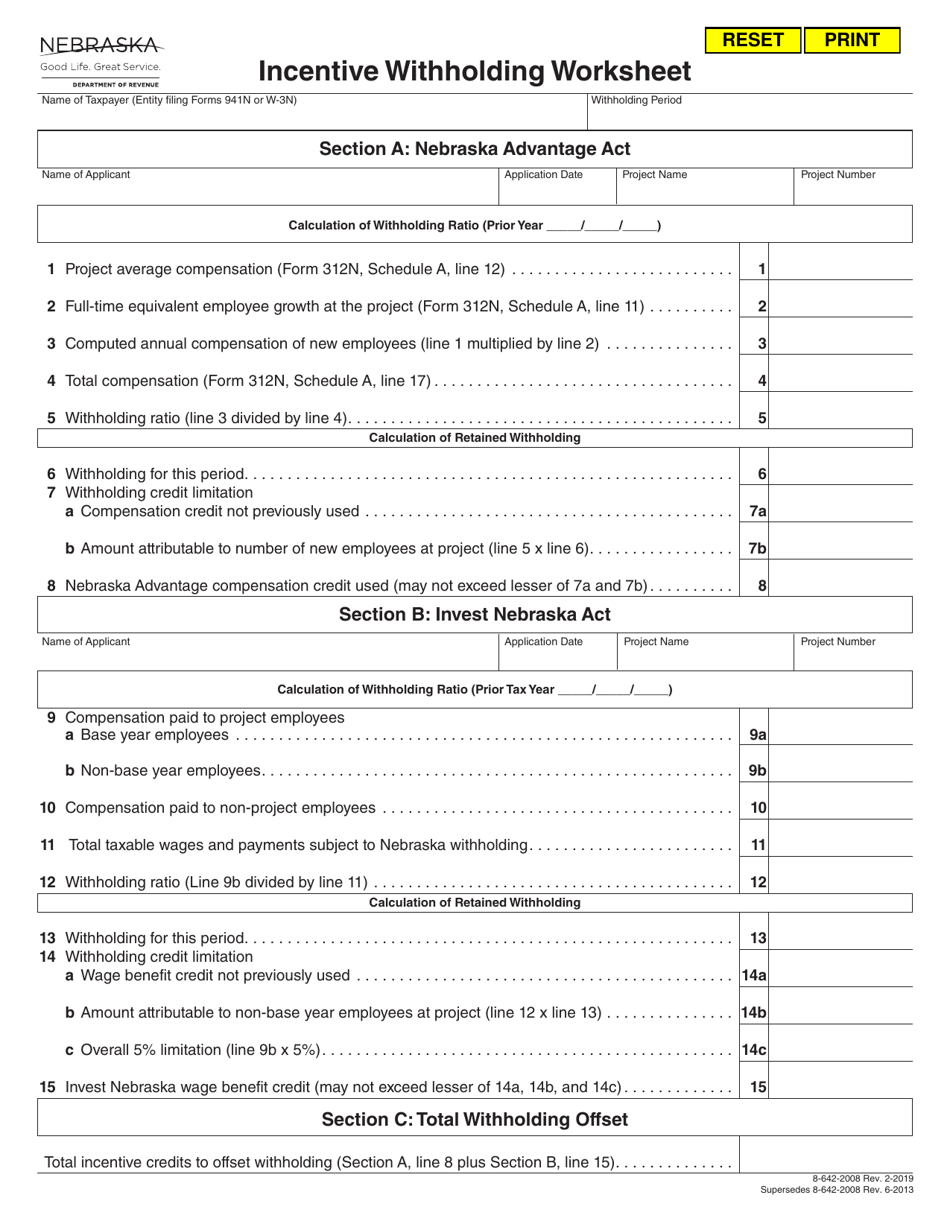

Nebraska Incentive Withholding Worksheet Download Fillable PDF

Save or instantly send your ready documents. (withholding payment/deposit uses same nebraska id number and pin) step 2. Nonrefundable portion of credit for qualified sick and family leave wages for leave taken. Web mailing addresses for forms 941. Nebraska income tax withholding return (11/2022) 941n.

You Must Attach Form 8974).

Web form 941n name and location address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address information, see. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Easily fill out pdf blank, edit, and sign them. Web december 6, 2021.

Web Form 941N Name And Location Address If You Are Not Licensed To Report Nebraska Income Tax Withholding, Or Are Changing Name And/Or Address Information, See.

Form 941n is the nebraska income tax withholding return, used for. Nebraska monthly income tax withholding deposit (10/2022) 501n. Connecticut, delaware, district of columbia, georgia,. Nebraska recently updated forms 941n and 501n for tax year 2021.

(Withholding Payment/Deposit Uses Same Nebraska Id Number And Pin) Step 2.

Web section 9501 of the american rescue plan act of 2021 (the arp) provided for cobra premium assistance in the form of a full reduction in the premium otherwise payable by. Web form 941 for 2022: Dor will not mail form 941n to anyone required to pay and file returns electronically, or. Form 941 is used by employers.

Save Or Instantly Send Your Ready Documents.

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken. Nebraska income tax withholding return (11/2022) 941n. Web to print a form 941n. Web complete form 941n online with us legal forms.