2021 Form 5471 Instructions

2021 Form 5471 Instructions - When and where to file. Web 23 apr 2021 by anthony diosdi schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Shareholder who doesn't qualify as either a category 5b or 5c filer. Persons with respect to certain foreign corporations, including recent updates, related forms, and. December 2022) department of the treasury internal revenue service. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Complete, edit or print tax forms instantly. Our instructor chaya siegfried will. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Form 5471 with respect to its ownership of certain foreign.

Web tax year 2022 form 5471 filing is a filing requirement and an information return that applies to u.s. 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax. Persons with respect to certain foreign corporations. Web this class is designed to help accountants with minimal experience with form 5471 gain a better understanding of how to complete this form. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Residents, officers, directors, or shareholders in certain foreign. When and where to file. When a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. So, a 5a filer is an unrelated section. Form 5471 with respect to its ownership of certain foreign.

There have been revisions to the form in both 2017 and. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Web 23 apr 2021 by anthony diosdi schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. 5 form 5471 is filed when the. Web the instructions to form 5471 describes a category 5a filer as a u.s. Persons with respect to certain foreign corporations, including recent updates, related forms, and. Web who has to report ownership in a foreign corporation? Complete, edit or print tax forms instantly. 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax.

2002 HTML Instructions for Form 5471,

The december 2021 revision of separate. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Shareholder who doesn't qualify as either a category 5b or 5c.

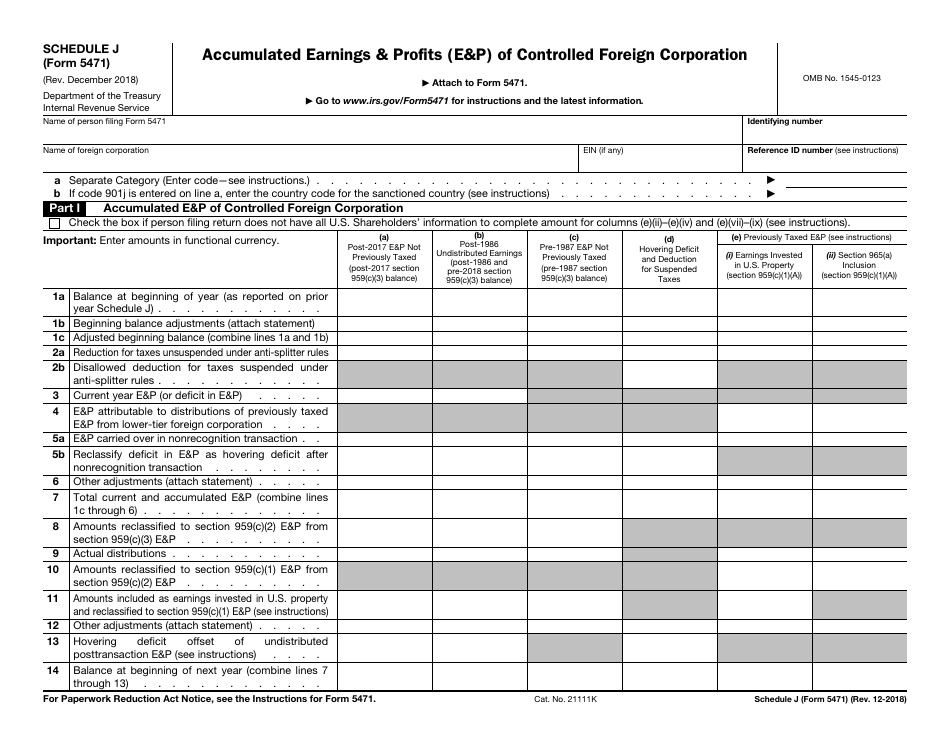

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web the form 5471 begins with a question on page 1 box b by asking you to select one or more categories of being a filer. Web information about form 5471, information return of u.s. Web 2021 schedule fe instructions report with respect ito foreign entities a corporation that is required to file u.s. The classification selected will determine the.

