1099 Int Fillable Form

1099 Int Fillable Form - For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). You might receive this tax form from your bank. For whom you withheld and paid any foreign tax on interest. Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. Current general instructions for certain information returns. Web instructions for recipient recipient’s taxpayer identification number (tin). For internal revenue service center. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. Web iris is a free service that lets you:

Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. You might receive this tax form from your bank. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Current general instructions for certain information returns. For internal revenue service center. Web iris is a free service that lets you: For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10. For privacy act and paperwork reduction act notice, see the. For whom you withheld and paid any foreign tax on interest.

Submit up to 100 records per upload with csv templates. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For internal revenue service center. Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. However, you may still need to include the information from it on your return. For the most recent version, go to irs.gov/form1099int. You might receive this tax form from your bank. The form details interest payments, related.

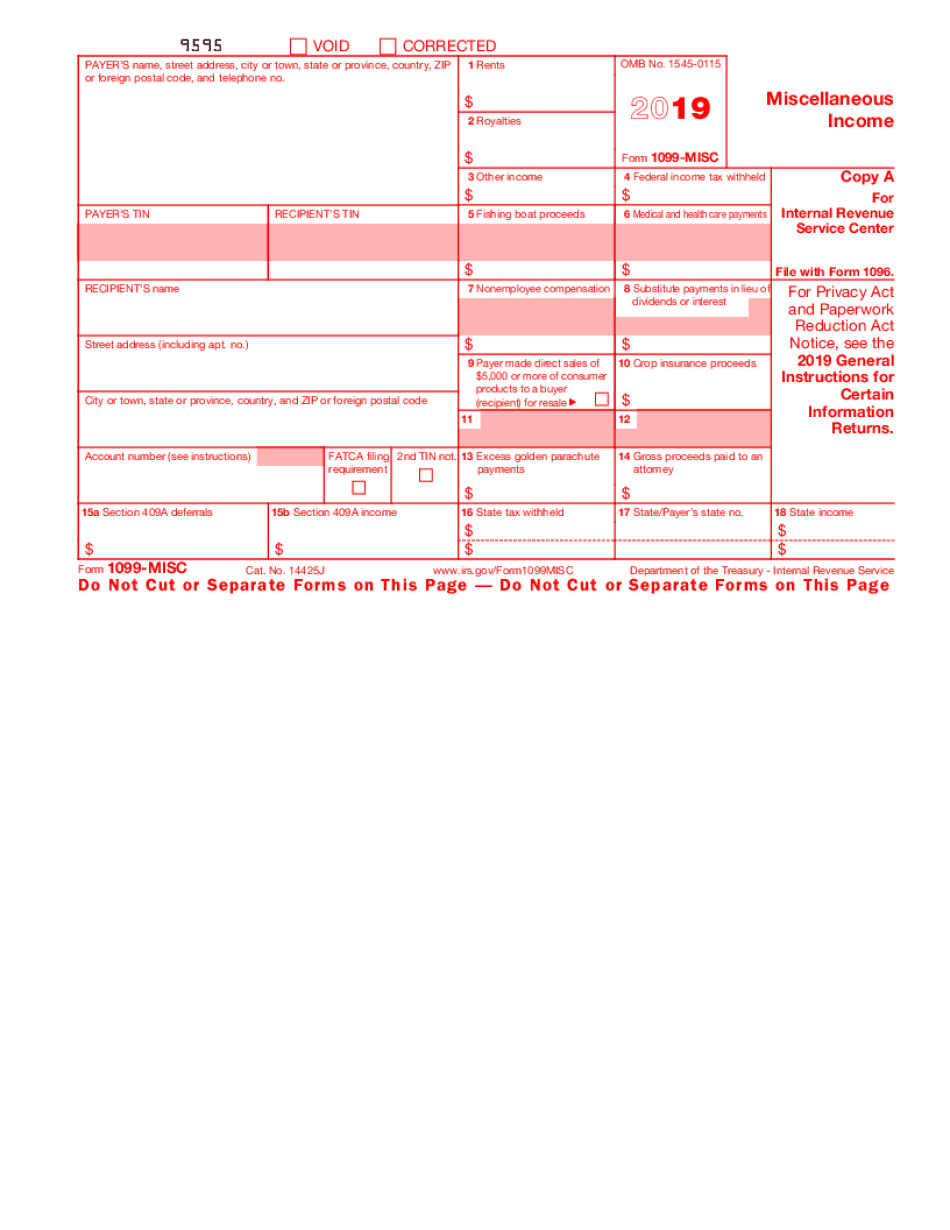

form 1099 misc 2018 template Fill Online, Printable, Fillable Blank

For privacy act and paperwork reduction act notice, see the. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). However, you may still need to include the information from it on your return. Submit up to.

