2022 Form 8863

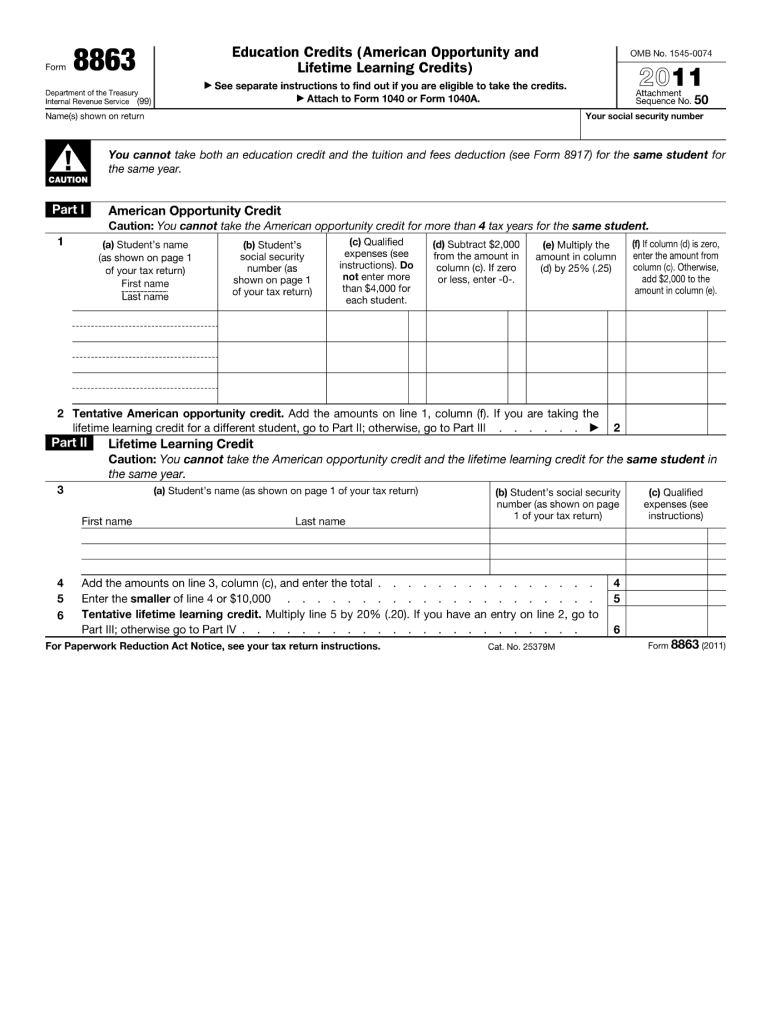

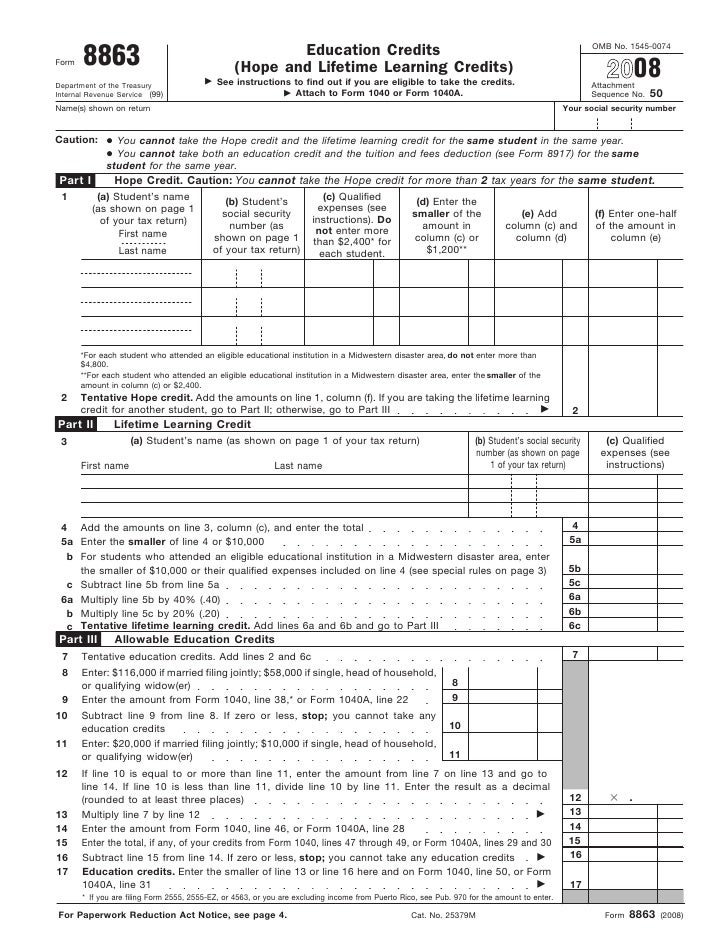

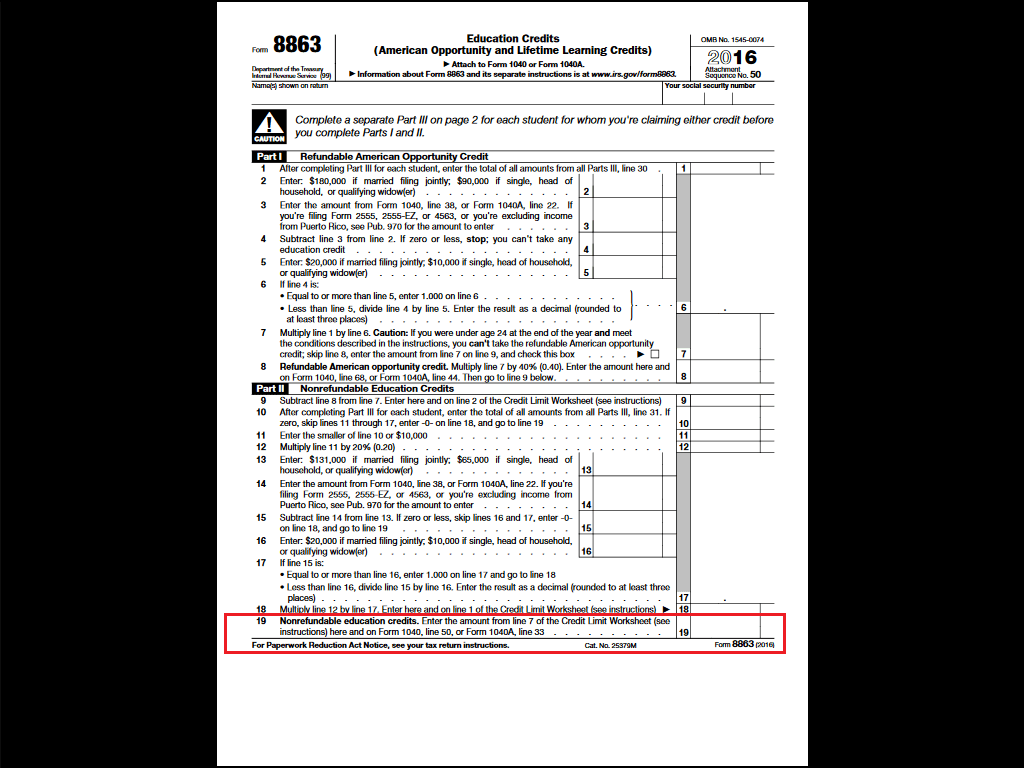

2022 Form 8863 - Education credits \(american opportunity and lifetime learning credits\) keywords: Ensure you understand the eligibility criteria, tax credit options, and the sections you must complete. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web read the irs form 8863 for 2022 instructions before filling out the sample. Education credits are based on the amount of the student’s adjusted qualified. Web form 8863, education credit, is the tax form for claiming the educational credits on your federal income return. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022 we last updated the education credits (american opportunity. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web december 2, 2022 draft as of form 8863 department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits) attach. Ad get ready for tax season deadlines by completing any required tax forms today.

Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web form 8863 helps students find and claim the right education credit for their situation. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Education credits \(american opportunity and lifetime learning credits\) keywords: Web read the irs form 8863 for 2022 instructions before filling out the sample. Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Web h&r block is here to help you rock this year’s tax season, so we’ll break down the basics you should know about form 8863, including what it is, who qualifies, what expenses. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Web december 2, 2022 draft as of form 8863 department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits) attach. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Web form 8863 (2022) title: Use this tax form to claim the american opportunity tax credit. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022 we last updated the education credits (american opportunity. Ad get ready for tax season deadlines by completing any required tax forms today. Web american opportunity credit vs. Web we last updated federal form 8863 in december 2022 from the federal internal revenue service. Web h&r block is here to help you rock this year’s tax season, so we’ll break down the basics you should know about form 8863, including what it is, who qualifies, what expenses. Web form 8863, education credit, is the tax form for claiming the educational credits on your federal income return.

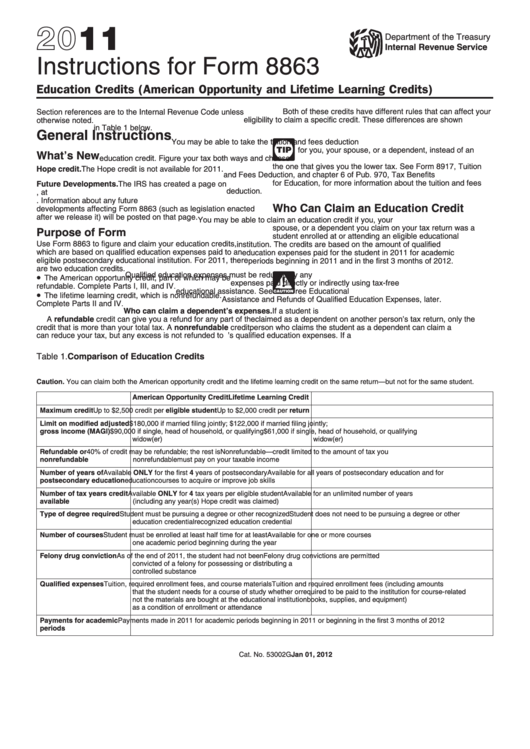

Instructions For Form 8863 Education Credits (American Opportunity

Web form 8863, education credit, is the tax form for claiming the educational credits on your federal income return. It’s an online fillable pdf document that you can save as a pdf file after filling it out. If you can’t find it, or if. Ad get ready for tax season deadlines by completing any required tax forms today. Web we.

IRS Update for Form 8863 Education Tax Credits The TurboTax Blog

Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Ad get ready for tax season deadlines by completing any required tax forms today. Web we last updated federal form 8863 in december 2022 from the federal internal revenue service. Web form 8863, education.

Form 8863 Credit Limit Worksheet

This form is for income earned in tax year 2022, with tax returns due in april. The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Ad get ready for tax season deadlines by completing.

Form 8863Education Credits

Web lifetime learning credit if you do not qualify for the american opportunity credit, you may be able to take a credit of up to $2,000 for the total qualified education expenses paid for. Complete, edit or print tax forms instantly. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses.

Credit Limit Worksheet For Form 8863

Complete, edit or print tax forms instantly. Ensure you understand the eligibility criteria, tax credit options, and the sections you must complete. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web use form 8863 to figure and claim your education credits,.

Form 8863Education Credits

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web.

8863 Form 2022

Ad get ready for tax season deadlines by completing any required tax forms today. Web lifetime learning credit if you do not qualify for the american opportunity credit, you may be able to take a credit of up to $2,000 for the total qualified education expenses paid for. It’s an online fillable pdf document that you can save as a.

