2290 Form Printable

2290 Form Printable - Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. As soon as you have it on paper, you can enter the required data by hand and affix a signature. Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. Keep a copy of this return for your records. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. The current period begins july 1, 2023, and ends june 30, 2024. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file.

Keep a copy of this return for your records. For instructions and the latest information. As soon as you have it on paper, you can enter the required data by hand and affix a signature. Web irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. The current period begins july 1, 2023, and ends june 30, 2024. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. This statement is required for trucks weighing 55,000 pounds or more and is utilized to calculate and pay the federal highway use tax. The blank template can be downloaded in a pdf format, making it easily accessible and simple to complete. Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out.

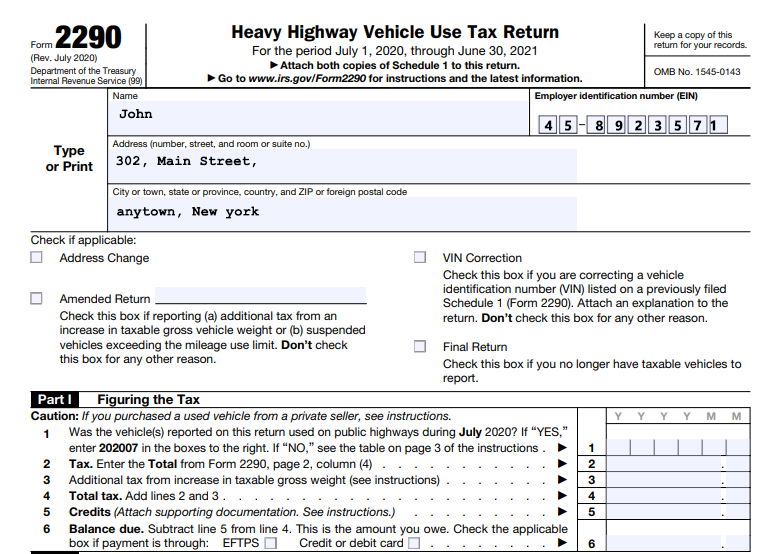

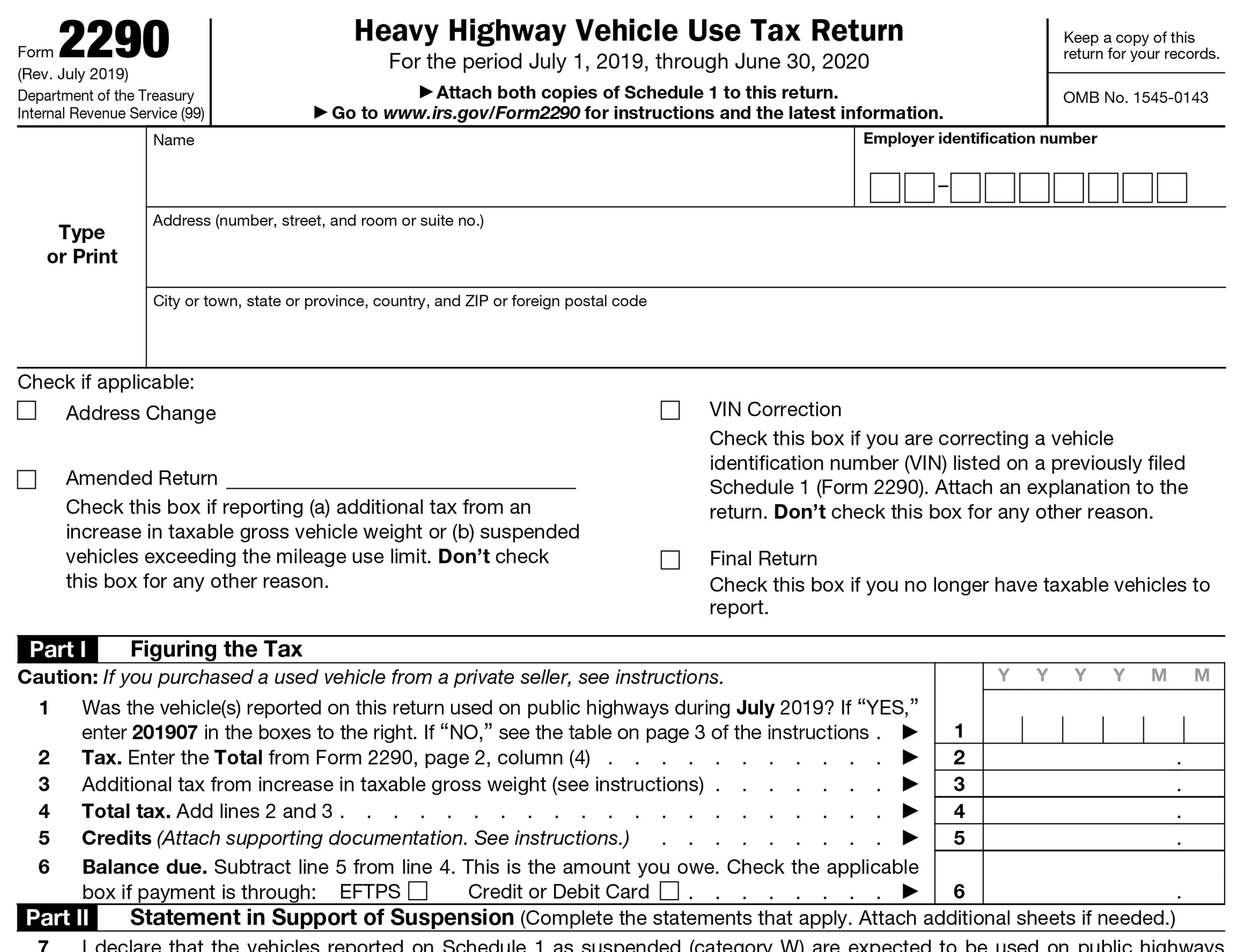

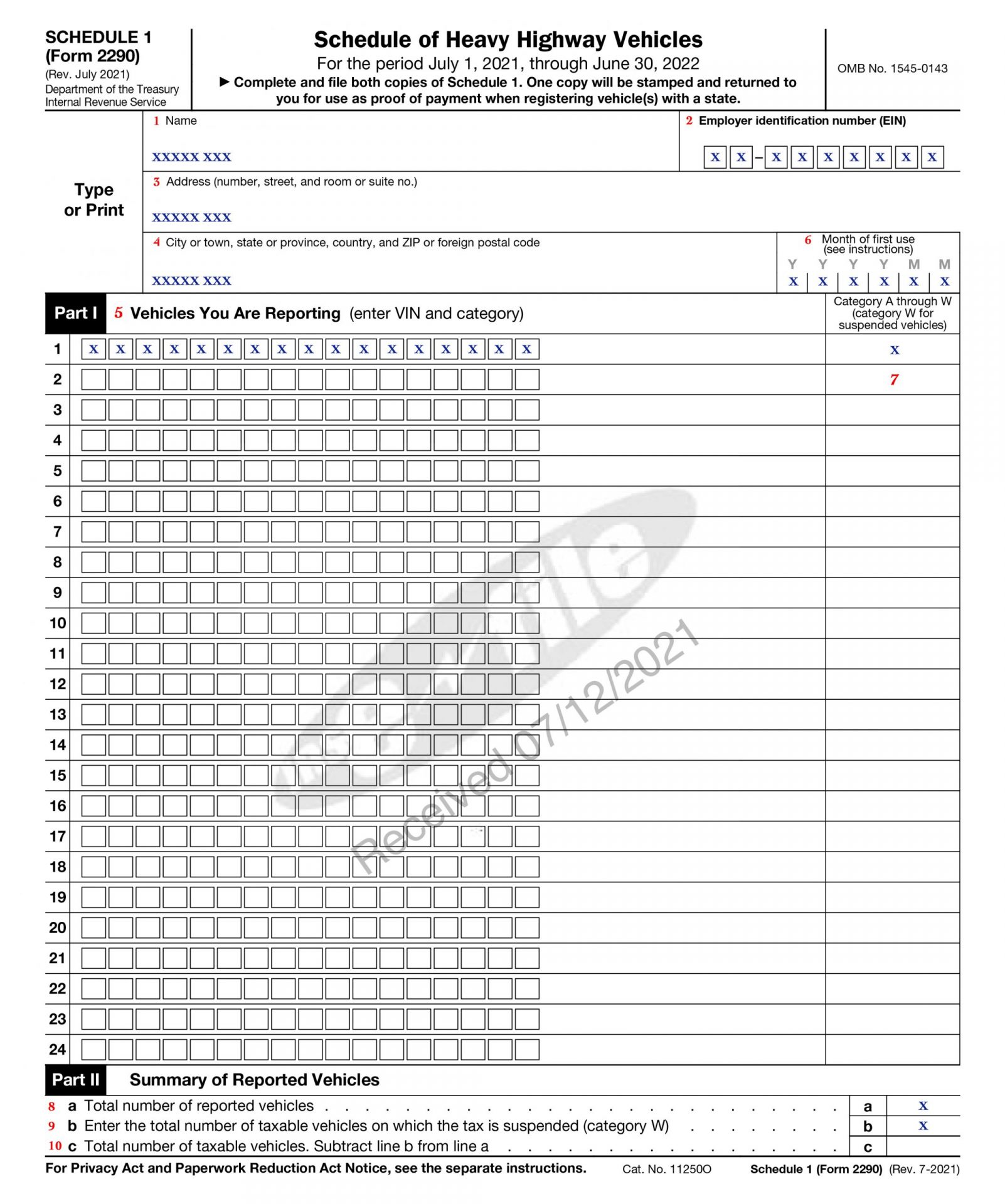

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins july 1, 2023, and ends june 30, 2024. For instructions and the latest information. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. Attach both copies of schedule 1 to this return. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

For instructions and the latest information. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. As soon as you have it on paper, you can enter the required data by hand and affix a signature. Web file form 2290 for any taxable vehicles first used on a.

