2022 Arkansas State Tax Form

2022 Arkansas State Tax Form - Ar1023ct application for income tax exempt status. Fill, sign, email ar1000f & more fillable forms, register and subscribe now! Web 42 rows name/address change, penalty waiver request, and request for copies of. The arkansas department of finance and administration distributes arkansas tax forms and instructions in the following ways: We will update this page with a new version of the form for 2024 as soon as it is made available. Web remittance must accompany this report • make checks payable to arkansas secretary of state phone: Web 2022 arkansas printable income tax forms 40 pdfs arkansas has a state income tax that ranges between 2% and 6.6%. Web arkansas income tax forms, tax brackets and rates are listed here by tax year. Ar1100esct corporation estimated tax vouchers. Arkansas tax brackets for tax year 2022.

Web marginal income tax rates for 2022 have been amended and the top rate will be reduced to 4.9%. Web download or print the 2022 arkansas form ar2210 (penalty for underpayment of estimated tax) for free from the arkansas department of revenue. Web state tax forms. Get current and prior year forms. Arkansas income brackets has been. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Web remittance must accompany this report • make checks payable to arkansas secretary of state phone: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Complete, edit or print tax forms instantly. We will update this page with a new version of the form for 2024 as soon as it is made available.

If you make $70,000 a year living in arkansas you will be taxed $11,683. We will update this page with a new version of the form for 2024 as soon as it is made available. Complete, edit or print tax forms instantly. Get current and prior year forms. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. We will update this page with a new version of the form for 2024 as soon as it is made available. Arkansas income brackets has been. Fill, sign, email ar1000f & more fillable forms, register and subscribe now! Be sure to verify that the form. Web tax help and forms internet you can access the department of finance and administration’s website at www.dfa.arkansas.gov.

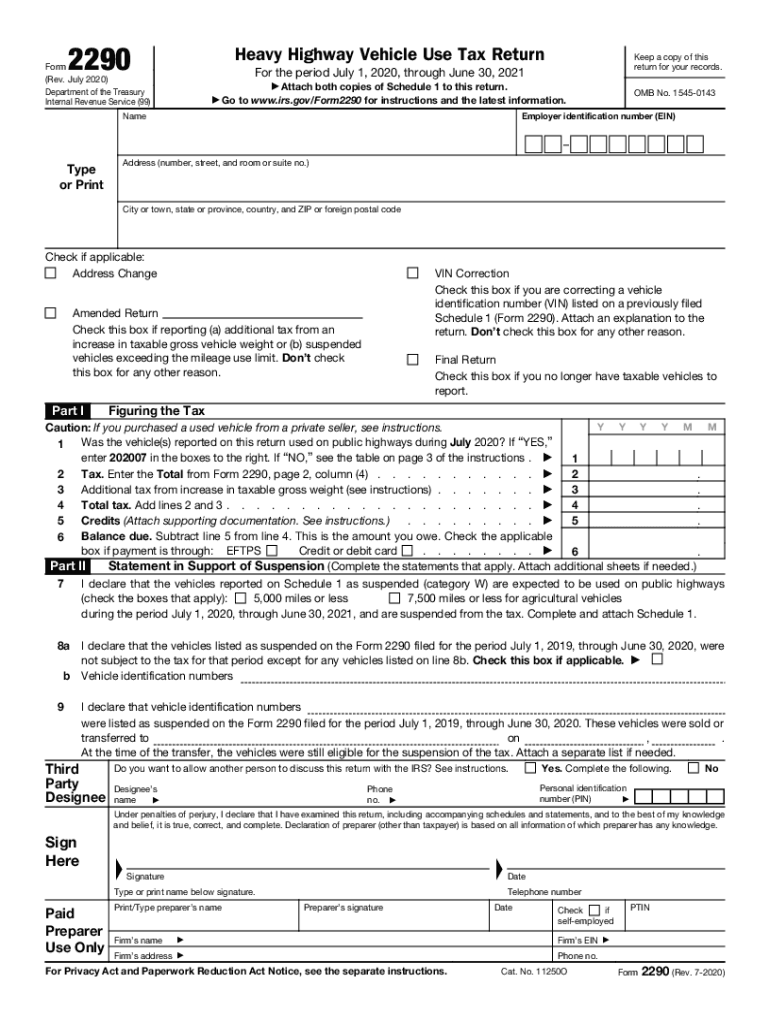

2020 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Web tax help and forms internet you can access the department of finance and administration’s website at www.dfa.arkansas.gov. We will update this page with a new version of the form for 2024 as soon as it is made available. Ar1023ct application for income tax exempt status. The arkansas department of finance and administration distributes arkansas tax forms and instructions in.

