1099 Nec Free Fillable Form

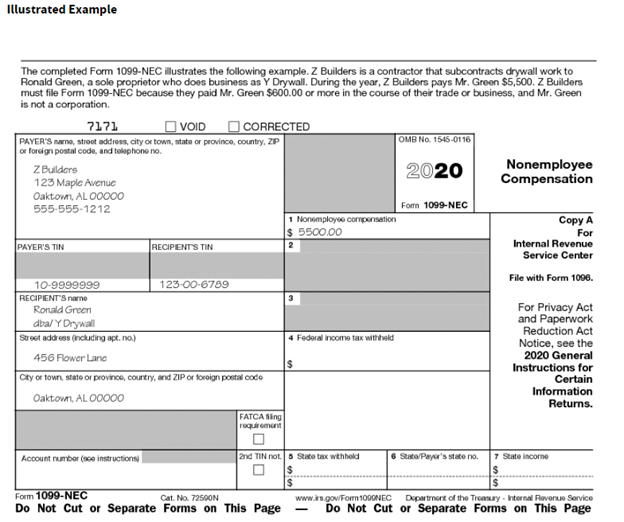

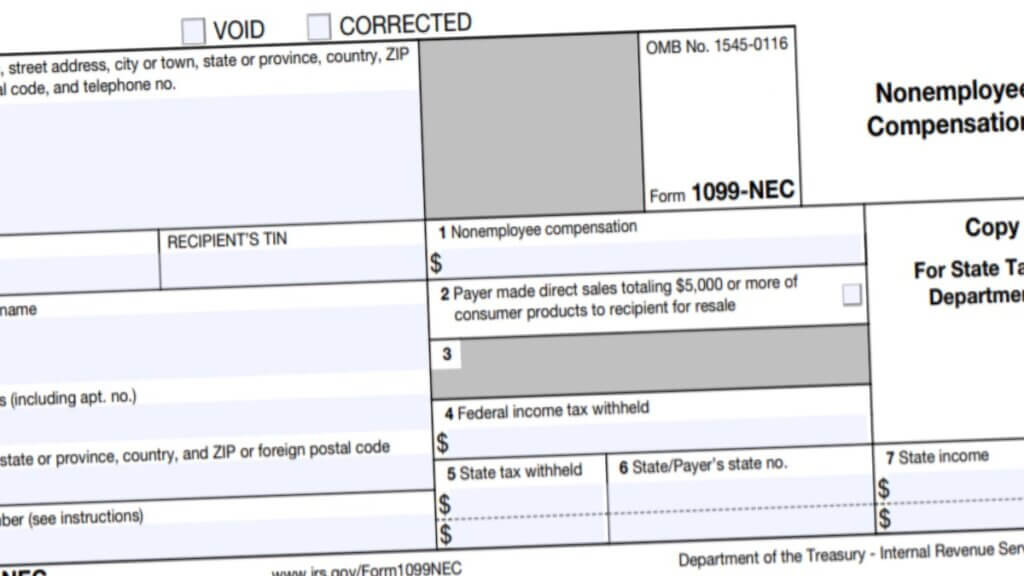

1099 Nec Free Fillable Form - For federal income tax purposes, payments made to people who aren’t directly employed by the company must be reported to the internal revenue service (irs). Specify your information in the first field. If you have made a payment of $600 or more to an independent contractor or if you have withheld any taxes, you must. Simple, and easy to use no software downloads or installation required. Account number (see instructions) 2nd tin not. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. Get your online template and fill it in using progressive features. All forms are printable and downloadable. Step by step video tutorial where can i find related tax.

For federal income tax purposes, payments made to people who aren’t directly employed by the company must be reported to the internal revenue service (irs). How does tax filing work for freelancers? For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign 1099 nec form 2021 online? For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Copy b and copy 2: 72590n do not cut or separate forms on this page — do not cut or separate forms on this page Examples of this include freelance work or driving for doordash or uber. Click the fill out form button. Irs form 1099 nec is due to the irs and to the contractor annually on “ january 31st of the following calendar year”.

