2021 Form 4562 Instructions

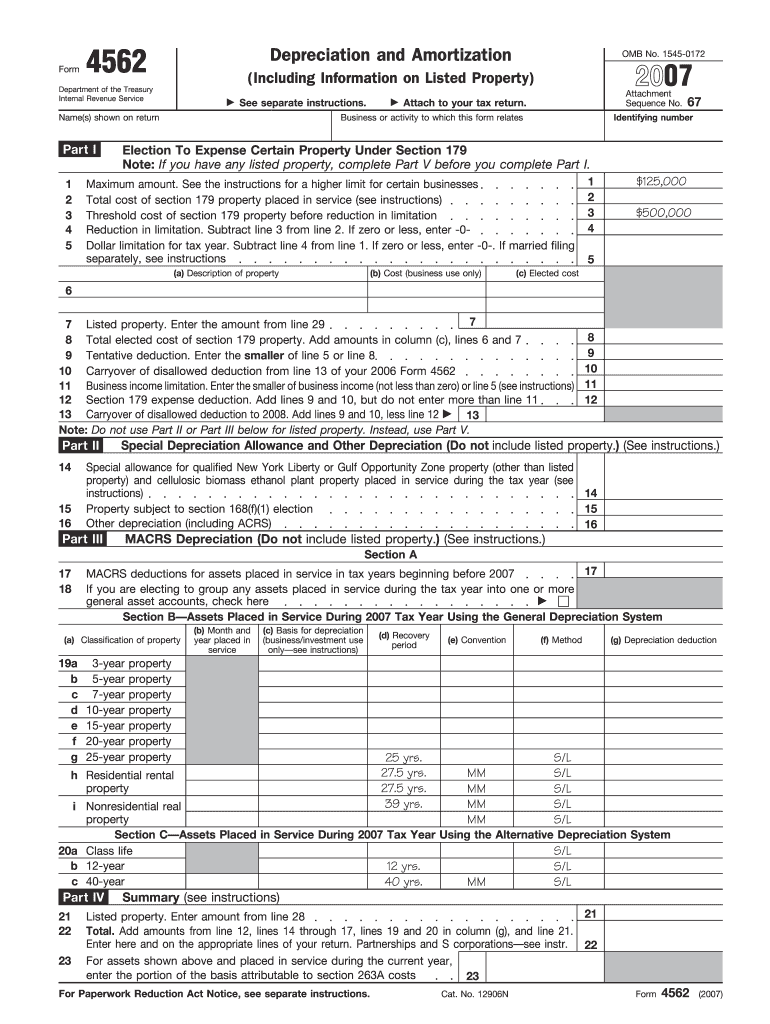

2021 Form 4562 Instructions - Learn what assets should be included on form 4562, as well as how often this form should. General instructions purpose of form who must file additional information definitions. Web popular forms & instructions; Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions. Try it for free now! Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Web 4562 georgia depreciation andamortization form (rev. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization. Iowa depreciation adjustments may still be required for assets placed in service during a tax year that beganbefore january 1, 2021 as Web adjustments are required on this form for property placed in service during a tax year that begins on or after january 1, 2021 if bonus depreciation was taken on the property for federal purposes.

05/26/22) (including informatio n on listed property) note: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions. Ad access irs tax forms. Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web adjustments are required on this form for property placed in service during a tax year that begins on or after january 1, 2021 if bonus depreciation was taken on the property for federal purposes. Amortization of research and experimental expenditures. Vermont homestead declaration and/or property tax. Web 2021 vermont income tax return booklet. Web 4562 georgia depreciation andamortization form (rev.

Individual tax return form 1040 instructions; Ad access irs tax forms. Vermont homestead declaration and/or property tax. 05/26/22) (including informatio n on listed property) note: Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization. Web adjustments are required on this form for property placed in service during a tax year that begins on or after january 1, 2021 if bonus depreciation was taken on the property for federal purposes. Try it for free now! Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Phase down of the special depreciation allowance for certain property.

2021 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions. Iowa depreciation adjustments may still be required for assets placed in service during a tax year that beganbefore january 1, 2021 as Purpose of form use form 8962 to figure the amount.

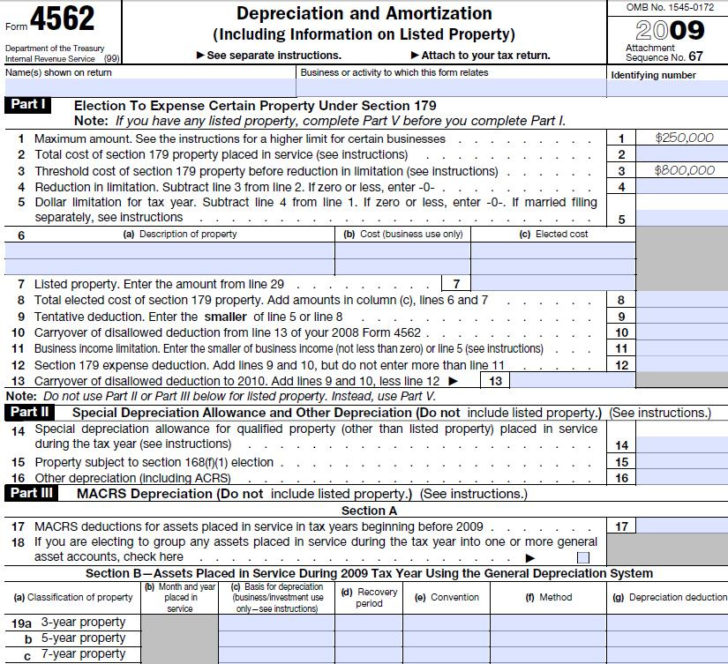

Macrs Depreciation Table 2017 Irs Review Home Decor

Individual tax return form 1040 instructions; Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web adjustments are required on this form for property placed in service during a tax year that begins on or after january 1, 2021 if bonus depreciation was taken on the property for federal purposes..