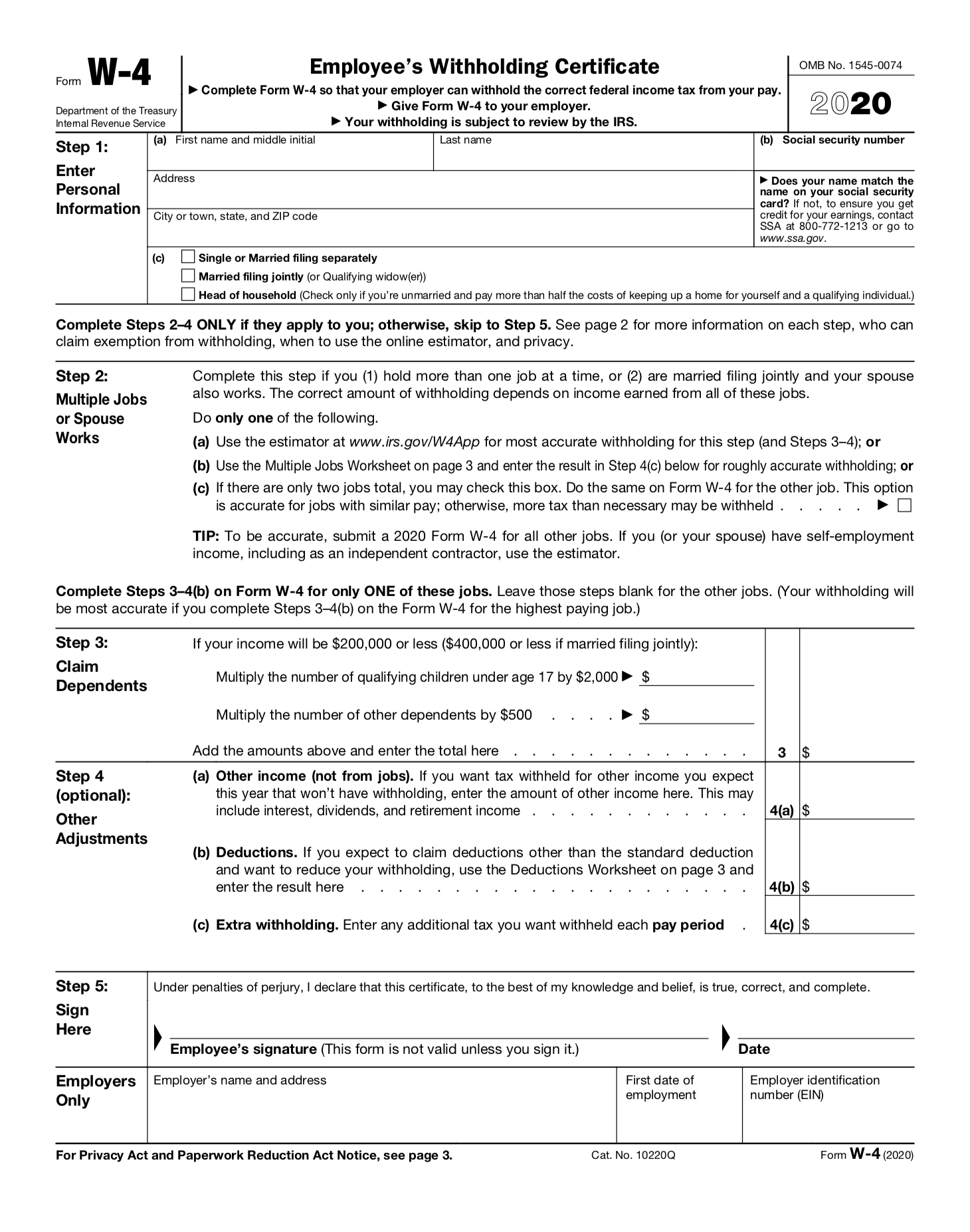

Integrated Staffing Staffing Solutions Saratoga Temporary Staffing

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web 2022 arkansas printable income tax forms 40 pdfs arkansas has a state income tax that ranges between 2% and 6.6%. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. We've been in.