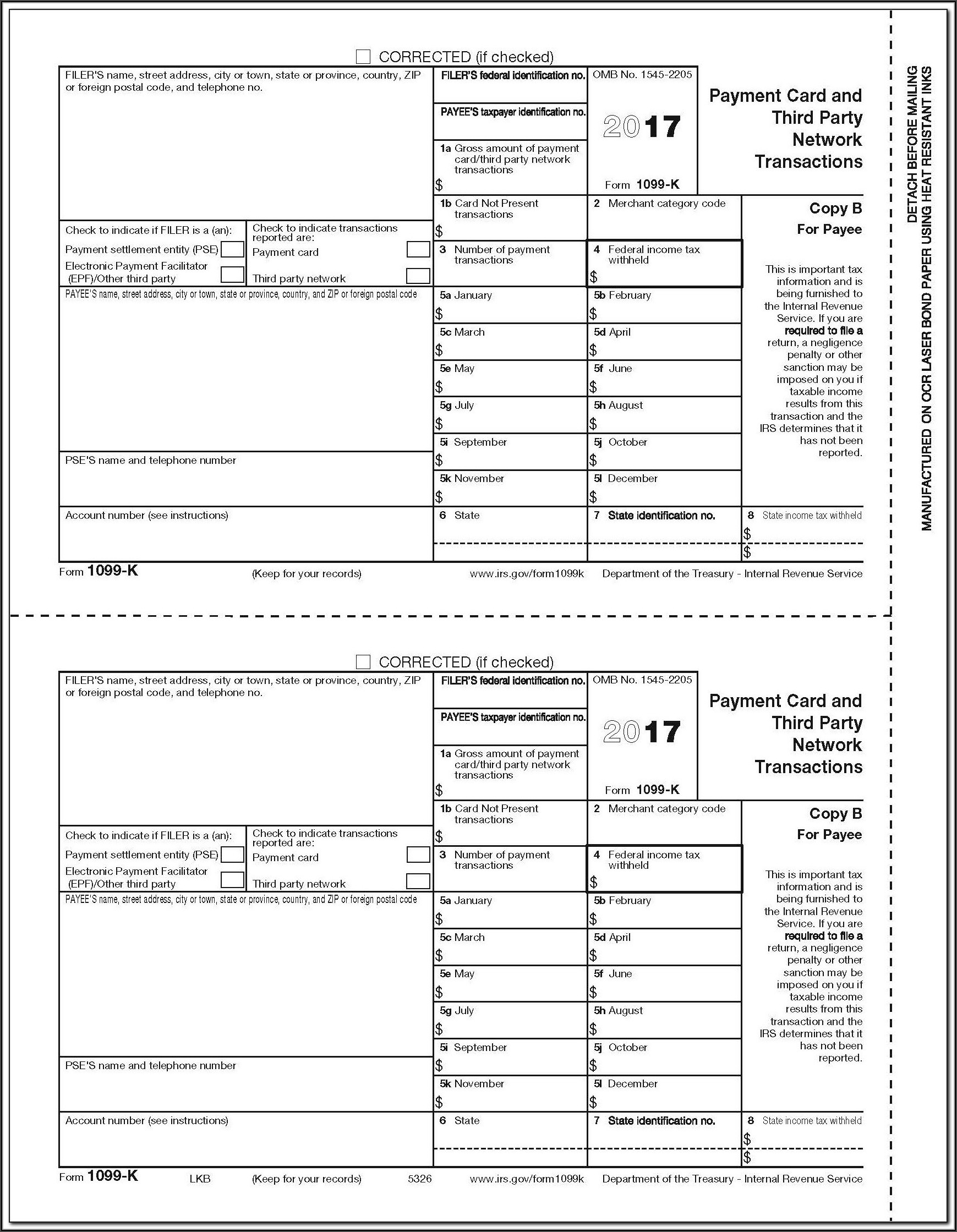

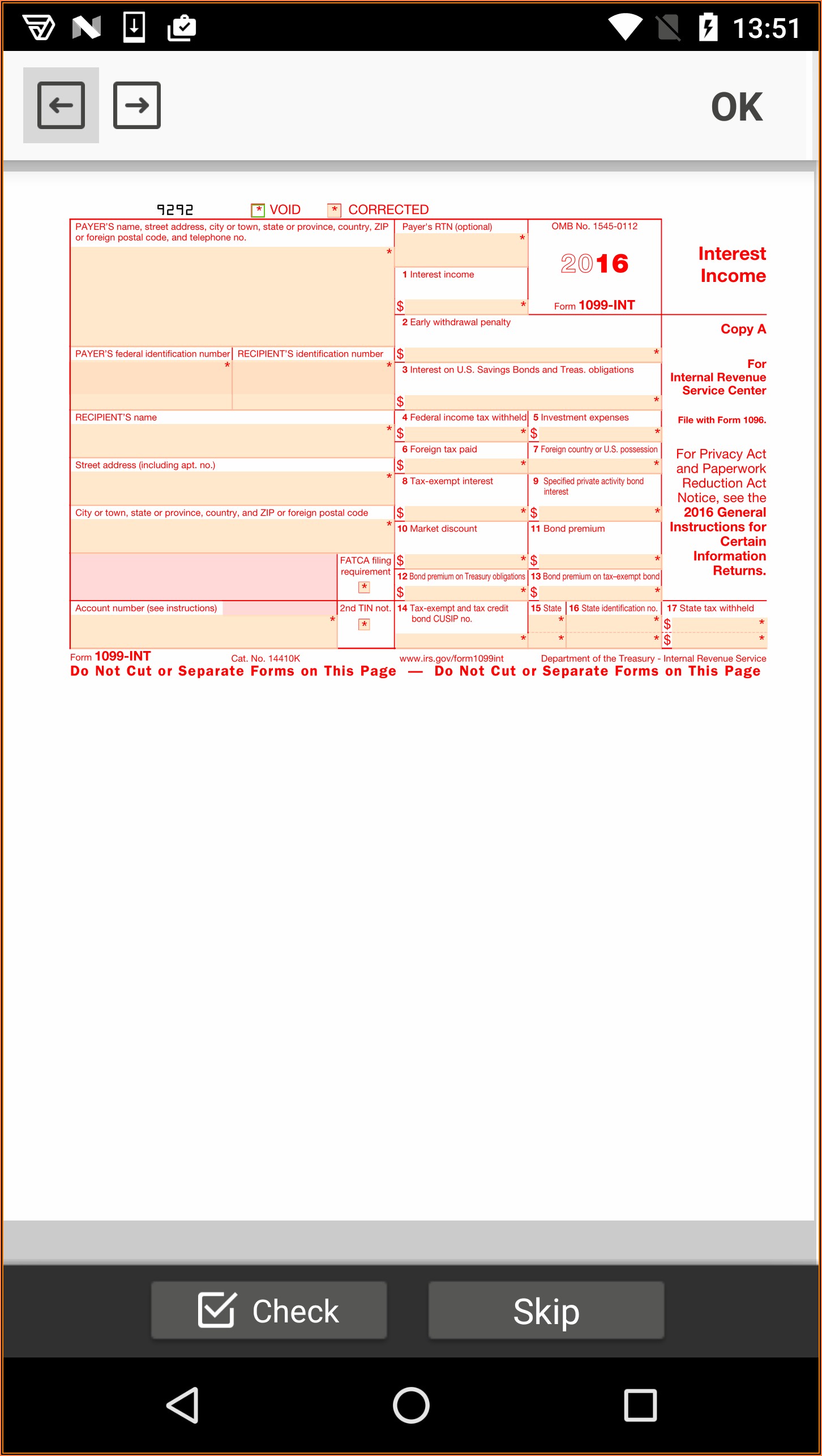

1099 Int Fillable Form 2017 Universal Network

For whom you withheld and paid any foreign tax on interest. Web instructions for recipient recipient’s taxpayer identification