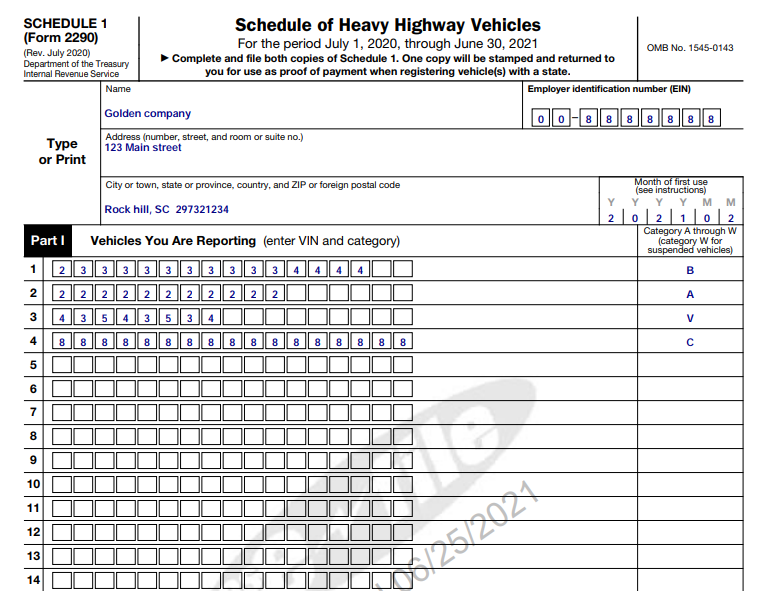

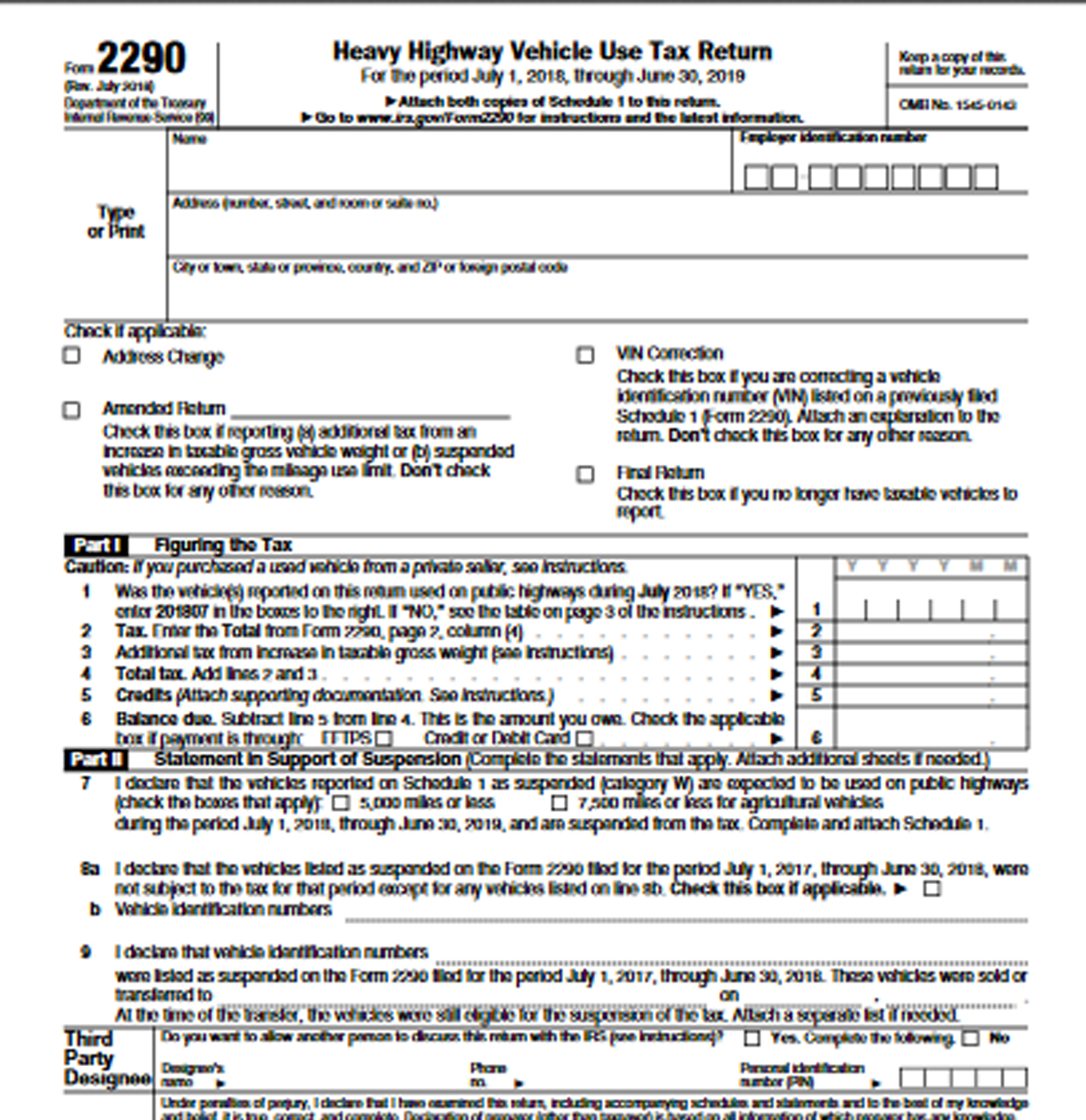

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). A highway motor vehicle for use.