Instructions 5471 Fill out & sign online DocHub

We will also attempt to provide guidance as to how to prepare this. Web new form 7204 (draft rev. Persons who are officers, directors, or shareholders of foreign entities that are classified as corporations for u.s. Complete, edit or print tax forms instantly. Web 23 apr 2021 by anthony diosdi schedule j of form 5471 tracks the earnings and profits.

form 5471 schedule j instructions 2022 Fill Online, Printable

Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Shareholder who doesn't qualify as either a category 5b or 5c filer. Web instructions for form 5471(rev. In most cases, special ordering rules. There have been revisions to the form in both 2017 and.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

Form 5471 with respect to its ownership of certain foreign. Web the form 5471 begins with a question on page 1 box b by asking you to select one or more categories of being a filer. Web new form 7204 (draft rev. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were.

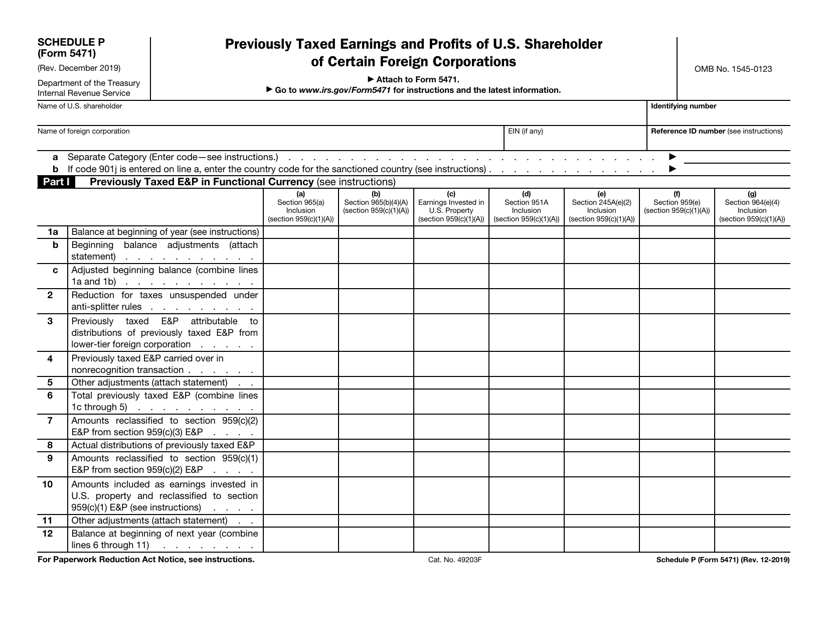

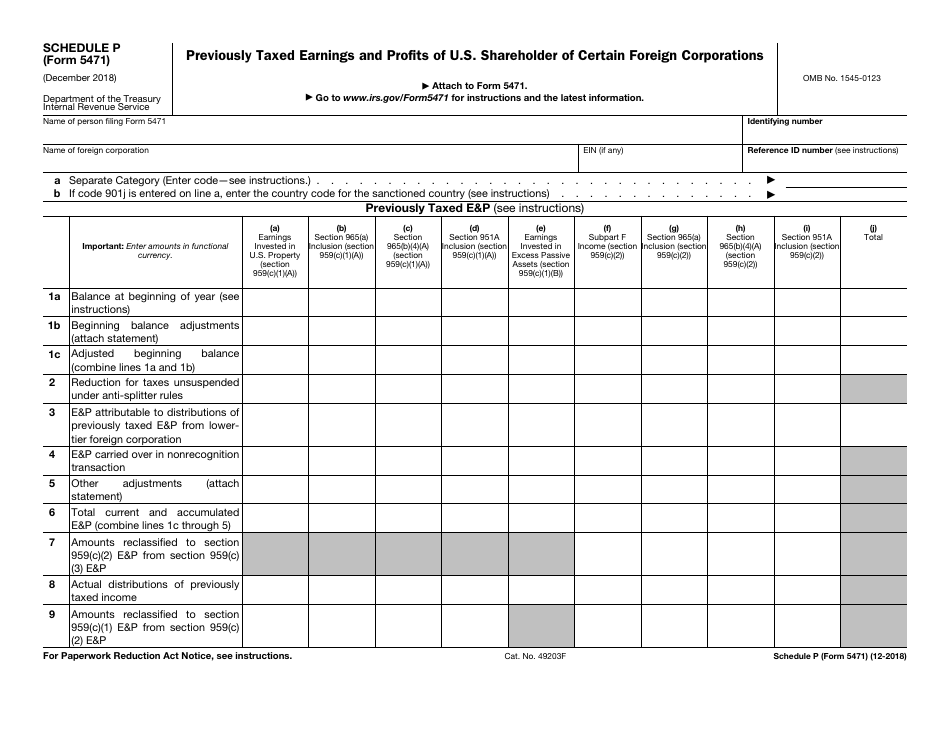

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

In most cases, special ordering rules. There have been revisions to the form in both 2017 and. So, a 5a filer is an unrelated section. Web who has to report ownership in a foreign corporation? Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471.

