1099 Misc Form 2016

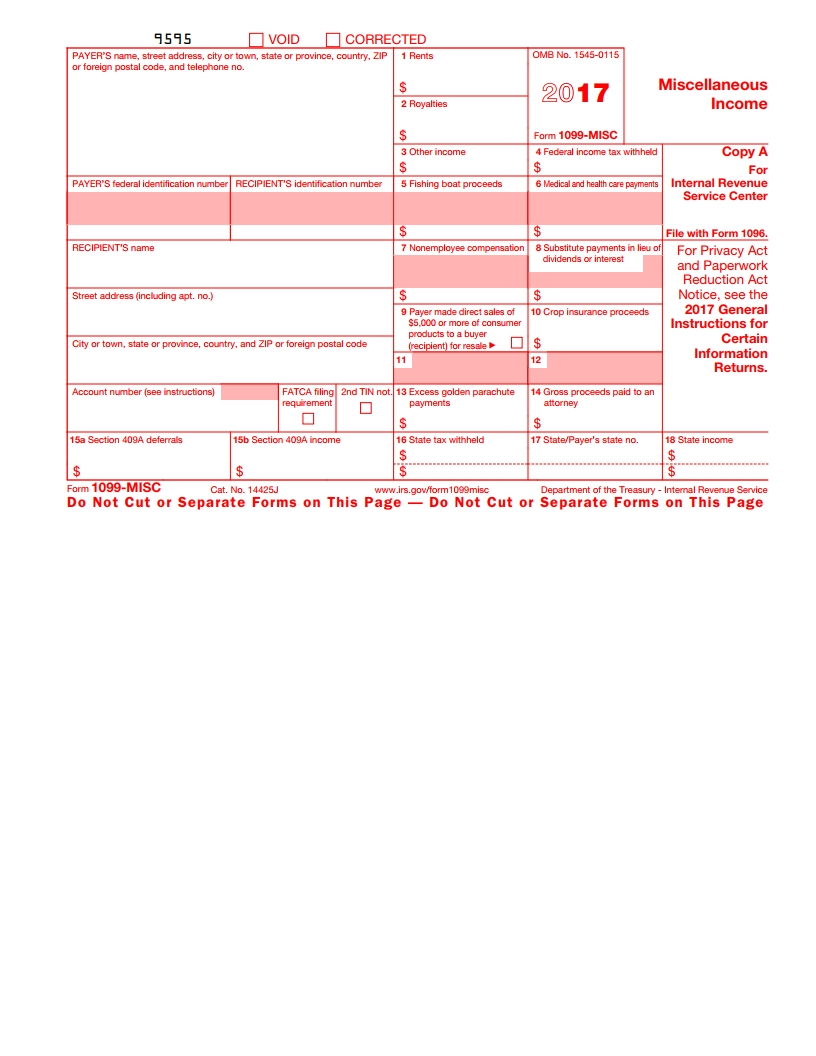

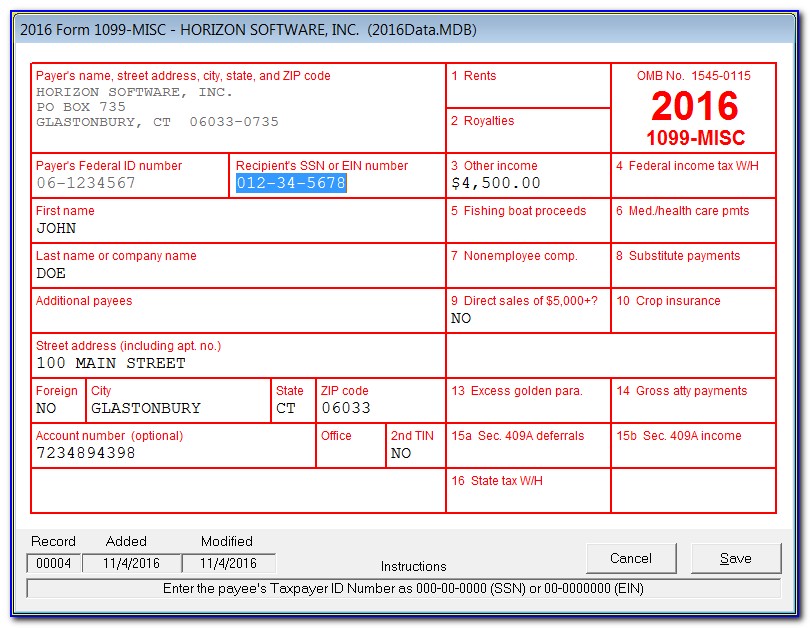

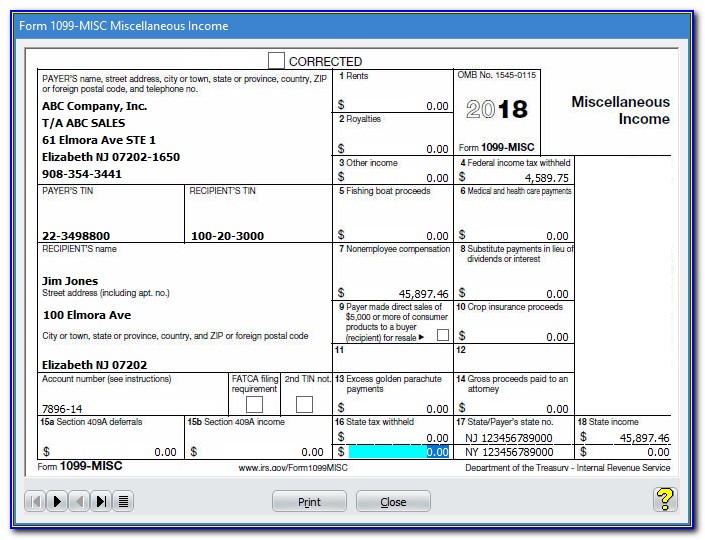

1099 Misc Form 2016 - Some common examples of payments. Rents if someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in box 1. Web 2016 check here if the debtor was personally liable for copy a for internal revenue service center file with form 1096. At least $10 in royalties (see the instructions for box 2) or. At least $10 in royalties or broker. Do not miss the deadline Copy 1 for state, city, or local tax department street address (including. If this form is incorrect or has been issued in error, contact the payer. This is important tax information. Ad get the latest 1099 misc online.

