623 Dispute Letter Template

623 Dispute Letter Template - Signnow has paid close attention to ios users and developed an application just for them. For the rest of you who know what it’s for, use the links below to get to what you came here for. A letter is end to the oc invoking a 623 investigation. You’re probably here because you have negative or inaccurate items on your credit report and you want or needto remove them. Web furnisher must thereafter report the correct information to cras. <driver’s product number (optional)> <.</p> Web what is a 623 dispute letter? Web a direct dispute is involved but it is only a part of the process. Web a 623 dispute letter is a notice that allows you to dispute a collection or debt directly with the creditor after filing a complaint with the credit bureau. One in four had an oversight that would hurt the consumer’s credit score.

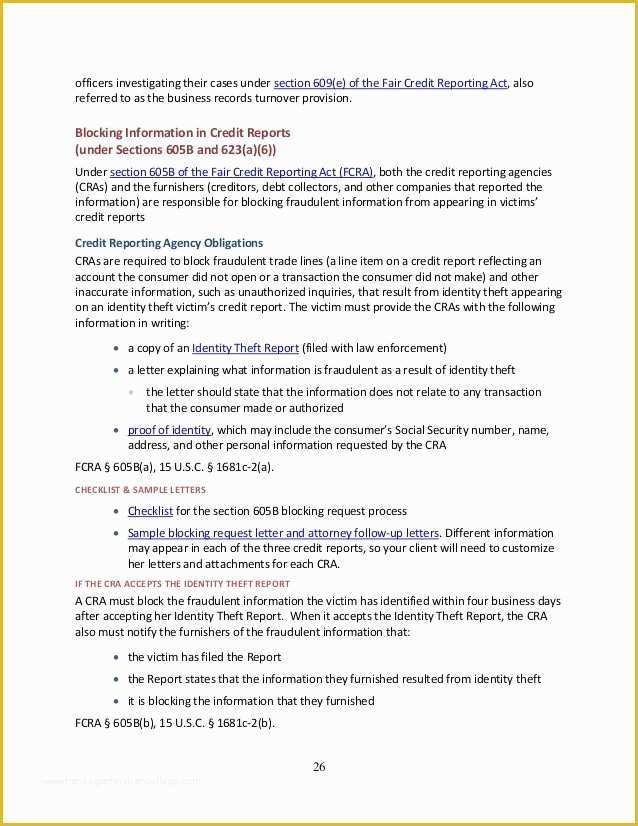

You’re probably here because you have negative or inaccurate items on your credit report and you want or needto remove them. Web a 623 dispute letter is a notice that allows you to dispute a collection or debt directly with the creditor after filing a complaint with the credit bureau. The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process. It refers to section 623 of the fair credit reporting act and contacts the data furnisher to prove that a debt belongs to the company. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). Web my letter stated that pursuant to fcra 623 their claim is disputed and validation is requested, the account had been disputed with the cra and was verified and now i demand strict proof that i have any legal obligation to the debt and pointed out that i disputed the collection of this account w/ asset acceptance and because they were. From what i've seen, the process breaks down as follows: The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the. If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information reported by the furnisher, the furnisher may not subsequently report that information to a cra without providing notice of the dispute. One in four had an oversight that would hurt the consumer’s credit score.

Web what is a 623 dispute letter? The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). What is the purpose of a 609 dispute letter? Signnow has paid close attention to ios users and developed an application just for them. Web a business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. Web a 623 dispute letter is a notice that allows you to dispute a collection or debt directly with the creditor after filing a complaint with the credit bureau. <driver’s product number (optional)> <.</p> Web the name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). For the rest of you who know what it’s for, use the links below to get to what you came here for.