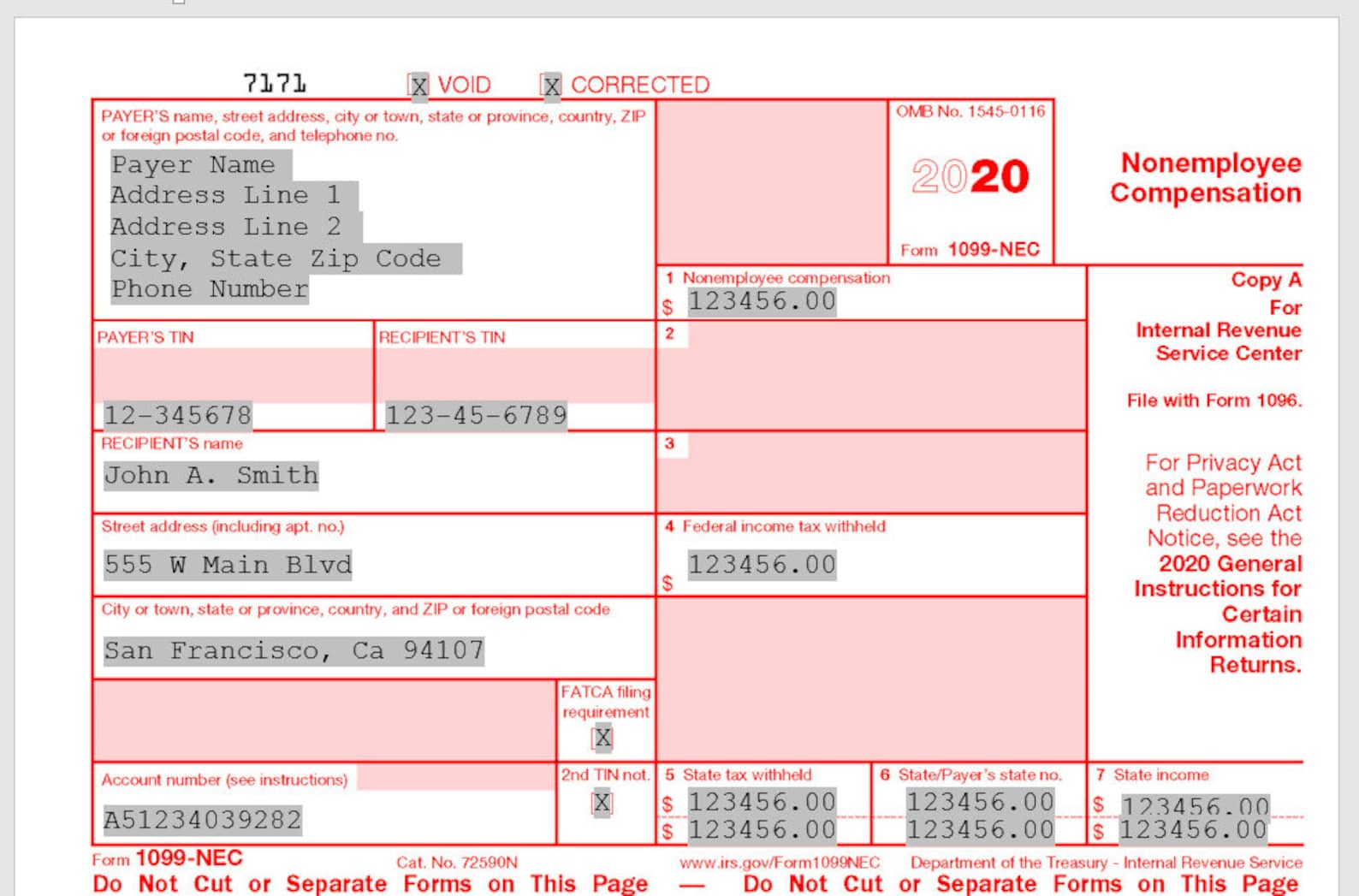

Write your and the recipient's tin. 72590n do not cut or separate forms on this page — do not cut or separate forms on this page If you have made a payment of $600 or more to an independent contractor or if you have withheld any taxes, you must. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Get your online template and fill it in using progressive features. Click the fill out form button. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. How does tax filing work for freelancers? Web file with form 1096. Irs form 1099 nec is due to the irs and to the contractor annually on “ january 31st of the following calendar year”.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Write your and the recipient's tin. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Get your online template and fill it in using progressive features. Web instructions for recipient recipient’s taxpayer identification number (tin). Simple, and easy to use no software downloads or installation.