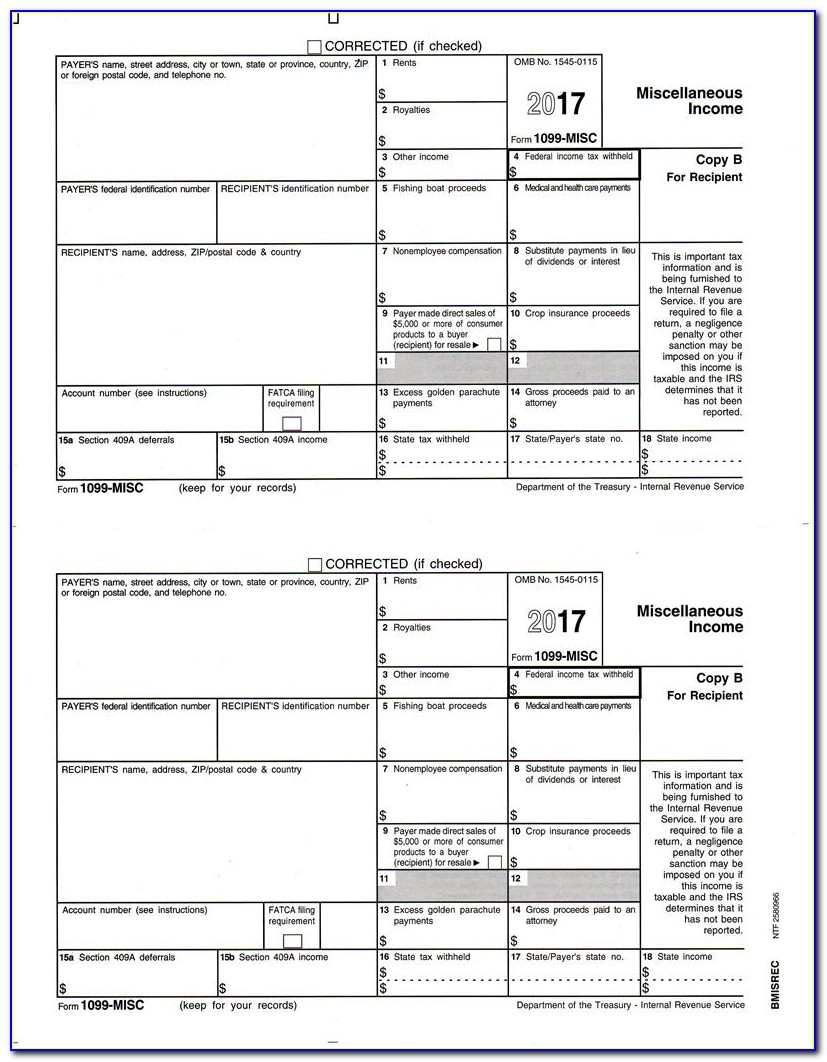

Web instructions for recipient recipient's taxpayer identification number (tin). Copy 1 for state, city, or local tax department street address (including. For privacy act and paperwork reduction. Ad get the latest 1099 misc online. Only amounts of $600 or more are. For your protection, this form may show only the last four digits of your social security number. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. In addition to the money paid to non. Web 2016 check here if the debtor was personally liable for copy a for internal revenue service center file with form 1096. Rents if someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in box 1.

If you cannot get this form corrected, attach an explanation to your tax return and. At least $10 in royalties or broker. Ad get the latest 1099 misc online. Web 2016 check here if the debtor was personally liable for copy a for internal revenue service center file with form 1096. Staples provides custom solutions to help organizations achieve their goals. Ad discover a wide selection of 1099 tax forms at staples®. Rents if someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in box 1. This is important tax information. Some common examples of payments. Where can i get a 1099 misc form for 2016?

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

In addition to the money paid to non. Get your 1099 misc form for 2016 from. This is important tax information. Web instructions for recipient recipient's taxpayer identification number (tin). Do not miss the deadline

The Tax Times 2016 Form 1099's are FATCA Compliant

Web instructions for recipient recipient's taxpayer identification number (tin). If you cannot get this form corrected, attach an explanation to your tax return and. Get your 1099 misc form for 2016 from. Ad get the latest 1099 misc online. Enter the income reported to you as if from.

1099 Misc Tax Form Printable Form Resume Examples VEk1zvBD8p

If this form is incorrect or has been issued in error, contact the payer. Some common examples of payments. Ad get the latest 1099 misc online. Enter the income reported to you as if from. Ad discover a wide selection of 1099 tax forms at staples®.

Free Printable 1099 Misc Form 2016 Form Resume Examples 4Y8b7Md16m

Staples provides custom solutions to help organizations achieve their goals. Rents if someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in box 1. At least $10 in royalties or broker. At least $10 in royalties (see the instructions for box 2) or. Web 2016 check here if the debtor was personally liable.

Free Downloadable 1099 Misc Form 2016 Universal Network

Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. If this form is incorrect or has been issued in error, contact the payer. For your protection, this form may show only the last four digits of your social security.

Printable 1099 Misc Form Form Resume Examples MW9pBOnaVA

Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. For your protection, this form may show only the last four digits of your social security number. Ad get the latest 1099 misc online. Web 2016 check here if the.

Irs 1099 Template 2016 Beautiful Form 1099 R Instructions Awesome Form

At least $10 in royalties or broker. Rents if someone pays you rent for office space, machinery, farmland, or pasture, you would report that figure in box 1. Fill, edit, sign, download & print. If this form is incorrect or has been issued in error, contact the payer. Web instructions for recipient recipient's taxpayer identification number (tin).

1099MISC Tax Basics

Enter the income reported to you as if from. Where can i get a 1099 misc form for 2016? Get your 1099 misc form for 2016 from. Only amounts of $600 or more are. At least $10 in royalties or broker.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