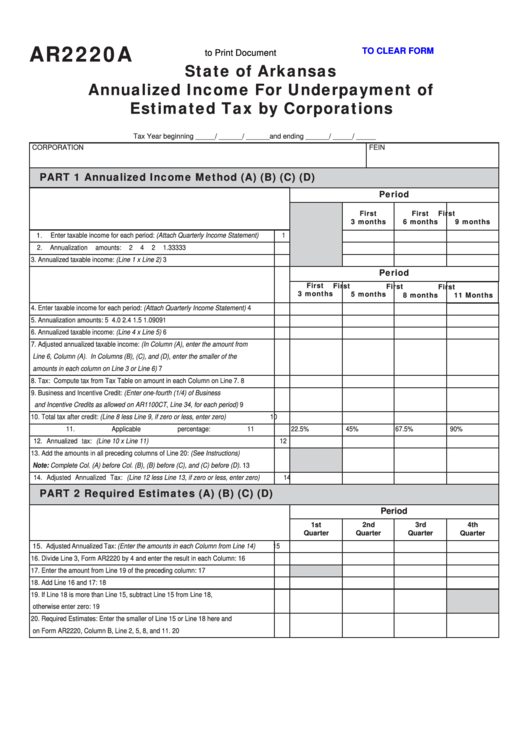

Fillable Form Ar2220a Annualized For Underpayment Of Estimated

Web remittance must accompany this report • make checks payable to arkansas secretary of state phone: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web itemized deduction schedule 2022_ar3_bc.pdf ar3 print form clear form 2022 itid221 arkansas individual income tax itemized deductions primary’s. Web this form is for income earned.

Individual Tax Return Arkansas Free Download

Web remittance must accompany this report • make checks payable to arkansas secretary of state phone: Web tax help and forms internet you can access the department of finance and administration’s website at www.dfa.arkansas.gov. Web state tax forms. Arkansas tax brackets for tax year 2022. Web this form is for income earned in tax year 2022, with tax returns due.

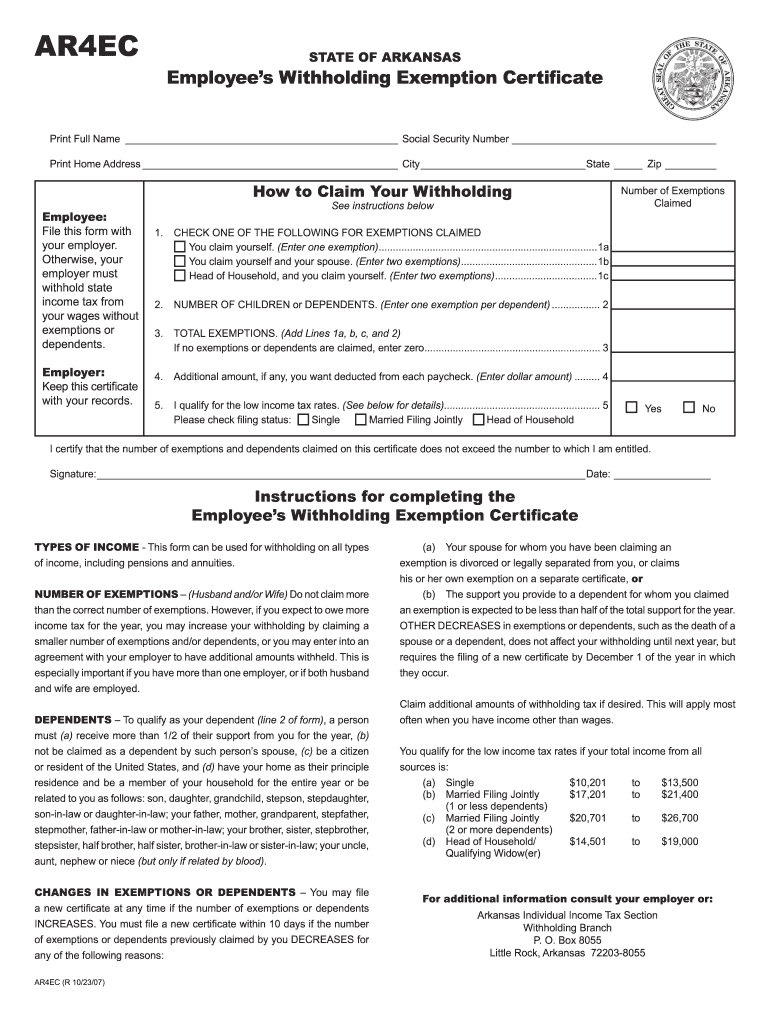

Ar4ec Fill out & sign online DocHub

Get current and prior year forms. Web prices of the fuels during 2022 as published by the energy information administration of the united. Web itemized deduction schedule 2022_ar3_bc.pdf ar3 print form clear form 2022 itid221 arkansas individual income tax itemized deductions primary’s. The arkansas department of finance and administration distributes arkansas tax forms and instructions in the following ways: We've.