number (tin). For the most recent version, go to irs.gov/form1099int. Submit up to 100 records per upload with csv templates. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10.

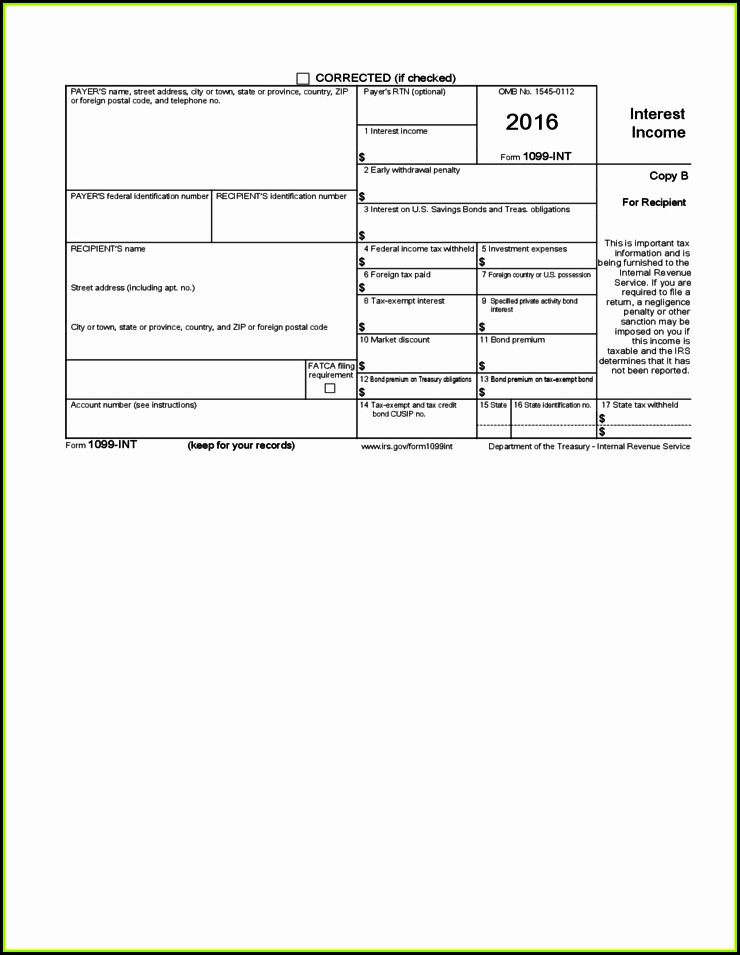

Free Fillable 1099 Form Form Resume Examples Bw9j7O3Y7X

Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. Current general instructions for certain information returns. Submit up to 100 records per upload with csv templates. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least.