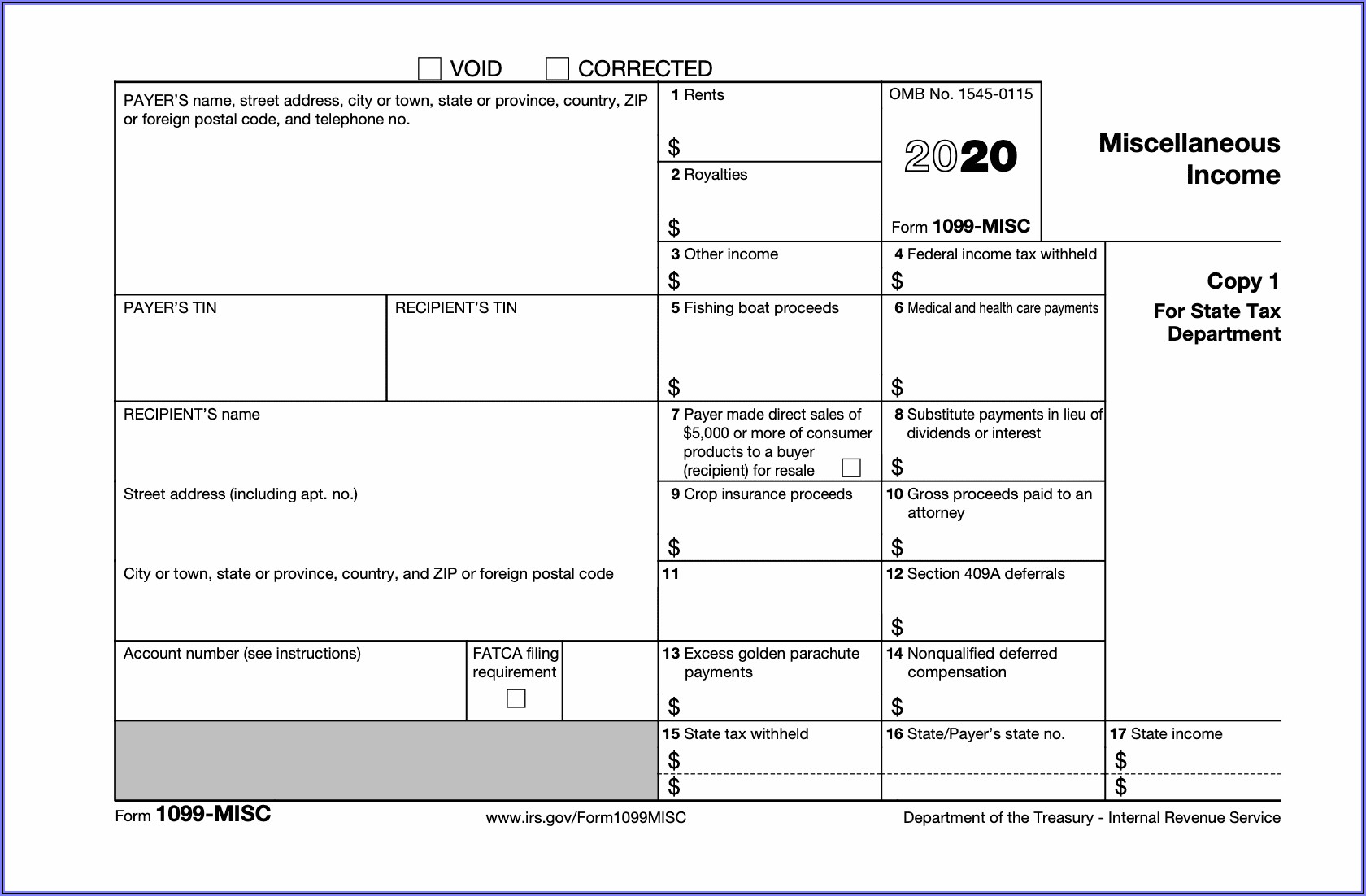

Copy 1 for state, city, or local tax department street address (including. In addition to the money paid to non. Where can i get a 1099 misc form for 2016? Ad discover a wide selection of 1099 tax forms at staples®. Only amounts of $600 or more are.

Some Common Examples Of Payments.

If you cannot get this form corrected, attach an explanation to your tax return and. If this form is incorrect or has been issued in error, contact the payer. Only amounts of $600 or more are. At least $10 in royalties or broker.

Rents If Someone Pays You Rent For Office Space, Machinery, Farmland, Or Pasture, You Would Report That Figure In Box 1.

Web instructions for recipient recipient's taxpayer identification number (tin). In addition to the money paid to non. Fill, edit, sign, download & print. For your protection, this form may show only the last four digits of your social security number.

For Privacy Act And Paperwork Reduction.

This is important tax information. Where can i get a 1099 misc form for 2016? Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. Ad discover a wide selection of 1099 tax forms at staples®.

Copy 1 For State, City, Or Local Tax Department Street Address (Including.

Get your 1099 misc form for 2016 from. Staples provides custom solutions to help organizations achieve their goals. Enter the income reported to you as if from. Web 2016 check here if the debtor was personally liable for copy a for internal revenue service center file with form 1096.