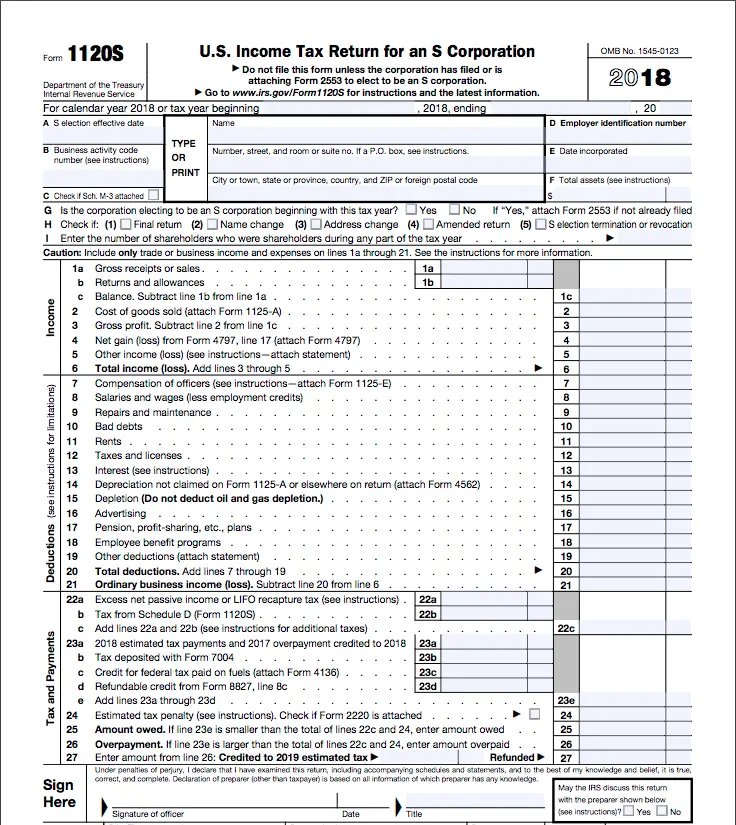

2018 Form 1120S

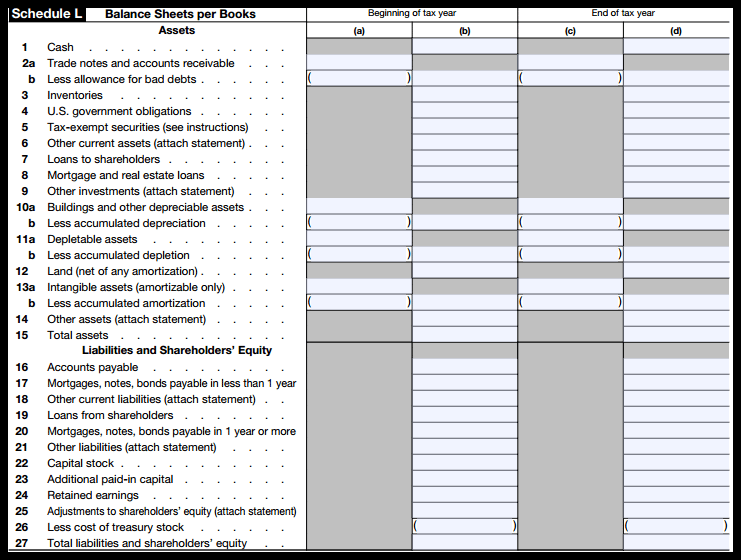

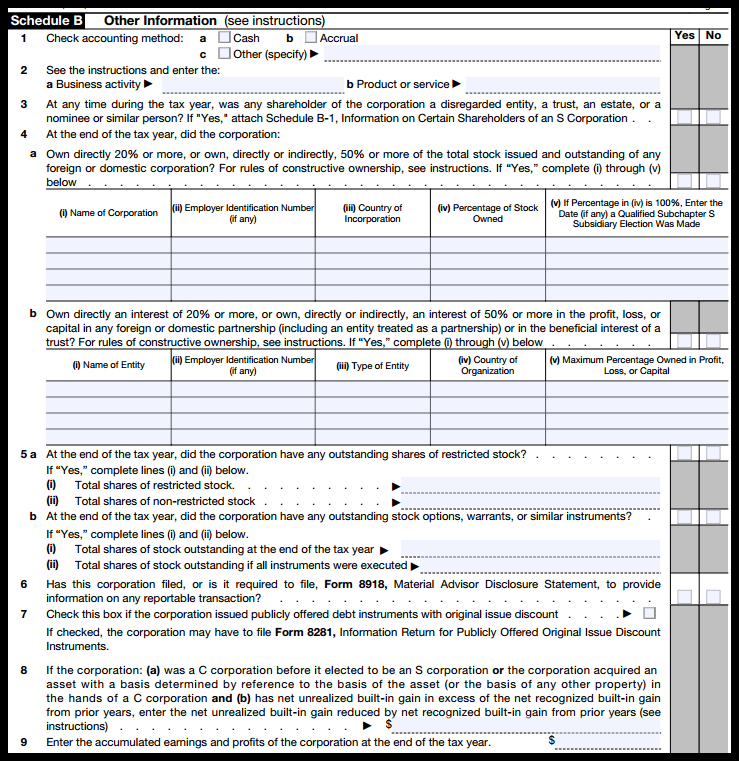

2018 Form 1120S - The form should not be filed unless. When you first start a return in turbotax business, you'll be asked. Web form 1120s (u.s. Rather the profit reported on the s. Complete, edit or print tax forms instantly. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! For steps to amend the return. (for shareholder's use only) department of the treasury. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. 2 schedule b other information (see instructions) 1.

Web see the instructions and enter the: Web section 1120s of the irs form 1120s deals with taxes and payments. The form should not be filed unless. Rather the profit reported on the s. When you first start a return in turbotax business, you'll be asked. For calendar year corporations, the due date is march 15, 2018. Open the originally filed return. Get ready for tax season deadlines by completing any required tax forms today. For steps to amend the return. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try!

For calendar year corporations, the due date is march 15, 2018. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Web form 1120s (2018) is used by s corporations to report their income, gains, losses, deductions, credits, and other information. Business activity b product or service at the end of the tax year, did the corporation own, directly or indirectly, 50% or more of the voting stock of. Complete, edit or print tax forms instantly. Web form 1120s (u.s. For steps to amend the return. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! When you first start a return in turbotax business, you'll be asked. Rather the profit reported on the s.

IRS Form 1120S Definition, Download & Filing Instructions

Open the originally filed return. For calendar year corporations, the due date is march 15, 2018. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. The form should not be filed unless. Rather the profit reported on the s.

IRS Form 1120S Definition, Download & Filing Instructions

(for shareholder's use only) department of the treasury. Get ready for tax season deadlines by completing any required tax forms today. Open the originally filed return. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Web section 1120s of the irs form 1120s deals with.

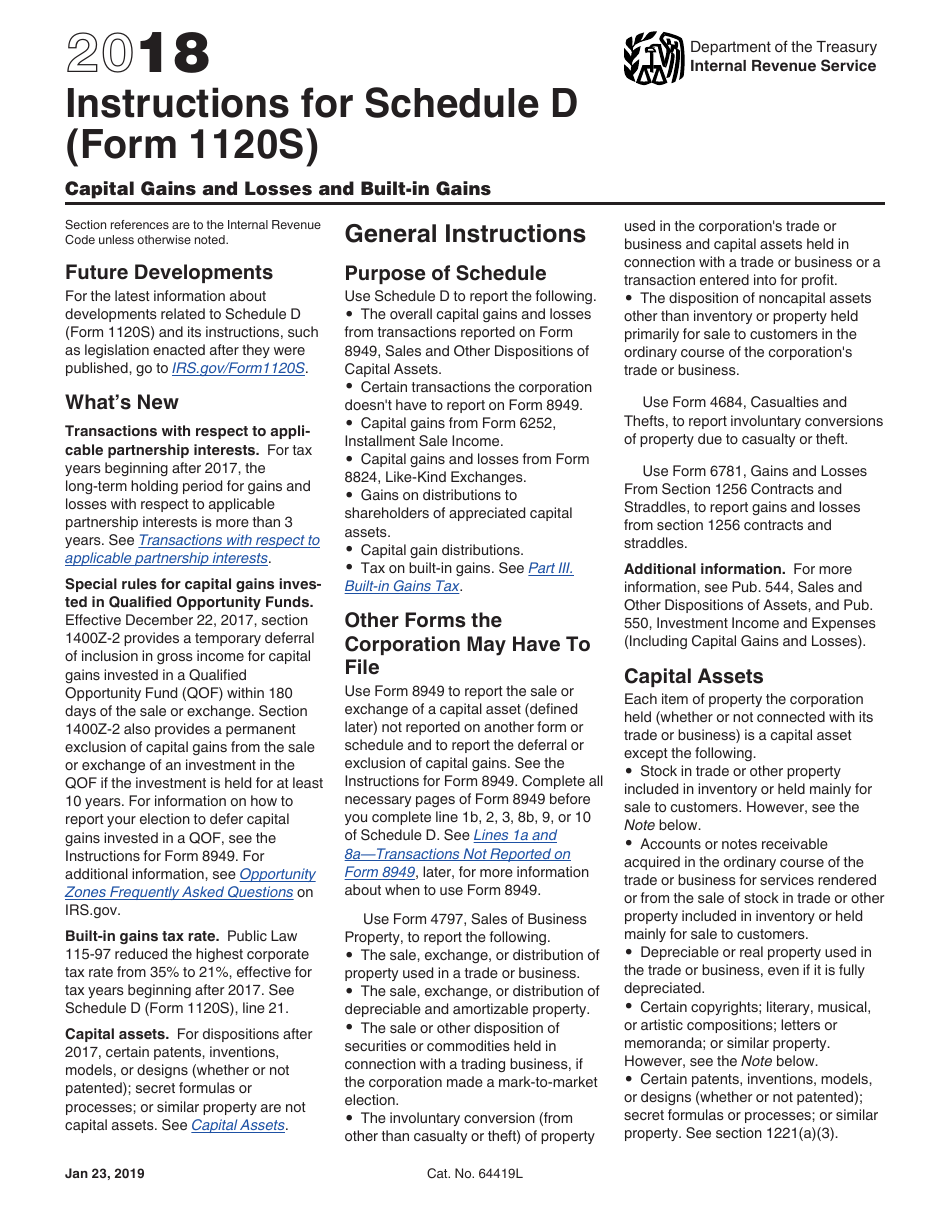

Download Instructions for IRS Form 1120S Schedule D Capital Gains and

Ad easy, fast, secure & free to try! Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Get ready for tax season deadlines by completing any required tax forms today. Income tax return for an s corporation) is available in turbotax business. Complete, edit or print tax forms instantly.

IRS Form 1120S Definition, Download, & 1120S Instructions

Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule. Web section 1120s of the irs form 1120s deals with taxes and payments. Web see the instructions and enter the: Get ready for tax season.

Fill Free fillable form 1120s u.s. tax return for an s

(for shareholder's use only) department of the treasury. Business activity b product or service at the end of the tax year, did the corporation own, directly or indirectly, 50% or more of the voting stock of. Web see the instructions and enter the: Open the originally filed return. Web generally, an s corporation must file form 1120s by the 15th.

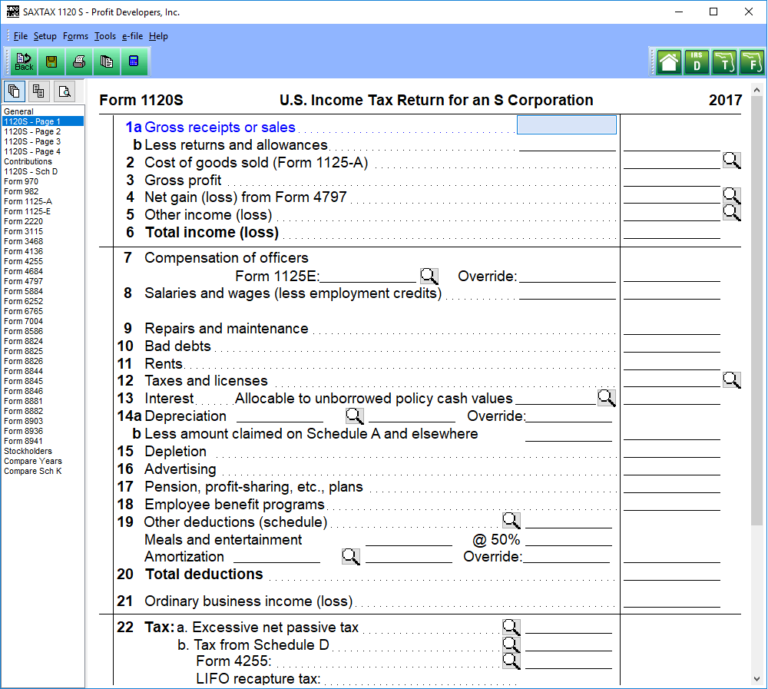

1120S Program SAXTAX

Web section 1120s of the irs form 1120s deals with taxes and payments. For calendar year corporations, the due date is march 15, 2018. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Web form 1120s (u.s. Web see the instructions and enter the:

2018 Form 1120 Federal Corporation Tax Return YouTube

2 schedule b other information (see instructions) 1. Open the originally filed return. Income tax return for an s corporation) is available in turbotax business. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The form should not be filed unless.

What Tax Form Does An Llc File

Web see the instructions and enter the: Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Web section 1120s of the irs form 1120s deals with taxes and payments. Web form 1120s (u.s. Web form 1120s (2018) is used by s corporations to report their.

Fill Free fillable form 1120s u.s. tax return for an s

Web form 1120s (2018) is used by s corporations to report their income, gains, losses, deductions, credits, and other information. (for shareholder's use only) department of the treasury. Ad easy, fast, secure & free to try! Complete, edit or print tax forms instantly. For calendar year corporations, the due date is march 15, 2018.

2018 form 1120s k1 Fill Online, Printable, Fillable Blank form

Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Web section 1120s of the irs form 1120s deals with taxes and payments. Rather the profit reported on the s. Income tax return for an s corporation) is available in turbotax business. Complete, edit or print.

For Steps To Amend The Return.

Open the originally filed return. Rather the profit reported on the s. Web form 1120s (u.s. Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule.

Web Section 1120S Of The Irs Form 1120S Deals With Taxes And Payments.

Complete, edit or print tax forms instantly. When you first start a return in turbotax business, you'll be asked. Ad easy, fast, secure & free to try! Get ready for tax season deadlines by completing any required tax forms today.

Business Activity B Product Or Service At The End Of The Tax Year, Did The Corporation Own, Directly Or Indirectly, 50% Or More Of The Voting Stock Of.

Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. The form should not be filed unless. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web form 1120s (2018) is used by s corporations to report their income, gains, losses, deductions, credits, and other information.

Web See The Instructions And Enter The:

(for shareholder's use only) department of the treasury. Income tax return for an s corporation) is available in turbotax business. For calendar year corporations, the due date is march 15, 2018. 2 schedule b other information (see instructions) 1.