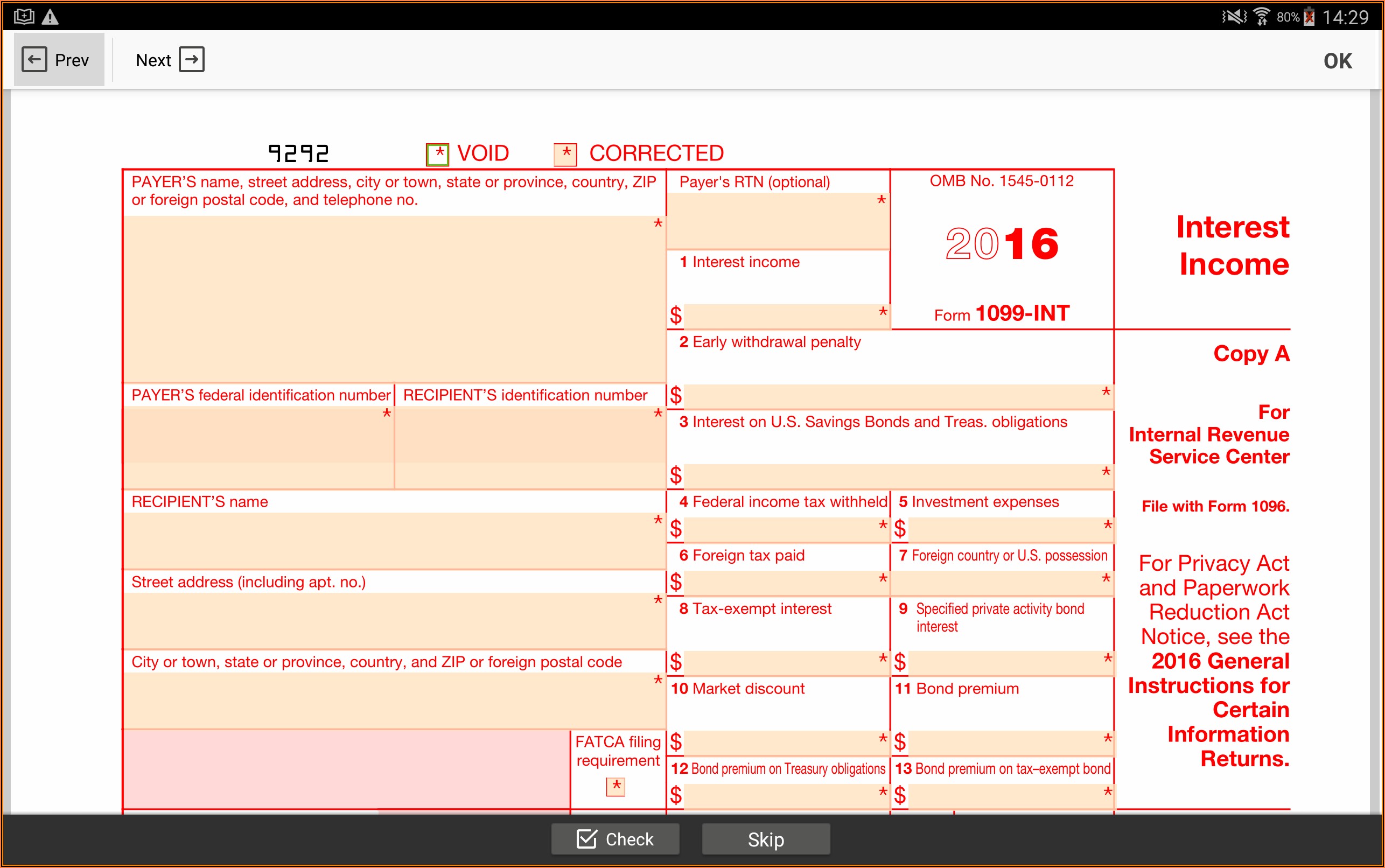

1099 Int Fillable Form 2017 Form Resume Examples 4x2vOKn95l

To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. For the most recent version, go to irs.gov/form1099int. Web instructions for recipient recipient’s taxpayer identification number (tin). Web to ease statement furnishing.

[最も好ましい] 1099 c form 2020 1663152020 form 1099c cancellation of debt

Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf.

Free Fillable Forms 1099 Int Form Resume Examples QJ9enWJYmy

Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. For the most recent version, go to irs.gov/form1099int. Web iris is a free service that lets you: You might receive this tax form from your bank. Web instructions for recipient recipient’s taxpayer identification number (tin).

Fillable Form 1099 Int Form Resume Examples A19XKw324k

The form details interest payments, related. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. For whom you withheld and paid any foreign tax on interest. For privacy act and paperwork.

