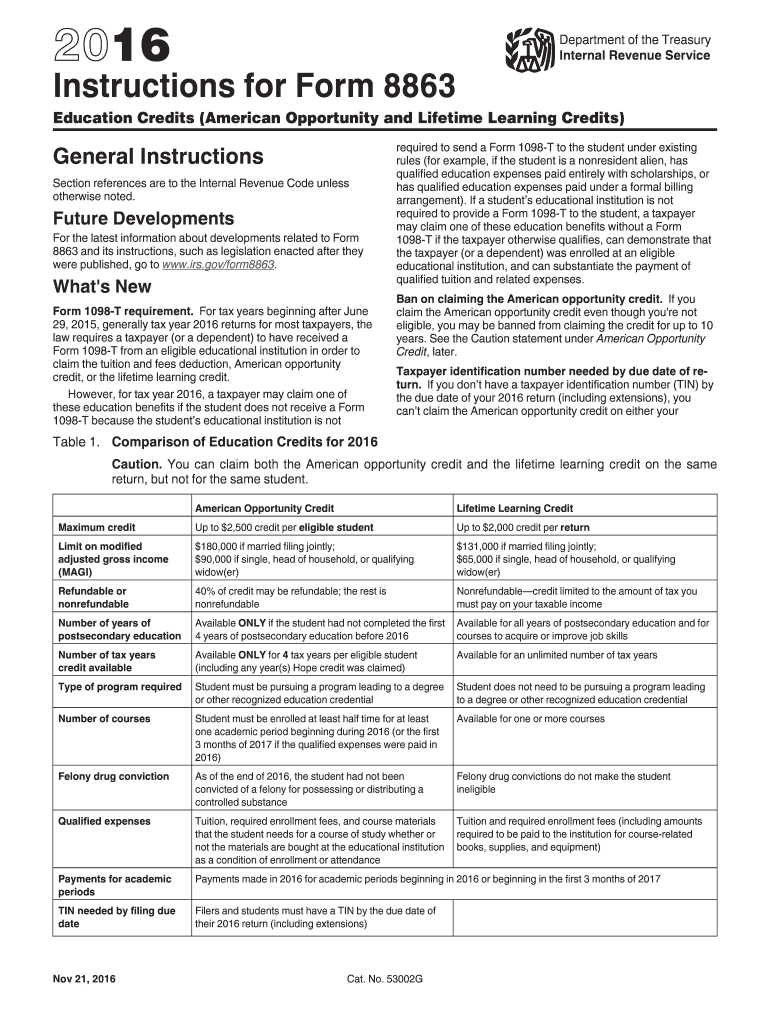

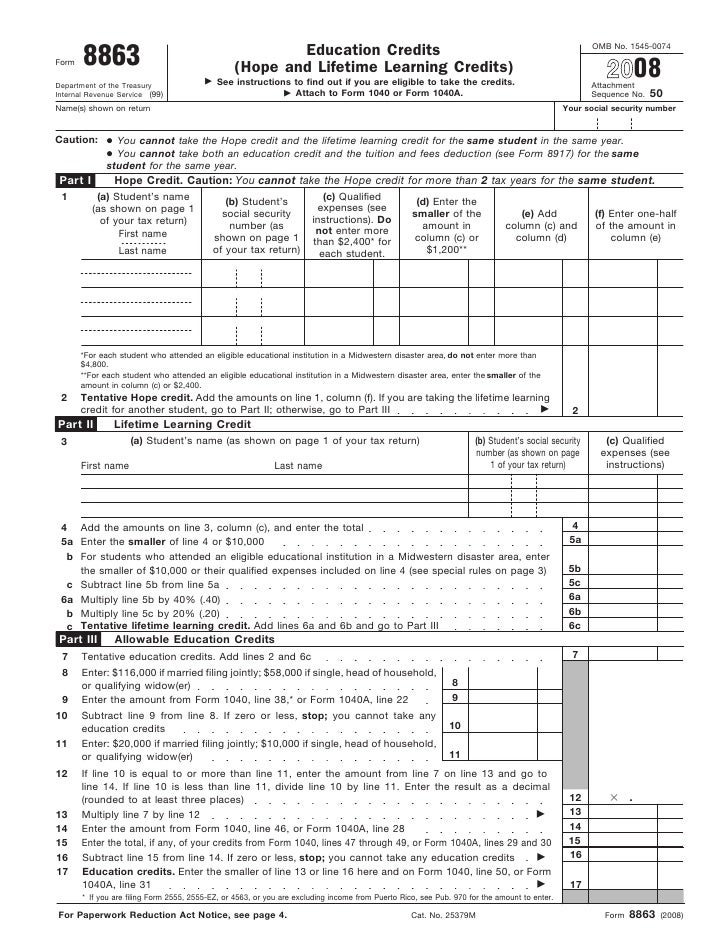

2021 Form 8863 Instructions

2021 Form 8863 Instructions - During your interview with bill and sue, you determine that $3,000 was paid in. Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. 14 minutes watch video get the form! What’s new personal protective equipment. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Education credits (american opportunity and lifetime learning credits). Web attach a completed form 8862, information to claim certain credits after disallowance, to your tax return for the next tax year for which you claim the credit. Department of the treasury internal revenue service. See form 8862 and its. Web per irs instructions for form 8863 education credits (american opportunity and lifetime learning credits), page 6:

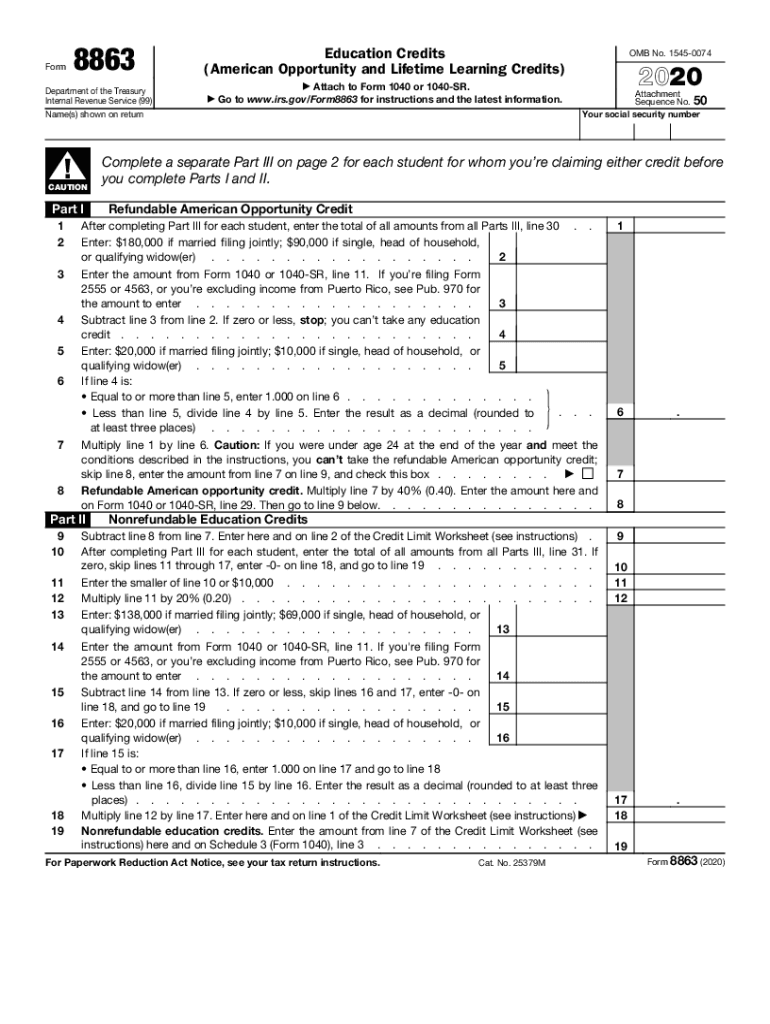

Number and street (or p.o. Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. Use the information on the form. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. During your interview with bill and sue, you determine that $3,000 was paid in. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: Web how to fill out form 8863. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Education credits (american opportunity and lifetime learning credits) 2022 form 8863: Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040.

Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Name of second educational institution (if any) (1) address. That’s the section where you’ll provide information about. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Web attach a completed form 8862, information to claim certain credits after disallowance, to your tax return for the next tax year for which you claim the credit. Education credits (american opportunity and lifetime learning credits) 2022 form 8863: Strange as it may sound, to fill out form 8863 you’ll want to start with part iii. What’s new personal protective equipment. Education credits (american opportunity and lifetime learning credits). Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040.

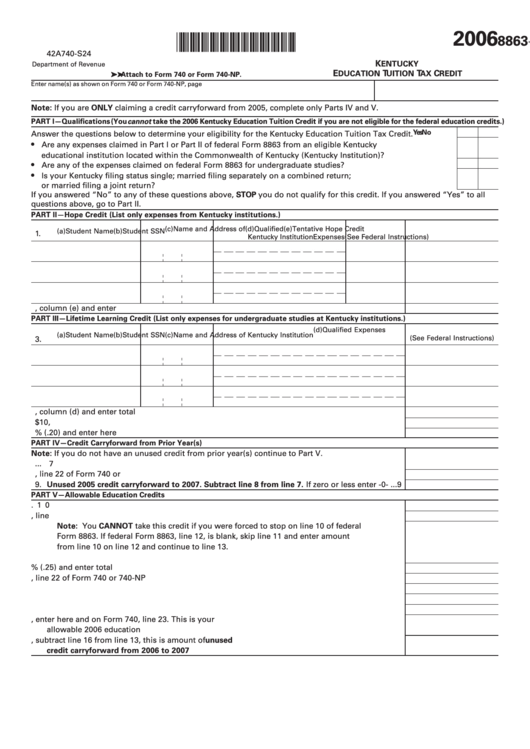

Form 8863K Education Tuition Tax Credit printable pdf download

Education credits (american opportunity and lifetime learning credits) 2022 form 8863: Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Web how to fill out form 8863. See form 8862 and its. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form.