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

Examples of this include freelance work or driving for doordash or uber. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Quick & secure online filing. 72590n do not cut or separate forms on this page — do not cut or separate forms on this.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Examples of this include freelance work or driving for doordash or uber. Once completed you can sign your fillable form or send for signing. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★.

What the 1099NEC Coming Back Means for your Business Chortek

Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Web file with form 1096. Specify your information in the first field. Pricing starts as low as $2.75/form.

1099 NEC Form 2022

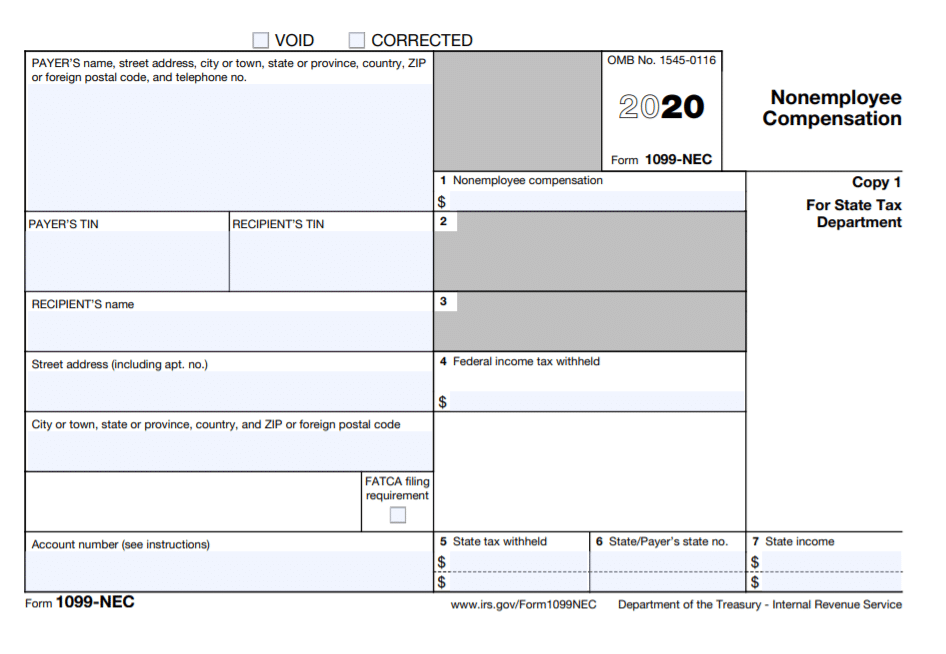

Irs form 1099 nec is due to the irs and to the contractor annually on “ january 31st of the following calendar year”. Copy b and copy 2: Specify your information in the first field. Click the fill out form button. Send to your state’s tax department.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

All forms are printable and downloadable. 72590n do not cut or separate forms on this page — do not cut or separate forms on this page Copy b and copy 2: For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Account number (see instructions) 2nd tin not.

What Is Form 1099NEC?

How does tax filing work for freelancers? Account number (see instructions) 2nd tin not. For federal income tax purposes, payments made to people who aren’t directly employed by the company must be reported to the internal revenue service (irs). Simple, and easy to use no software downloads or installation required. Step by step video tutorial where can i find related.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Web instructions.

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Simple, and easy to use no software downloads or installation required. Step by step video tutorial where can i find related tax. Use fill to complete blank online irs pdf forms for free. Get your online template and fill it in using progressive.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign 1099 nec form 2021 online? Specify your information.

Quick & Secure Online Filing.

Pricing starts as low as $2.75/form. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. 72590n do not cut or separate forms on this page — do not cut or separate forms on this page

If You Have Made A Payment Of $600 Or More To An Independent Contractor Or If You Have Withheld Any Taxes, You Must.

All forms are printable and downloadable. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Web file with form 1096. Write your and the recipient's tin.

How Does Tax Filing Work For Freelancers?

Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign 1099 nec form 2021 online? Get your online template and fill it in using progressive features. Simple, and easy to use no software downloads or installation required.

Once Completed You Can Sign Your Fillable Form Or Send For Signing.

Send to your state’s tax department. Specify your information in the first field. You can complete the form using irs free file or a tax filing software. Account number (see instructions) 2nd tin not.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)