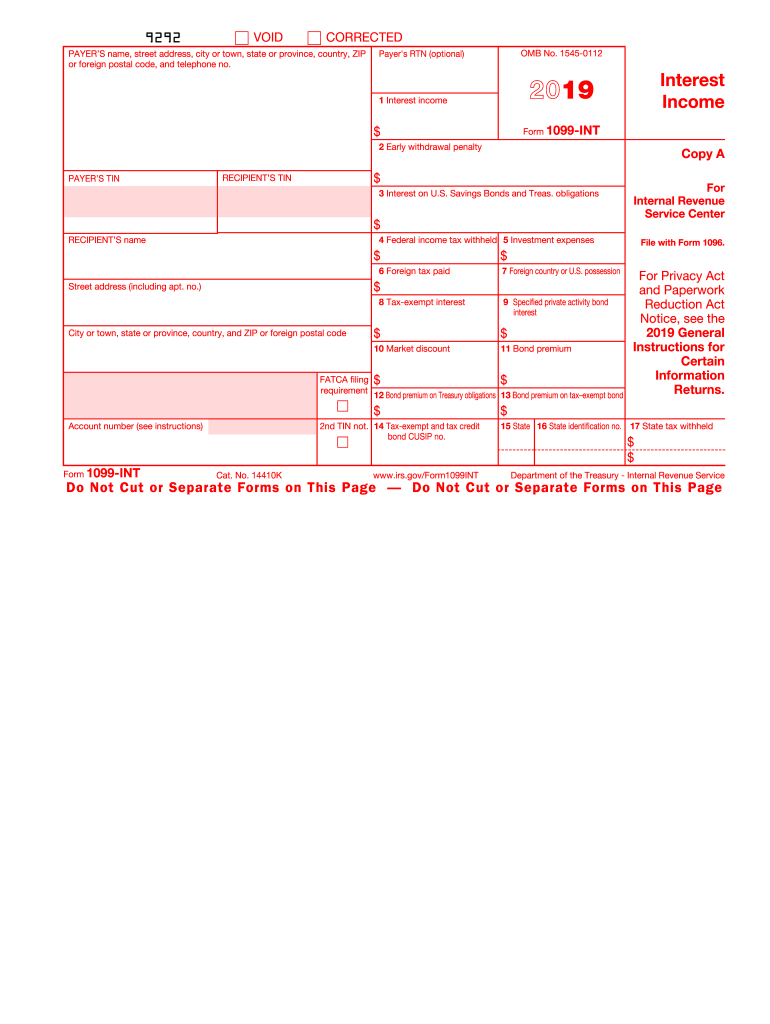

2019 Form IRS 1099INT Fill Online, Printable, Fillable, Blank PDFfiller

Submit up to 100 records per upload with csv templates. Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. For whom you withheld and paid any foreign tax on interest. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the.

1099 Int Fillable Form Free Form Resume Examples edV1KOz9q6

Web iris is a free service that lets you: You can complete these copies online for furnishing statements to recipients and for retaining in your own files. You might receive this tax form from your bank. The form details interest payments, related. Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf.

To Whom You Paid Amounts Reportable In Boxes 1, 3, Or 8 Of At Least $10 (Or At Least $600 Of Interest Paid In The Course Of Your Trade Or Business Described In The Instructions For Box 1.

For the most recent version, go to irs.gov/form1099int. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Current general instructions for certain information returns. You might receive this tax form from your bank.

To Whom You Paid Amounts Reportable In Boxes 1, 3, And 8 Of At Least $10.

You can complete these copies online for furnishing statements to recipients and for retaining in your own files. For privacy act and paperwork reduction act notice, see the. The form details interest payments, related. For internal revenue service center.

Web Iris Is A Free Service That Lets You:

Web to ease statement furnishing requirements, copies 1, b, 2, and c are fillable online in a pdf format available at irs.gov/form1099int and irs.gov/form1099oid. Web instructions for recipient recipient’s taxpayer identification number (tin). However, you may still need to include the information from it on your return. Submit up to 100 records per upload with csv templates.