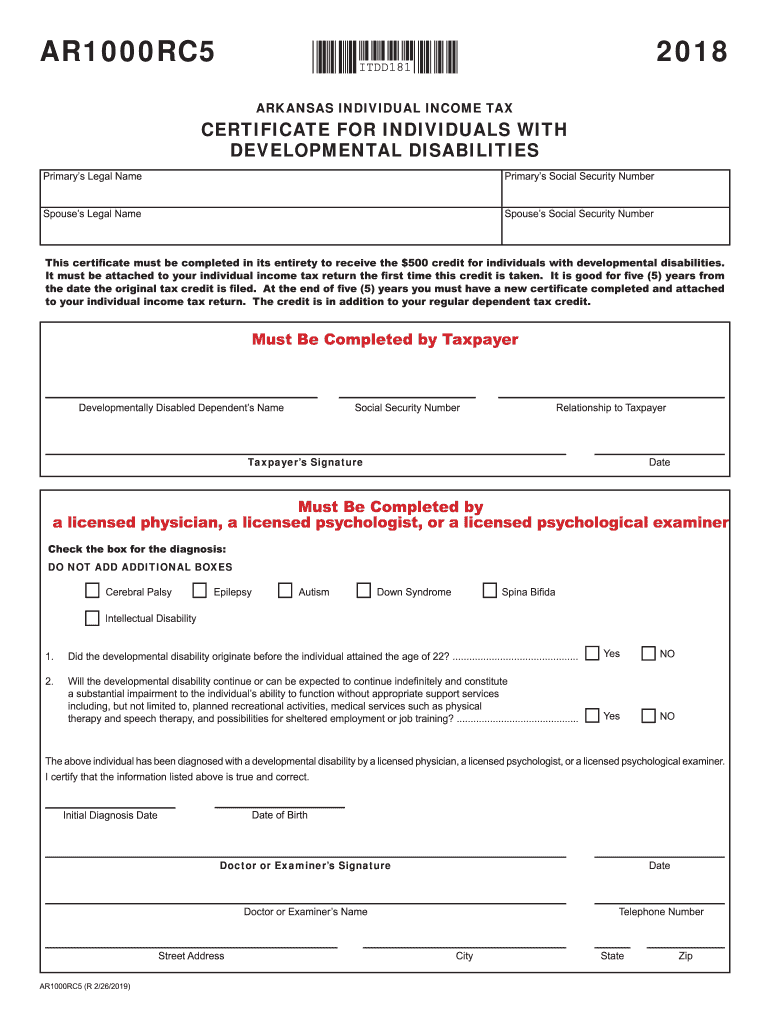

Ar1000rc5 2020 Fill Online, Printable, Fillable, Blank pdfFiller

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Web itemized deduction schedule 2022_ar3_bc.pdf ar3 print form clear form 2022 itid221 arkansas individual income tax itemized deductions.

