5695 Form 2022

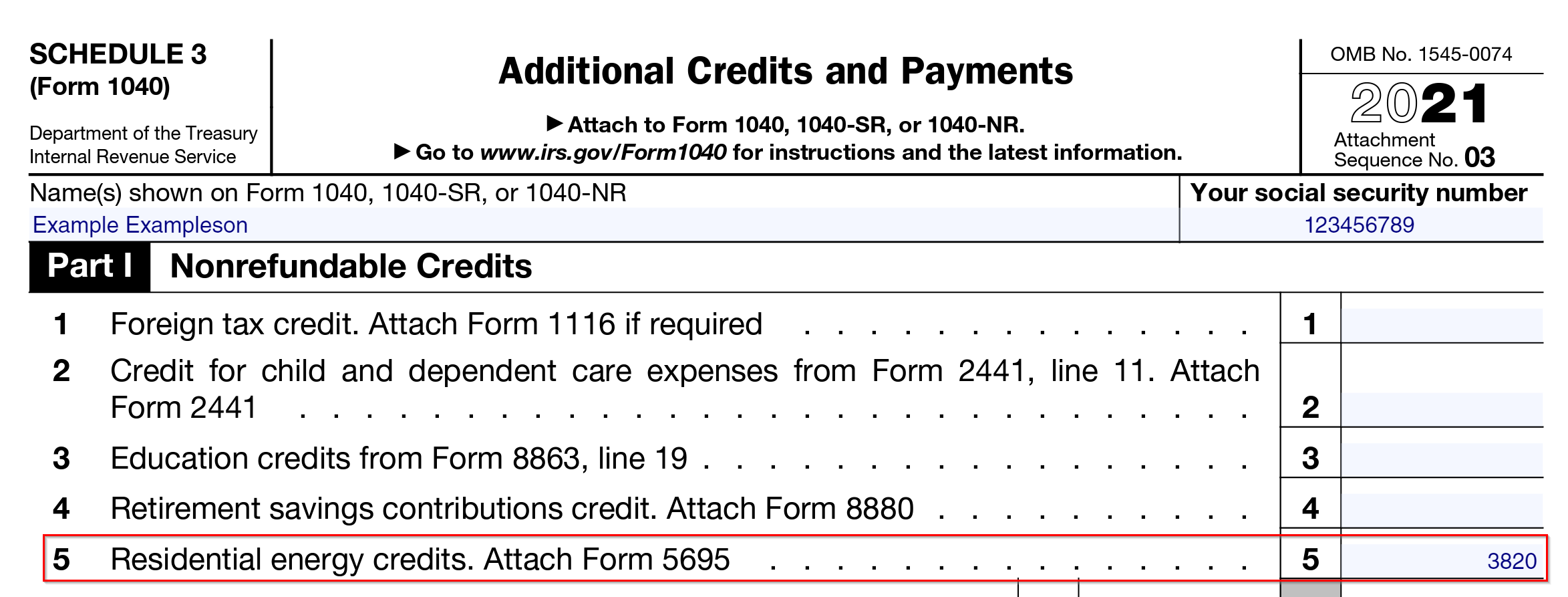

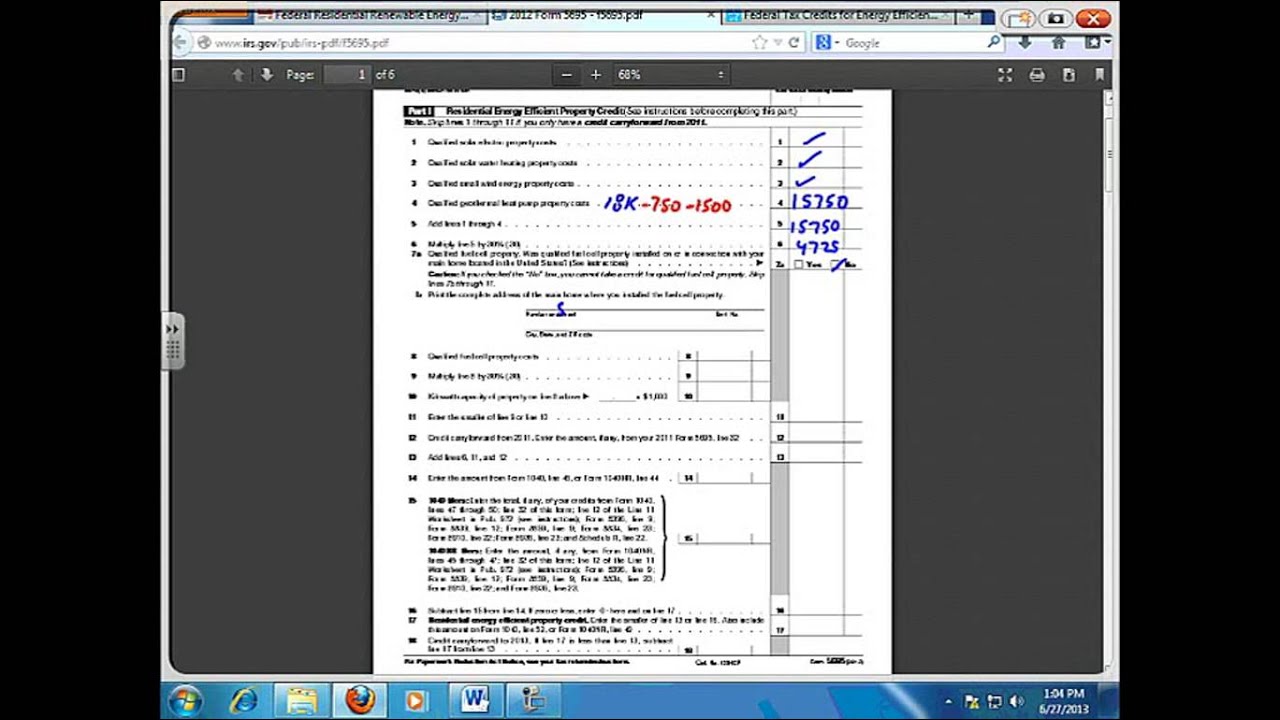

5695 Form 2022 - Form 5695 won't generate if the credit amount has been overridden. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. To add or remove this. Web what is the irs form 5695? Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Web for improvements installed in 2022 or earlier: Web federal — residential energy credits download this form print this form it appears you don't have a pdf plugin for this browser. You can download or print current.

It appears that the inflation reduction act extended this tax credit under the residential. The residential energy credits are: You can download or print current. Also use form 5695 to take any residential energy efficient property credit carryforward. Web the residential clean energy credit, and. Web credit carryforward from 2022. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. The energy efficient home improvement credit. Enter the amount, if any, from your 2022 form 5695, line 16. Please use the link below to download 2022.

Also use form 5695 to take any residential energy efficient property credit carryforward. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Web service through december 31, 2022. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal. Hit the green arrow with the inscription next to. Purpose of form use form 5695 to figure and take your residential energy credits. Use previous versions of form 5695. Web we last updated the residential energy credits in december 2022, so this is the latest version of form 5695, fully updated for tax year 2022. Enter the amount, if any, from your 2022 form 5695, line 16. To add or remove this.

Tax 2022 Irs Latest News Update

To add or remove this. Purpose of form use form 5695 to figure and take your residential energy credits. Web federal — residential energy credits download this form print this form it appears you don't have a pdf plugin for this browser. Web to enter the amount for form 5695, line 22a: Web what is the irs form 5695?

Form 5695 2021 2022 IRS Forms TaxUni

Web the residential clean energy credit, and. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web form 5695 2021 residential energy credits department of the treasury.

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

12 13 add lines 6b, 11, and 12. Purpose of form use form 5695 to figure and take your residential energy credits. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Use previous versions of form 5695. Extends the residential energy efficient property credit to qualified biomass fuel property costs.

Ev Federal Tax Credit Form

1, 2023, the credit equals 30% of certain qualified expenses,. Extends the residential energy efficient property credit to qualified biomass fuel property costs on line. 12 13 add lines 6b, 11, and 12. To add or remove this. Web service through december 31, 2022.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