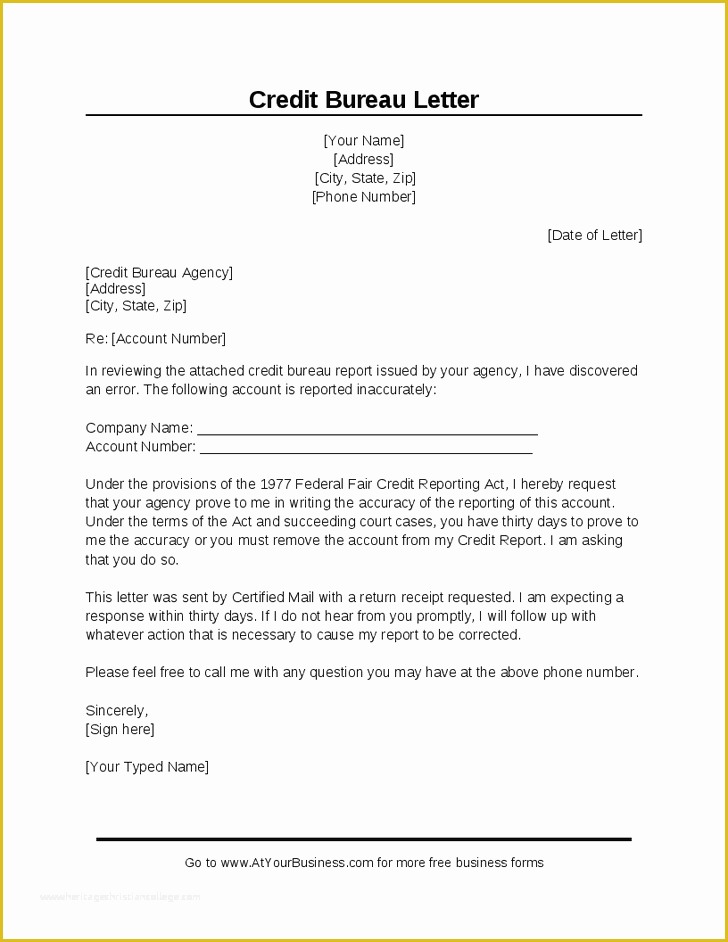

623 Dispute Letter Sample Your Letter

It refers to section 623 of the fair credit reporting act and contacts the data furnisher to prove that a debt belongs to the company. How does the 623 dispute method work? What is the purpose of a 609 dispute letter? Once you have gone through the process of sending a general dispute letter or a 609 and a 611.

Collection Dispute Letter The form letter below will help you dispute

The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). Date your name your address subject: Web my letter stated that pursuant to fcra 623 their claim is disputed and validation is requested, the account had been disputed with the cra and was verified and now i demand strict proof that i have any.

Credit Report Dispute Letter Template (1) PROFESSIONAL TEMPLATES

<driver’s product number (optional)> <.</p> Web a direct dispute is involved but it is only a part of the process. Tradeline is disputed in writing with the cra's (if not deleted or fixed go to step 2) step 2: From what i've seen, the process breaks down as follows: What is the purpose of a 609 dispute letter?

Dispute Letter Template For Medical Collections Cover Letters

The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the. Tradeline is disputed in writing with the cra's (if not deleted or fixed go to step 2) step 2: Web a 623 dispute letter is a notice that allows you to dispute a collection or.

Free 609 Credit Dispute Letter Templates Of Free Section 609 Credit

Date your name your address subject: Disputing information in credit report i am writing to inform you that i am disputing the following information your organization gave (enter the name of the credit bureau). A letter is end to the oc invoking a 623 investigation. Web the 623 dispute method allows you to dispute any inaccurate information on your credit.

The enchanting Template For Credit Report Dispute Letter Samples

One in four had an oversight that would hurt the consumer’s credit score. A letter is end to the oc invoking a 623 investigation. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information reported by the.

Free 609 Credit Dispute Letter Templates Of 609 Dispute Letter to

Tradeline is disputed in writing with the cra's (if not deleted or fixed go to step 2) step 2: Web what is a 623 dispute letter? Web the name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). The method allows you to dispute a debt directly with the creditor in question as long as.

No Response to 623 Dispute Letter While You are In It Debt Validation

Web the 623 dispute method allows you to dispute any inaccurate information on your credit report directly with the original creditor. Signnow has paid close attention to ios users and developed an application just for them. A 623 is also known as a “dispute of debt notice.”. How do i write a dispute letter to a collection agency? To find.

623 Dispute Letter Sample Your Letter

Web 623 credit report dispute letter sample template. The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the. A 623 is also known as a “dispute of debt notice.”. You’re probably here because you have negative or inaccurate items on your credit report and you.

623 Method to Dispute Negative Information With Original Creditor

Date your name your address subject: The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). Disputing information in credit report i am writing to inform you that i am disputing the following information your organization gave (enter the name of the credit bureau). Web what is a 623 dispute letter? Web 4the 609.

Web 623 Credit Report Dispute Letter Sample Template.

Web the 623 dispute method allows you to dispute any inaccurate information on your credit report directly with the original creditor. What is the purpose of a 609 dispute letter? Web my letter stated that pursuant to fcra 623 their claim is disputed and validation is requested, the account had been disputed with the cra and was verified and now i demand strict proof that i have any legal obligation to the debt and pointed out that i disputed the collection of this account w/ asset acceptance and because they were. For the rest of you who know what it’s for, use the links below to get to what you came here for.

Web A 623 Dispute Letter Is A Notice That Allows You To Dispute A Collection Or Debt Directly With The Creditor After Filing A Complaint With The Credit Bureau.

Web 623 credit report dispute letter. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). How do i write a dispute letter to a collection agency? You’re probably here because you have negative or inaccurate items on your credit report and you want or needto remove them.

A Letter Is End To The Oc Invoking A 623 Investigation.

The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process. The name 623 dispute method refers to section 623 of the fair credit reporting act (fcra). If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information reported by the furnisher, the furnisher may not subsequently report that information to a cra without providing notice of the dispute. Date your name your address subject:

Web A Business Uses A 623 Credit Dispute Letter When All Other Attempts To Remove Dispute Information Have Failed.

Web a direct dispute is involved but it is only a part of the process. From what i've seen, the process breaks down as follows: Signnow has paid close attention to ios users and developed an application just for them. The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.