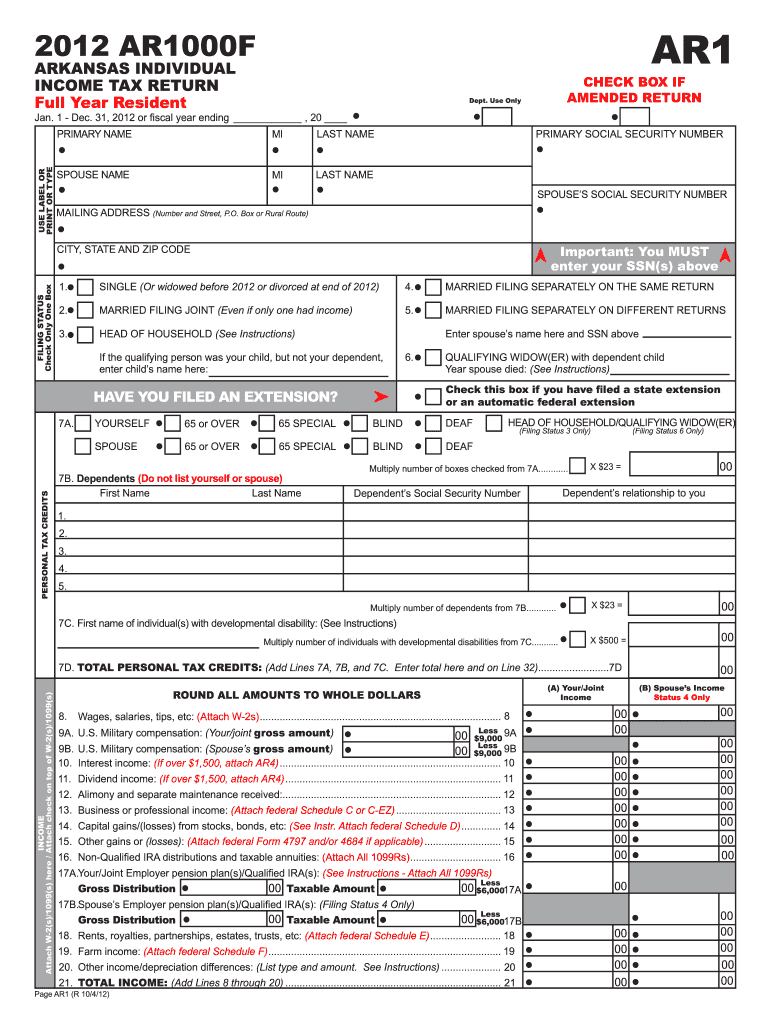

Individual Tax Return Arkansas Free Download

Web arkansas income tax forms, tax brackets and rates are listed here by tax year. Get current and prior year forms. We've been in the trucking industry 67+ years. We will update this page with a new version of the form for 2024 as soon as it is made available. Ar1023ct application for income tax exempt status.

Arkansas Form Tax Fill Out and Sign Printable PDF Template signNow

Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Web marginal income tax rates for 2022 have been amended and the top rate will be reduced to 4.9%. We will update this page with a new version of the form for 2024 as soon as.

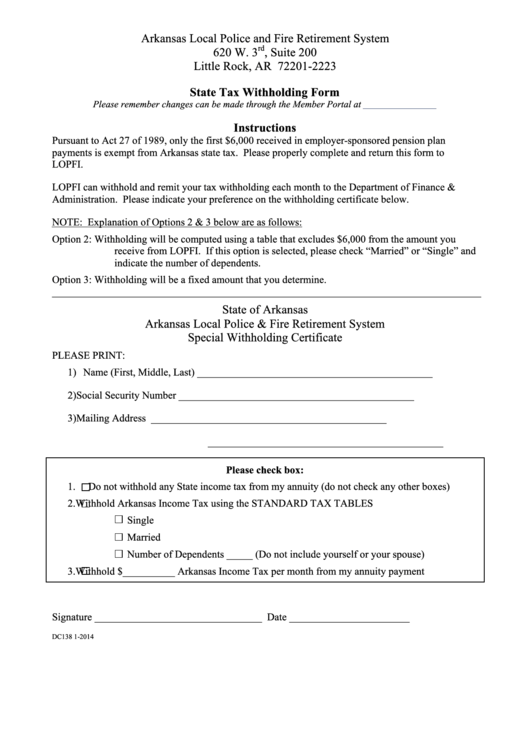

Fillable Arkansas State Tax Withholding Form printable pdf download

Complete, edit or print tax forms instantly. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Fill, sign, email ar1000f & more fillable forms, register and subscribe now! Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of.

Vietnam Social Security Declaration Download SEO POSITIVO

If you make $70,000 a year living in arkansas you will be taxed $11,683. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Arkansas tax brackets for tax year 2022. Web tax help.

Web Prices Of The Fuels During 2022 As Published By The Energy Information Administration Of The United.

Web tax help and forms internet you can access the department of finance and administration’s website at www.dfa.arkansas.gov. We will update this page with a new version of the form for 2024 as soon as it is made available. Web marginal income tax rates for 2022 have been amended and the top rate will be reduced to 4.9%. Ar1100esct corporation estimated tax vouchers.

Web Remittance Must Accompany This Report • Make Checks Payable To Arkansas Secretary Of State Phone:

Be sure to verify that the form. Web download or print the 2022 arkansas form ar2210 (penalty for underpayment of estimated tax) for free from the arkansas department of revenue. Web itemized deduction schedule 2022_ar3_bc.pdf ar3 print form clear form 2022 itid221 arkansas individual income tax itemized deductions primary’s. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available.

Ar1023ct application for income tax exempt status. Web more about the arkansas form ar1000f individual income tax tax return ty 2022 arkansas form ar1000f must be filed by all qualifying taxpayers yearly. Complete, edit or print tax forms instantly. Arkansas tax brackets for tax year 2022.

Web This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

The arkansas department of finance and administration distributes arkansas tax forms and instructions in the following ways: Web 2022 arkansas printable income tax forms 40 pdfs arkansas has a state income tax that ranges between 2% and 6.6%. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Details on how to only prepare and print an arkansas.