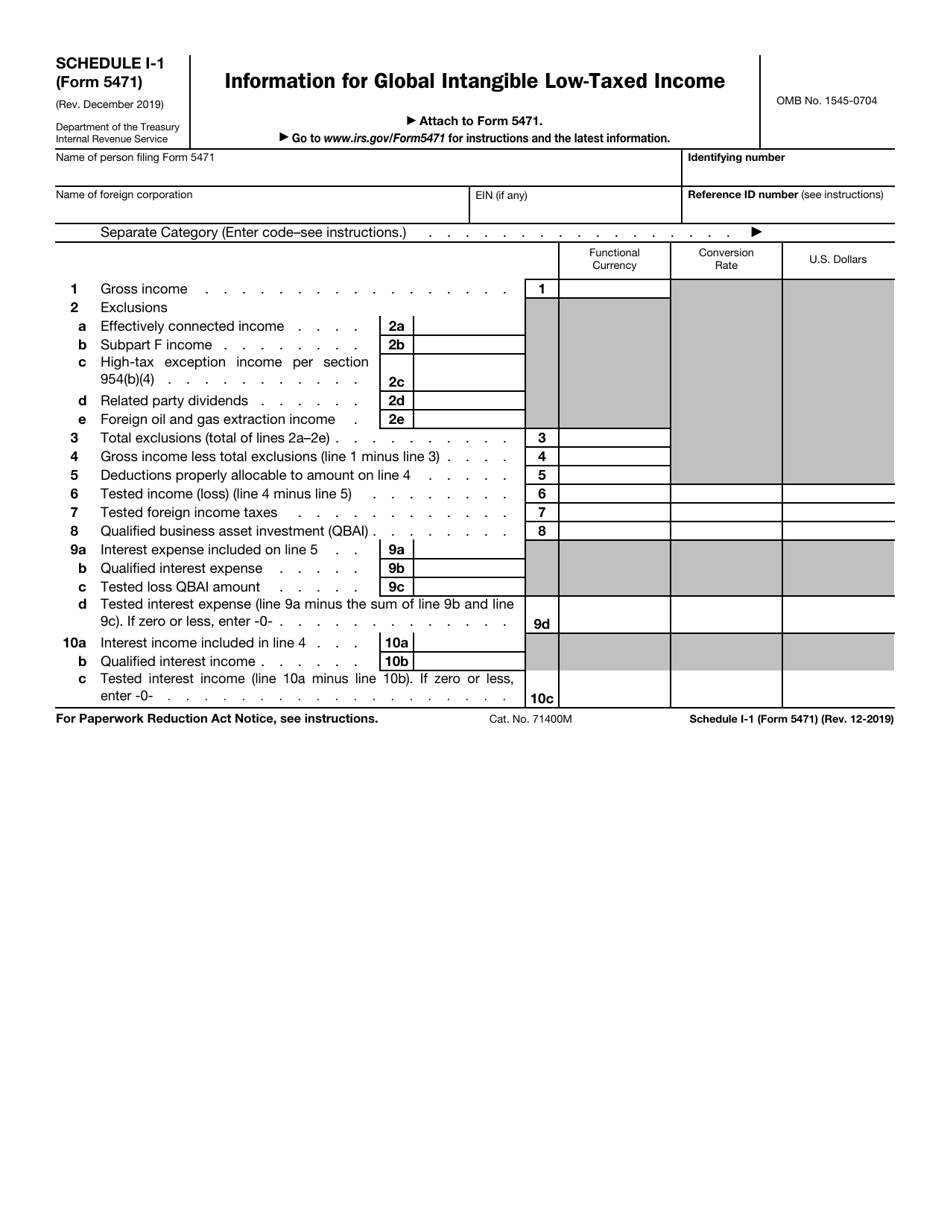

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

Residents, officers, directors, or shareholders in certain foreign. Web 04 aug 2021 by anthony diosdi form 5471 is used by certain u.s. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Web instructions for form 5471(rev. Form 5471 has different requirements and instructions for each type of filer, and within each.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Shareholder who doesn't qualify as either a category 5b or 5c filer. When and where to file. Web usa december 13 2021 form 5471 form 5471 is becoming an increasingly important form for any us taxpayer in the world with interest in a foreign corporation. Web 04 aug 2021 by anthony diosdi form 5471 is used by certain u.s. Register.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web who has to report ownership in a foreign corporation? Residents, officers, directors, or shareholders in certain foreign. Our instructor chaya siegfried will. There have been revisions to the form in both 2017 and. Web the instructions to form 5471 describes a category 5a filer as a u.s.

2012 form 5471 instructions Fill out & sign online DocHub

Web tax year 2022 form 5471 filing is a filing requirement and an information return that applies to u.s. Register and subscribe now to work on your irs 5471 & more fillable forms. Web information about form 5471, information return of u.s. The december 2021 revision of separate. Web who has to report ownership in a foreign corporation?