Credit Limit Worksheet A Fill Online, Printable, Fillable, Blank

Web per irs instructions for form 8863 education credits (american opportunity and lifetime learning credits), page 6: Education credits (american opportunity and lifetime learning credits) 2022 form 8863: Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and.

Form 8863 Edit, Fill, Sign Online Handypdf

Web attach a completed form 8862, information to claim certain credits after disallowance, to your tax return for the next tax year for which you claim the credit. That’s the section where you’ll provide information about. 14 minutes watch video get the form! Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: Number.

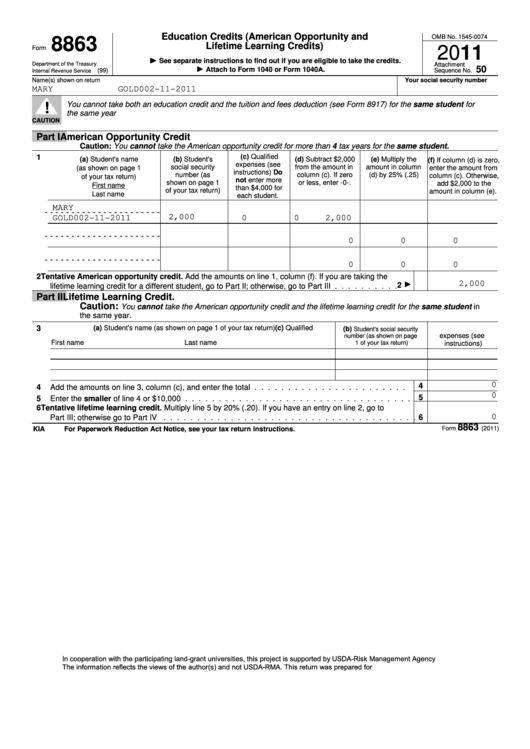

Sample Form 8863 Education Credits (American Opportunity And Lifetime

Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: 14 minutes watch video get the form! Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. See form 8862 and its. During your interview with bill and sue, you determine that $3,000 was paid in.

Form 8863 Fill out & sign online DocHub

Web how to fill out form 8863. Number and street (or p.o. Education credits (american opportunity and lifetime learning credits). That’s the section where you’ll provide information about. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use.

8863 Instructions Form Fill Out and Sign Printable PDF Template signNow

During your interview with bill and sue, you determine that $3,000 was paid in. Line 7 if you were under age 24 at the end of 2021 and the. Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Web per irs instructions for form 8863 education credits (american opportunity and lifetime learning credits), page 6: Department.

Form 8863 Instructions Fill Out and Sign Printable PDF Template signNow

Web attach a completed form 8862, information to claim certain credits after disallowance, to your tax return for the next tax year for which you claim the credit. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: Number and street (or p.o. Amounts paid for personal protective equipment (ppe), such as masks, hand.

2021 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to.

Form 8863Education Credits

See form 8862 and its. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Line 7 if you were under age 24 at the end of 2021 and the. Education credits (american opportunity and.

Form 8863 Education Credits (American Opportunity and Lifetime

Line 7 if you were under age 24 at the end of 2021 and the. During your interview with bill and sue, you determine that $3,000 was paid in. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web information about form 8863, education.

Web Attach A Completed Form 8862, Information To Claim Certain Credits After Disallowance, To Your Tax Return For The Next Tax Year For Which You Claim The Credit.

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web how to fill out form 8863. Strange as it may sound, to fill out form 8863 you’ll want to start with part iii. What’s new personal protective equipment.

Form 8863 Typically Accompanies Your 1040 Form,.

During your interview with bill and sue, you determine that $3,000 was paid in. Education credits (american opportunity and lifetime learning credits) 2022 form 8863: Department of the treasury internal revenue service. That’s the section where you’ll provide information about.

Web Use Form 8863 To Figure And Claim Your Education Credits, Which Are Based On Adjusted Qualified Education Expenses Paid To An Eligible Educational Institution.

Line 7 if you were under age 24 at the end of 2021 and the. Education credits (american opportunity and lifetime learning credits) attach to form 1040 or 1040. Education credits (american opportunity and lifetime learning credits). Step by step instructions comments in.

Web Information About Form 8863, Education Credits (American Opportunity And Lifetime Learning Credits), Including Recent Updates, Related Forms And Instructions On.

Web form 8863 department of the treasury internal revenue service (99) education credits (american opportunity and lifetime learning credits) a attach to form 1040 or 1040. See form 8862 and its. Instructions for form 8863, education credits (american opportunity and lifetime learning credits) 2021 12/15/2021 form 8863: Web irs form 8863 instructions by forrest baumhover july 24, 2023 reading time: