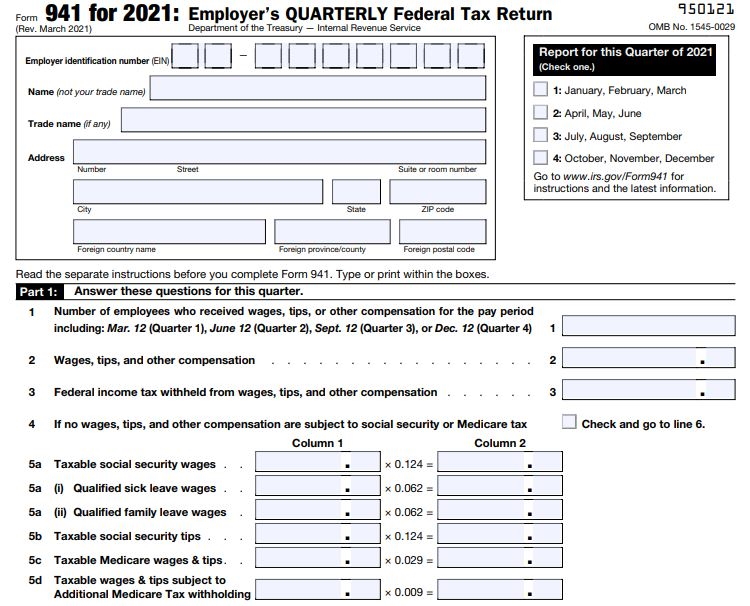

2021 941 Form

2021 941 Form - Find your 941 forms from the filing period you need. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Pay the employer's portion of social security or medicare tax. Web 2021 form 941 author: Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web about form 941, employer's quarterly federal tax return. Employer s quarterly federal tax return created date: Read the separate instructions before you complete form 941. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. The june 2021 revision of form 941.

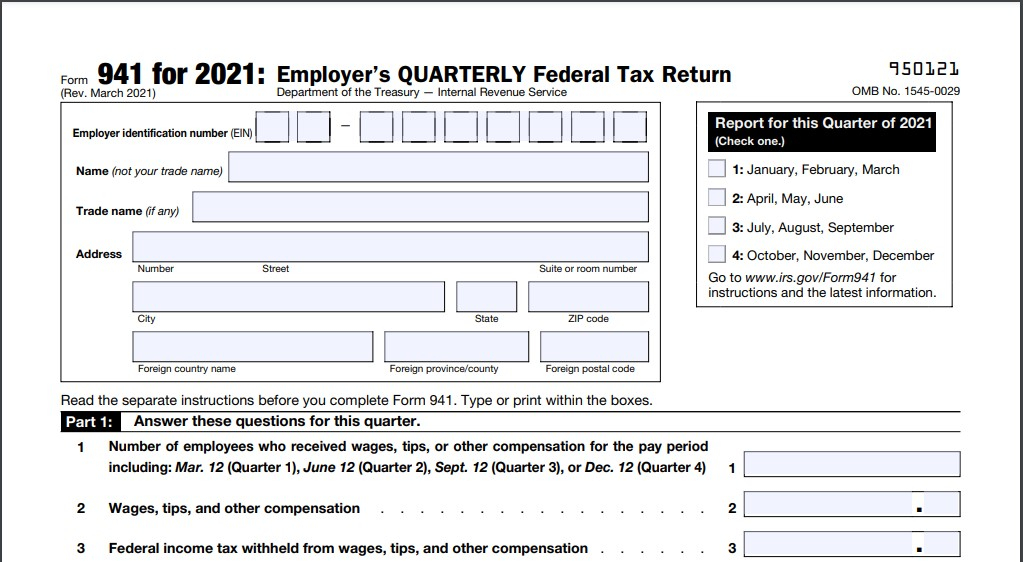

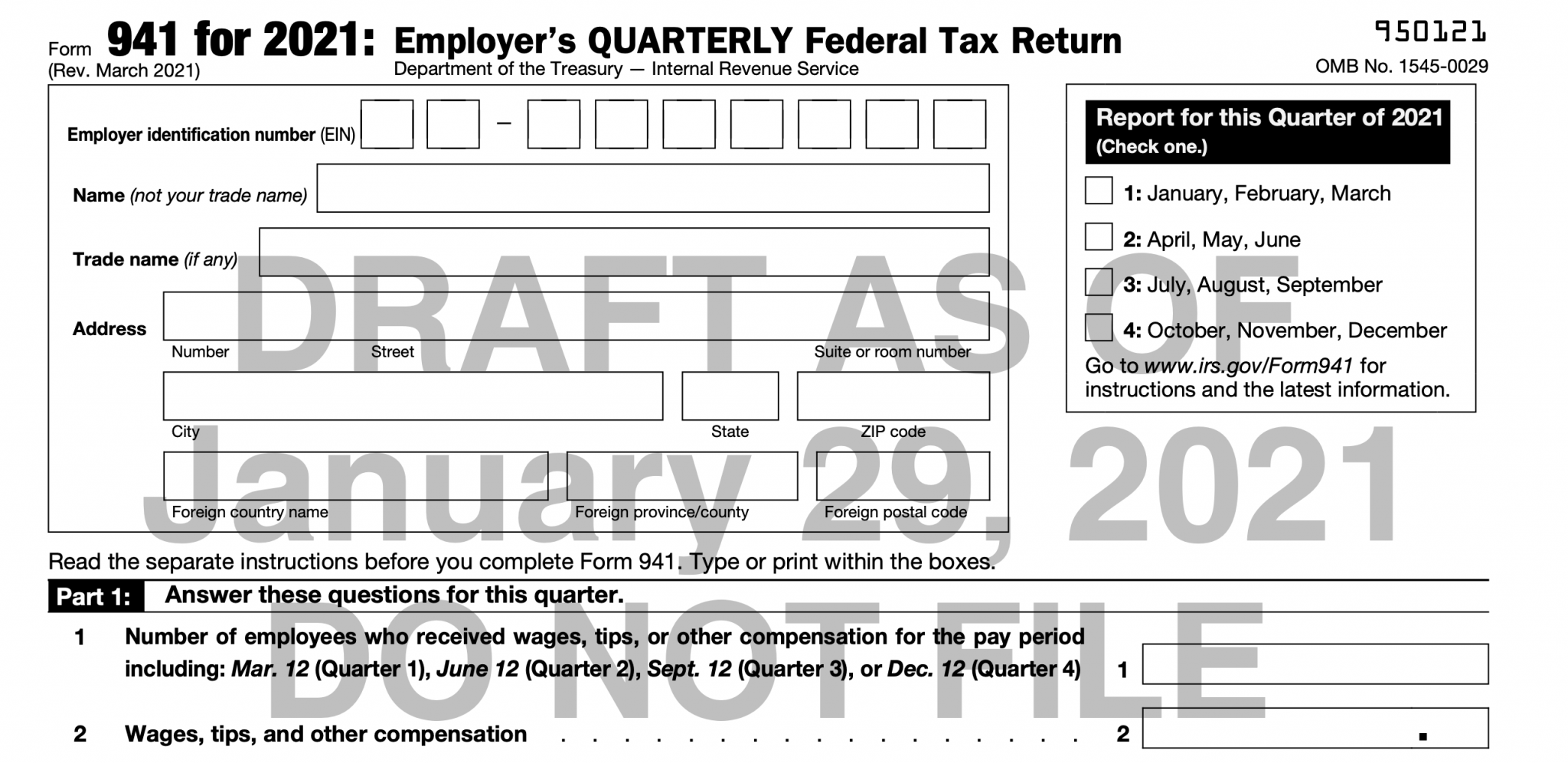

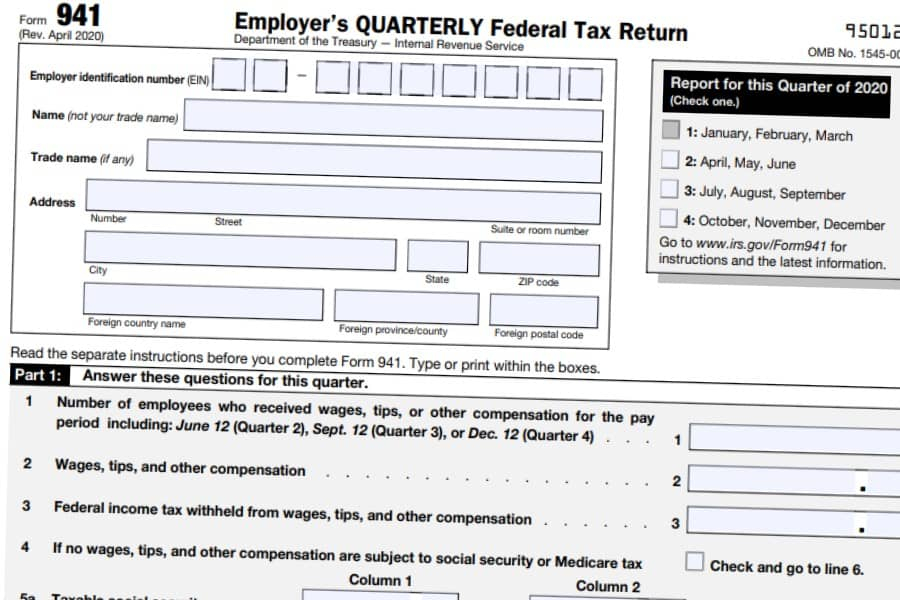

Find your 941 forms from the filing period you need. Web report for this quarter of 2021 (check one.) 1: If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return. Pay the employer's portion of social security or medicare tax. Instructions for form 941 (2021) pdf. Read the separate instructions before you complete form 941. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Employer identification number (ein) — name (not. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021.

Employer s quarterly federal tax return created date: Web employer's quarterly federal tax return for 2021. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Pay the employer's portion of social security or medicare tax. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Employer identification number (ein) — name (not. Instructions for form 941 (2021) pdf. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web about form 941, employer's quarterly federal tax return. For instructions and the latest information.

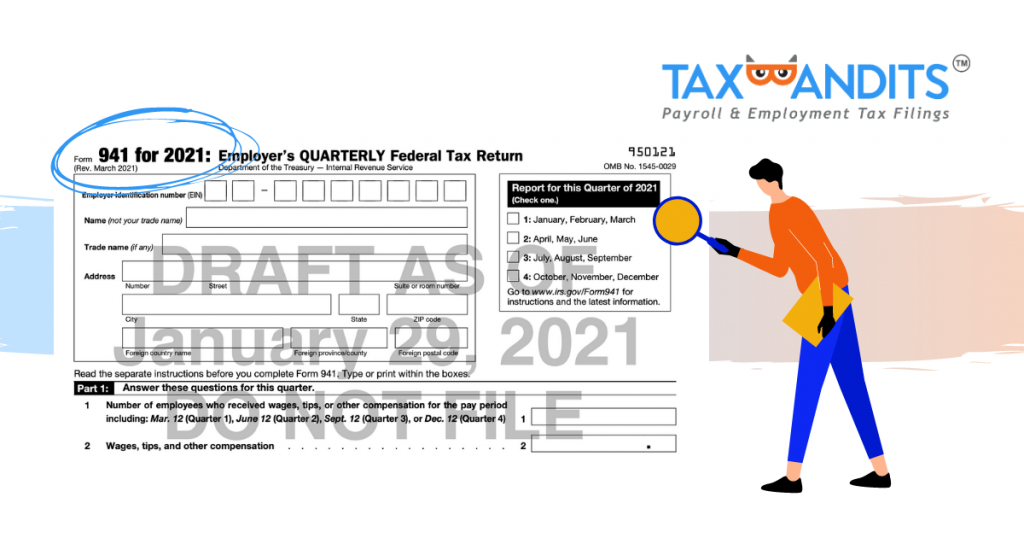

The IRS Released A Draft of Form 941 for Tax Year 2021 Blog TaxBandits

Type or print within the boxes. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Web about form 941, employer's quarterly federal tax return. Read.

2022 Louisiana Tax Withholding Form

Type or print within the boxes. Web employer's quarterly federal tax return for 2021. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Find your 941 forms from the filing period you need. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021.

The IRS Released A Draft of Form 941 for Tax Year 2021 Blog TaxBandits

Instructions for form 941 (2021) pdf. For instructions and the latest information. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Web form 941 for 2021: Pay the employer's portion of social security or medicare tax.

IRS Form 941X Complete & Print 941X for 2021

The june 2021 revision of form 941. Web form 941 for 2021: Pay the employer's portion of social security or medicare tax. Web 2021 form 941 author: Go to the employee menu and choose payroll center.

Printable 941 Tax Form 2021 Printable Form 2022

If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Find your 941 forms from the filing period you need. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the.

How to Fill out IRS Form 941 Nina's Soap

Read the separate instructions before you complete form 941. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Find your 941 forms from the filing period you.

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

Web 2021 form 941 author: Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Read the separate instructions before you complete form 941. For instructions and the latest information. Web report for this quarter of 2021.

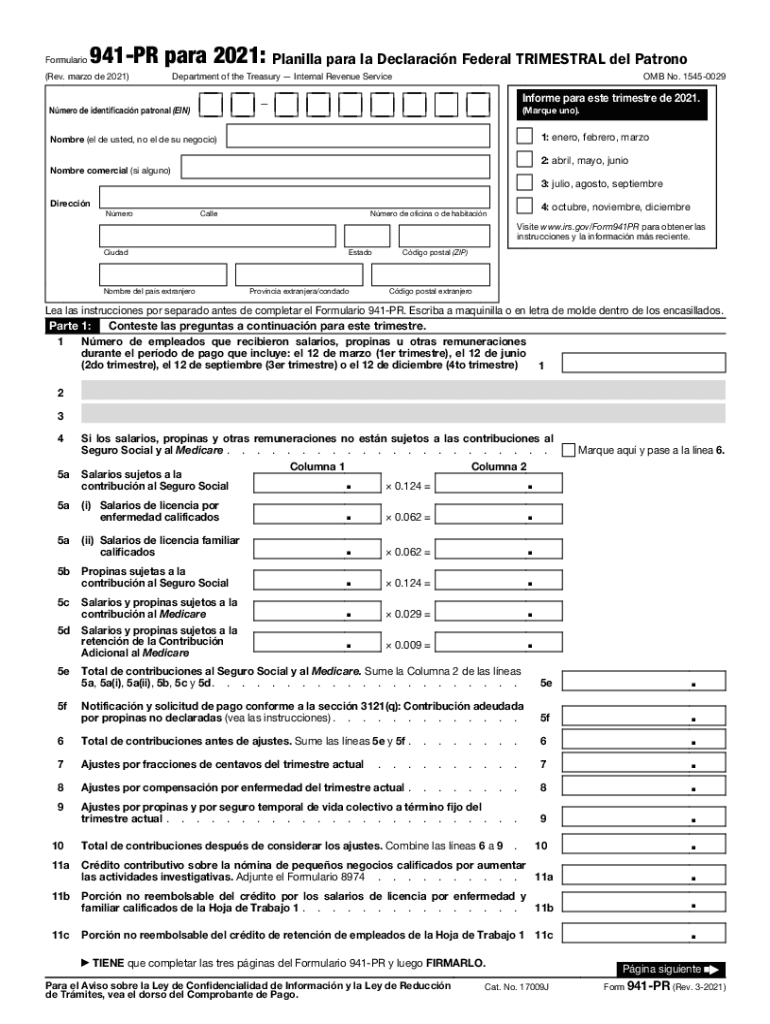

941 Pr 2021 Form Fill Out and Sign Printable PDF Template signNow

Web 2021 form 941 author: Web form 941 for 2021: Go to the employee menu and choose payroll center. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web if you file those in quickbooks desktop,.

941 Form 2021 941 Forms

Web employer's quarterly federal tax return for 2021. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying.

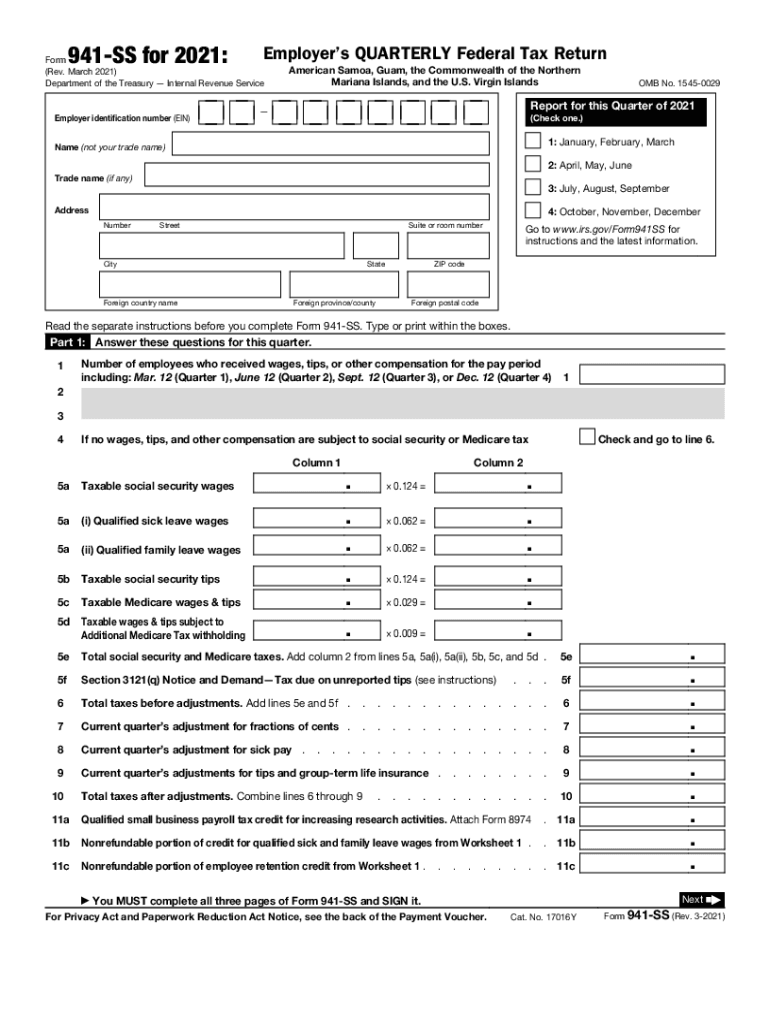

2021 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return. Read the separate instructions before you complete form 941. Find your 941 forms from the filing period you need. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Report income taxes,.

For Employers Who Withhold Taxes From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax (Also Known As Schedule B).

Go to the employee menu and choose payroll center. Web about form 941, employer's quarterly federal tax return. Web employer's quarterly federal tax return for 2021. If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return.

Web Irs Form 941, Also Known As The Employer’s Quarterly Federal Tax Return, Is Where Businesses Report The Income Taxes And Payroll Taxes That They Withheld From Their Employees’ Wages — As Well.

The june 2021 revision of form 941. For instructions and the latest information. Read the separate instructions before you complete form 941. Employer identification number (ein) — name (not.

Web Report For This Quarter Of 2021 (Check One.) 1:

Find your 941 forms from the filing period you need. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Employer s quarterly federal tax return created date: March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121.

Reminders Don't Use An Earlier Revision Of Form 941 To Report Taxes For 2021.

Instructions for form 941 (2021) pdf. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Web form 941 for 2021: Pay the employer's portion of social security or medicare tax.