For tax years 2006 through 2017 it was also used to calculate the nonbusiness. Web service through december 31, 2022. Also use form 5695 to take any residential energy efficient property credit carryforward. Extends the residential energy efficient property credit to qualified biomass fuel property costs on line. 12 13 add lines 6b, 11, and 12.

Form 5695 YouTube

Extends the residential energy efficient property credit to qualified biomass fuel property costs on line. The energy efficient home improvement credit. Web what is the irs form 5695? Web the 2022 irs form 5695 still refers to qualifying metal or asphalt roofs. Use previous versions of form 5695.

2021 IRS Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Extends the residential energy efficient property credit to qualified biomass fuel property costs on line. Use form 5695 to figure and take. Web service through december 31, 2022. 1, 2023, the credit equals 30% of certain qualified expenses,.

Form 5695 2021 2022 IRS Forms TaxUni

It appears that the inflation reduction act extended this tax credit under the residential. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Enter the amount, if any, from your 2022 form 5695, line 16. The consolidated appropriations act, 2021: Web credit carryforward from 2022.

Form 5695 workout for geothermal YouTube

Enter your energy efficiency property costs. You can download or print current. The energy efficient home improvement credit. Purpose of form use form 5695 to figure and take your residential energy credits. Also use form 5695 to take any residential energy efficient property credit carryforward.

BENNINGTON POOL & HEARTH IRS FORM 5695 RESIDENTIAL ENERGY CREDITS

Web the 2022 irs form 5695 still refers to qualifying metal or asphalt roofs. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Purpose of form use form 5695 to figure and take your residential energy credits. The consolidated appropriations act, 2021: Form 5695 won't generate.

Web The Residential Clean Energy Credit, And.

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal. Web per irs instructions for form 5695: For tax years 2006 through 2017 it was also used to calculate the nonbusiness. To add or remove this.

Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web credit carryforward from 2022. Web we last updated the residential energy credits in december 2022, so this is the latest version of form 5695, fully updated for tax year 2022. You can download or print current.

Use Form 5695 To Figure And Take.

12 13 add lines 6b, 11, and 12. The residential energy credits are: The consolidated appropriations act, 2021: Members will also be able to request a paper form beginning.

Web What Is Form 5695?

Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Extends the residential energy efficient property credit to qualified biomass fuel property costs on line. Web to enter the amount for form 5695, line 22a: Enter your energy efficiency property costs.