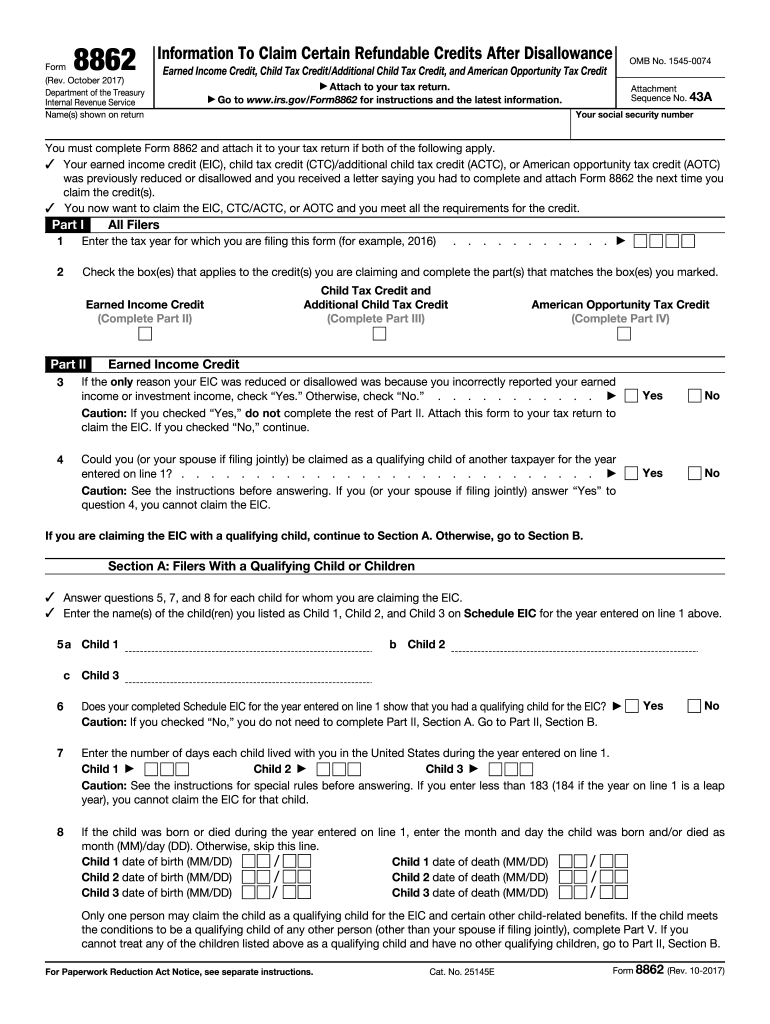

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

Education credits are based on the amount of the student’s adjusted qualified. Web h&r block is here to help you rock this year’s tax season, so we’ll break down the basics you should know about form 8863, including what it is, who qualifies, what expenses. Web american opportunity credit vs. Web form 8863, education credit, is the tax form for.

Form 8863 Credit Limit Worksheet

Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022 we last updated the education credits (american opportunity. Use the information on the form. Web h&r block is here to.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web american opportunity credit vs. Ad get ready for tax season deadlines by completing any required tax forms today. It’s an online fillable pdf document that you can save as a pdf file.

Web Information About Form 8863, Education Credits (American Opportunity And Lifetime Learning Credits), Including Recent Updates, Related Forms And Instructions On.

The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Ensure you understand the eligibility criteria, tax credit options, and the sections you must complete. Web form 8863 helps students find and claim the right education credit for their situation. Ad get ready for tax season deadlines by completing any required tax forms today.

Complete, Edit Or Print Tax Forms Instantly.

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web december 2, 2022 draft as of form 8863 department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits) attach. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022 we last updated the education credits (american opportunity. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Use The Information On The Form.

Use this tax form to claim the american opportunity tax credit. Web h&r block is here to help you rock this year’s tax season, so we’ll break down the basics you should know about form 8863, including what it is, who qualifies, what expenses. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Web Form 8863 Above Is For The 2022 Taxes You’re Filing In 2023 After The Start Of The Tax Season.

This form is for income earned in tax year 2022, with tax returns due in april. If you can’t find it, or if. Web form 8863, education credit, is the tax form for claiming the educational credits on your federal income return. Web we last updated federal form 8863 in december 2022 from the federal internal revenue service.