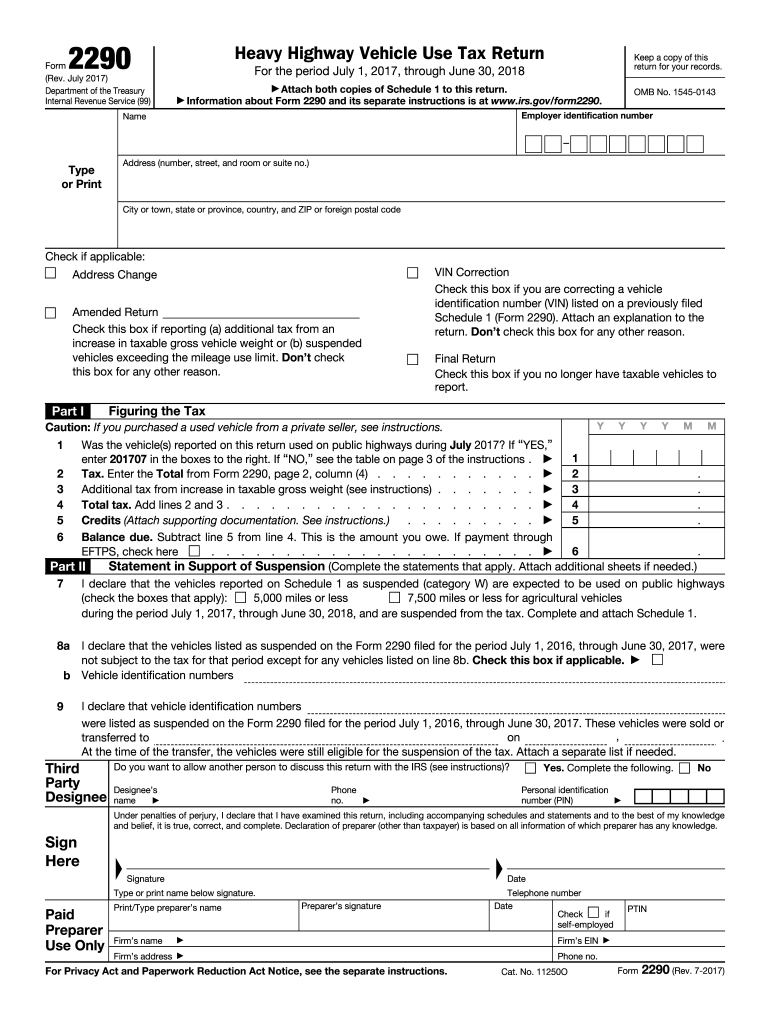

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. This statement is required for trucks weighing 55,000 pounds or more and is utilized to calculate and pay the federal highway use tax. Keep a copy of this return for your records. The blank template can be downloaded in a pdf format, making.

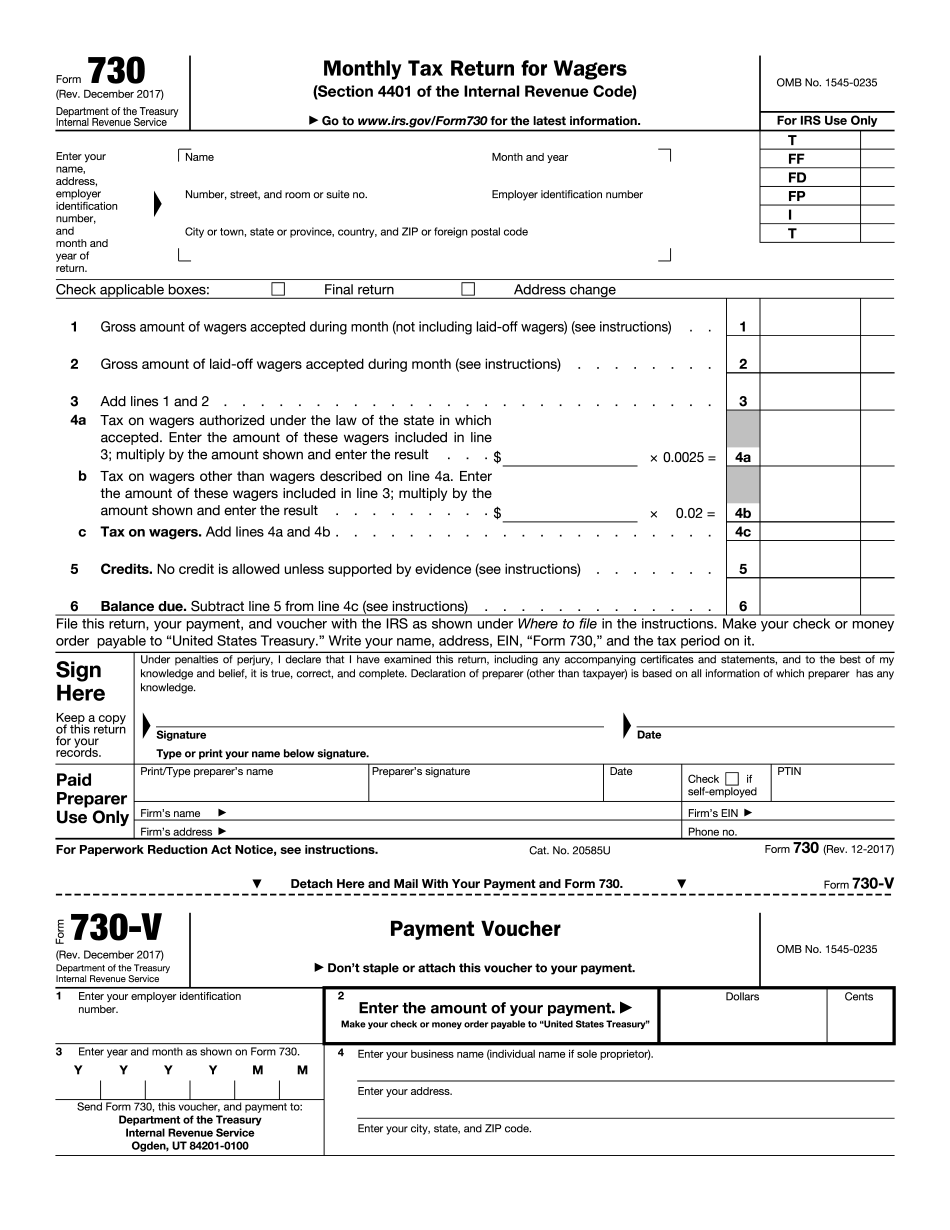

form 2290 20182022 Fill Online, Printable, Fillable Blank

See when to file form 2290 for more details. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is.