December 2022) Department Of The Treasury Internal Revenue Service.

The classification selected will determine the appropriate. There have been revisions to the form in both 2017 and. Shareholder who doesn't qualify as either a category 5b or 5c filer. Form 5471 with respect to its ownership of certain foreign.

Web Who Has To Report Ownership In A Foreign Corporation?

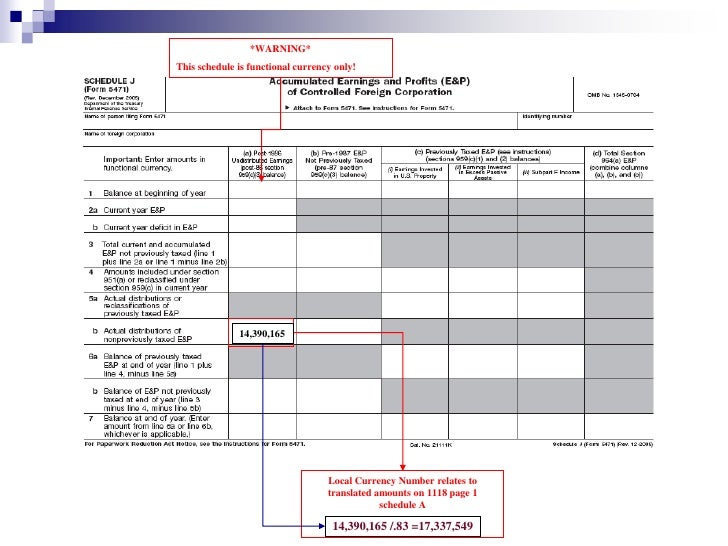

Web 23 apr 2021 by anthony diosdi schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Residents, officers, directors, or shareholders in certain foreign. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web 04 aug 2021 by anthony diosdi form 5471 is used by certain u.s.

Web Usa December 13 2021 Form 5471 Form 5471 Is Becoming An Increasingly Important Form For Any Us Taxpayer In The World With Interest In A Foreign Corporation.

5 form 5471 is filed when the. 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Complete, edit or print tax forms instantly.

The December 2021 Revision Of Separate.

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web 2021 schedule fe instructions report with respect ito foreign entities a corporation that is required to file u.s. In most cases, special ordering rules. Persons who are officers, directors, or shareholders of foreign entities that are classified as corporations for u.s.