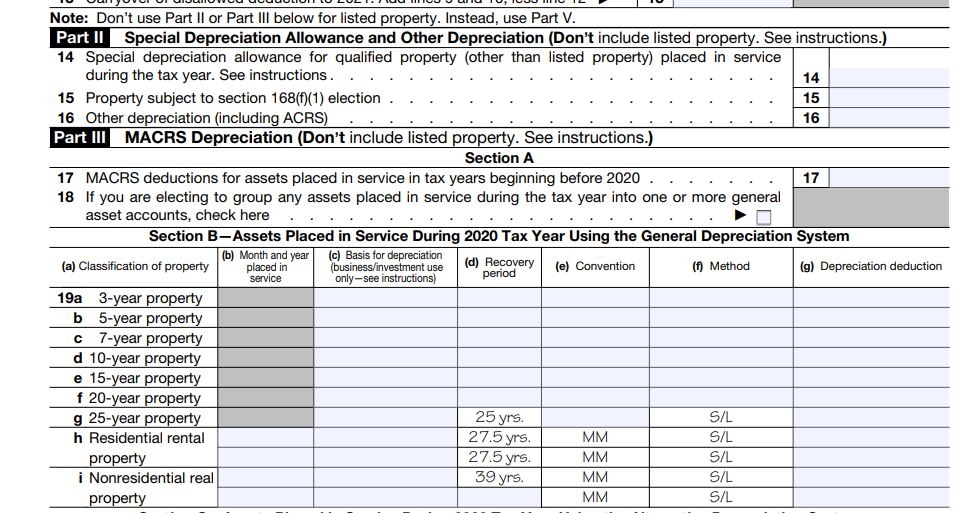

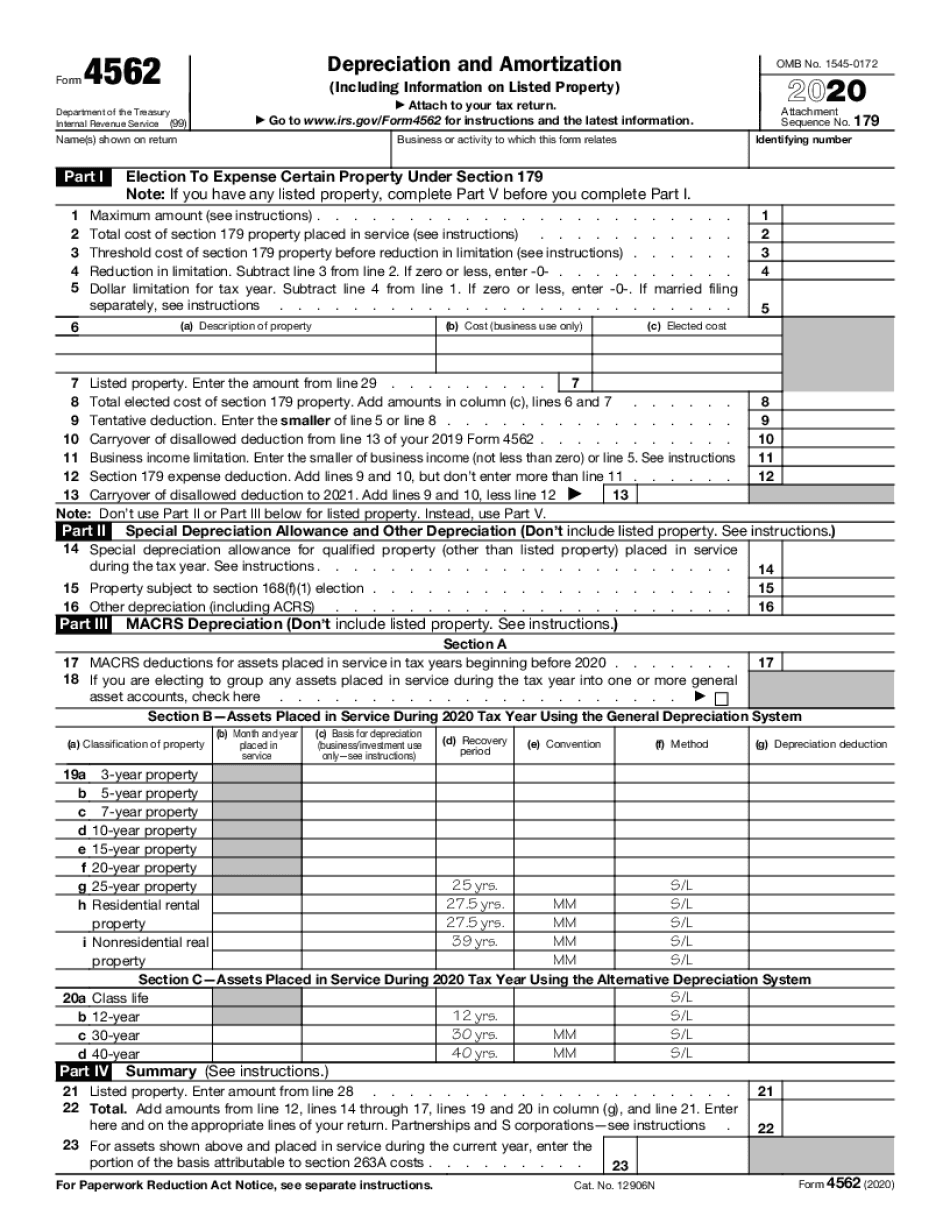

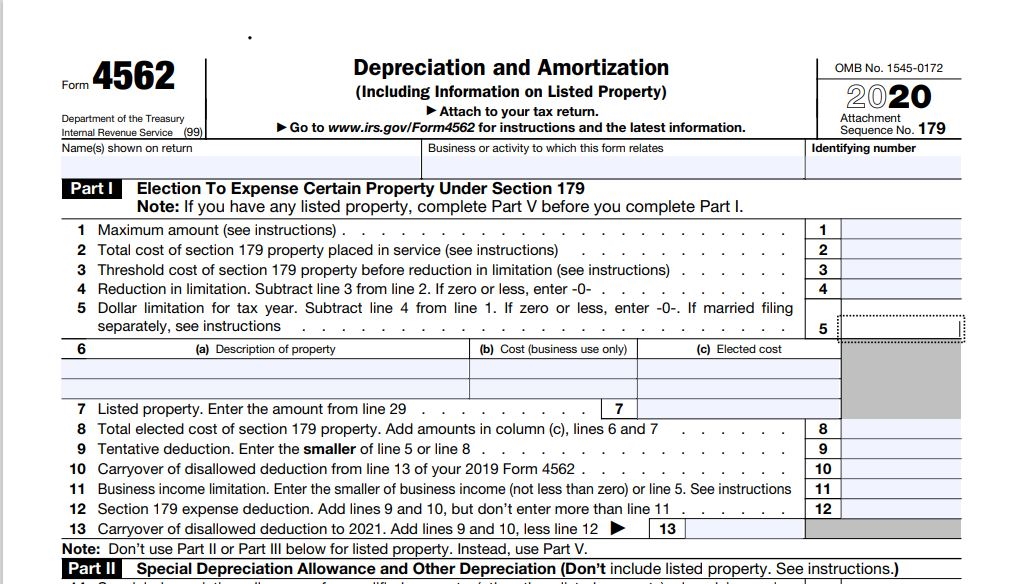

2020 Form 4562 Depreciation and Amortization21 Nina's Soap

Web 2021 instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Ad access irs tax forms. Ad upload, modify or create forms. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property..

√ダウンロード example 60 hour driving log filled out 339415How to fill out

Complete, edit or print tax forms instantly. 05/26/22) (including informatio n on listed property) note: Web 2021 vermont income tax return booklet. This booklet includes forms and instructions for: Get ready for tax season deadlines by completing any required tax forms today.

Depreciation Form 4562 2020 Fill Online Printable Free Nude Porn Photos

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Try it for free now! Vermont homestead declaration and/or property tax. Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions.

4562 Form 2021

Learn what assets should be included on form 4562, as well as how often this form should. Web 2021 instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Phase down of the special depreciation allowance for certain property. Ad upload, modify or create.

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Individual tax return form 1040 instructions; Get ready for tax season deadlines by completing any required tax forms today. Learn what assets should be included on form 4562, as well as how often this form should. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization. Web adjustments are required on this form for property placed.

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

Try it for free now! Iowa depreciation adjustments may still be required for assets placed in service during a tax year that beganbefore january 1, 2021 as General instructions purpose of form who must file additional information definitions. Individual tax return form 1040 instructions; Web 4562 georgia depreciation andamortization form (rev.

Form 4562 Depreciation And Amortization Irs Gov Fill Out Sign Online Dochub

Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions. Web 2021 vermont income tax return booklet. General instructions purpose of form who must file additional information definitions. Get ready for tax season deadlines by completing any required tax forms today. Georgia doe s not allow any additional depreciation benefits provided by i.r.c.

Formulario 4562 depreciation and amortization Actualizado mayo 2022

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Georgia doe s not allow any additional depreciation benefits provided by i.r.c. Ad upload, modify or create forms. Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of.

Web 2021 Vermont Income Tax Return Booklet.

Get ready for tax season deadlines by completing any required tax forms today. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Ad upload, modify or create forms. Georgia section 168(k), 1400l, 1400n(d)(1), and certain other provisions.

Form 4562 Is Used To Claim A Depreciation/Amortization Deduction, To Expense Certain Property, And To Note The Business Use Of Cars/Property.

Georgia doe s not allow any additional depreciation benefits provided by i.r.c. 05/26/22) (including informatio n on listed property) note: Try it for free now! Vermont homestead declaration and/or property tax.

Web Form 4562 Department Of The Treasury Internal Revenue Service (99) Depreciation And Amortization.

Get ready for tax season deadlines by completing any required tax forms today. Web 2021 instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web popular forms & instructions; Phase down of the special depreciation allowance for certain property.

This Booklet Includes Forms And Instructions For:

Amortization of research and experimental expenditures. Web adjustments are required on this form for property placed in service during a tax year that begins on or after january 1, 2021 if bonus depreciation was taken on the property for federal purposes. Individual tax return form 1040 instructions; Iowa depreciation adjustments may still be required for assets placed in service during a tax year that beganbefore january 1, 2021 as