How to Efile Form 2290 for 202223 Tax Period

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Web irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. The current period begins.

Printable 2290 Form Customize and Print

Attach both copies of schedule 1 to this return. As soon as you have it on paper, you can enter the required data by hand and affix a signature. A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Web file form 2290 for any taxable vehicles first used on a public highway during or after.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. Web get a printable tax form 2290 as.

Free Printable Form 2290 Printable Templates

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. See when to file form 2290 for more details. Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it.

2290 Heavy Highway Tax Form 2017 Universal Network

Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable.

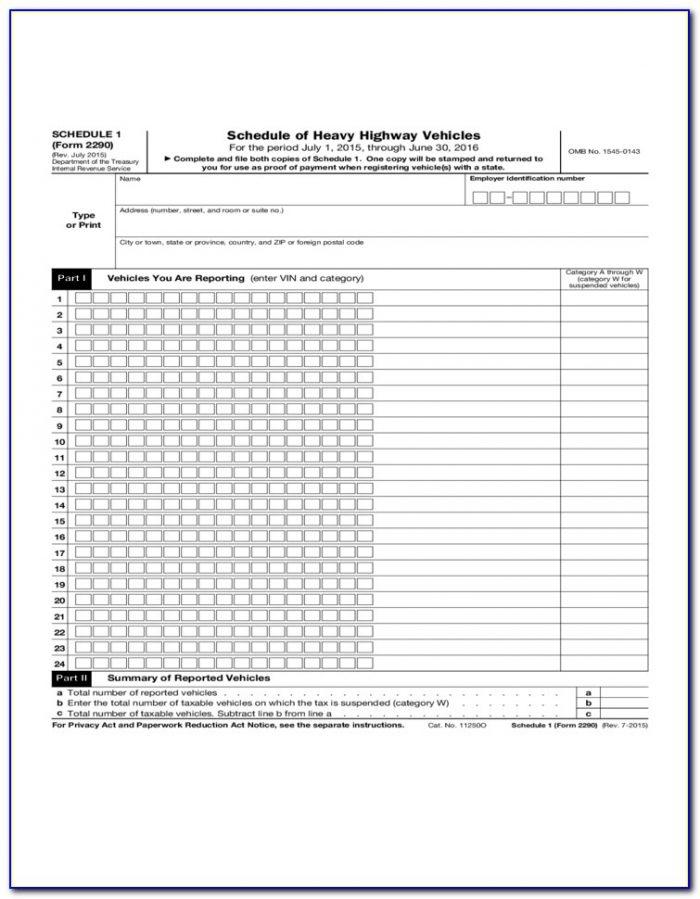

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Attach both copies of schedule 1 to this return. Web form 2290, heavy highway vehicle use tax return, is generally used by.

For Instructions And The Latest Information.

Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. The blank template can be downloaded in a pdf format, making it easily accessible and simple to complete. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered.

Web Form 2290 Must Be Filed For The Month The Taxable Vehicle Is First Used On Public Highways During The Current Period.

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. The current period begins july 1, 2023, and ends june 30, 2024. Web irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. As soon as you have it on paper, you can enter the required data by hand and affix a signature.

Form 2290 Is Used To Figure And Pay The Tax Due On Certain Heavy Highway Motor Vehicles.

See when to file form 2290 for more details. A highway motor vehicle for use tax purposes is defined inside the instructions booklet. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later).

Web File Form 2290 For Any Taxable Vehicles First Used On A Public Highway During Or After July 2022 By The Last Day Of The Month Following The Month Of First Use.

Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. Attach both copies of schedule 1 to this return. This statement is required for trucks weighing 55,000 pounds or more and is utilized to calculate and pay the federal highway use tax. Keep a copy of this return for your records.